BDSwiss Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The BDSwiss brand caters to over 1.6 million registered forex and CFD traders, and offers the full MetaTrader platform suite alongside its own proprietary BDSwiss Mobile and WebTrader apps. BDSwiss demonstrates good order execution statistics (which the broker publishes monthly), produces quality research, and provides access to over 1,000 tradable symbols – though its spreads are higher than industry leaders.

-

Minimum Deposit:

$10-$5000 -

Trust Score:

76 -

Tradeable Symbols (Total):

1081

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Pros

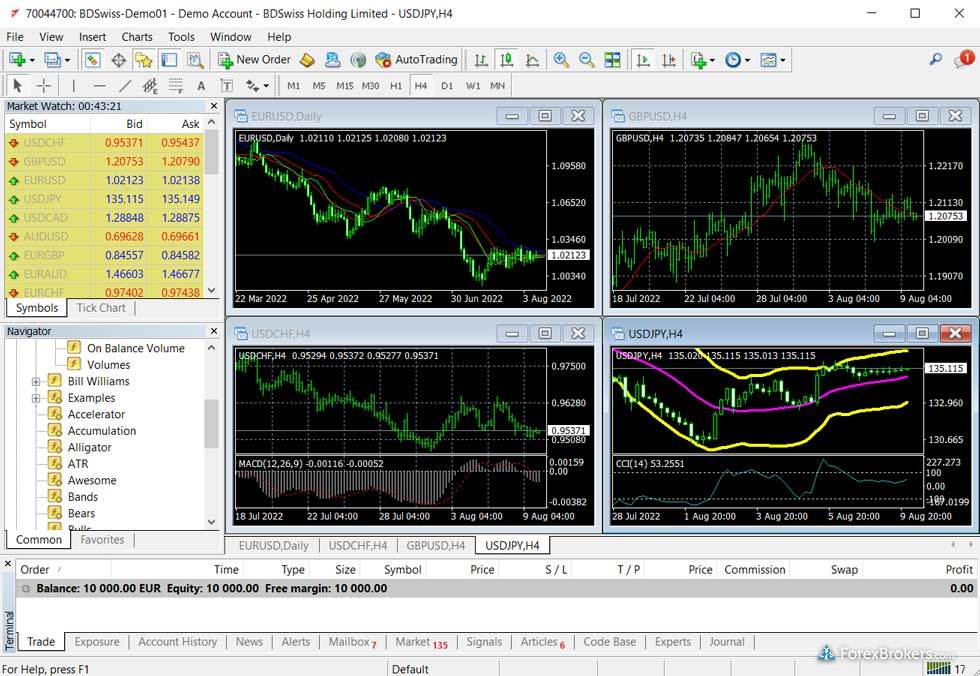

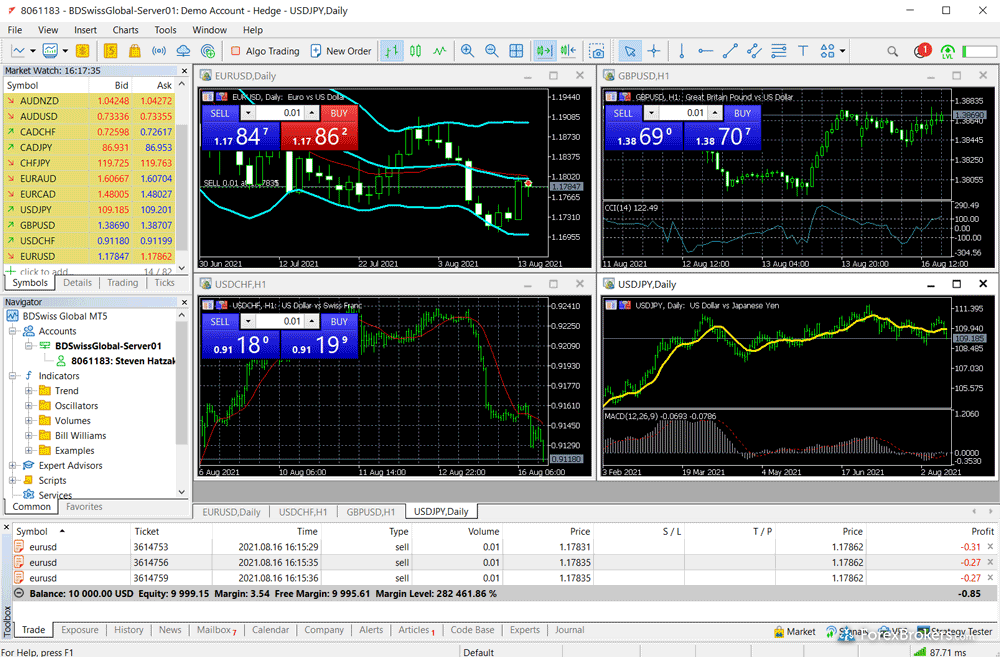

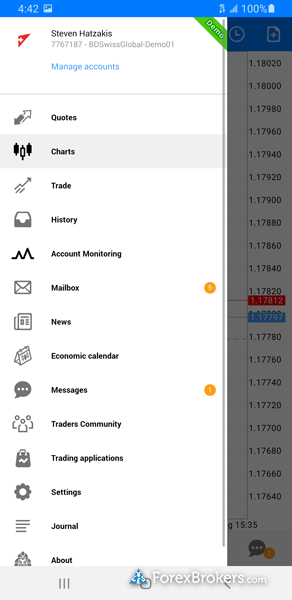

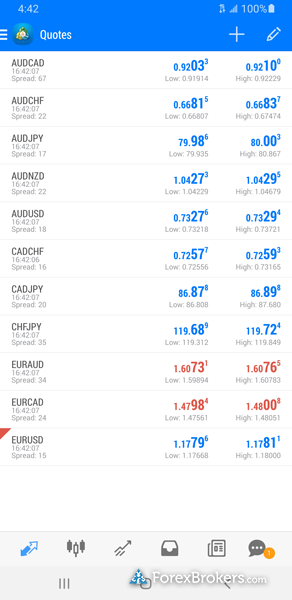

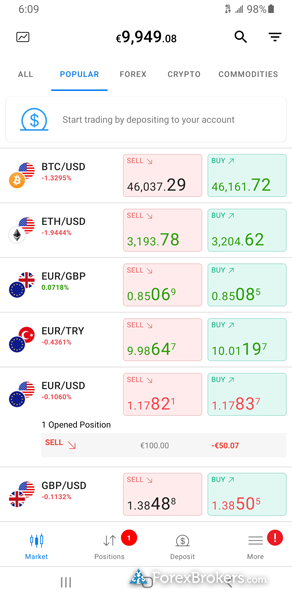

- Multiple available platforms, including its BDSwiss Mobile and WebTrader apps, as well as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- BDSwiss’ Triple Zero account, launched in February 2022 and available to new clients outside the EU, features all-in pricing close to zero pips (for 12 month promo period). Average spread data is not available.

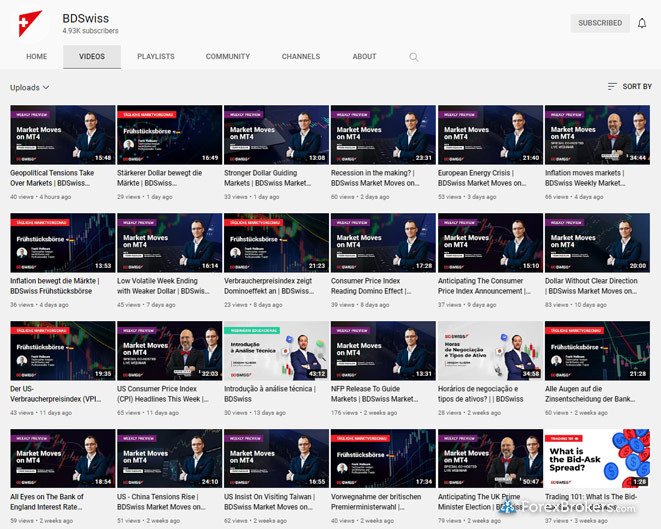

- Daily Videos market coverage series is created by in-house staff.

- Acts as an agency broker, demonstrating balanced slippage with no requotes or order rejections (execution statistics are published monthly).

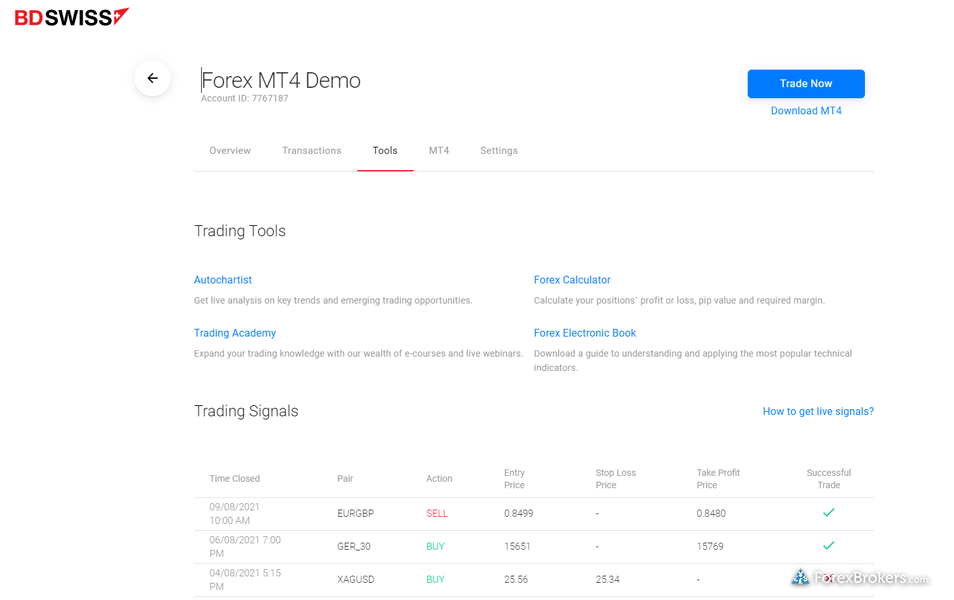

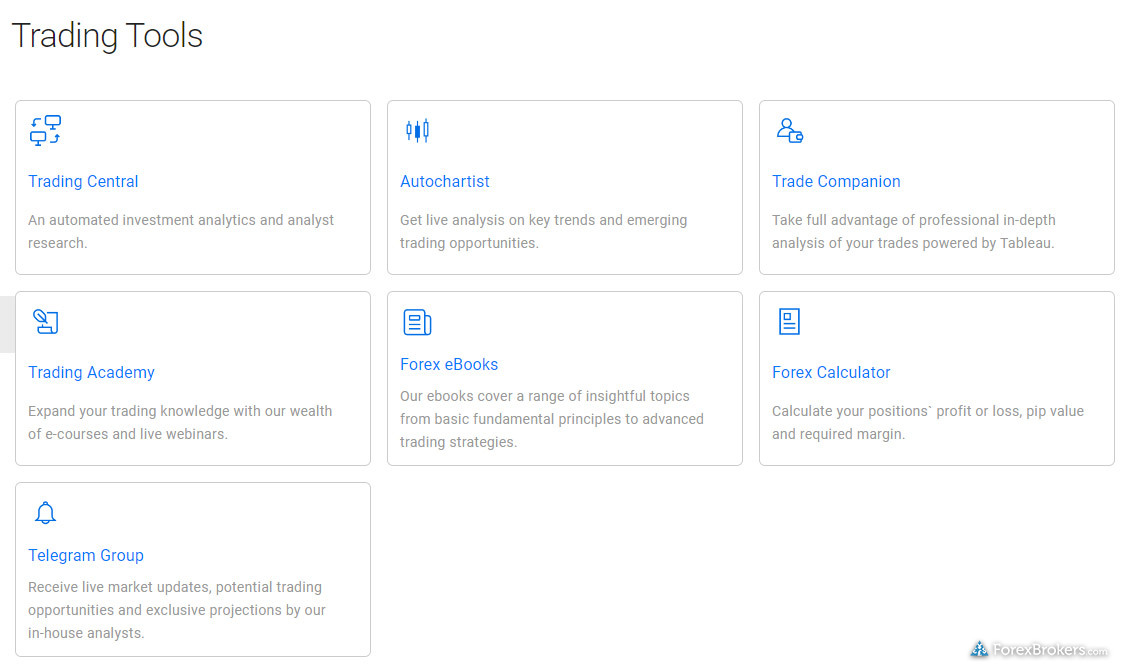

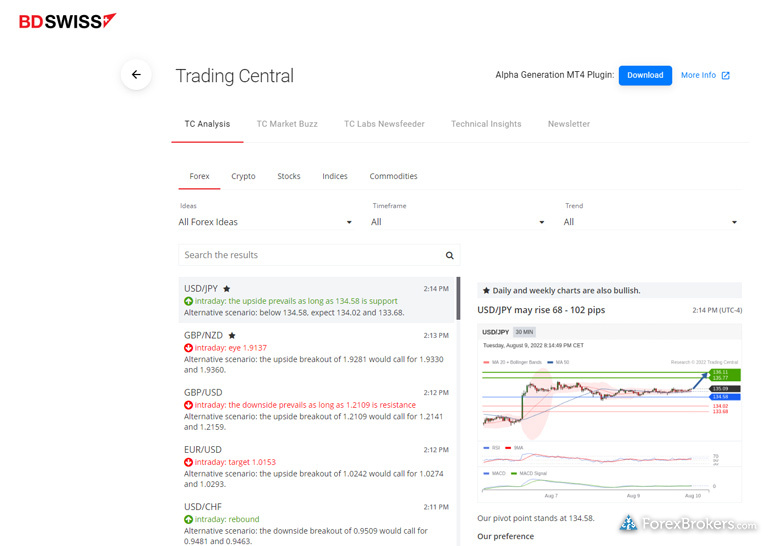

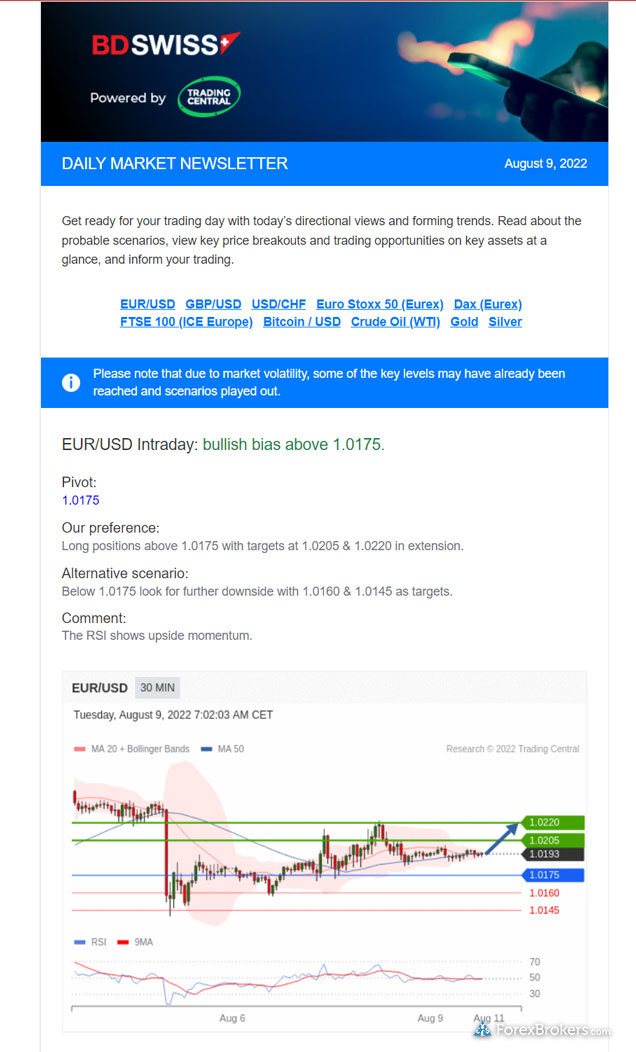

- Offers Autochartist and proprietary Trends Analysis.

- Trading signals and real-time alerts are available via the BDSwiss Telegram channel.

- RAW account has lower spreads and commissions (though it requires a $5,000 deposit).

- VIP clients gain access to the Premium version of Trend Analysis, with 500 trend patterns.

- BDSwiss launched Trade Companion as a trade analytics tool, available if you deposit at least $500.

- AI-powered Trends Analyisis tool launched in Web Trader

Cons

- Though it does complement the full MetaTrader suite, BDSwiss’ proprietary mobile app is fairly basic.

- Beginner’s educational content lacks a progress-tracking feature.

- Spread of 1.6 pips on the EUR/USD for its Classic account is expensive, despite the good execution statistics.

- Does not permit scalping.

- The FCA has directed the broker to stop offering CFDs to U.K. clients after its marketing practices drew regulatory scrutiny.

- BDSwiss no longer accepts EU residents.

- BDSwiss’ $30 inactivity fee, charged after 90 days with no trading activity, is very steep.

Overall summary

| Feature |

BDSwiss BDSwiss

|

|---|---|

| Overall Rating |

|

| Trust Score | 76 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is BDSwiss safe?

BDSwiss is considered Average Risk, with an overall Trust Score of 76 out of 99. BDSwiss is not publicly traded and does not operate a bank. BDSwiss is authorised by one Tier-1 regulators (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 license (High Risk). BDSwiss is authorised by the following Tier-1 regulators: Regulated in the European Union via the MiFID passporting system . Learn more about Trust Score.

| Feature |

BDSwiss BDSwiss

|

|---|---|

| Year Founded | 2012 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 2 |

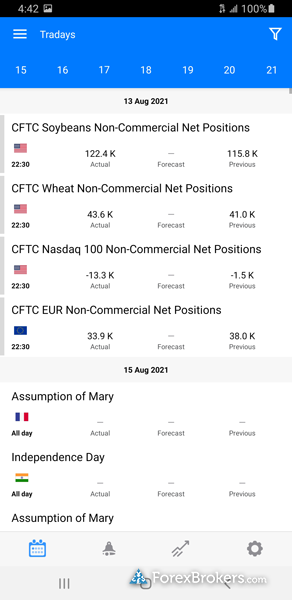

BDSwiss platforms and tools

Is BDSwiss UK regulated?

No, BDSwiss is no longer regulated in the United Kingdom (U.K.) with the Financial Conduct Authority (FCA).

That being said, BDSwiss holds multiple regulatory licenses throughout the EU, including from Cyprus where it is authorised by the Cyprus Securities and Exchange Commission (CySEC), but no longer accepts EU residents. It is also regulated as a Tied Agent under its German entity, and is passported across the EU (and outside of the EU into Switzerland). It's worth noting that as of January 2024, BD Swiss is not accepting clients from within the EU. The brand also holds an offshore regulatory license from the island nation of Mauritius.

What is the minimum deposit for BDSwiss?

The minimum deposit at BDSwiss will vary depending on your chosen account type. The broker’s VIP account requires a $3,000 minimum deposit and its Raw account requires $5,000, while the Classic account’s minimum first deposit of $100 (or currency equivalent) may vary depending on your country of residence and if you were referred by a third party.

What happened with BDSwiss in the UK?

In May of 2021, the FCA cited BDSwiss for prohibited marketing practices originating from certain of its affiliates and social media influencers, and required that the broker halt doing business in the U.K. and refrain from marketing to U.K. residents until a number of outstanding items are rectified by the broker, as per the FCA announcement.

In a nutshell, the FCA has imposed rules which restrict the marketing and sale of CFDs to retail consumers, and the FCA believes that BDSwiss - via some of its affiliates - broke those rules.

BDSwiss partnered with affiliates that marketed referrals to retail traders, and in the process they largely referred them to BDSwiss’ overseas firms that don’t provide FCA protections. Essentially, this means that U.K. consumers were being encouraged to open accounts with a broker they associated with the FCA, but did not receive the protections that should be afforded by an FCA-regulated broker.

According to the FCA, “almost 99% of them were referred to the Overseas Firms, meaning the clients did not benefit from the protections afforded to consumers dealing with an authorized firm.” Additionally, BDSwiss’ affiliates marketed trading signal providers, and in doing so they “frequently fail(ed) to mention that the underlying financial instruments being recommended are CFDs.”

Post-Brexit note: Leading up to Brexit, many brokers in the EU that were previously passported under MiFiD in countries such as the U.K. had to either obtain a full registration with the U.K. post-Brexit, or operate under a Temporary Permission Regime (TPR) to give them time to become regulated or exit the U.K. altogether. BDSwiss is no longer operating under the TPR in the U.K., and is no longer authorised by the FCA.

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Forex Trading Apps of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Forex Brokers of 2024

- Compare Forex Brokers

- Best Brokers for TradingView of 2024

- Best Copy Trading Platforms of 2024

- Best MetaTrader 4 Brokers of 2024

- International Forex Brokers Search

- Best Forex Brokers for Beginners of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare BDSwiss Competitors

Select one or more of these brokers to compare against BDSwiss.

Show all