Forex trading platforms education comparison

How do I start trading forex?

Here are the 8 steps to start trading forex with a trusted broker:

- Study free educational material (check out my guide to the best free forex trading courses).

- Open a free demo account and practice.

- Learn how to use the trading software.

- Develop a trading strategy.

- Open a live account with a trustworthy, well-regulated forex broker.

- Deposit a small amount of risk capital.

- Focus on managing percentage returns.

- Only scale once you’ve established a consistent track record.

Tips for beginners:

- Before depositing real money, open a free demo account that lets you get a feel for how the broker’s trading platform works.

- After you’ve learned how to use the software and have practiced trading with the demo (virtual) account, move on to a live forex trading account with a trusted forex broker.

- Always begin with an amount of capital that you can afford to lose before deciding to invest more serious amounts.

Can I teach myself forex trading?

Yes, and while studying the fundamentals of forex trading won’t guarantee success in the forex markets, it's an important first step for beginner forex traders.

Check out this quick video where I break down some of the forex market fundamentals and some important facts about forex trading:

The best forex brokers also offer a wide range of free educational materials in a variety of formats. We’ve compiled some free beginner’s resources as well as some expert tips for beginners to aid you in your forex educational journey. You can also check out my guide to the best free forex trading courses.

Free forex trading educational courses and resources:

Expert tips for beginner forex traders:

Free versus paid educational content: Many forex education companies charge for their services, but our research has found that some of the best educational content is available directly from the online forex brokers themselves – though not all brokers offer comprehensive educational options.

Content from brokers versus third parties: Working with a trusted and regulated online broker gives you the added benefit of being able to reach out to their customer support team to speak with a trading specialist. Speaking with someone on the trading desk can help beginners find answers to general forex trading questions – but keep in mind that brokers cannot give you advice or recommendations on what to buy or sell.

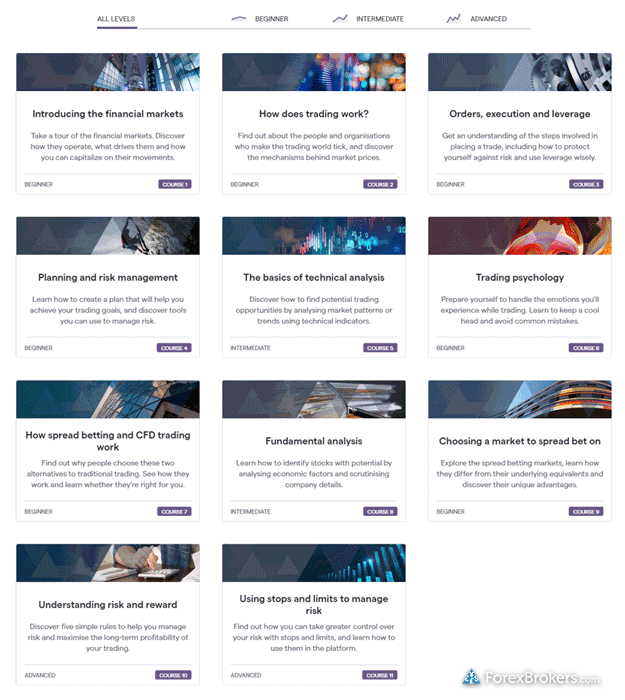

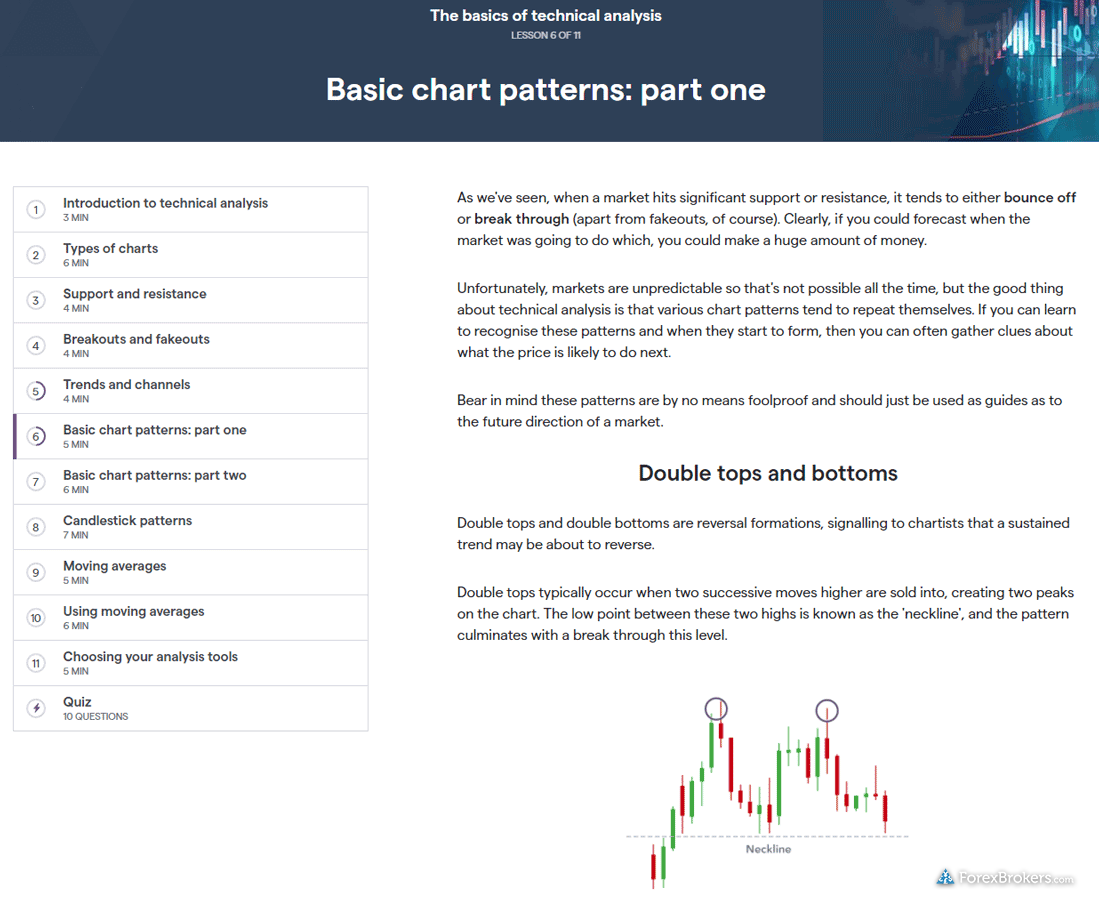

Ease of use: Trading software can vary in quality from broker to broker, and some platforms can be far more complex to learn than others – especially if you have limited forex trading experience. Plus500's simple platform design makes it a good one for learning the fundamentals. Some brokers, like IG, offer learning courses that feature progress tracking and quizzes designed to test your knowledge as you move through the material.

How to develop a forex trading strategy in ten steps

Here are some questions every trader should ask themselves when creating an investment strategy or forex trading methodology:

- Set goals: What are the specific goals I want to reach with my trading strategy?

- Manage time: How much time do I have each day to dedicate to trading?

- Capital commitment: What is my ideal trading budget for accomplishing my goals, and what is the most I am willing to risk overall?

- Trade frequency: What’s the number of trades I should aim for each week?

- Factor risk/reward: What is the maximum risk/reward target for each trade that will still align with my goals, and what is my overall percentage risk tolerance?

- Analyze price action and research: How will I identify trading opportunities?

- Opening a position: How will I decide when to enter a trade?

- Closing a position: How will I decide when to exit a trade early, or to modify my stop-loss/limit levels if my expectation of market conditions changes before my targets are reached?

- Calculate your odds: What winning percentage do I need in order to be profitable (after accounting for my trading costs)?

- Use your trading statistics: How long should I stick to my trading plan and establish a track record of results, before modifying my strategy or deciding to invest more money?

How much money do you need to trade forex?

The amount of money you will need to trade forex depends on several factors, including your expected trade sizes, risk threshold per trade, the available margin requirements from the broker (i.e., leverage), and any minimum deposit requirement to open your account.

Let’s look at an example:

Say that you plan to trade one mini lot (10,000 units) of the euro currency, and your forex broker offers a maximum of 20:1 leverage. Your trading funds will need to cover at least 5% of the trade value just for the margin, and another €1 for every pip you plan on risking when the market moves against your position. Note: In this case, 1 pip is 0.0001 euros worth of currency.

That mini lot of 10,000 EUR/USD would require at least 500 euros in margin (based on the 20:1 leverage). If you wanted to risk no more than 200 pips per trade you’d need another 200 euros, bringing the required starting balance up to 700 euros.

Let’s look at a couple of other examples of how this could break down in your forex trading account:

Trading a standard lot: Calculating for the above trading scenario, but for a standard lot (100,000 units of currency), you’d just add an extra zero to each variable. The 20:1 margin requirement would be 5,000 euros and the pip value would be 10 euros per pip. Risking 200 pips would require 2,000 euros in risk capital, bringing the total to 7,000 euros.

Trading a micro lot: Likewise, calculating the same scenario for a micro contract or (1,000 units of currency per lot), we can just remove one zero from each variable. The pip value becomes 10 cents, the margin requirement would be 50 euros, and the risk capital (for 200 pips) would require 20 euros.

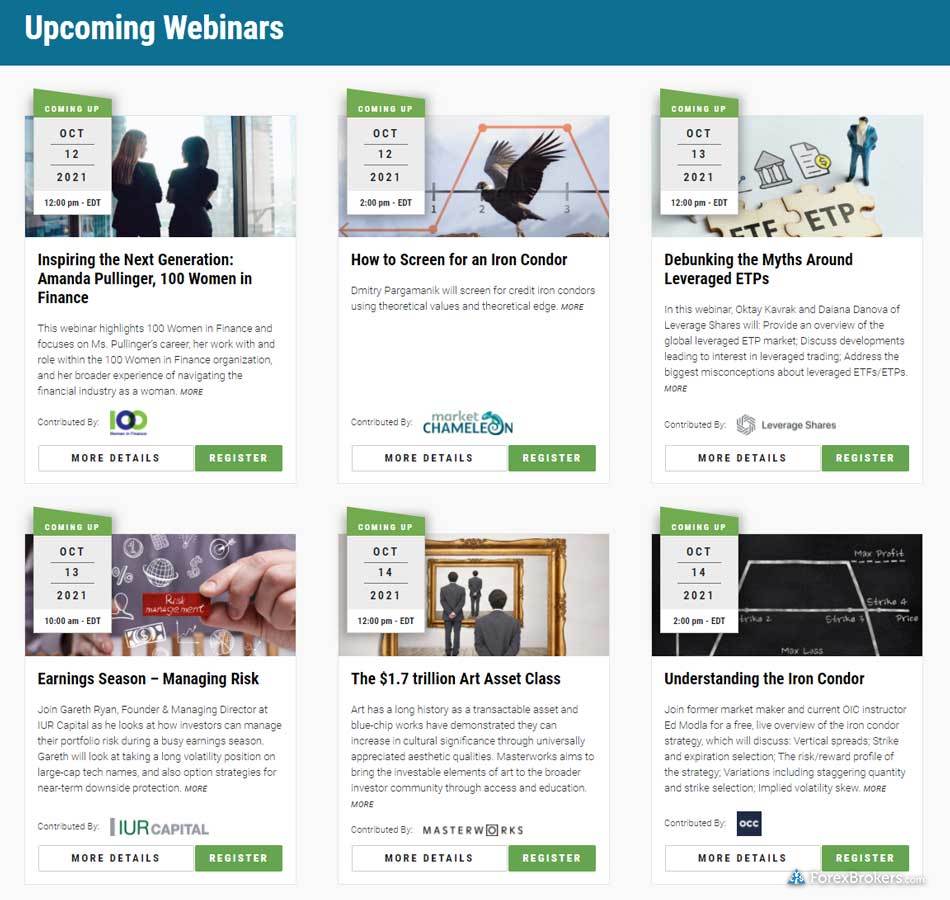

Forex brokers with great educational content for beginners

1. IG

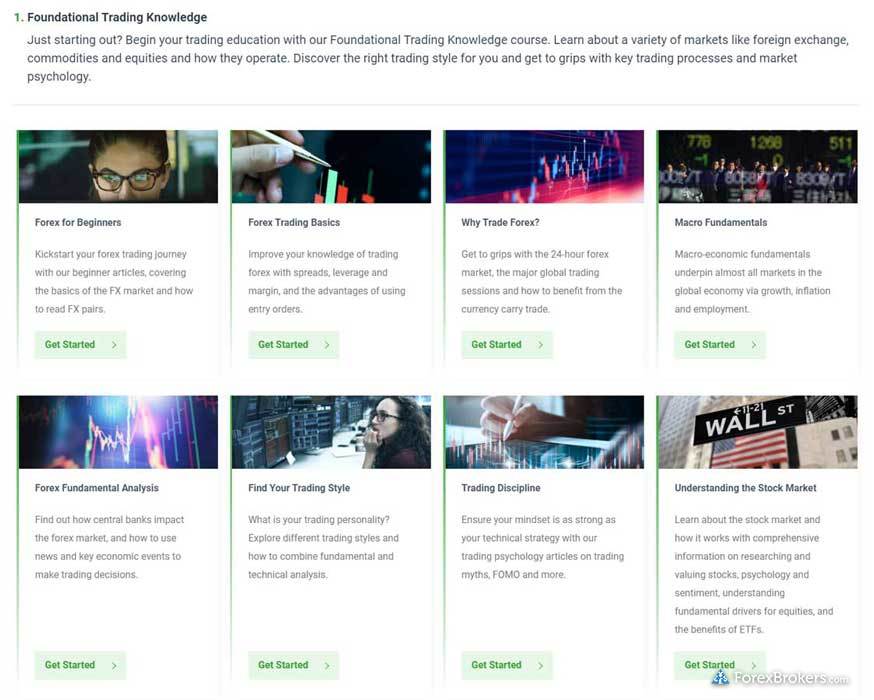

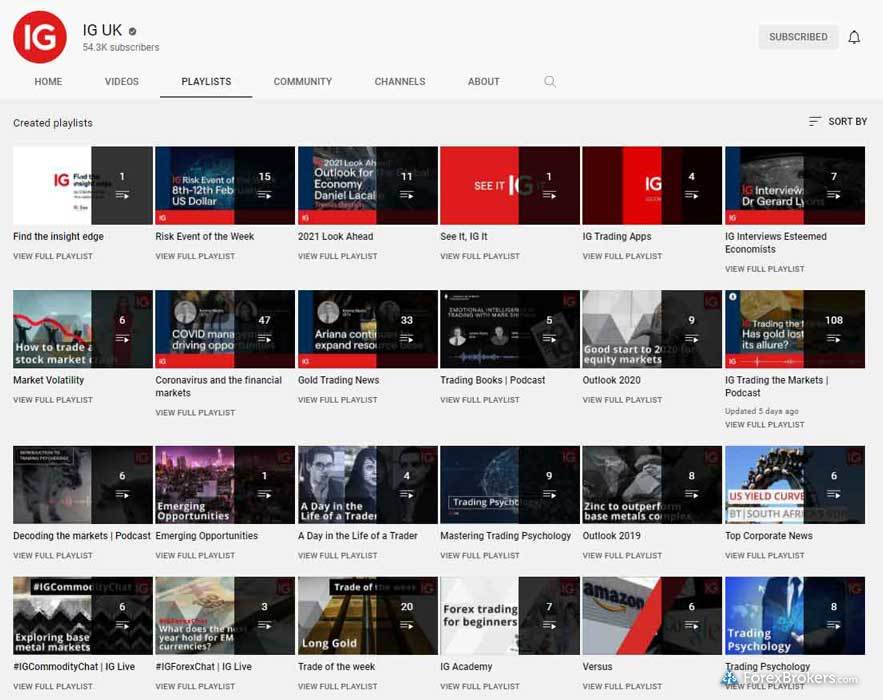

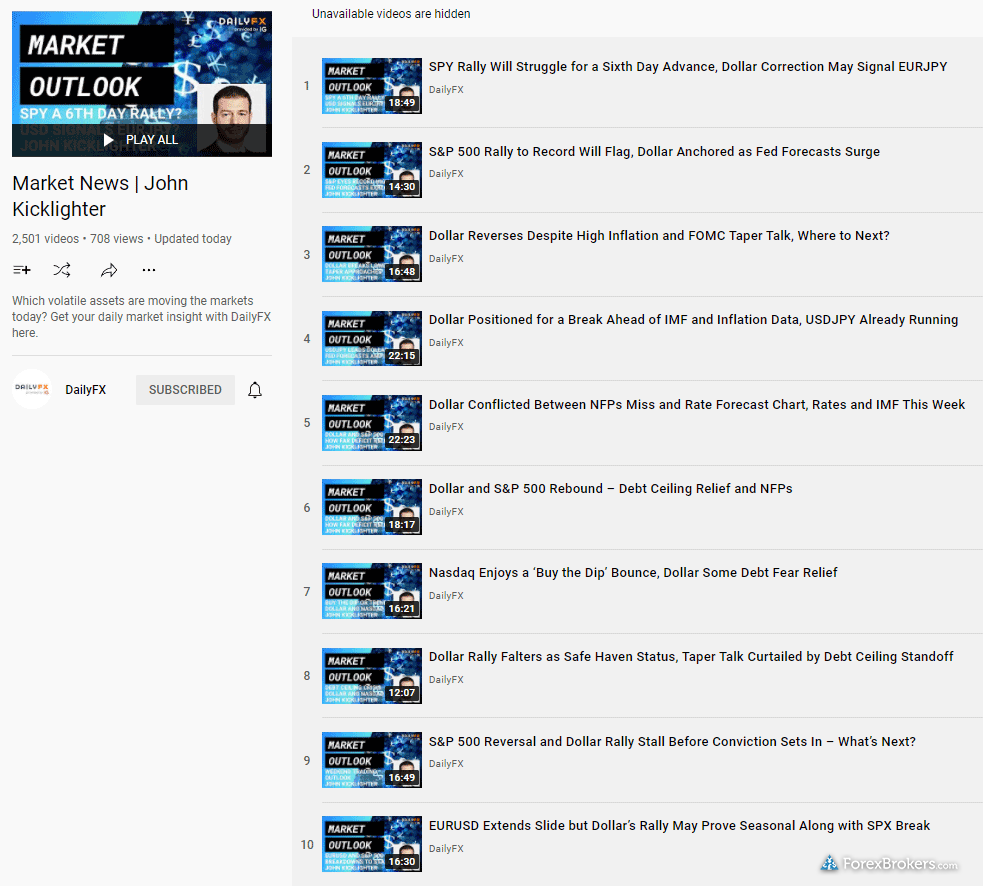

IG is my pick for the best forex broker for beginners in 2024, largely due to its comprehensive, thoughtfully curated offering of educational content. I’m consistently impressed with the quality and quantity of IG’s seemingly endless collection of educational resources. Beginner forex traders at IG will find educational videos, articles, quizzes, and courses. IG has even developed a mobile app expressly dedicated to financial markets education. Check out my review of IG to learn more.

Check out a gallery of screenshots from IG's educational offering, taken by our research team during our product testing.

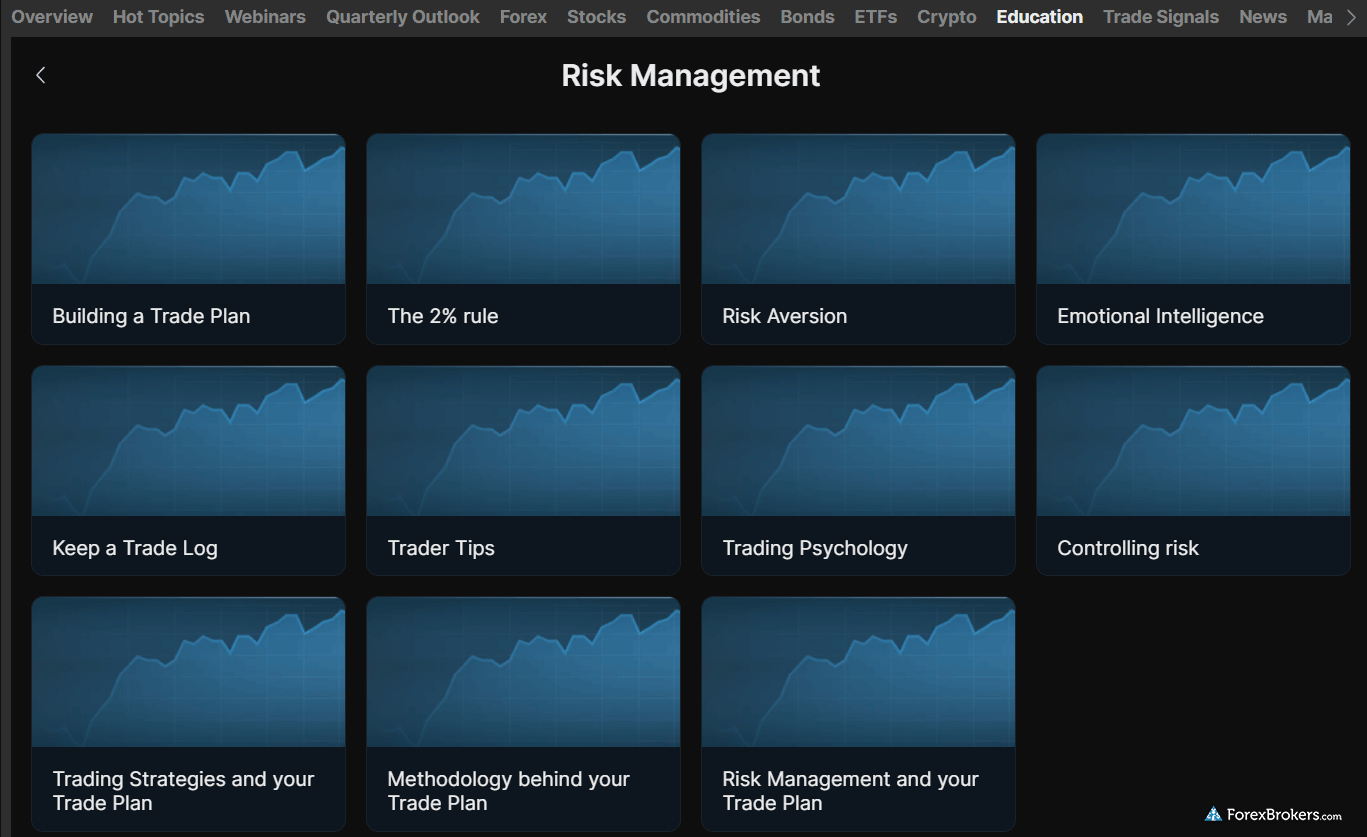

2. Saxo

Traders at Saxo gain access to high-quality information about financial markets with unique insights from Saxo’s analysts and educators. Saxo offers 20 high-quality video courses and dozens of articles dedicated to financial markets education. Additionally, Saxo’s market research content is so comprehensive and informative that I consider it a highly valuable educational resource. Whether I’m listening to the Market Call podcast to learn about stagflation, perusing the broker’s FAQs, or checking out Saxo’s high-quality research, I almost always learn something new about how markets function at Saxo. Read my review of Saxo to learn more.

Browse a gallery of screenshots from Saxo's educational offering, taken by our research team during our product testing.

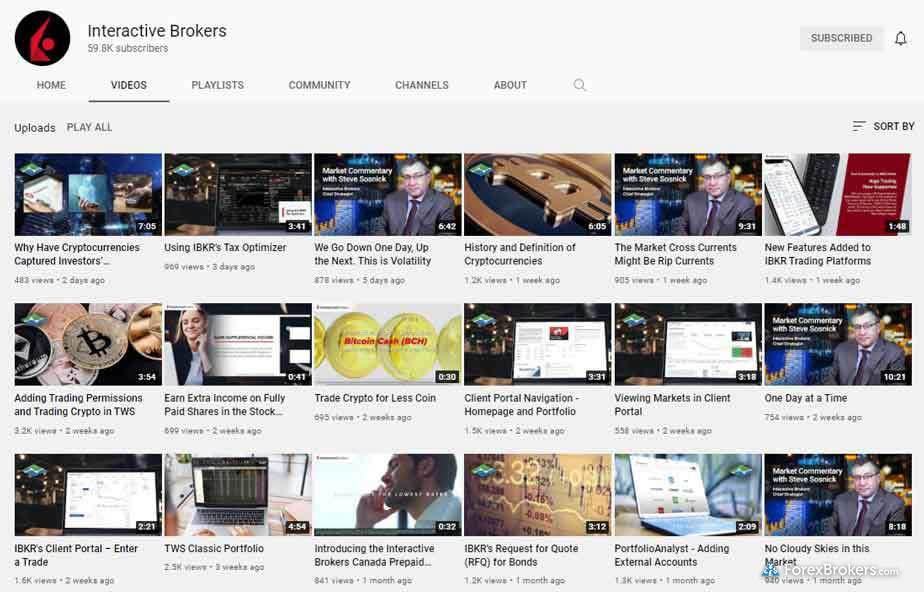

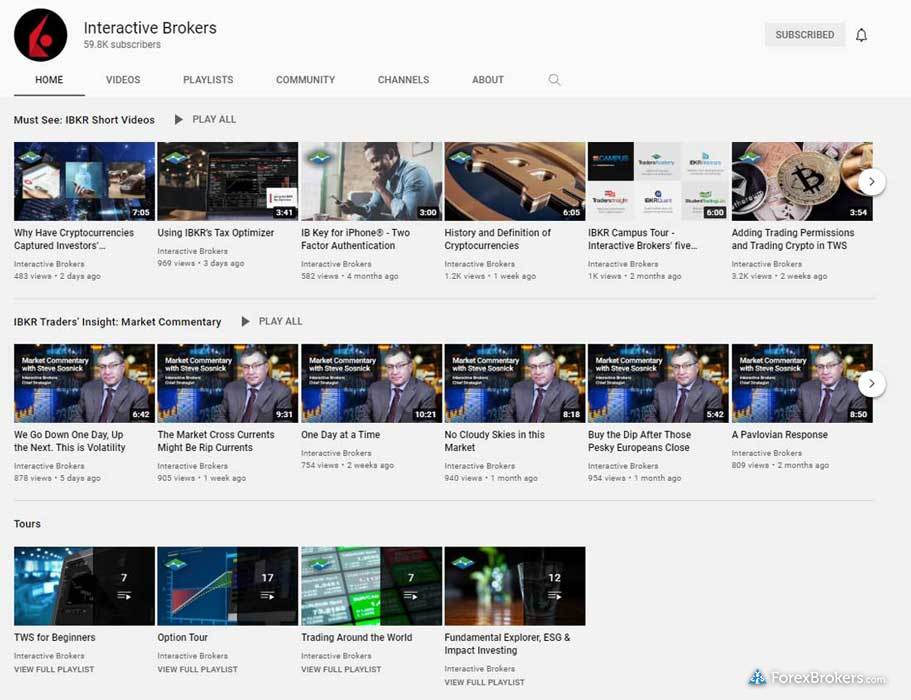

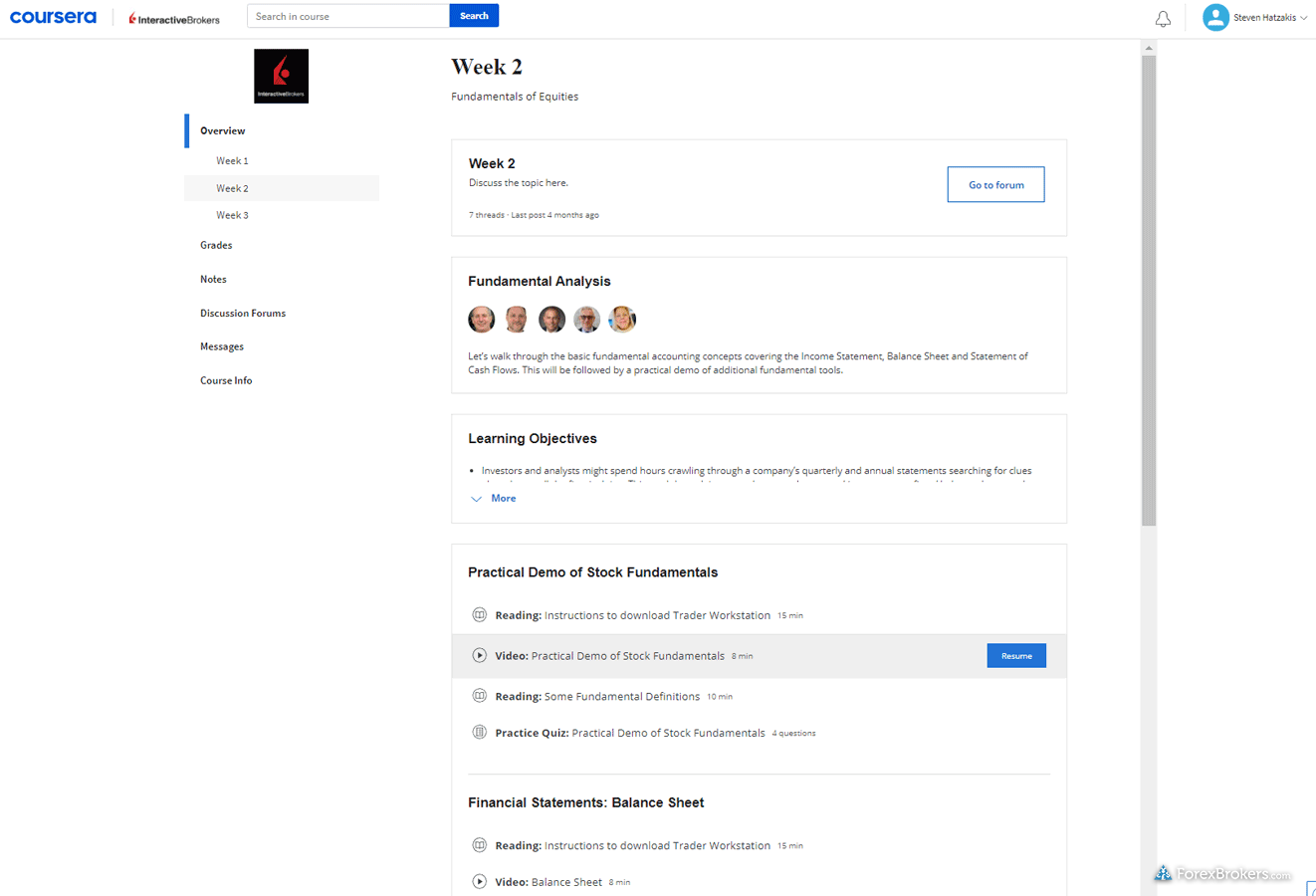

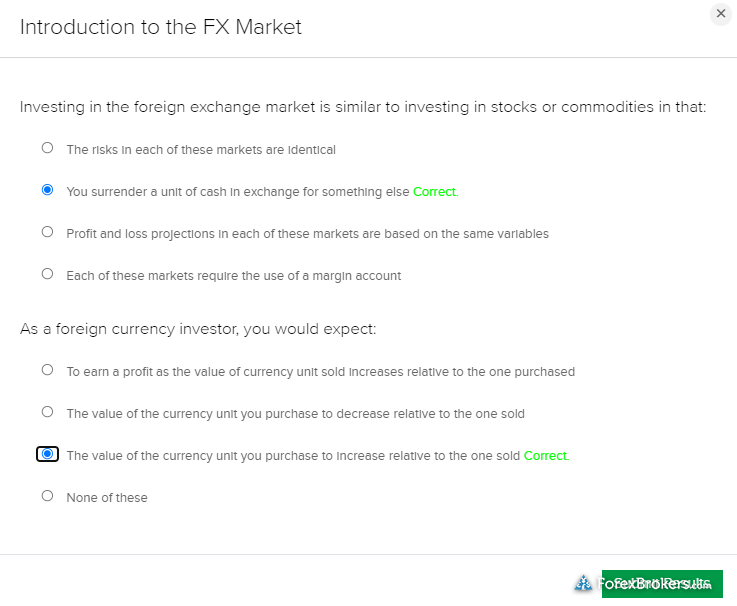

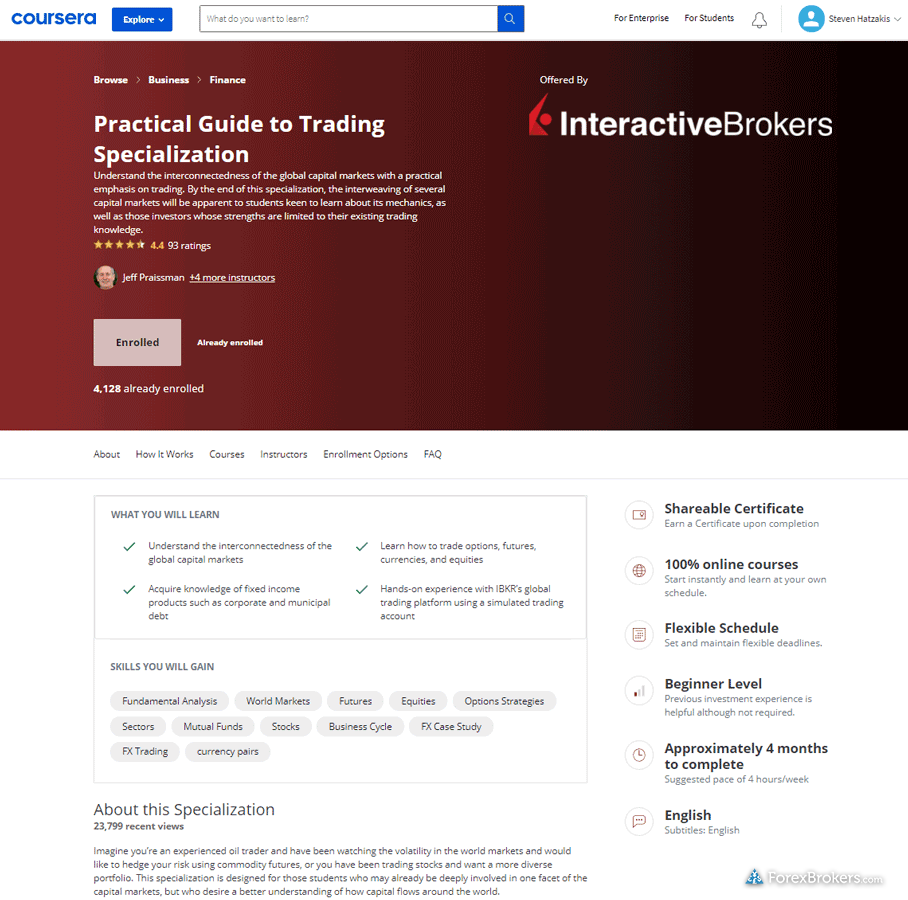

3. Interactive Brokers

Interactive Brokers has significantly expanded its scope of educational content for beginners in recent years. The IBKRCampus offers university-grade content alongside a wide variety of resources and learning materials for beginner forex traders. The broker’s Traders’ Academy portal delivers helpful content that covers basic topics and includes advanced learning courses, complete with interactive quizzes and progress tracking as you go through each lesson. The IBKR Student Trading Lab (STL) offers a companion tool for college finance courses – a great resource if you are a beginner studying finance. Simply put, it’s hard to stay on top of all of the excellent educational content available at Interactive Brokers, making it one of the best forex brokers for beginners in 2024. Learn more by reading my review of Interactive Brokers.

Take a look at a some screenshots from Interactive Broker's educational offering, taken by our research team during our product testing.

Which forex broker has the lowest minimum deposit?

There are several forex brokers, such as CMC Markets, that advertise a $0.00 minimum deposit. This just means that you can open a live account and deposit whatever amount you’d like to start trading – there’s no minimum funding requirement.

The following five brokers have zero-dollar minimum deposit requirements for opening a live forex trading account:

Note: When deciding how much money to start with, be sure to keep extra costs in mind such as wire transfer fees and other transfer-related costs that may depend on your chosen payment method. It’s also important to consider the collateral (margin) you plan to use for your expected trade sizes.

Even if your forex broker does not have a minimum deposit requirement, you’ll still need a method for funding your account to place live forex trades. PayPal has become a popular way for forex traders to fund their trading accounts, due to PayPal’s extensive international presence and wide range of supported currencies. Check out our guide to the best PayPal forex brokers to learn more about using PayPal to fund your account, and to see our list of the best forex brokers that accept PayPal.

How do I choose a forex broker?

Your first step when choosing a forex broker is ensuring that holds regulatory licenses from reputable jurisdictions. Choosing a regulated broker that is permitted to offer services in your country helps you avoid potential forex scams. Also, by selecting a trusted forex broker that is well-capitalized, you reduce the risk of the broker going bankrupt and losing your deposit.

To select a forex broker, start by looking for brokers that are regulated in your country and any available consumer compensation funds provided as protection against bankruptcy. Next, read full-length forex reviews. Finally, compare your top two choices side by side to decide on a winner.

auto_stories Pro tip:

Beginner forex traders should also consider trading costs, range of markets, available platforms, mobile trading apps (see our top picks for forex trading apps), market research and news sources, educational articles, and the quality of customer service that the forex broker provides.

What are the most popular currency pairs?

The most heavily traded currency pairs by volume all include the U.S. dollar (USD), followed by the euro (EUR), Japanese yen (JPY), Great British Pound (GBP), Australian dollar (AUD), Canadian dollar (CAD), and Swiss Franc (CHF). This is according to the latest Triennial Survey by the Bank for International Settlements (BIS), which found that approximately 88% of all forex trades include the U.S. dollar. Check out Currency Pairs on Wikipedia for some more high-level information.

Note: The resulting pairs from these popular currencies are known as the "major pairs" and include the EUR/USD, USD/JPY, GBP/USD, AUD/USD, CAD/USD, CHF/USD, and followed by the Chinese renminbi (CNY), which is the eighth most traded currency, but seventh most traded currency pair when combined with the U.S. dollar (CNY/USD).

Here is an excerpt from the Triennial Survey from BIS:

What is the best forex broker for beginners?

If you're a beginner looking for a thorough selection of educational materials, then IG is the best choice among forex brokers. We've also written an extensive guide for the best forex brokers in the U.S. for beginners, in addition to the brokers that support international traders.

Also noteworthy is Plus500 for its trading platform, which is great for beginners thanks to a simple layout that is easy to learn.

Can I get rich by trading forex?

While possible, getting rich by trading forex is rare. Practice and skill are required to make money trading forex. Successful traders strive to make trades that, on average, return larger profits (winners) than losses (losers) over time. Historically speaking, several hedge fund managers have been able to get rich trading forex.

For example, George Soros made over £1 billion in profit by short selling the British pound in 1992, in what can be described (if one is prone to understatement) as a large bet. Read more about what's known as Black Wednesday on Wikipedia.

Tips for getting started with forex trading

Forex trading is complex and may not be suitable for everyone. Whether forex trading is right for you will depend on your individual financial situation, trading goals, and level of experience as a trader and investor. Beginners who are just getting started as forex traders should exercise caution; the majority of forex traders lose money.

That said, forex trading continues to grow in popularity. If you want to jump into the largest financial market in the world, here are my top 5 tips for getting started as a forex trader:

1. Open a forex trading account with a trustworthy forex broker. Read through your forex broker’s applicable terms and conditions (it’s always a good idea to read all the fine print) and complete the live account application process.

2. Fund your new brokerage account. You’ll need to choose a reliable deposit method (supported by your broker) for sending and receiving funds. Always make sure you are starting with an amount you can afford to risk.

3. Try out a free demo account. Starting with a forex demo account (also known as virtual trading or paper trading) lets you try out your broker’s platform and get comfortable with the broker’s offering – without risking any real money.

4. Create a trading plan. Even the best forex traders can lose money. The key to long-term success as a forex trader is to create a trading plan that helps you establish a consistent trading record, and keep your average losses low (relative to your average profits). Keep track of your trading plan (along with new forex lingo and trader jargon) in a dedicated trading journal. I suggest checking out investor.com's guide to the best online trading journals for some great resources.

5. Enter the forex market and place your first trade. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell. You are now a forex trader! Again, you should only risk funds that you can afford to risk.

warning Pro tip:

If you're a beginner, you should familiarize yourself with the risks associated with forex trading. Beginners will also need to watch out for sophisticated forex scams. Check out my guide to forex scams to protect yourself – and your funds – from scammers.

Is forex trading profitable?

The majority of traders lose money. Therefore, to beat the odds and make money trading forex, you must have a trading strategy that focuses not only on identifying trading opportunities (i.e., signals when to buy or sell) but also calculates the optimum trade size relative to your balance. In addition, your target risk and profit levels should be determined in advance using a stop-loss order and limit.

This way, you have a plan on when to exit a trade – whether at a loss or profit. To be successful in trading, you just need to keep your average losses smaller than your average profit (though of course, that’s easier said than done).

Gambling versus investing: One of the reasons that so many traders lose money is that they take risks that are larger than their budget allows. Many traders treat investments as they would gambling, where their risk is uncontrolled or unbalanced.

If you want to increase your chances of trading forex profitably, treat it as an investment by focusing on limiting your risk relative to the target profit on each trade. In addition, look for trading opportunities that have a higher probability of reaching their profit potential – though these may be harder to find, it’s sometimes better to wait for the right opportunity, rather than jumping into the market just because it is there.

percent Pro tip:

Even if you have a sizeable investment portfolio or budget for trading, starting small and focusing on the percentage returns can be a great way to scale your investment over time.

The Best Forex Trading Platforms for Beginners

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the best forex brokers for beginners, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Also explore educational content across a variety topics at our sister sites :

Methodology

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In order to assess the overall trading experience and to evaluate the ease of use of online trading platforms for beginner traders, we test across a wide range of devices and operating systems.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running macOS 12.5 to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 15, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

Our research team rigorously tests the most important features sought by beginner traders, such as the quality and variety of educational resources, the ease of use of any available trading platforms, the value of the broker’s actionable market research, and the number of regulatory licenses held by the broker.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

Blain Reinkensmeyer

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

IG

IG

AvaTrade

AvaTrade

eToro

eToro

Plus500

Plus500

Capital.com

Capital.com

XTB

XTB

CMC Markets

CMC Markets

Interactive Brokers

Interactive Brokers

Saxo

Saxo

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

City Index

City Index

Swissquote

Swissquote

FXCM

FXCM

OANDA

OANDA

Pepperstone

Pepperstone

XM Group

XM Group

Admirals

Admirals

FP Markets

FP Markets

Tickmill

Tickmill

IC Markets

IC Markets

FxPro

FxPro

Markets.com

Markets.com

FinecoBank

FinecoBank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

FXPrimus

FXPrimus

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX