What are forex signals?

Similar to social copy trading, forex signals are a way for traders to share trading opportunities with other traders and investors. When a trading opportunity is identified, or when certain predefined conditions are met, forex signal providers can share that information (typically a buy-or-sell recommendation) with other forex traders.

Traders that receive forex signals can choose whether to act upon the signal’s recommendation. Generally speaking, trading signals are either bullish (indicating a buying opportunity), or bearish (indicating a selling opportunity).

Some signal providers are fellow human traders, and some signals are created by computer programs, but nearly all trading signals are technical in nature and utilize some underlying form of technical analysis – often involving indicators which perform calculations on the price action of an asset.

Best Forex Trading Signals Providers

Trading signals are just one tool in your trading arsenal, and should not replace your own trading strategy. That said, there are some forex signal services, platforms, and technology providers that deliver a great experience for traders who want to discover forex trading signals.

Here are some of my favorite signal providers (in no particular order):

Acuity Trading

Founded in 2013, Acuity Trading delivers a full suite of innovative products designed to help traders analyze market data information, including price action, market news, and economic calendar events. In March 2021, Acuity Trading announced its acquisition of Signal Centre, previously known as PIA First, which provides trading signals and remains an independent brand following the acquisition.

Acuity Trading also provides actionable market sentiment data. In 2017, Acuity formed a strategic partnership with Dow Jones Newswire to help power its calendar products and economic events analysis, which are available at a growing number of forex and CFD brokers.

Autochartist

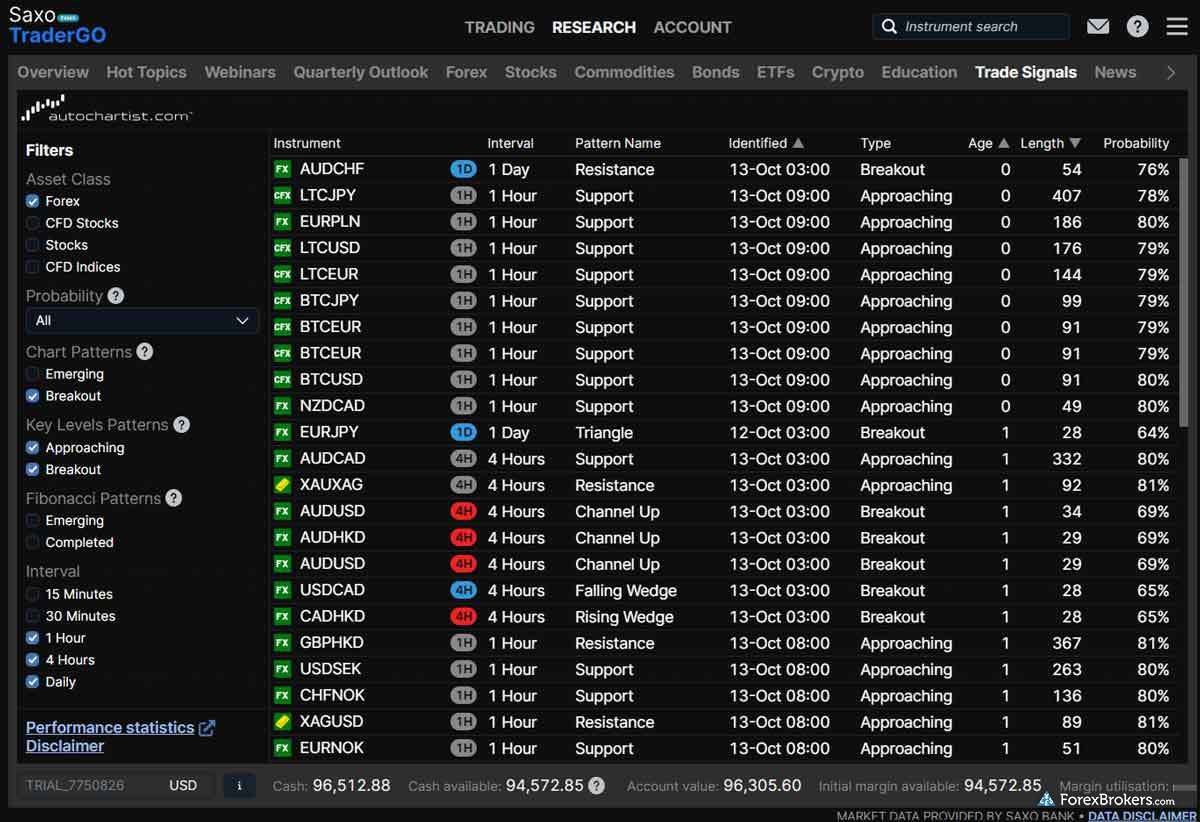

Founded in 2004, Autochartist is a platform technology company that offers a suite of products and powerful analytical tools for traders and investors. Over the years, it has grown into a global brand that is in compliance with over a dozen global regulations from related authorities, and its technologies are used by many popular online forex and CFD brokers. Autochartist is perhaps best known for its automated chart patterns, “trade setups” (similar to trading signals), its web-based platform, and its MetaTrader plugin.

Autochartist provides trading signals driven by its database of technical charting patterns, and a plethora of other resources for traders, such as macroeconomic and fundamental news analysis, price forecasts, and risk calculations. Autochartist also offers social sentiment data on forex currency pairs and a range of other assets, updated on a minute-to-minute basis with data pulled from Twitter. Autochartist won the #1 Trading Signals Technology Provider award for the ForexBrokers.com 2024 Annual Awards.

MetaTrader Signals Market

MetaTrader is a platform suite developed by MetaQuotes Software that includes the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. When you are trading with a MetaTrader broker, you receive access by default to the MetaTrader Signals Market within the desktop platform and on MQL5 (except in rare cases where it is restricted by your broker).

Within the MetaTrader Signals Market, signal providers may use fully automated trading systems, discretionary trading systems (in which the provider decides when to place trades), or a combination of both types. Traders have the ability to view each trading signal provider’s number of subscribers (as well as other qualitative and quantitative metrics) to help assess the provider's performance.

Note: Some signal providers in the MetaTrader Signals Market may charge a recurring subscription fee for using their trading signals.

Signal Centre

Formerly known as PIA First, Signal Centre was acquired by Acuity Trading in early 2021 and has since remained an independent provider, though it can now leverage the technology from its parent company to power a growing list of participating brokers. Signal Centre is regulated by the Financial Conduct Authority (FCA) in the U.K., which is a requirement for companies that offer trading signals to U.K. investors.

Trading Central

Founded in 1999, Trading Central has become a major provider of technological solutions for the online brokerage industry. Known for its expanding suite of applications and automated technical analysis, Trading Central delivers a range of robust trading tools and resources such as investment research, economic calendar events, trader sentiment data, and a formidable offering of trading signals.

In the U.S., Trading Central is a Registered Investment Advisor (RIA) and is regulated in Hong Kong by the Hong Kong Securities and Futures Commission (SFC). Within the EU, Trading Central is a member of the self-regulatory organization Association Nationale des Conseils Financiers (ANACOFI-CIF), and registered with ORIAS which manages registrations and is supervised by the treasury department in France.

read_moreMore about Trading Central

Check out our guide to Trading Central to learn more about this popular technology provider, and to see our picks for the best forex brokers that offer Trading Central.

Types of forex trading signals

Some forex trading signals are generated by human traders, while others are 100% computer-driven. Computer-generated trading signals use formulas to perform calculations on the price action of an asset until the pre-defined conditions that generate the signal are met. Human-generated trading signals may incorporate similar technical analysis, but include the element of human discretion.

Are forex signals worth it?

Yes, forex signals can be worth using – provided that you conduct your own analysis and develop a detailed trading strategy. That said, forex signals are not a catch-all solution for successful trading. You still have to identify which signals to follow, which to avoid, and what the size of your trades will be once you’ve identified a trading opportunity. Developing your own risk-management philosophy and creating a trading strategy based on your personal trading goals are just as important when using forex trading signals.

Can forex signals make you rich?

Though not impossible, it’s unlikely that simply following forex trading signals will make you rich. In fact, statistics show that the vast majority of retail forex traders lose money, year after year. Finding success while using forex trading signals has more to do with how you manage your trading strategy and portfolio, and less to do with the particular signals you choose or trades you make.

savingsRemember:

Forex trading – whether you use forex signals or not – is not a way to make fast, easy money. Traders who try to convince you otherwise likely take extreme risks and bank on luck – or are running forex scams. Check out our guide to avoiding forex scams.

Can I get free forex signals?

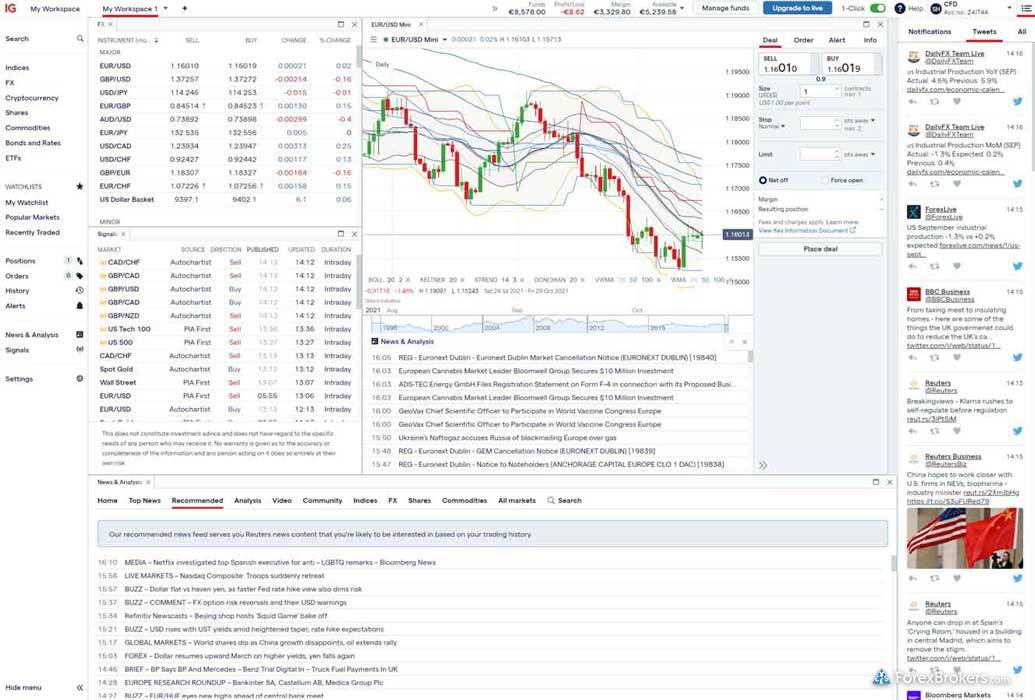

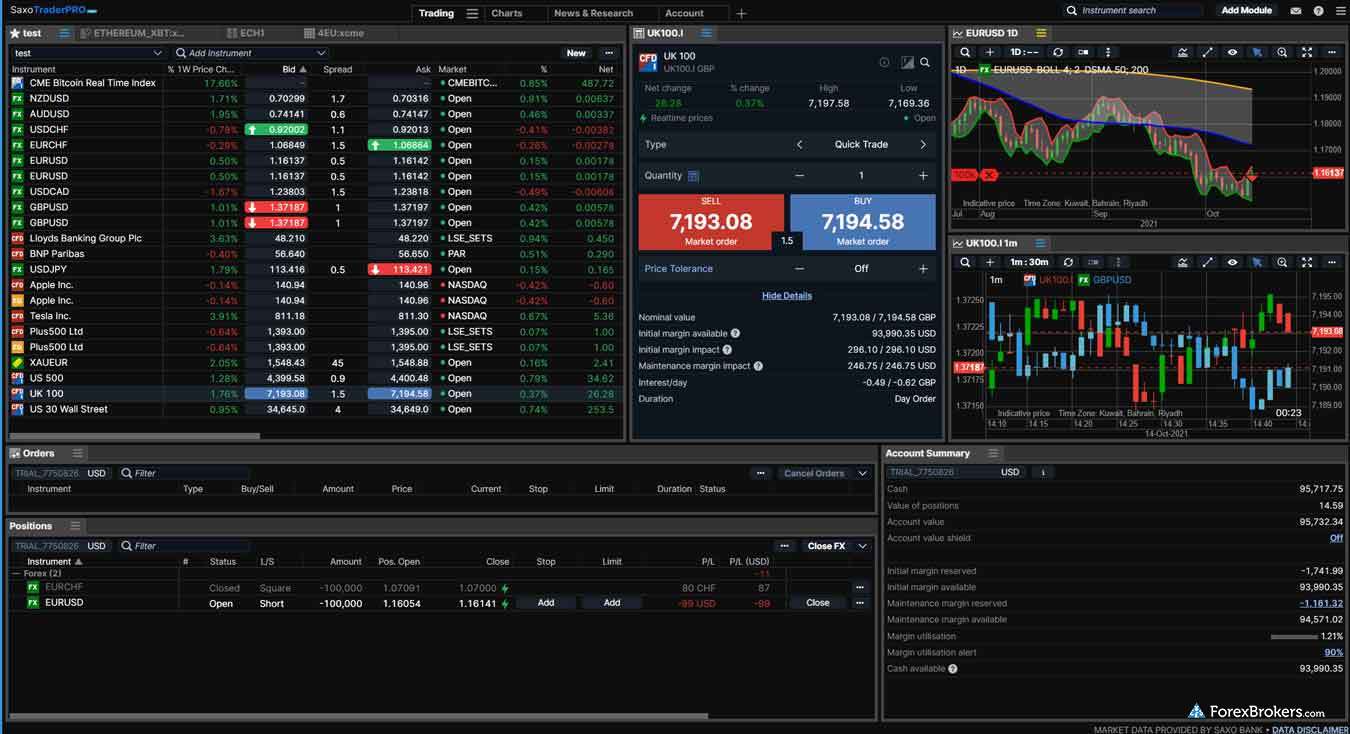

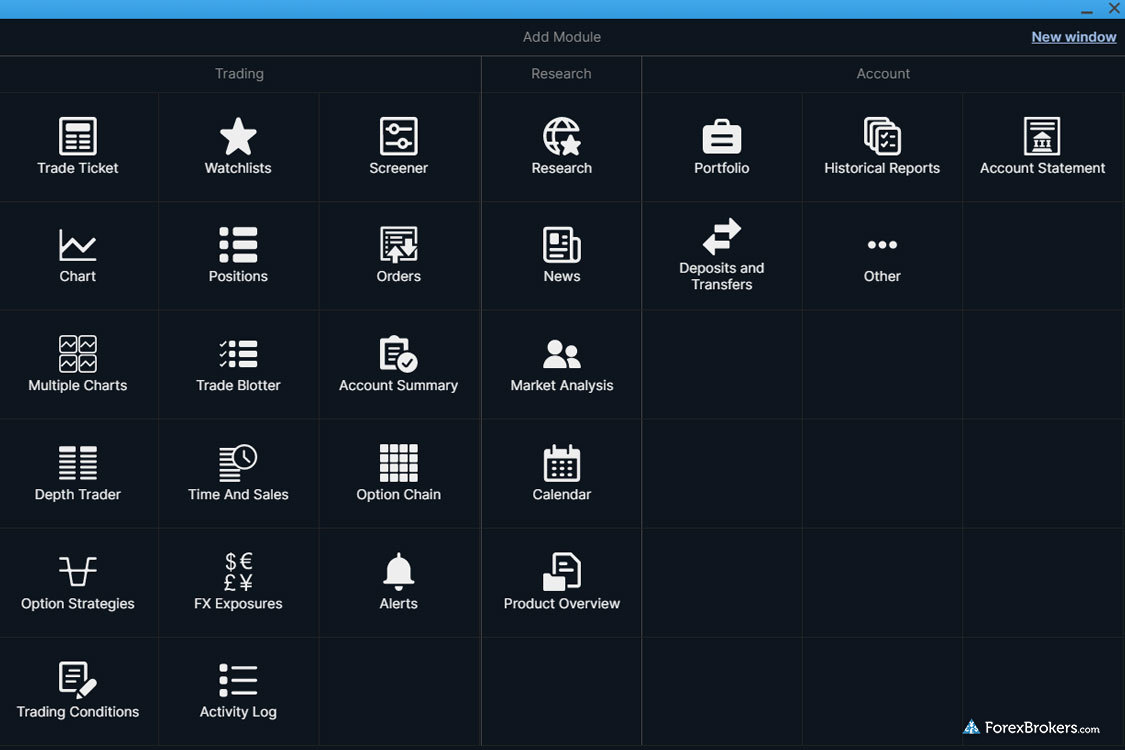

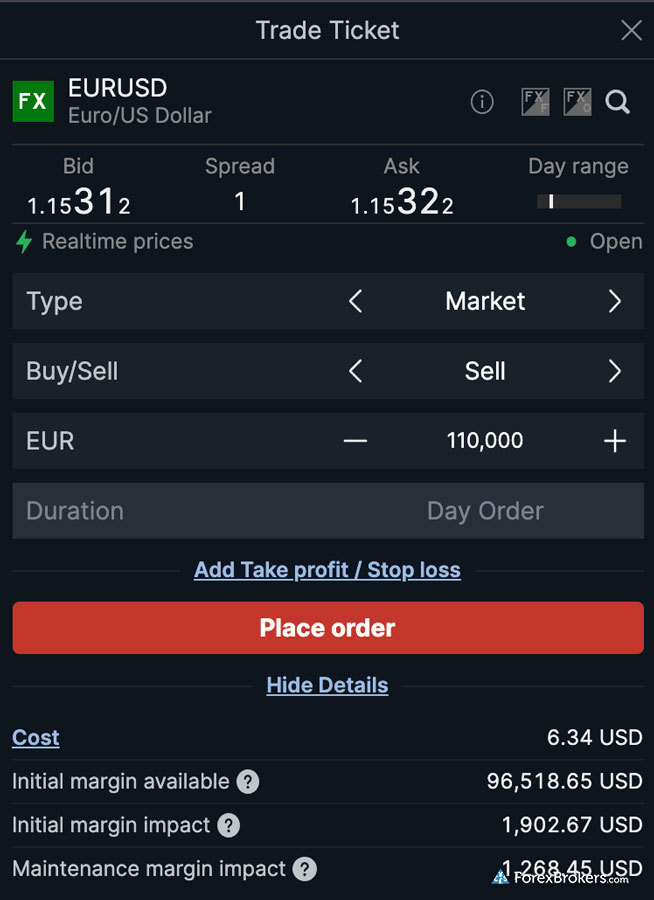

Yes, the best forex brokers offer access to high-quality free forex signals, usually available within their platform or through a dedicated website. For example, IG directly integrates PIA First and Autochartist within its web-based trading platform. One thing about IG’s integration of trading signals that I appreciate is the ability to copy a trading signal directly into a trade ticket. This feature (which is offered by other top brokers, such as Saxo) allows you to place an order without having to type in every detail, providing a smooth user experience.

Learn how to use trading signals on IG's web platform by checking out our video walkthrough:

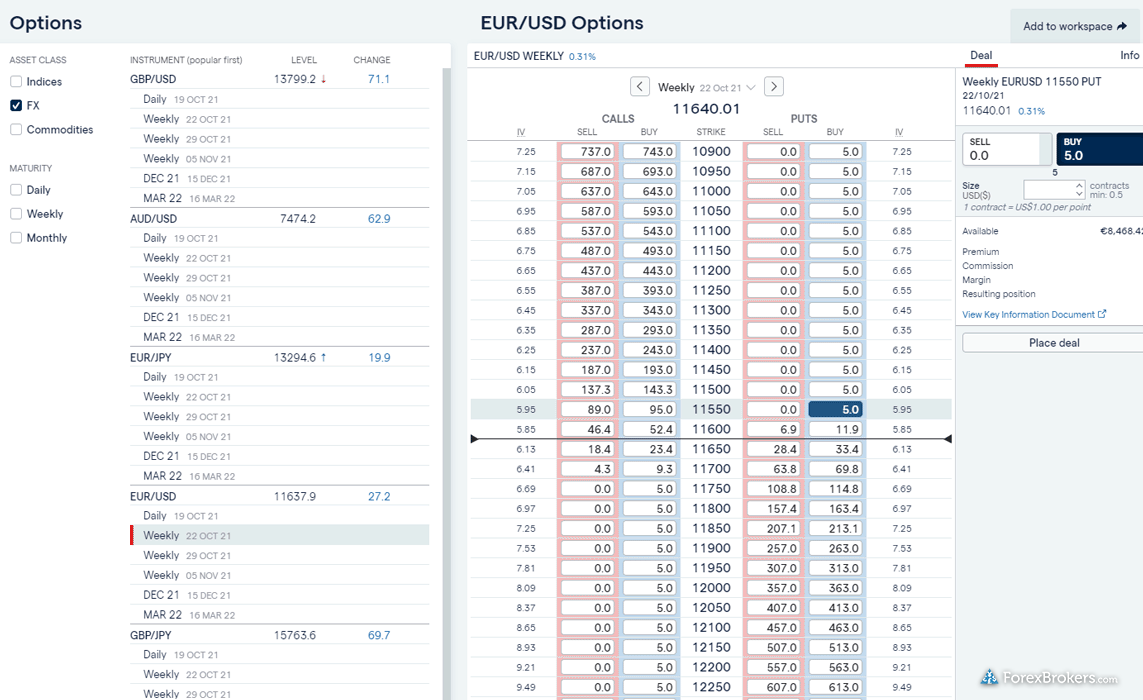

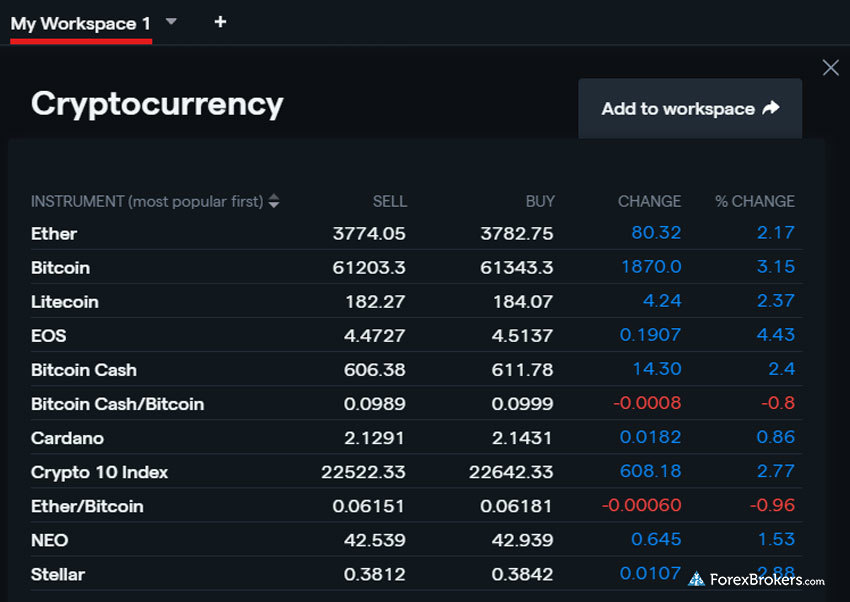

Screenshots of trading signal integration at IG:

Screenshots of IG's trading platforms for web and desktop:

Screenshots of Saxo's trading platforms for web and desktop:

What is the best signal for forex?

Simply put, the best signal for forex trading is the one that makes you money. That said, using forex signals when trading is not a get-rich-quick scheme. Choosing forex signals can be complicated, and finding success with forex signals is easier said than done. The quality of a forex signal will depend on a number of factors, including the strength of the signal and the market conditions that could help (or hinder) the signal’s potential. You also still have to be mindful of your trade sizes, expected trade durations, and the way you’ll use stop-loss and limit orders for risk management.

Important factors to consider when analyzing a trading signal:

- Strength - The probability or confidence level that the expected outcome will materialize.

- Recency - The time the signal was published (Has it expired? Has it already reached its target?)

- Event-type quality - Was the signal based on a common event (such as a chart pattern breakout), information from a technical indicator, or from a confluence of multiple factors?

infoPro tip:

Trading signals should never be a replacement for developing your own trading strategy, they should be used to complement an existing strategy.

What’s the difference between copy trading and trading signals?

Copy trading (also known as social trading, mirror trading, or auto trading) is an automatic process. Once you’ve chosen a copy trading signal provider and copied their strategy, all of their trades will automatically be replicated (or, copied) in your brokerage account. With forex trading signals, it’s ultimately up to the trader to decide if they want to follow the signal's recommendation. For example, a trader might receive a forex trading signal that looks promising, but decide to pass on the trading opportunity after conducting their own analysis.

chatInterested in copy trading?

Check out our guide to the best forex brokers for social copy trading to learn more about how copy trading works, and to see our picks for the best copy trading platforms in the industry.

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the top seven MetaTrader 5 brokers, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular guides to forex trading tools and platforms

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In order to assess the best brokers for trading signals, we research and test each individual broker’s product offering. We examine a wide range of features and evaluate forex brokers based on our own data-driven variables. We determine if the broker offers trading signals, and we look for the availability of third-party signal providers. We also test for a number of supplementary features that can distinguish trading signal offerings, such as direct integration within the broker's platform technology and the ability to use trading signals to fill a trade ticket.

Browser-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we test trading signals on mobile devices; for Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

IG

IG

Saxo

Saxo

Interactive Brokers

Interactive Brokers

CMC Markets

CMC Markets

FOREX.com

FOREX.com

City Index

City Index

eToro

eToro

Charles Schwab

Charles Schwab

XTB

XTB

Capital.com

Capital.com

Swissquote

Swissquote

AvaTrade

AvaTrade

Plus500

Plus500

FXCM

FXCM

OANDA

OANDA

Pepperstone

Pepperstone

XM Group

XM Group

Admirals

Admirals

FP Markets

FP Markets

Tickmill

Tickmill

IC Markets

IC Markets

FxPro

FxPro

Markets.com

Markets.com

FinecoBank

FinecoBank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

FXPrimus

FXPrimus

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX