Octa Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Octa (formerly OctaFX) offers a basic, low-cost MetaTrader platform experience alongside its proprietary web and social copy-trading platform.

Octa has made great strides with its pricing options for traders and its educational content, but suffers from a limited range of tradeable instruments.

-

Minimum Deposit:

$25 -

Trust Score:

70 -

Tradeable Symbols (Total):

230

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

Octa pros & cons

Pros

- Founded in 2011, Octa is regulated in one Tier-1 jurisdiction and one Tier-2 jurisdiction. Learn more about Trust Score and regulatory jurisdictions.

- Maintains a growing array of well-organized research, with trading ideas, daily updates, weekly forecasts, and third-party content.

- Octa offers a proprietary platform for social copy trading and the OctaTrader web platform.

- Octa advertises swap-free trading accounts and Sharia-compliant trading accounts.

- Margin is tiered by account balance size, in-line with best practices to help protect larger investment amounts from excessive use of leverage.

Cons

- Customers served by the broker’s Mwali entity are not afforded the same regulatory protection from the MISA, compared to more established and trusted jurisdictions.

- Arbitrage is not permitted; more than 30 requests per minute by an EA on MT4 can get your bot banned.

- Octa appears to offer competitive trading costs, but its listed spreads lack corresponding date ranges.

- Only a narrow selection of tradeable symbols (just over 230) are available on MT5, and only 80 on its OctaTrader platform.

- Though Octa continue to develop its market research, it struggles to compete with the best brokers in that category.

- The cTrader platform is no longer available at Octa.

Overall summary

| Feature |

Octa Octa

|

|---|---|

| Overall Rating |

|

| Trust Score | 70 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Octa Safe?

Octa is considered Average Risk, with an overall Trust Score of 70 out of 99. Octa is not publicly traded and does not operate a bank. Octa is authorised by one Tier-1 regulator (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and zero Tier-4 regulators (High Risk). Octa is authorised by the following Tier-1 regulators: Regulated in Cyprus and in the European Union via the MiFID passporting system. Learn more about Trust Score.

| Feature |

Octa Octa

|

|---|---|

| Year Founded | 2011 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

Investment Products

Octa offers barely 230 tradeable instruments, which varies by platform, with the most on its MT5 offering. By comparison, industry leaders Saxo, IG, and CMC Markets all offer over 10,000 tradeable instruments.

Cryptocurrency: Cryptocurrency trading at Octa is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

The following table summarizes the products available to Octa clients.

| Feature |

Octa Octa

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 230 |

| Forex Pairs (Total) | 35 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Fees

Octa has struggled with pricing in the past, but has vastly improved in this category and is now gaining on the lowest-cost MetaTrader brokers. In addition, Octa boasts no slippage on 97.5% of its executed orders, and no overnight carry costs, yet has restrictions in place that can hinder high-frequency traders.

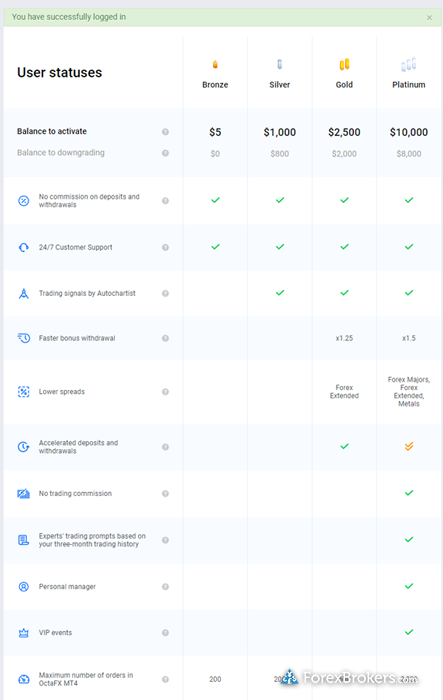

Account types: Any commissions or fees you pay at Octa will depend on your chosen account type and the Octa entity under which your account is regulated. European clients will choose the broker’s EU entity, whereas international clients are served either from South Africa, or from Octa’s offshore entity in Mwali. In the EU, only MT5 is promoted and thus a single account is available, whereas the foreign entities offer accounts for both MT4 and MT5, alongside OctaTrader.

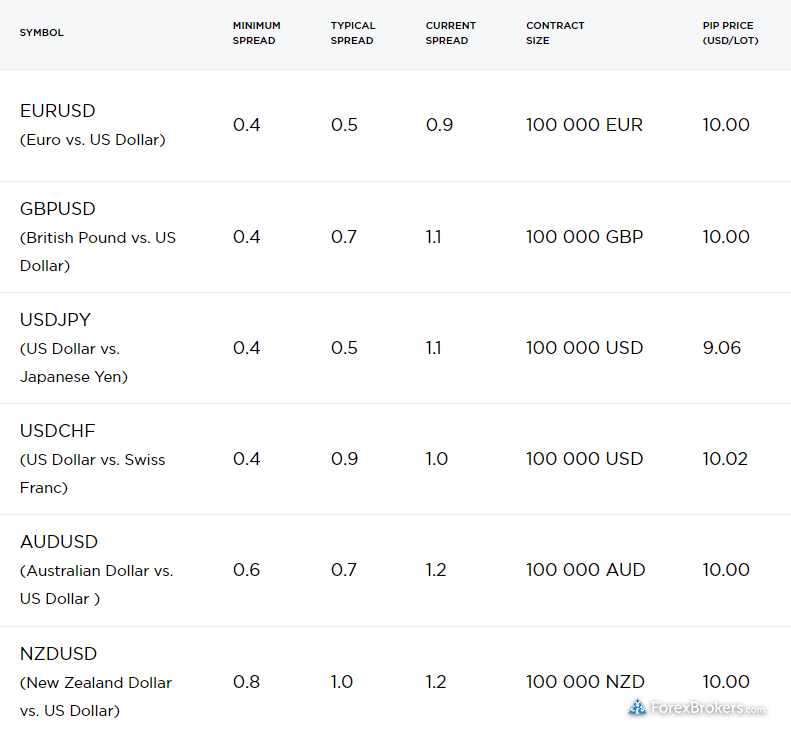

Spreads: Octa’s spread pricing varies depending on which of its entities regulates your account. For example, its EU entity is slightly better for the EUR/USD pair with 0.5 pips listed as the average spread, compared to 0.9 pips for the foreign entities. It’s worth noting that Octa does not provide a date range for its typical spread data listed on its website, and thus the values don’t carry as much weight as spreads that have a corresponding date reference. All in all, Octa has improved its pricing and appears to keep pace with the lowest-cost MetaTrader brokers, but with no date range available for its average spread claim, we were unable to make an exact comparison.

| Feature |

Octa Octa

|

|---|---|

| Minimum Deposit | $25 |

| Average Spread EUR/USD - Standard | 0.9 |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | No |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Octa does have a proprietary app for social copy trading (the Octa Copytrading app), yet it still trails behind industry leaders such as IG and Saxo. Check out my picks for the best mobile trading apps in the industry.

Apps overview: Octa is primarily a MetaTrader-only broker, with iOS and Android versions of the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) app come standard and are both available for download from the Apple App Store and Google Play store, respectively. Octa also offers its proprietary mobile app - Octa Copytrading - for social copy trading . I was unable to install or test this app due to geolocational restrictions I encountered on Google Play.

| Feature |

Octa Octa

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 7 |

| Watchlist Syncing | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

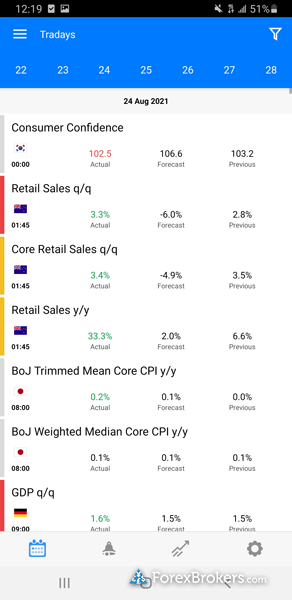

| Mobile Economic Calendar | Yes |

Other trading platforms

Though Octa provides access to its proprietary OctaTrader web trading platform, Octa is primarily a MetaTrader broker, offering MetaQuotes Software Corporation’s suite of platforms that include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

OctaTrader: Octa’s newly launched web platform delivers a simple trading experience, offering the basics needed for essential trading operations without any frills or advanced features. While OctaTrader has made notable progress year-over-year, such as with the addition of research content and the ability to trade directly within the chart, it still has a long way to go if it wants to compete with the trading platforms offered by the best forex brokers in the industry.

Copy trading: Octa offers a web interface for copy trading (providers are known as Masters) that connects to its MetaTrader 4 (MT4) platform offering. Overall, I found that the available performance statistics made it difficult to make meaningful comparisons between Octa's "Masters." Octa’s copy trading offering still trails behind the best brokers for social copy trading.

There are 2,951 trading systems known as "Master Traders" to copy on Octa's Copytrading app, and a few new tools were recently added to make it easier for you to compare the performance rankings when selecting which traders to copy.

For example, the "minimum expertise" field lets you choose between newer systems, all the way up to those with legend status. I was also pleased to see a risk score assigned to each trader, to help users differentiate between traders with historically conservative results versus those that have had more volatility and risk. It would be useful to be able to sort the columns from highest to lowest, but that feature is not yet available when looking at the Master Rating results page.

Pro tip: It's important to remember that past performance is not indicative of future returns, and although choosing trading systems with consistent historical returns can increase the statistical probability compared to traders that are less consistent, when it comes to projecting potential future rates of returns, other factors must be considered, including your personal goals and risk tolerance.

For instance, consider the timing or when to copy or when not to, whether there are any existing open positions, and the number of followers a trader has, as well as the percentage of profit sharing (i.e. performance fee), among other data and tools available when making selections.

| Feature |

Octa Octa

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 30 |

| Charting - Drawing Tools (Total) | 15 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 7 |

Market research

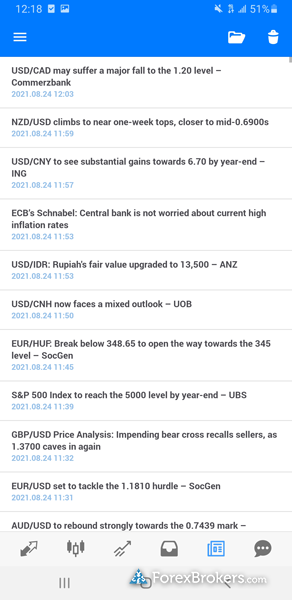

Octa’s market research is well organized and varied in its content. Rather than specializing in any one field, Octa provides a wide assortment of content types. However, when compared to research leaders IG, Saxo, and CMC Markets, Octa has room to enhance its research offering.

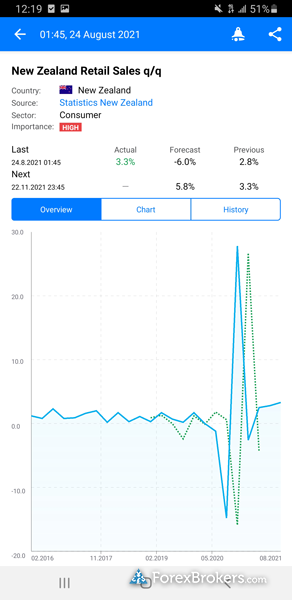

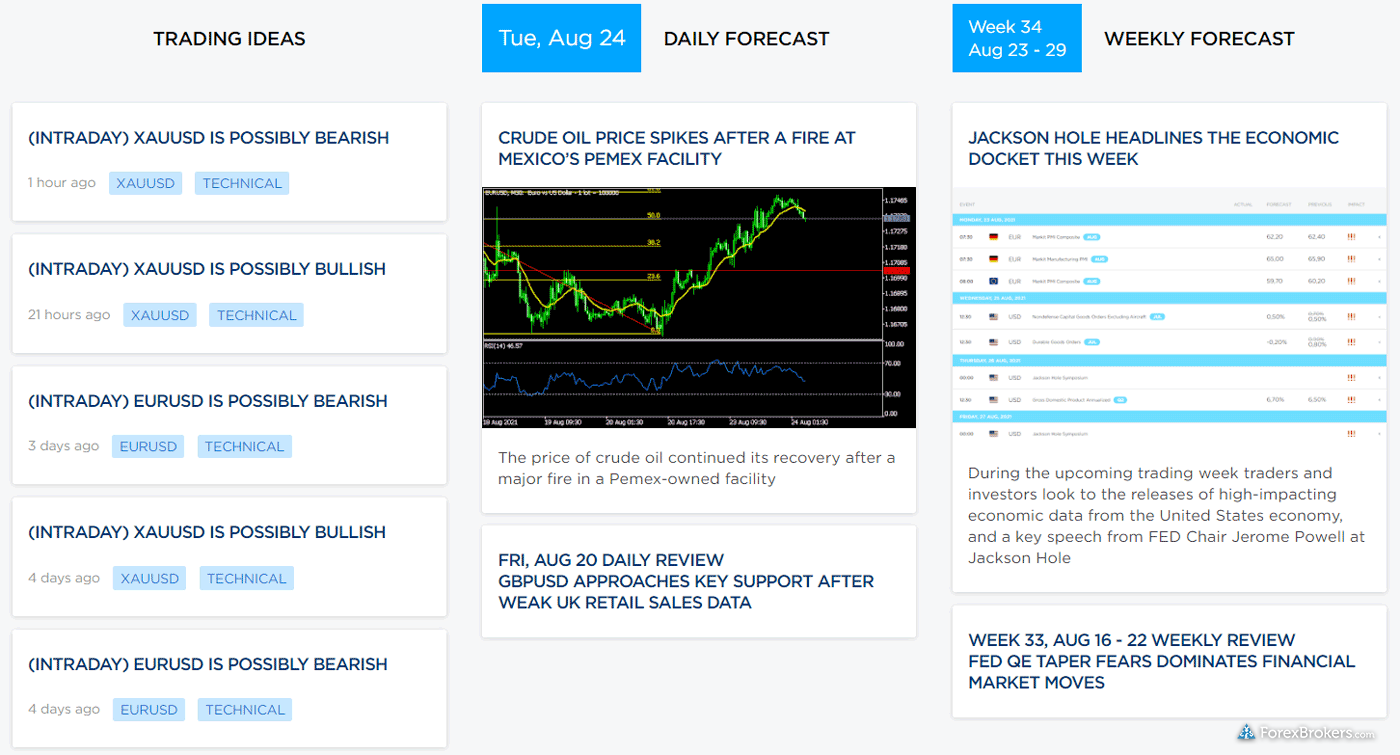

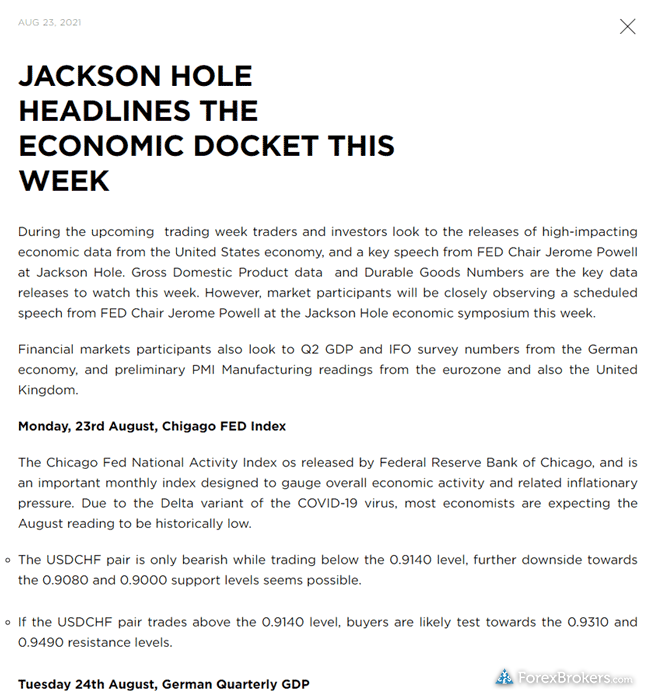

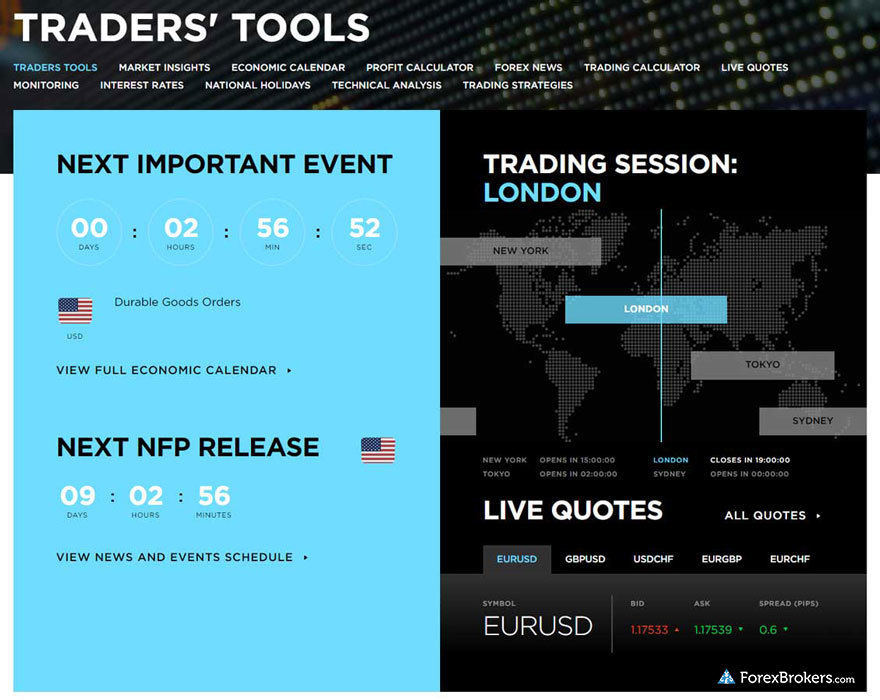

Research overview: Octa’s research content lives in its Market Insights section, which features an economic calendar, daily analysis posts, as well as automated technical analysis by way of MetaTrader’s Autochartist plugin. My favorite features were the interest rates tracker, daily and weekly forecast articles, and the economic calendar – which was useful for keeping track of national holidays and global trading hours.

Market news and analysis: Octa produces daily articles that cover technical and fundamental analysis across popular trading symbols including forex and CFDs. It also offers its OC LiveTrader series, which consists of video content that is live-streamed on its YouTube channel, which recently surpassed one million subscribers. The quality of Octa’s research material is a touch above with what you’d typically find with the average broker, although still trails behind the rich content offered by the best brokers in this category.

| Feature |

Octa Octa

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | No |

Education

Octa has improved its educational offering with webinars and live trading session recordings and expanded its educational articles and videos. I appreciated that it has begun producing videos on advanced topics, such as Elliot Wave trading.

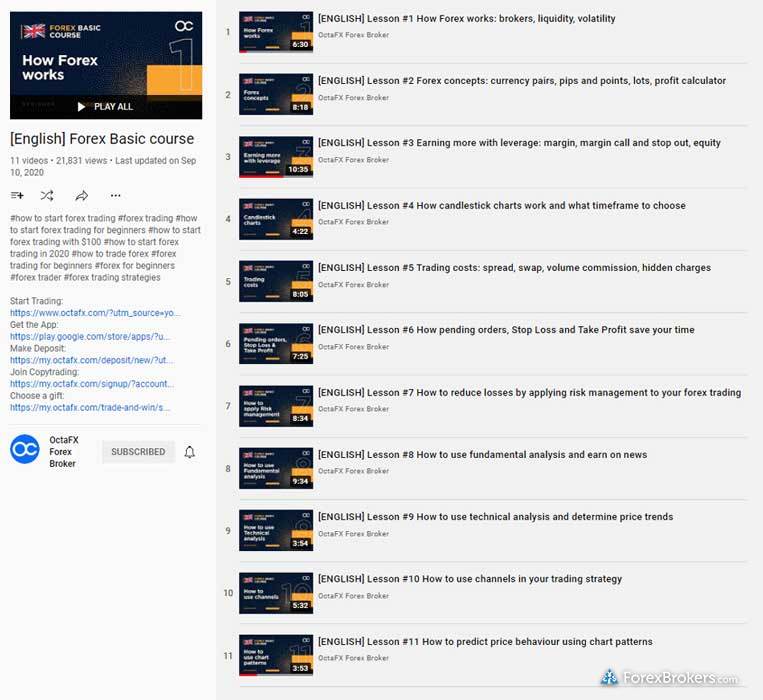

Learning center: Octa’s website has a dedicated forex education section with roughly 20 articles for beginners. The Octa Youtube channel has archived webinars, and also hosts its Forex Basic Course video series that spans 11 parts.

Features like its trading glossary, platform tutorials, and dozens of Frequently Asked Questions (FAQs) help to flesh out Octa’s educational offering. That being said, there isn’t much educational content for learning how to trade or understand market dynamics. It's worth mentioning that the broker does have a blog and a YouTube channel, yet I was still left wanting more.

Room for improvement: Octa’s educational offering continues to benefit from an overall expansion of its video content and an increase in the range of topics covered. Adding additional written articles and courses would be a further benefit. I'd also like to see a deeper level of organization; arranging the educational content by experience level would balance the overall experience. Check out my guide to the best free forex trading courses to see my favorite sources of free forex education.

| Feature |

Octa Octa

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Octa offers the full MetaTrader suite, albeit with a fairly limited offering of tradeable instruments. There’s no question – if Octa wants to compete with the best MetaTrader brokers, it needs to make improvements in its range of products and its research and education.

Though it has been granted regulatory status in Cyprus and South Africa via an intermediary (Orinoco Capital), Octa’s lack of additional reputable licenses heavily weighs down its Trust Score. Becoming regulated in more jurisdictions – especially in Tier-1 jurisdictions – will go a long way towards building trust with existing and prospective customers.

About Octa

Founded in 2011, Octa (formerly OctaFX) is part of a group of global entities, which include Octa Markets LTD (based in the island of Mwali) and Octa Markets Cyprus Ltd (based in Cyprus). Octa also provides financial services through its intermediary, Orinoco Capital (based in South Africa).

Is Octa a good broker?

Octa is an up-and-coming broker that has been in operation for nearly 10 years. Its growth has enabled Octa to continue to expand its products and services. Adding additional regulatory licenses in Tier-1 jurisdictions would be a step toward winning more client trust.

Is my money safe with Octa?

Octa is regulated in Cyprus by the Securities & Exchange Commission (CySEC) and in South Africa by the Financial Sector Conduct Authority (FSCA). Octa holds just one Tier-1 license and one Tier-2 license, resulting in a grade of "Average Risk" within the ForexBrokers.com Trust Score rating system.

Founded in 2011, Octa holds a regulatory license in Europe via its Cyprus-based entity – Octa Markets Cyprus Ltd – which is regulated by the Cyprus Securities and Exchange Commission (CySEC). Your account may be eligible for certain CySEC protections – in the extraordinary event of Octa Markets Cyprus Ltd.’s bankruptcy, for example, you’ll be protected for up to 20,000 euros from the Investor Compensation Fund (ICF). In South Africa, Octa provides financial services to clients through an intermediary, Orinoco Capital, which is licensed by the Financial Sector Conduct Authority (FSCA).

Octa Markets Ltd is the brand’s international entity based in Mwali, and it provides limited regulatory protection, as the Mwali International Services Authority (MISA) is not known to be an efficient regulator of forex brokers. The security of your funds – in terms of regulatory protection – will depend on which Octa entity holds your account, and which –if any – relevant regulations provide customer protections. It's worth noting that Octa's primary execution venue is one of its own entities in St. Lucia.

What is the minimum deposit for Octa?

Minimum deposits at Octa will vary depending on your country of residence and your chosen payment method. They can go as low as $25 (USD) when funding with Visa/Mastercard, to 50 euros (EUR) when using Skrill/Neteller to as much as 500,000 Indian rupees (INR). It’s important to note that minimum deposits and trading costs will also depend on which Octa entity you choose for establishing your trading account.

Octa has over 50 different payment options, such as Visa, Neteller, Fasapay and bitcoin, as well as a large variety of local bank transfers. The availability of these payment methods may also depend on your country of residence.

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Forex Brokers for Beginners of 2024

- International Forex Brokers Search

- Best Forex Trading Apps of 2024

- Best Brokers for TradingView of 2024

- Best MetaTrader 4 Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Forex Brokers of 2024

- Best Copy Trading Platforms of 2024

- Compare Forex Brokers