Pepperstone Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pepperstone offers a growing range of tradeable markets, good-quality research, and support for multiple social copy trading platforms.

Pepperstone provides access to TradingView, cTrader and MetaTrader, and its wide range of available third-party tools and plugins enhances its already-impressive suite of available platforms.

-

Minimum Deposit:

$0 -

Trust Score:

95 -

Tradeable Symbols (Total):

1726

Can I open an account with this broker?

Yes, based on your detected country of HK, you can open an account with this broker.

Pepperstone pros & cons

Pros

- Founded in 2010, Pepperstone is regulated in three Tier-1 jurisdictions, two Tier-2 jurisdictions, and two Tier-4 jurisdictions.

- Pepperstone won Best in Class honors for our MetaTrader, Algo Trading, and Copy Trading categories in our 2024 Annual Awards.

- Pepperstone’s dual offering of MetaTrader and cTrader is a great fit for algorithmic traders and copy traders.

- Pepperstone provides multiple platform add-ons that enhance the MetaTrader experience.

- Research at Pepperstone is better than the industry average – though it still trails leaders such as IG or Saxo.

- Pepperstone offers a growing selection of tradeable markets.

- Pricing is competitive for active traders on Pepperstone's Razor accounts, though trading costs for retail traders are just average.

- Multiple social copy trading platforms are available.

- Pepperstone's newly-launched proprietary mobile app has a good variety of features.

Cons

- The range of educational materials at Pepperstone is close to the industry average – but not as good as category leaders.

- Does not provide interactive courses, progress tracking, or educational quizzes.

Overall summary

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Overall Rating |

|

| Trust Score | 95 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Pepperstone safe?

Pepperstone is considered Highly Trusted, with an overall Trust Score of 95 out of 99. Pepperstone is not publicly traded, does not operate a bank, and is authorised by three Tier-1 regulators (Highly Trusted), two Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and two Tier-4 regulators (High Risk). Pepperstone is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system. Learn more about Trust Score or see where the different Pepperstone entities are regulated.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Year Founded | 2010 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 3 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 2 |

Offering of investments

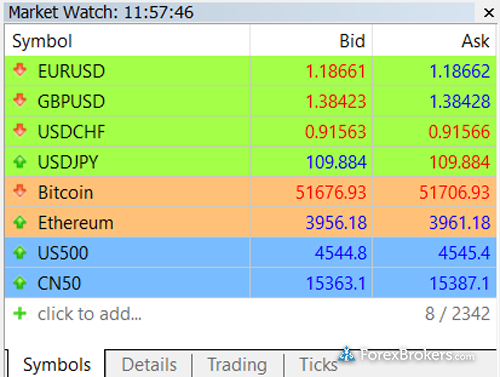

While there are 2,342 symbols shown in Pepperstone’s MetaTrader 5 (MT5) platform, some of these are actually duplicates. That being said, there are more than 1,000 distinct markets available for trading – including forex and CFDs.

Cryptocurrency: Cryptocurrency trading is available at Pepperstone through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except for professional clients).

The following table summarizes the different investment products available to Pepperstone clients.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 1726 |

| Forex Pairs (Total) | 65 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

Pepperstone is an agency-execution broker that offers excellent pricing on its Razor account when combined with its Active Trader program for high-volume traders. Meanwhile, its Standard account is not as impressive, and features comparably higher spreads.

Razor account: The Razor account can be used with the TradingView, MetaTrader (MT4 or MT5), or cTrader platforms, and follows a commission-based pricing structure (in addition to prevailing spreads). Pepperstone listed an average spread of 0.10 pips for the EUR/USD on its Razor account (as of July 2024). When including the commission-equivalent of 0.70 pips, the all-in cost increases to 0.80 pips – which is close to the industry average.

Standard account: Pepperstone’s Standard account is commission-free, and has listed an average spread of 1.1 pips on the EUR/USD (as of July 2024). When considering the Razor’s all-in cost of 0.80 pips (including commission), the Standard account is the more expensive option.

Active traders: Pepperstone's Active Trader program will rebate a portion of the spread, depending on your monthly trading volume and the applicable tier.

United Kingdom and EU: Professional clients that trade at least £20 million per month of forex can be eligible for a rebate on the spreads paid of 15% per lot (rates vary for commodities and indices). The rebate continues to improve up to 25% for those who trade more than £200 million per month.

Australia: For Professional clients, a minimum of 100 lots is required (over a three month period) to qualify for the lowest tier in Pepperstone's Active Trader program. Tier One provides a discount of 10% per standard lot, which reduces the effective spread. Tier Three – available to those who trade more than 3001 lots monthly – provides a 30% spread reduction.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 1.10 |

| All-in Cost EUR/USD - Active | 0.80 |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

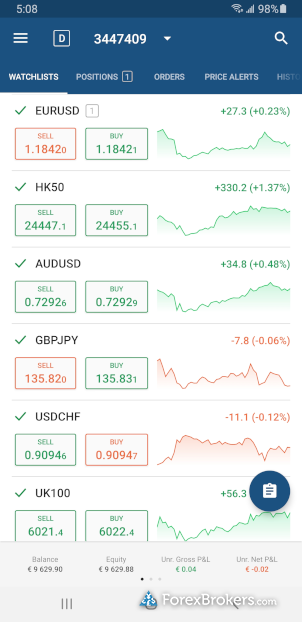

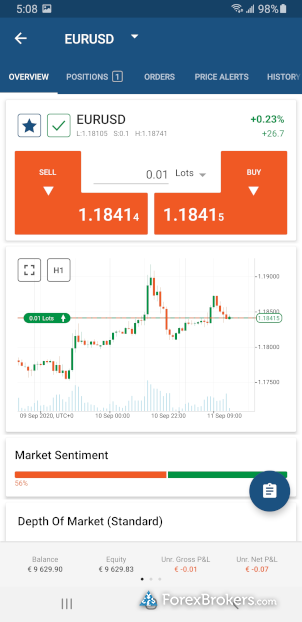

There are multiple third-party platform options for mobile trading at Pepperstone as well as the broker's proprietary Pepperstone mobile app.

Apps overview: Traders have access to the TradingView app, along with the MetaTrader suite of mobile apps (MT4 and MT5), as well as the cTrader mobile app – all of which are available directly from their respective developers on Google Play (for Android) and Apple App Store (for iOS). Last but not least, the Pepperstone app is also available on Google Play and the Apple App Store.

Pepperstone Trading App: Pepperstone recently launched its Pepperstone mobile app. This newer app is a step in the right direction with standout features such as the ability to close all positions with one click. I'm looking forward to seeing how this proprietary app progresses in the months and years to come. That said, it still has a long way to go to compete with the best brokers in this category.

Ease of use: With TradingView, MetaTrader and cTrader available alongside its own proprietary app, Pepperstone offers plenty of options when it comes not only to functionality but also the ease of use factor, thanks to the modern design of these applications. While its new mobile app has less features than the other options available, one benefit it conveys is ease of use. Traders needing more can simply switch to the more advanced mobile apps available at Pepperstone.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 7 |

| Watchlist Syncing | Yes |

| Charting - Indicators / Studies (Total) | 15 |

| Charting - Drawing Tools (Total) | 30 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | Yes |

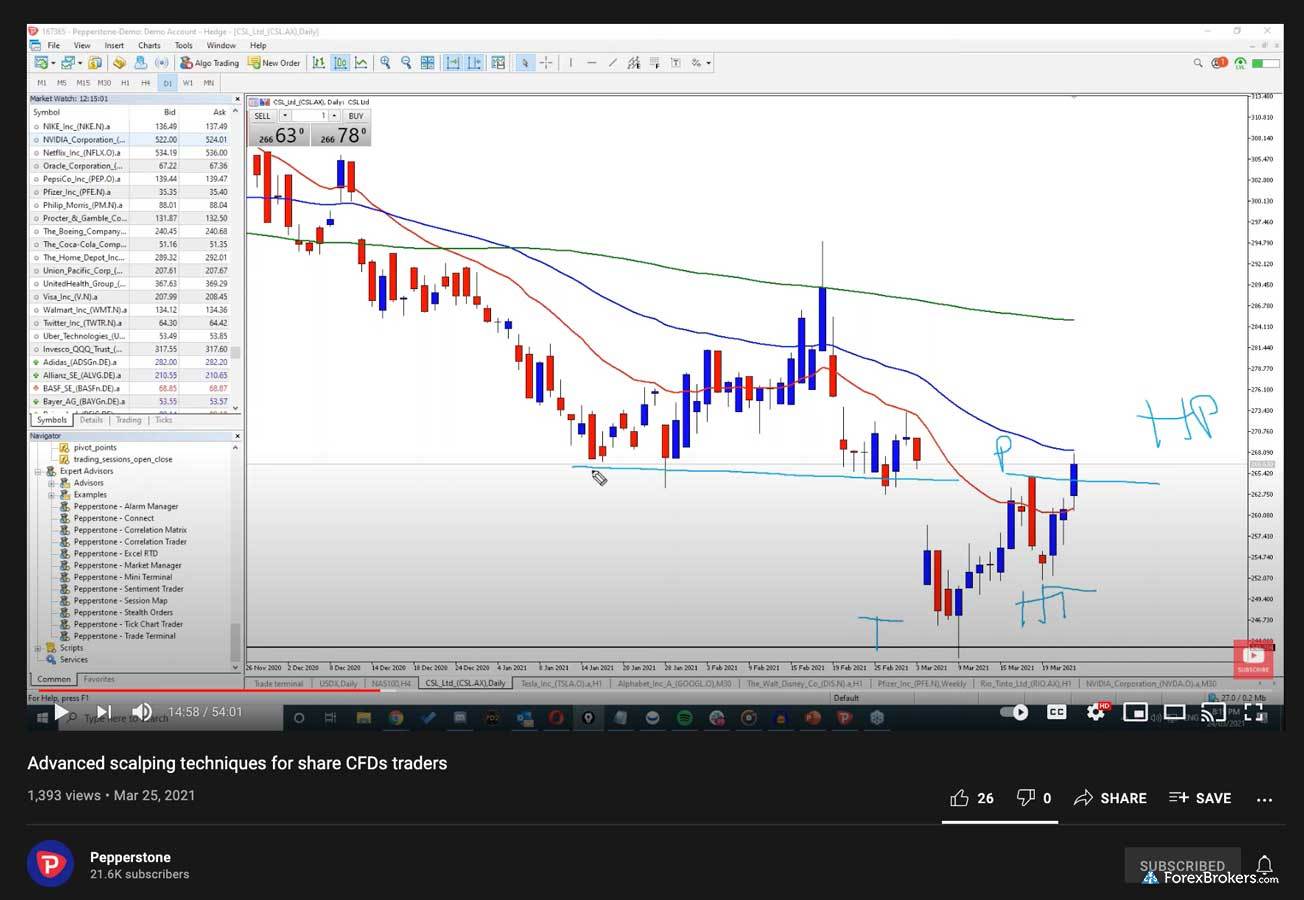

Other trading platforms

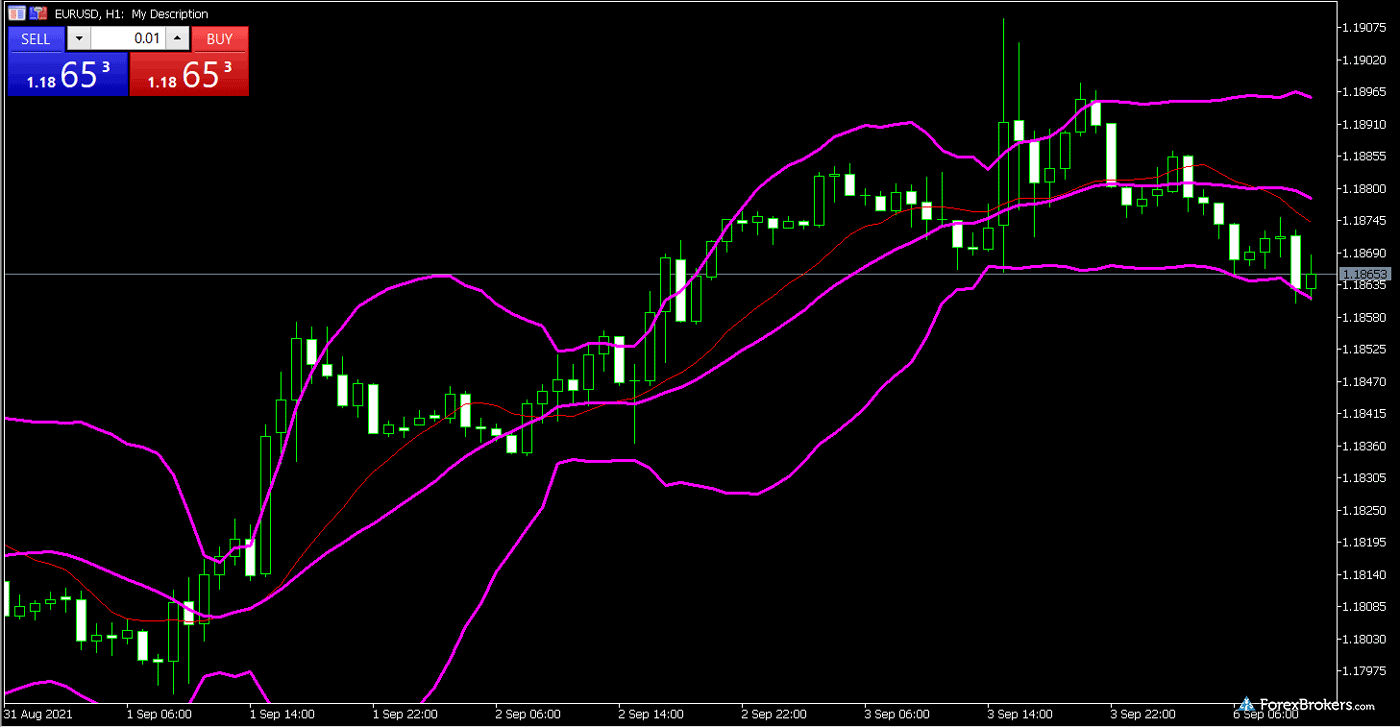

Though Pepperstone lacks a proprietary platform, it offers nearly every third-party platform available on the market. Overall, I was impressed and Pepperstone earned Best in Class honors for MetaTrader in our 2024 Annual Awards.

Platforms overview: Pepperstone offers the full MetaTrader suite (MT4 and MT5) developed by MetaQuotes Software Corporation, as well as the cTrader platform developed by Spotware Systems – both available for desktop and web, along with the popular TradingView platform. Pepperstone also recently launched its own proprietary platform, further expanding its range of platforms. cAlgo is available for algorithmic trading, and traders can use both of Pepperstone’s account types (Standard or Razor) with any platform.

Pepperstone also finished Best in Class for Algo Trading in our 2024 Annual Awards. If you’d like to learn more about the best algo trading software or the best trading platforms for high-frequency traders, check out our high-frequency trading guide.

Charting: Charts are robust on both cTrader and MetaTrader. Both platforms support algorithmic trading, each with their own strengths and weaknesses. cTrader’s web-based platform has an advantage with its broader range of trading tools, though it requires the standalone cAlgo platform to run in parallel, whereas MetaTrader's desktop version contains the algorithmic trading module.

Trading tools: Pepperstone offers a suite of Smart Trader Tools plugins available as an add-on for MetaTrader accounts, alongside access to Autochartist and API trading. For social copy trading, Pepperstone offers multiple platforms, including Copy Trading by Pepperstone (powered by Pelican), Signal Start for MetaTrader, and DupliTrade for cTrader (though the latter requires a $5,000 minimum balance, and DupliTrade is not available within the EU). Pepperstone finished Best in Class in the Social Copy Trading category for the seventh consecutive year in 2024.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | Yes |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 15 |

| Charting - Drawing Tools (Total) | 30 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 7 |

Market research

Pepperstone delivers a good balance of research content in both video and written format. The quality of Pepperstone’s research offering is a touch above the industry average, yet it’s not quite as robust as what’s offered by category leaders like IG and Saxo.

Research overview: Pepperstone offers traders a combination of in-house content and access to third-party tools from providers like Autochartist (for pattern recognition and trading signals) and Delkos (for risk management). Pepperstone also provides access to a suite of MetaTrader add-ons called Smart Trader Tools which includes useful features like sentiment indicators.

Market news and analysis: Pepperstone's in-house research consists of multiple daily articles and videos which cover technical and fundamental analysis. Content is synced across Pepperstone’s website and YouTube channel, and streaming news headlines can be found in the cTrader platform.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | Yes |

Education

While Pepperstone has a respectable array of archived webinars and videos, it is light on written content compared to education leaders such as FXCM or CMC Markets.

Learning center: Pepperstone has a "trading guides" category that features over 40 articles – organized by experience level. Pepperstone offers roughly a dozen platform tutorials, and conducts a handful of webinars each month that are then added to its catalog of archived webinars on its YouTube channel. In addition to its weekly webinars, Pepperstone recently launched a 150 minute online seminar called Pepperstone Talks, featuring industry experts such as John Bollinger, among other prominent industry persons. The webinars are archived which allows you to review them again if you missed the live event.

Room for improvement: Though I found Pepperstone’s educational content to be high-quality, the overall offering was in line with the industry average for this category. Adding interactive courses with progress tracking and quizzes, and organizing articles by experience level would be welcome enhancements.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Pepperstone has continued to increase its range of markets for forex and CFD traders (including spread-betting available in the U.K. and Ireland). It offers a rich platform experience for MetaTrader, cTrader, and TradingView – and its launch of a proprietary mobile app has helped inch Pepperstone closer to competing with the best forex brokers in the mobile category.

Considering the low minimum deposit requirements, and its robust research and range of support for third-party platforms, Pepperstone is a great option for forex and CFDs traders – regardless of experience level. In 2024, Pepperstone finished best in class for Social Copy Trading, Algo Trading, and MetaTrader.

What is the minimum deposit for Pepperstone?

Pepperstone recently reduced its minimum deposit from $200 down to zero, making it easier to get started regardless of your trading budget. Note that there may be exceptions to this minimum depending on the payment method chosen and your country of residence.

How much does Pepperstone cost?

Your trading costs at Pepperstone will mainly depend on what you trade and which type of account you set up. Using the EUR/USD as an example, after factoring in the per-trade commission of 0.7 pips, the effective spreads on the the all-in cost of the commission-based Razor account were 0.80 pips compared to the Standard account with average spreads of 1.1 pips (using July 2024 data).

However, if you are an active trader, there are liquidity rebates available if you surpass certain monthly trading volume thresholds, which can further reduce your trading costs at Pepperstone.

Is my money safe with Pepperstone?

Pepperstone is a trusted broker thanks to its many years of operation, and its regulatory status in Tier 1 jurisdictions including in the U.K., EU, and Australia, in addition to Tier 2 and Tier 4 licenses.

These factors make Pepperstone a safe broker to hold your money, as it reliably processes more than $12.55 billion in daily trading volume and is trusted by more than 300,000 retail traders globally.

Choosing a broker that is well-capitalized - such as Pepperstone - is also important to reduce your counterparty risk, as any compensation fund may not suffice to cover all client losses in the extraordinary case of insolvency (depending on the size of your account balance).

About Pepperstone

Founded in 2010 in Melbourne, Pepperstone is regulated in Australia, the U.K., Cyprus, Germany, Kenya the UAE, and the Bahamas – locations that are also home to Pepperstone offices. Pepperstone processes, on average, $12.55 billion of trades daily for more than 300,000 retail trading accounts.

ForexBrokers.com 2024 Annual Awards

For the ForexBrokers.com 2024 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Social Copy Trading, Ease of Use, MetaTrader, Algo Trading, Crypto Trading, and Professional Trading.

For more information, see how we test.

Category awards

Pepperstone Pepperstone

|

Algo Trading | MetaTrader | Social Copy Trading |

| Rank #1 | |||

| Streak #1 | |||

| Best in Class | |||

| Best in Class Streak | 3 | 7 | 7 |

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Article Resources

Pepperstone Regulation Pepperstone Education, Pepperstone YouTube channel

Popular Forex Guides

- Best Zero Spread Forex Brokers of 2024

- Best MetaTrader 4 Brokers of 2024

- International Forex Brokers Search

- Best Forex Trading Apps of 2024

- Best Forex Brokers for Beginners of 2024

- Best Forex Brokers of 2024

- Compare Forex Brokers

- Best Copy Trading Platforms of 2024

- Best Brokers for TradingView of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare Pepperstone Competitors

Select one or more of these brokers to compare against Pepperstone.

Show all