FlowBank Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FlowBank’s short history, recent bankruptcy proceedings, and lack of additional regulatory licenses bring down its overall Trust Score to a "Do Not Trust" level.

Note: As of 13 June 2024, Swiss regulator FINMA has opened bankruptcy proceedings against FlowBank SA, stating that the bank no longer has the minimum capital required for its business operations.

-

Minimum Deposit:

$0 -

Trust Score:

58 -

Tradeable Symbols (Total):

408600

Recent news

June 2024: As of 13 June 2024, Swiss regulator FINMA has opened bankruptcy proceedings against FlowBank SA, stating that the bank no longer has the minimum capital required for its business operations. You can find out more by reading FINMA's official press release.

Can I open an account with this broker?

Use our country selector tool to view available brokers in your country.

FlowBank pros & cons

Pros

- Previously a great choice for investing in local Swiss regional exchanges and financial markets.

- Offered fractional shares for a growing selection of popular U.S. companies.

- Provided connectivity to numerous global exchanges, with a vast selection of options markets, as well as forex, CFDs, and other derivatives such as exchange-traded securities.

- Offered in-house platforms alongside access to the full MetaTrader platform suite.

- FlowBank clients are protected with up to $100,000 in deposit insurance from esisuisse (membership in this self-regulatory organization is mandatory for all banks in Switzerland). This is important now that FlowBank is going through bankruptcy proceedings.

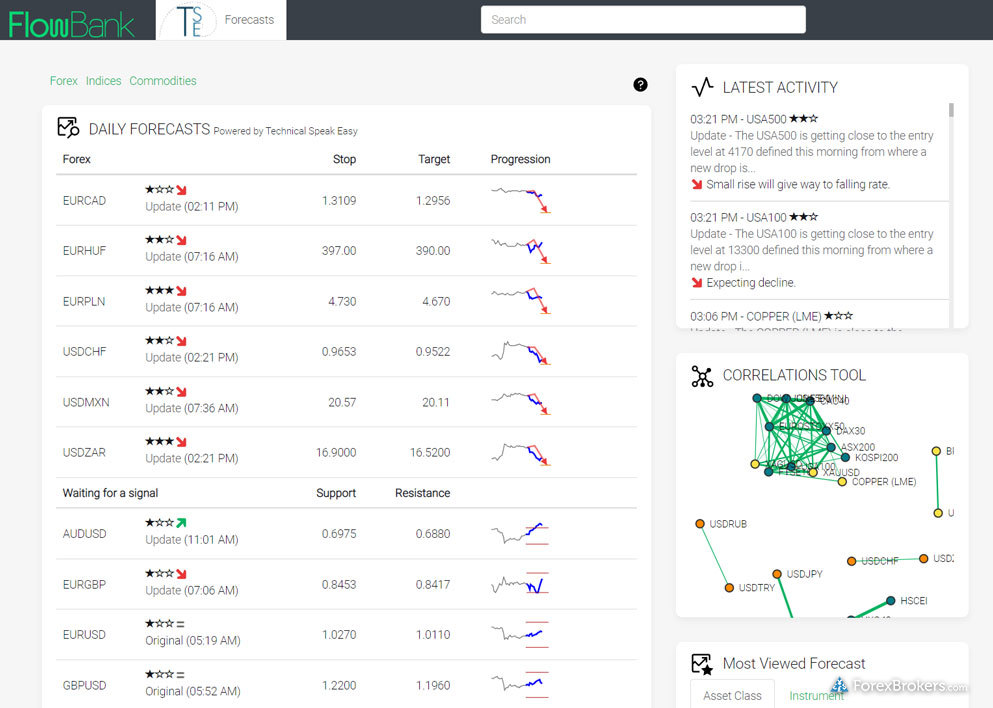

- Daily forecasts powered by Technical Speak Easy, featuring integrated trading signals.

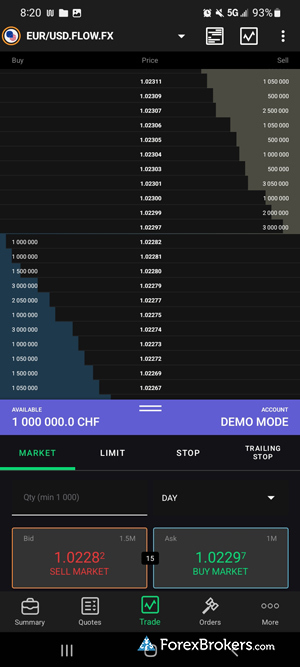

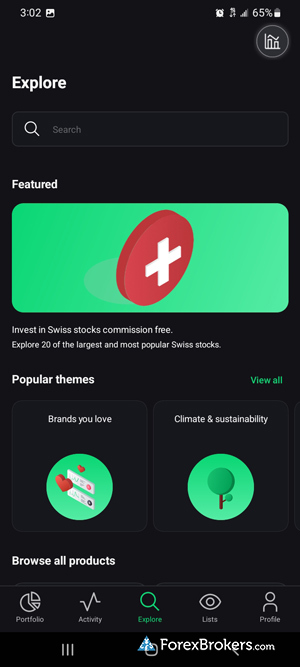

- The FlowBank mobile trading app was streamlined and designed for beginner investors.

Cons

- Swiss regulator FINMA has opened bankruptcy proceedings against FlowBank SA, stating that the bank no longer has the minimum capital required for its business operations.

- FlowBank was a relatively new broker with a limited operating history.

- The FlowBank Pro app for mobile and desktop lacked integrated research.

- FlowBank’s scope of educational materials was limited compared to category leaders.

- Charts had a limited historical data range (e.g., less than one year of EUR/USD data for charting analysis).

- FlowBank charged a quarterly custody fee (regardless of whether you’ve been actively trading) which ranges from 10 to 50 CHF.

- The FlowBank Pro platform’s design couldn't compete with more modern platforms (such as Saxo’s SaxoTraderPRO).

FlowBank Bankruptcy

Bankruptcy proceedings have been opened against FlowBank, what happens now?

FINMA, the Swiss financial markets regulator, has initiated bankruptcy proceedings against FlowBank SA due to its breach of regulatory capital requirements. As a result, trading has been halted and no new transactions can be initiated. A list of claims will be assessed for every FlowBank client to determine their eligibility as claimants.

All creditors – including customers who held bank accounts at FlowBank – will have to register their claims with the liquidator. For any questions, FlowBank clients should contact the official liquidator, Walder Wyss AG (WalderWyss.com), based in Switzerland.

Will I get all of my money back from FlowBank?

All FlowBank banking client deposits are insured up to 100,000 CHF, thanks to the mandatory deposit insurance in place for Swiss banks via esisuisse.

According to the regulator's press release, clients with more than 100,000 CHF on deposit at FlowBank will be included in the claims and paid out in whole or in part as proceedings move forward, depending on available assets. Amounts in excess of 100,000 CHF become part of a third class of bankruptcy claims.

Creditors receive priority in a bankruptcy proceeding. If you hold a deposit at FlowBank, you can expect to be contacted by the liquidator, Walder Wyss AG, to discuss payment options afforded to you as part of the liquidation process.

When will I receive my money from FlowBank?

According to FINMA, up to 100,000 CHF will be paid out, per customer, within seven days of providing payment instructions to the liquidator. If you are a FlowBank customer, it would be prudent to contact the liquidator immediately to begin the withdrawal process.

What will happen to securities held at FlowBank?

The manner in which securities are held at FlowBank (either in its name as owner, or in the name of underlying client accounts) will determine whether securities will be exempt from the bankruptcy process or liquidated to become part of the bankruptcy. It is expected to take several weeks to determine how the shares are held in terms of ownership. In the US, for example, it is customary for many brokers to hold the shares in the brokers own name, also known as the “street” name. US brokers only hold securities in the customers name if a customer requests to have share certificates mailed to them.

Who can I contact at FlowBank if I have any questions?

The FlowBank website now displays a static landing page related to this bankruptcy case, directing clients to contact the liquidator at [ project-liquidateurfb@walderwyss.com ].

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Overall Summary

| Feature |

FlowBank FlowBank

|

|---|---|

| Overall Rating |

|

| Trust Score | 58 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

Is FlowBank safe?

FlowBank is considered Do Not Trust, with an overall Trust Score of 58 out of 99. FlowBank operates a regulated Swiss bank, but as of 13 June 2024, Swiss regulator FINMA has opened bankruptcy proceedings against FlowBank SA, stating that the bank no longer has the minimum capital required for its business operations. Learn more about Trust Score.

| Feature |

FlowBank FlowBank

|

|---|---|

| Year Founded | 2020 |

| Publicly Traded (Listed) | No |

| Bank | Yes |

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

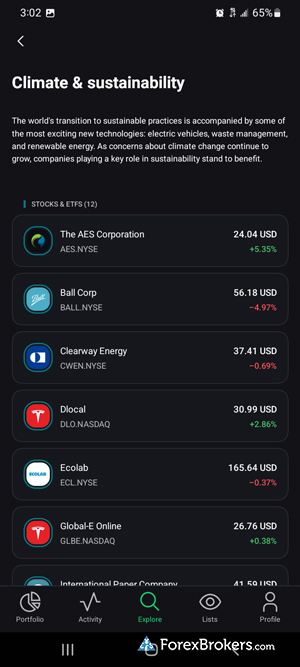

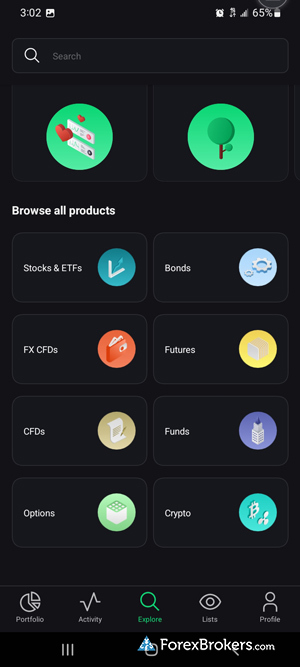

Investment Products

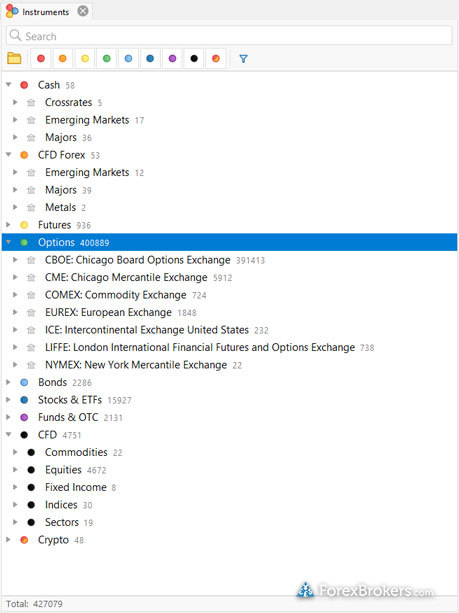

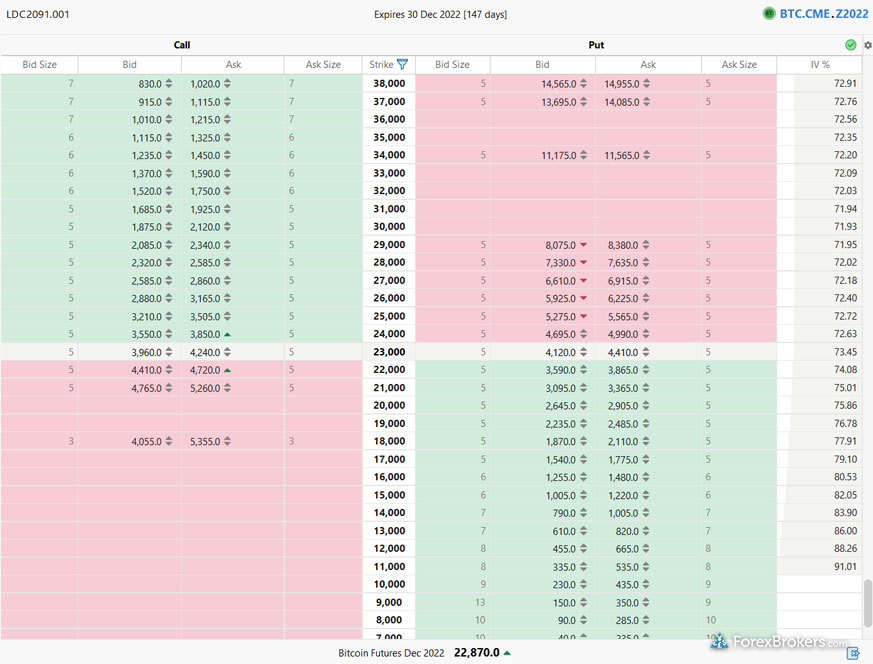

A true multi-asset broker, FlowBank offers a substantial range of products that includes 4,751 CFDs, 53 forex pairs, 44 crypto derivatives, 2,131 funds and OTC products, 15,926 shares, 936 futures, and a whopping 382,433 options when counting all available options contracts and expiries at various strike prices.

Excluding options, FlowBank offers 26,118 symbols – that number alone is still more than the total symbols offered by most brokers. This massive list of products can be navigated dynamically by asset class from within the trading platform, making it the single largest product offering with that ability. Only Swissquote offers a greater number of products – check out our review of Swissquote for more information.

| Feature |

FlowBank FlowBank

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 408600 |

| Forex Pairs (Total) | 52 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

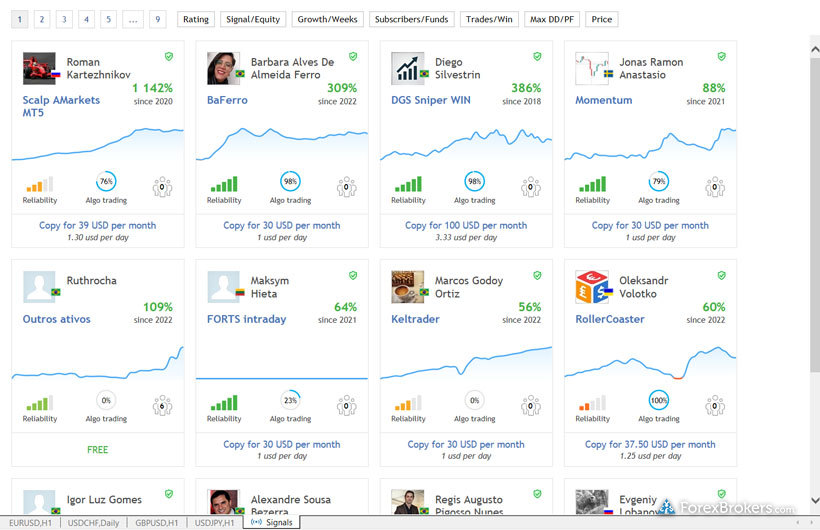

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers |

Fees

FlowBank does not publish average spreads across its account types, so we were unable to evaluate its pricing at a granular level. That said, FlowBank’s Platinum account – which requires a minimum deposit of 100,000 CHF deposit – advertises a minimum (not average) spread of 0.5 pips. Though this minimum spread is the same as what’s offered with FlowBank’s Classic account, the Platinum account boasts commission rates that are 50% lower (when trading shares and options). Outside of the broker’s Platinum account, the minimum deposit – and any related fees – may vary depending on your country of residence.

Active Traders: Rebates are also available for high-volume forex traders with at least CHF 50 million in turnover. This program pays back 3 CHF per million for the first tier, and 7 CHF if you trade more than $500 million per month.

FlowBank also publishes its monthly trading volumes, from the risk it internalizes on accounts with market-making execution, and provides agency execution for certain of its investment products. And while FlowBank lists a zero dollar minimum account requirement to open an account, this may vary depending on your country of residence.

Custody fees: With some brokers, inactivity fees can be avoided by placing a trade within a set time period. FlowBank’s custody fees, however, cannot be avoided. Traders will pay a small quarterly custody fee ranging from 10 CHF to a maximum of 50 CHF (based on a rate of 0.10% of assets, plus VAT).

Traders tend to pay a premium to hold an account with a Swiss Bank that has brokerage capabilities, and FlowBank is no exception. Saxo, for example, also has a presence in Switzerland as a bank, and will charge custody fees when you hold open positions on certain stocks (even if they aren’t CFDs, or leveraged). FlowBank just charges this fee at the account level, rather than by instrument.

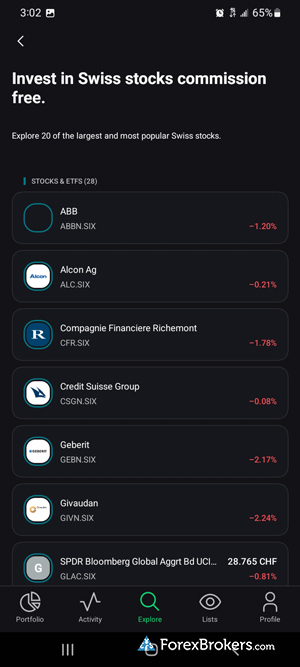

Share pricing: It’s here where FlowBank’s pricing really shines, allowing traders to trade securities and invest in local Swiss exchanges on a commission-free basis.

Market data subscriptions: Fees per venue for real-time data can vary at FlowBank, ranging from as low as $1 per month when subscribing to NYSE AMEX or NASDAQ data, to as much as $125 per month for ICE EU Commodities.

| Feature |

FlowBank FlowBank

|

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | Yes |

| ACH or SEPA Transfers | Yes |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | No |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

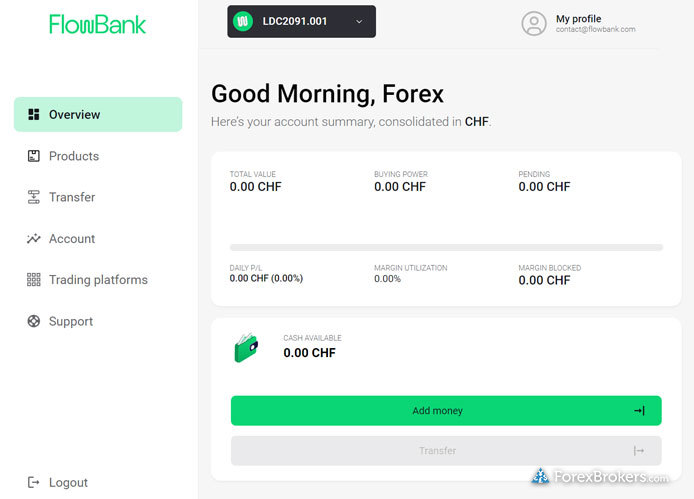

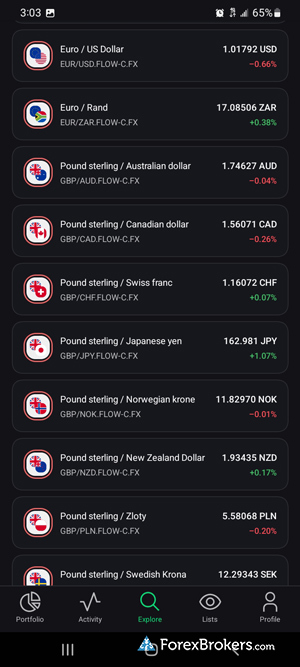

Mobile trading apps

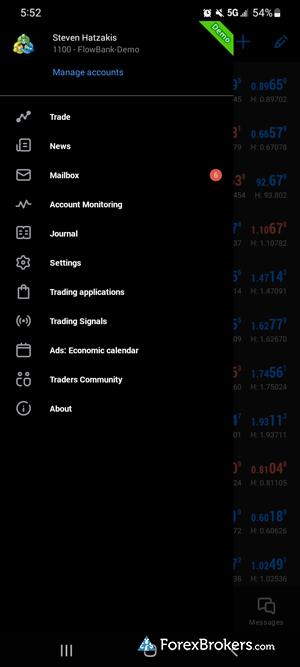

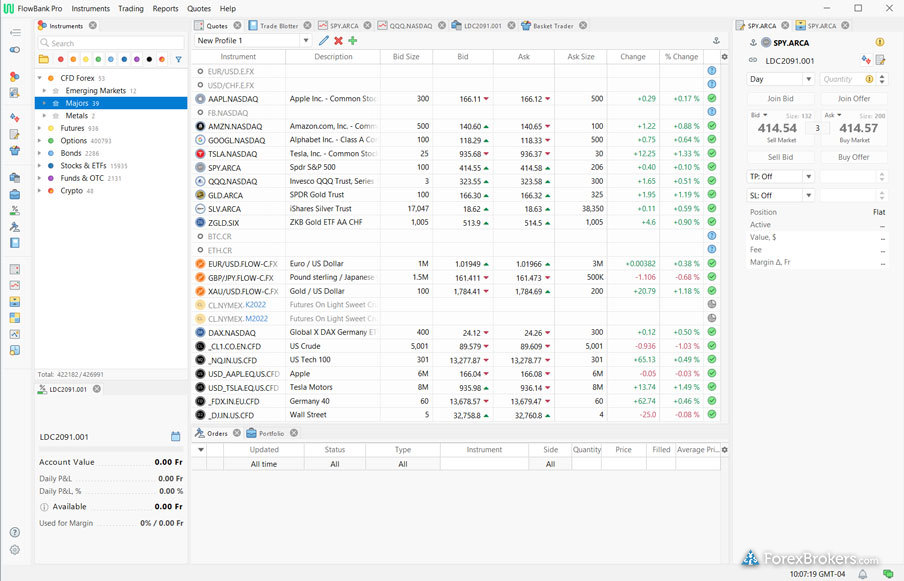

With FlowBank, traders gain access to four mobile apps: the full MetaTrader suite (MT4 and MT5), as well as the proprietary FlowBank app for mobile and FlowBank Pro for mobile and desktop.

MetaTrader: Traders who choose to use the MetaTrader suite at FlowBank will find the no-frills MetaTrader experience, with no standout extra features.

FlowBank app: The FlowBank app is mobile-only, and primarily functions to support banking clients. The FlowBank app experience is reminiscent of the Robinhood app – a simple, straightforward app experience that’s been stripped of any added features.

FlowBank Pro app: The FlowBank Pro app is available for mobile and desktop, and features a greater focus on trading (as compared to its simpler counterpart, the FlowBank app). I found the interface easy to use and far more modern than the standard desktop version, though its lack of market research and integrated news left me wanting more from the experience. I've found that best mobile apps in the industry strike a balance between powerful trading tools and integrated research and educational resources.

| Feature |

FlowBank FlowBank

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 7 |

| Watchlist Syncing | No |

| Charting - Indicators / Studies (Total) | 37 |

| Charting - Drawing Tools (Total) | 17 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | Yes |

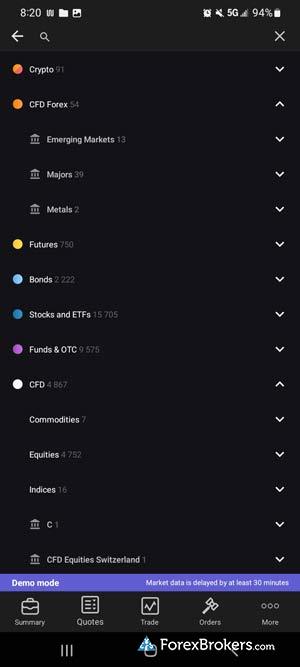

Other trading platforms

FlowBank offers the full MetaTrader platform suite, alongside the broker’s proprietary FlowBank Pro platform suite.

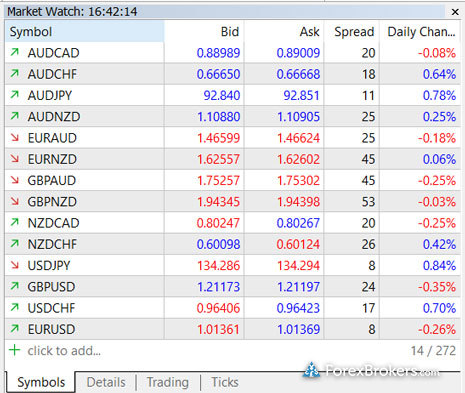

MetaTrader: Though traders at FlowBank gain access to the full MetaTrader suite (MT4 and MT5) from MetaQuotes Software, there are no major enhancements, platform add-ons, or plugins to distinguish FlowBank as a top MetaTrader broker. It’s also worth noting that the available range of markets for MetaTrader at FlowBank is significantly smaller (just under 300) than the staggering range of markets available on the Flow Bank Pro platform.

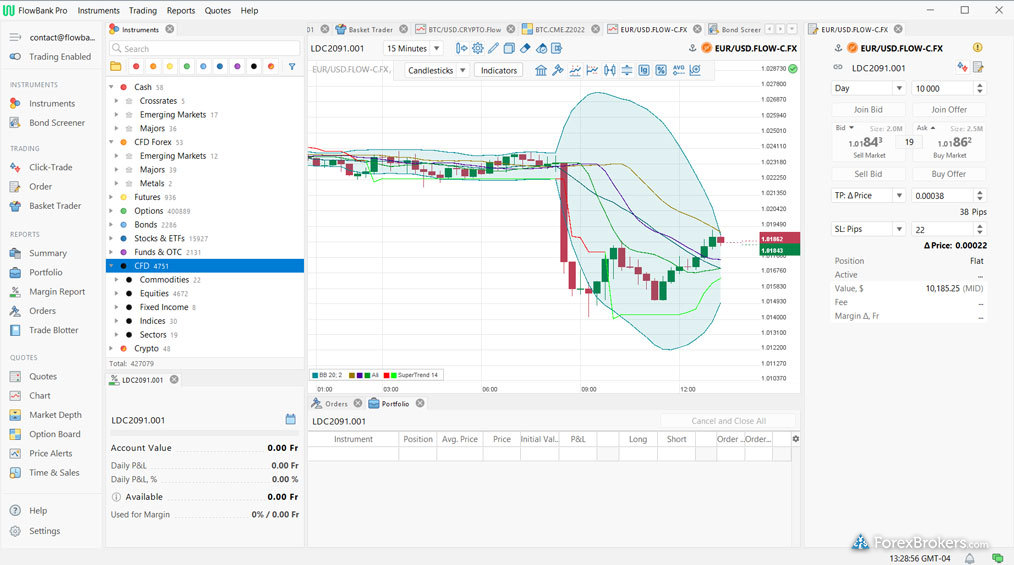

Ease of Use: My first impression of the FlowBank Pro desktop platform was that it resembles a trading application from the early 2000s. In other words, functionality takes precedence over appearance. FlowBank Pro’s user experience is not optimized for beginners, and the aptly-named platform is more suited to professional traders.

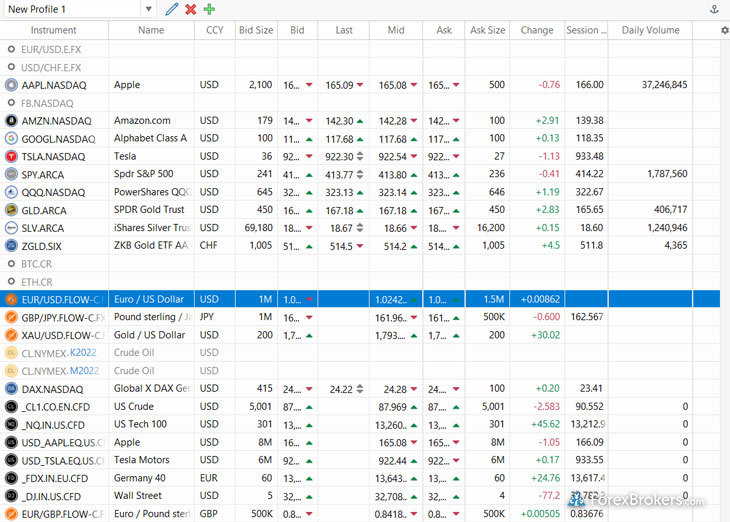

FlowBank Pro’s watchlist supports up to 40 columns, including dedicated parameters for bonds and options trading, as well as coupon discount and expiry. Coupled with the ability to create additional custom watchlists, these added fields have the potential to transform the watchlist into a stock screener tool, allowing you to scan multiple securities, including options, forex and CFD markets.

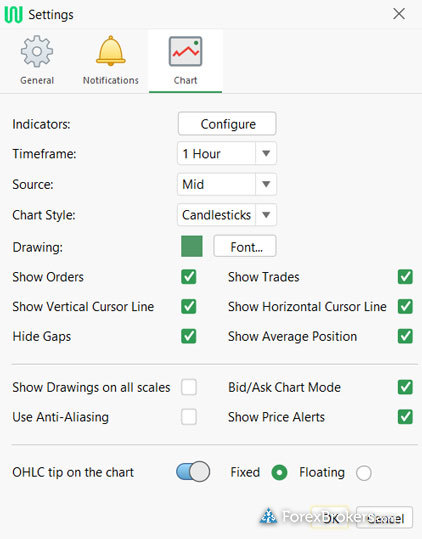

Charting: Charts in FlowBank Pro are decent, and feature 37 indicators and 17 drawing tools. The biggest drawback that comes with using FlowBank Pro’s desktop charts is the limited historical data available on symbols such as the EUR/USD or Bitcoin. By default, charts load just two years of data. Traders who are serious about technical analysis demand at least 10-15 years' worth of data, and some of the best brokers provide an even greater range of historical price data within their charting modules. Link opportunity to StockTrader?

Charting aside, I was impressed with the display and organization of global markets within the FlowBank Pro platform. At a glance, traders can see the exchange or asset class, as well as the number of available symbols from that venue.

The FlowBank Pro platform’s most significant shortcoming is its limited historical data for technical analysis. Though it also lacks integrated research, it has a lot of potential and demonstrates how far FlowBank has come in such a short period of time.

Overall, FlowBank Pro delivers a true multi-asset experience, with a range of investment products that’s comparable in scope to industry leaders such as Interactive Brokers, IG and Saxo.

| Feature |

FlowBank FlowBank

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 37 |

| Charting - Drawing Tools (Total) | 17 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 7 |

Market research

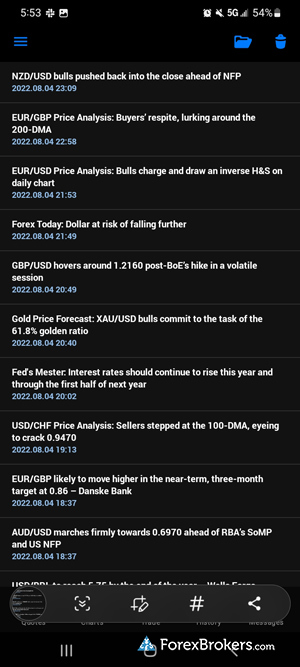

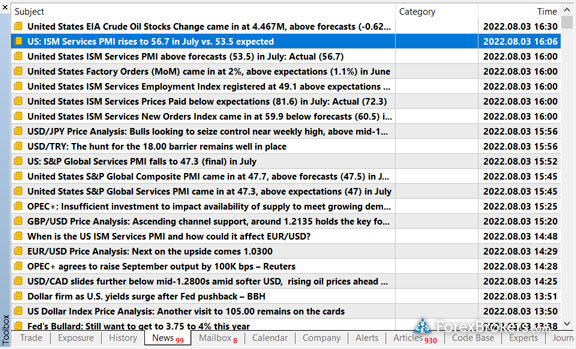

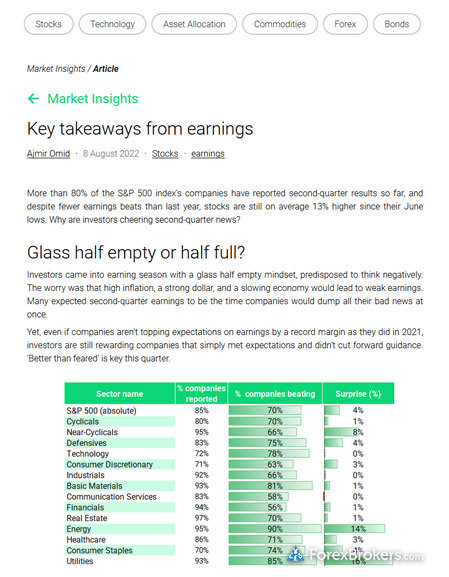

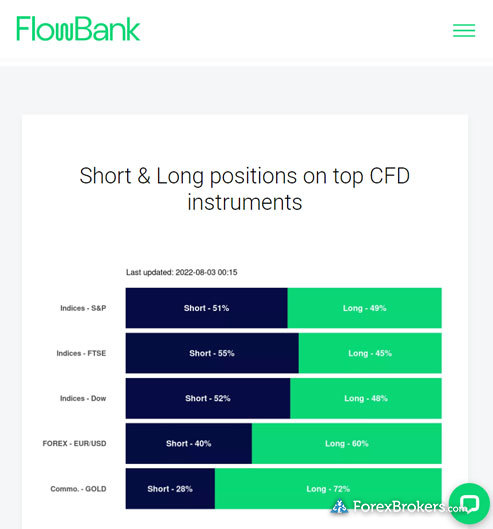

Research at FlowBank consists of newsletter articles, videos, trading signals, and periodic (daily, weekly, and monthly) content updates. The MetaTrader platform provides integrated news articles, but FlowBank’s own Pro platform suite lacks market research altogether.

Research overview: Research at FlowBank primarily lives on the broker’s website. FlowBank’s LiveWire news feed offers market updates, its daily MarketFlow newsletter is available each morning, and its Market Insights section features daily articles and blog posts. I found the Popular Theme series in particular to be useful, though the section definitely has room to expand.

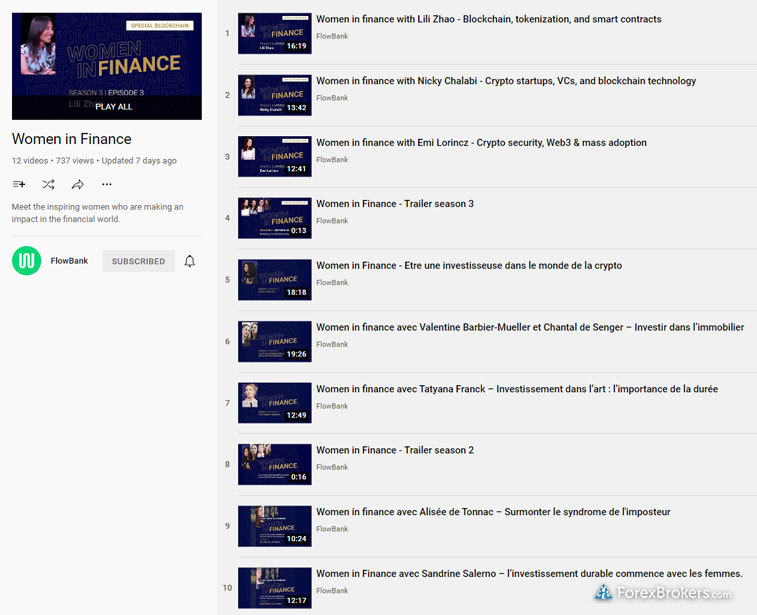

Market news and analysis: LiveWire features technical analysis reports, and the broker’s FlowTV video series (on YouTube) contains good-quality videos, with content that ranges from basic to advanced.

That said, the broker’s video content is fairly limited in length and overall variety (particularly when compared to category leaders such as IG and Interactive Brokers). Though FlowBank has already laid a decent foundation here – especially for a two-year old brokerage – there’s plenty of room for the broker to improve in this category.

Trading signals: Powered by Technical Speak Easy, trading signals are directly integrated within FlowBank’s website and nicely organized by asset class, with detailed analysis accompanying each signal. Integrating this feature within the FlowBank Pro platform would be a welcome enhancement, and would help to fill the void of research on FlowBank Pro.

| Feature |

FlowBank FlowBank

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | Yes |

Education

Education is a category where FlowBank has considerable opportunity for growth. Currently, its offering consists of a dozen or so videos and articles, as well as platform tutorials for FlowBank’s own platforms.

Learning center: I enjoyed watching some of the broker’s archived webinars, though there didn’t appear to be any upcoming webinars in the future.

Room for improvement: The content I did find at FlowBank was good, but expanding the variety of subject matter will only benefit traders who are looking to expand their knowledge of financial markets. Introducing dedicated video playlists organized by topic or experience level would improve the user experience at FlowBank, and I always encourage the addition of progress tracking and quizzes to enhance the overall educational experience.

| Feature |

FlowBank FlowBank

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | No |

Final thoughts

As the newest entrant to the Swiss online brokerage industry, FlowBank offers traders and investors the allure of holding a Swiss bank account (and all the associated benefits) while still providing access to a multi-asset brokerage solution – all from one account.

FlowBank caters to both beginners and advanced traders with its mobile app and FlowBank Pro platform. That being said, the platform would benefit from the addition of more robust market research, as well as more extensive historical data for its charts. It also wouldn’t hurt to bring the design of the Pro platform up to today’s standards, like its mobile banking app.

Overall, FlowBank impresses as a true multi-asset broker. While it may lack some of the advanced features offered by the best brokers, you can access more advertised symbols at FlowBank than at IG, CMC Markets, or Plus500. As a result, FlowBank earned Best in Class honors for Offering of Investments in our 2024 Annual Awards. As a company that is barely three years old, FlowBank has made an astounding amount of progress in such a short period, and at this pace, I am eagerly looking forward to its future developments.

About FlowBank

FlowBank was founded in 2020 by Charles Henri Shabet, a forex brokerage industry veteran with a long history of leading global online brokerages. In March of 2022, crypto investment firm CoinShares (OTCQX: CNSRF) increased its stake in FlowBank by investing the equivalent of $26.5 million and joined its board with nearly a third of the voting rights following approval from FINMA, the Swiss regulatory body.

ForexBrokers.com 2024 Annual Awards

For the ForexBrokers.com 2024 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Social Copy Trading, Ease of Use, MetaTrader, Algo Trading, Crypto Trading, and Professional Trading.

For more information, see how we test.

Category awards

FlowBank FlowBank

|

Offering of Investments |

| Rank #1 | |

| Streak #1 | |

| Best in Class | |

| Best in Class Streak | 2 |

Is FlowBank legit?

Yes, FlowBank is legit, and is not a scam broker. FlowBank holds a highly regarded banking license in Switzerland, a country where trillions of dollars (an estimated 25% of global wealth) are held in Swiss bank accounts. As a Swiss bank, FlowBank is regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA), and is a member of esisuisse, which can provide you with up to 100,000 Swiss francs in deposit compensation insurance in the extraordinary event of a Swiss Bank’s insolvency (bankruptcy).

For these reasons, it is always prudent to be aware of a broker’s level of capitalisation, to reduce your counterparty risk with a SwissBank. FlowBank publishes both its execution statistics and regulatory reports, with the latest showing $125 million in assets and a Basel III ratio of 11.58%, which is about 1% within its target as of December 31, 2021.

What type of broker is FlowBank?

FlowBank is a multi-asset broker that offers numerous asset classes and investment products, such as forex, CFDs, exchange-traded securities (including shares), and a range of derivatives that includes options and futures.

Accordingly, FlowBank offers both execution types (depending on the markets you trade) – including market-maker execution, according to its legal disclosure, as well as agency execution, depending on the markets you trade. FlowBank also publishes its trade execution statistics periodically with monthly totals per asset class, including for its B Book (market-making execution).

What is the minimum amount required to open a FlowBank account?

There is no minimum deposit requirement for opening a Classic account at FlowBank (though this may vary depending on your country of residence. If you opt for the more exclusive Platinum account, the minimum deposit is 100,000 CHF. Otherwise, for the classic account, even though there is no minimum deposit, the minimum account funding may vary depending on your country of residence, as per Flow Bank’s FAQ section.

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Brokers for TradingView of 2024

- International Forex Brokers Search

- Compare Forex Brokers

- Best MetaTrader 4 Brokers of 2024

- Best Forex Brokers for Beginners of 2024

- Best Forex Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best Forex Trading Apps of 2024

- Best Zero Spread Forex Brokers of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare FlowBank Competitors

Select one or more of these brokers to compare against FlowBank.

Show all