Moneta Markets Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Moneta Markets offers the MetaTrader suite of platforms as well as a web and mobile app powered by TradingView. While it does support a decent range of third-party features and a growing range of markets, Moneta Markets has limited research and educational offerings.

-

Minimum Deposit:

$50 -

Trust Score:

72 -

Tradeable Symbols (Total):

1016

Can I open an account with this broker?

Yes, based on your detected country of HK, you can open an account with this broker.

Pros

- Moneta Markets has regulatory status with one Tier-one jurisdiction, one Tier-2 jurisdiction, and one Tier-4 jurisdiction.

- PRO Trader web-platform powered by TradingView offers trading from the charts with the ability to drag-and-drop when modifying orders.

- Moneta Markets CopyTrader powered by Pelican Exchange, and ZuluTrade are available for social copy trading.

- Offers the MetaTrader suite alongside its PRO Trader and AppTrader platforms powered by TradingView.

Cons

- Moneta Markets is not a good choice for low-cost trading unless you deposit $20,000 for its Ultra ECN account.

- Some modules on Moneta Markets site were outdated, and some simply did not load.

- Offers a smaller range of markets than leading multi-asset brokers.

- Despite providing Trading Central add-ons and branded Moneta TV daily video content, Moneta Markets lacks comprehensive, quality market research.

- There are over 100 educational videos in the Moneta Markets Masters Course, but there is a distinct absence of in-depth written articles.

Overall Summary

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Overall Rating |

|

| Trust Score | 72 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Moneta Markets safe?

Moneta Markets is considered Average Risk, with an overall Trust Score of 72 out of 99. Moneta Markets is not publicly traded, does not operate a bank, and is authorised by one Tier-1 regulator (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulator (High Risk). Moneta Markets is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC). Learn more about Trust Score.

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Year Founded | 2009 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 1 |

Offering of investments

The range of markets available will depend on which Moneta Markets entity and platform you use, with up to 1016 symbols available across various CFD markets including forex, shares, indices, commodities, and metals.

Cryptocurrency: Cryptocurrency trading is available at Moneta Markets through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

The table below summarizes the different investment products available to Moneta Markets clients.

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 1016 |

| Forex Pairs (Total) | 54 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

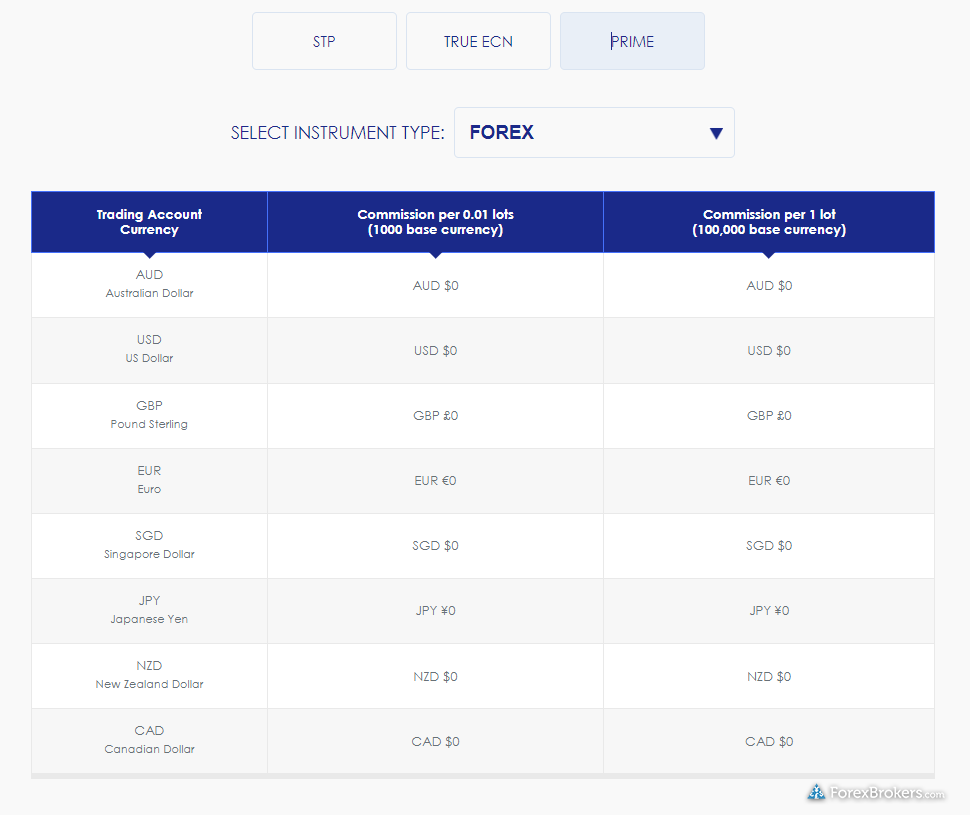

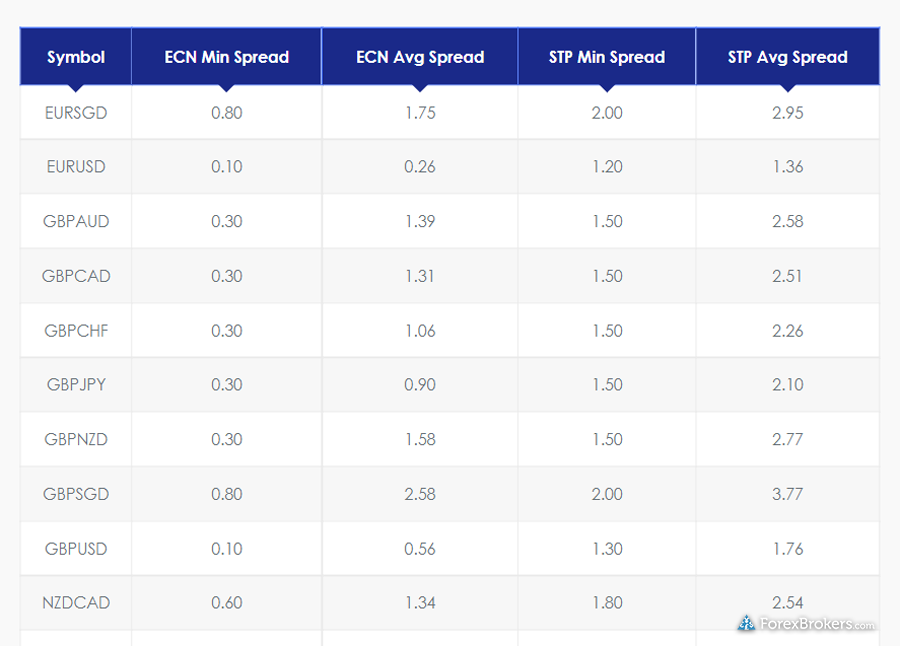

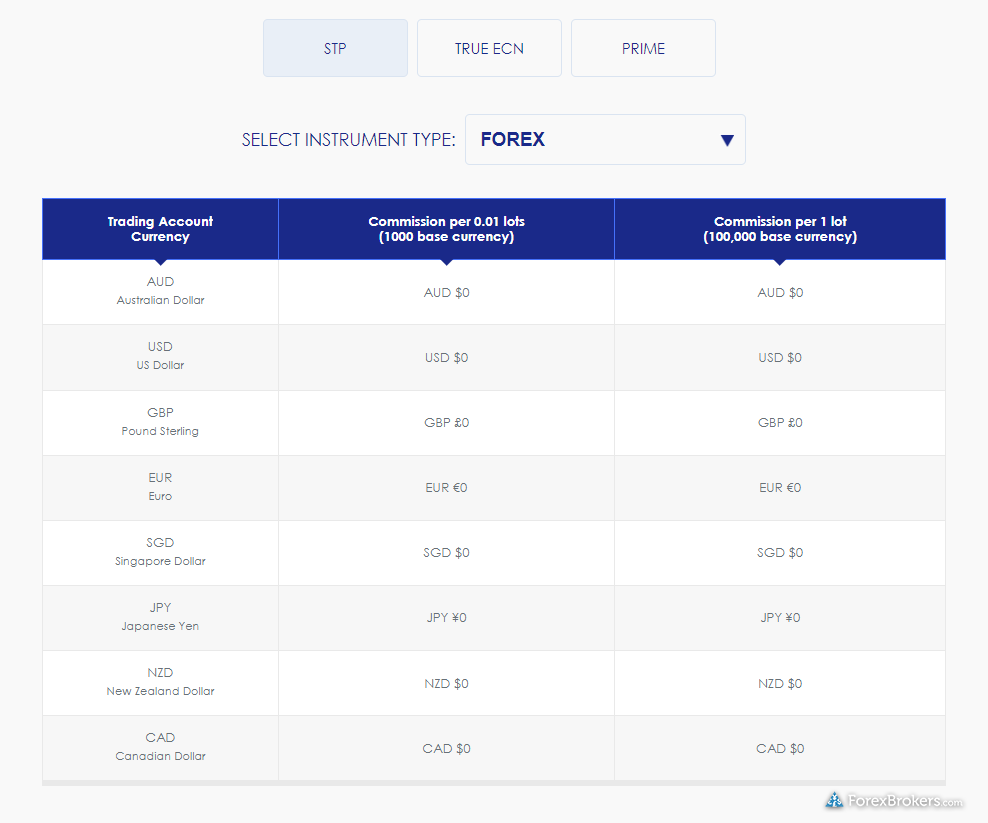

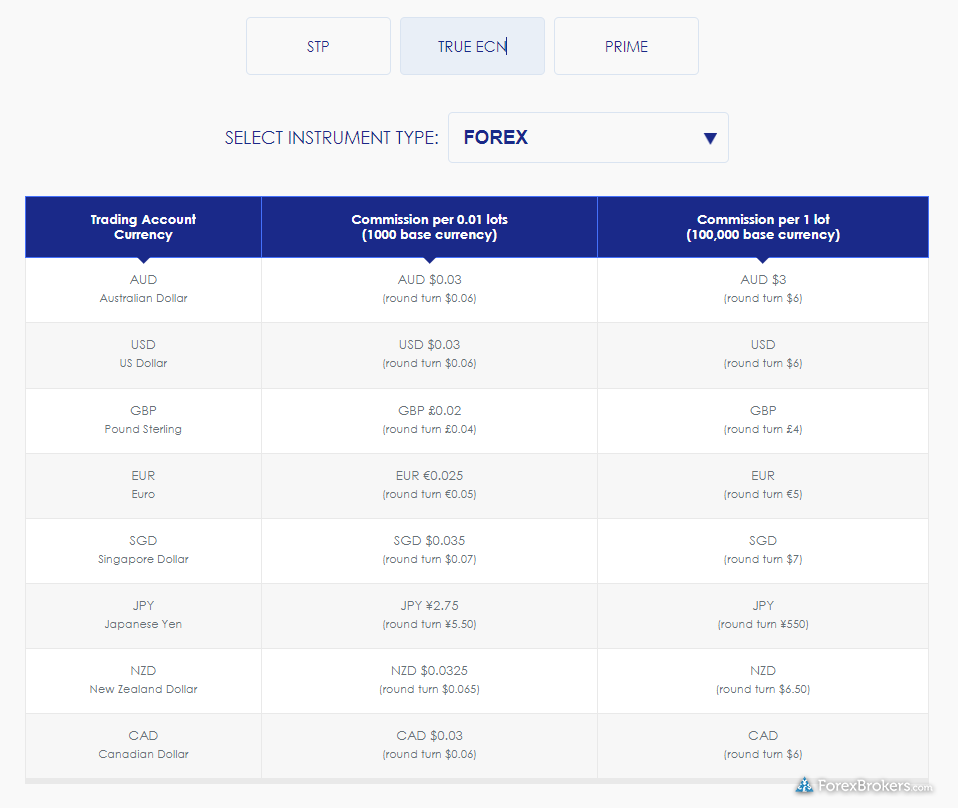

Trading costs at Moneta Markets vary depending on which of its three account options you choose: the commission-based Moneta Prime ECN and Ultra ECN accounts, or the commission-free Direct STP account. Moneta Markets’ STP account is commission-free although spreads are higher forex trading, compared to its Prime ECN account. Likewise, its Ultra ECN account is better than the industry average with tighter spreads and a commission of $2 per round-turn lot, but requires a $20,000 deposit. Overall, Moneta Markets’ pricing can’t yet compete with the best forex brokers.

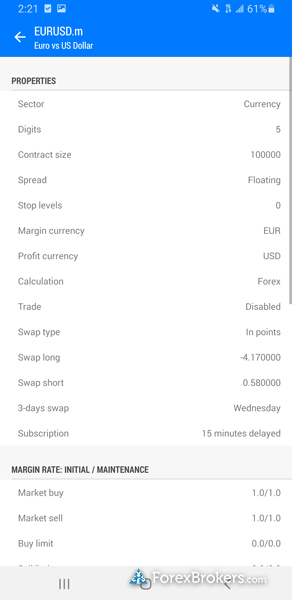

Spread-only accounts: The Direct STP account boasts an average spread of 1.38 pips for the EUR/USD pair for the month of August 2023.

Commission-based accounts: The Prime ECN account features an average spread of 0.194 pips for the EUR/USD pair (during August 2023), and a commission of $3 per side for every 100,000 units (or $6 per round-trip standard lot). This brings the all-in cost for the Prime ECN account to roughly 0.79 pips (0.19+0.60), which is slightly below the industry average. By comparison, the Ultra ECN account features an even lower commission of $2 round-trip ($1 per side) for traders who deposit $20,000 or more.

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Minimum Deposit | $50 |

| Average Spread EUR/USD - Standard | 1.38 |

| All-in Cost EUR/USD - Active | 0.79 |

| Active Trader or VIP Discounts | No |

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | No |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

Moneta Markets offers the MetaTrader suite of platforms, as well as the AppTrader mobile app powered by TradingView. Moneta Markets’ AppTrader provides the standard TradingView experience that technical traders appreciate. Moneta Markets also offers a few extra add-ons to enhance the default MetaTrader experience.

Apps overview: Moneta Markets provides AppTrader, powered by TradingView, alongside the full MetaTrader mobile platform suite (MT4 and MT5), which are all available on Google Play for Android and on Apple’s App Store for iOS devices.

Ease of use: Though AppTrader is easy to use, there just isn’t much going on in the app and there remains plenty of room to improve beyond the basic TradingView experience. I’d like to see Moneta Markets mirror some of the web platform’s features on its AppTrader mobile app to more closely unify the experience across devices.

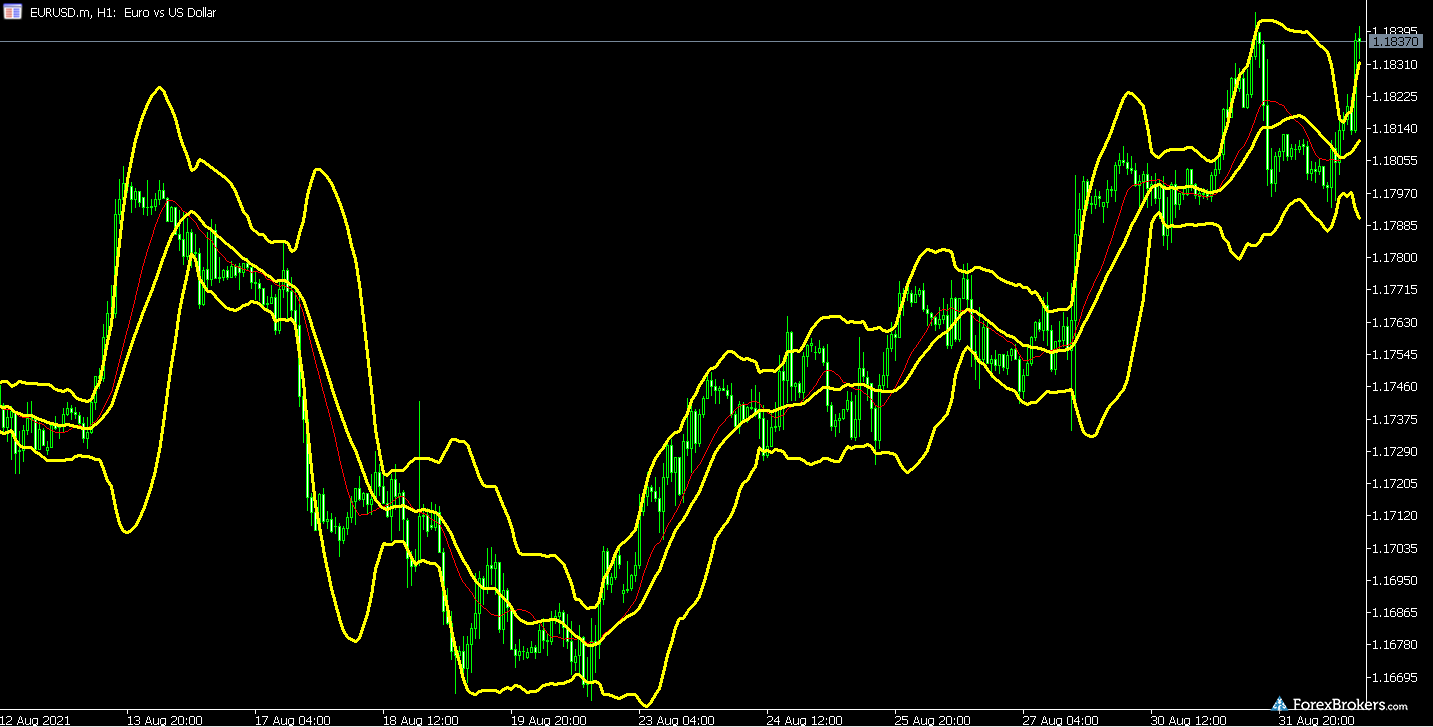

Charting: Charts within AppTrader are powered by TradingView, and match the web version with over 100 indicators available by default. While there is lot to like about AppTrader, the mobile app experience has fewer features than the best brokers in this category. For comparison, Saxo has nearly perfected the art of creating a rich trading experience across devices (even trend lines are synced across platforms).

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 4 |

| Watchlist Syncing | Yes |

| Charting - Indicators / Studies (Total) | 105 |

| Charting - Drawing Tools (Total) | 78 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

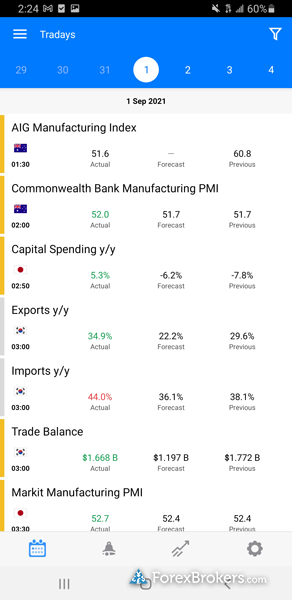

| Mobile Economic Calendar | Yes |

Other trading platforms

Moneta Market’s WebTrader platform has a clean layout, but a shallow selection of features, compared to its PRO Trader platform which uses TradingView for charting. For example, there are no news headlines available, and only four watchlist columns in the WebTrader platform.

Platforms overview: Moneta Markets offers you two choices of trading platforms: the MetaTrader platform suite (MT4 and MT5) developed by MetaQuotes Software Corporation, and the Pro Trader web-based platform powered by TradingView.

Charting: The MetaTrader platforms are widely used among technical analysis enthusiasts for their robust charting capabilities, Moneta's AppTrader web platform (powered by TradingView) features equally impressive charting that allows you to add trendlines, indicators, and drawing tools.

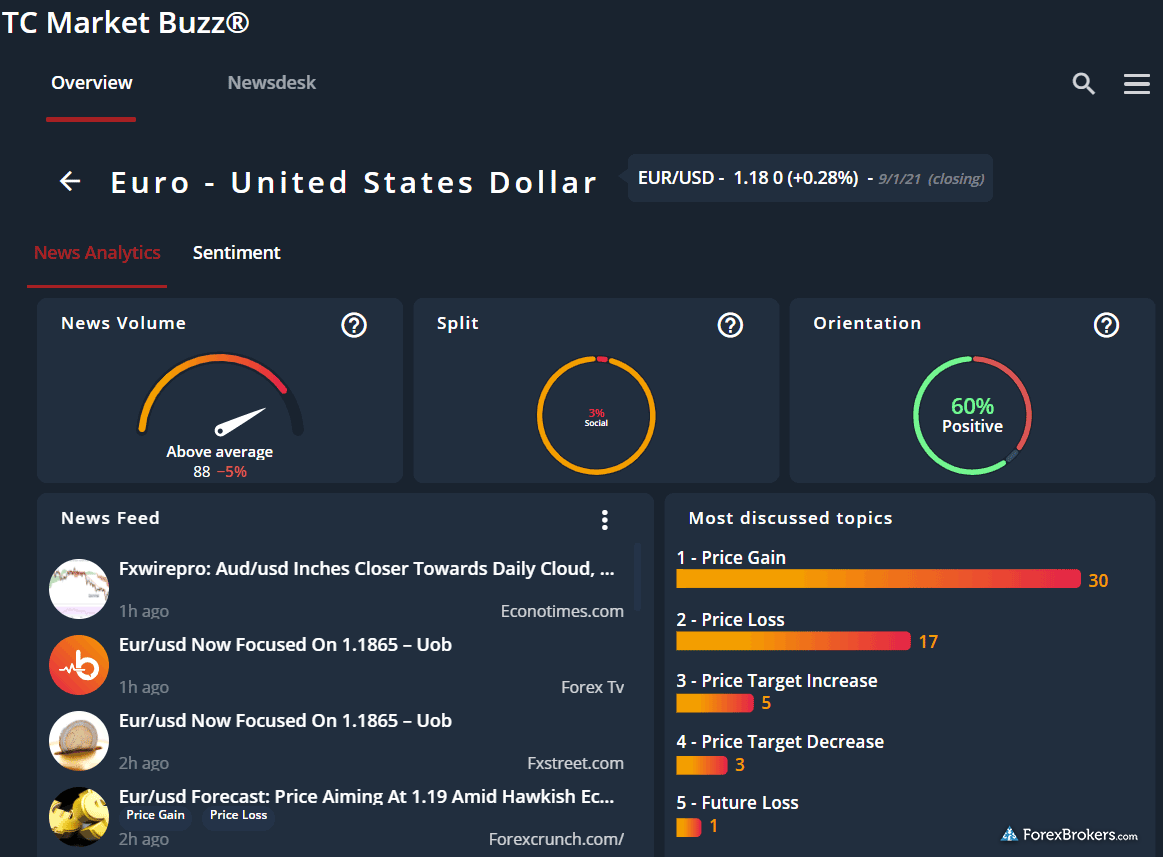

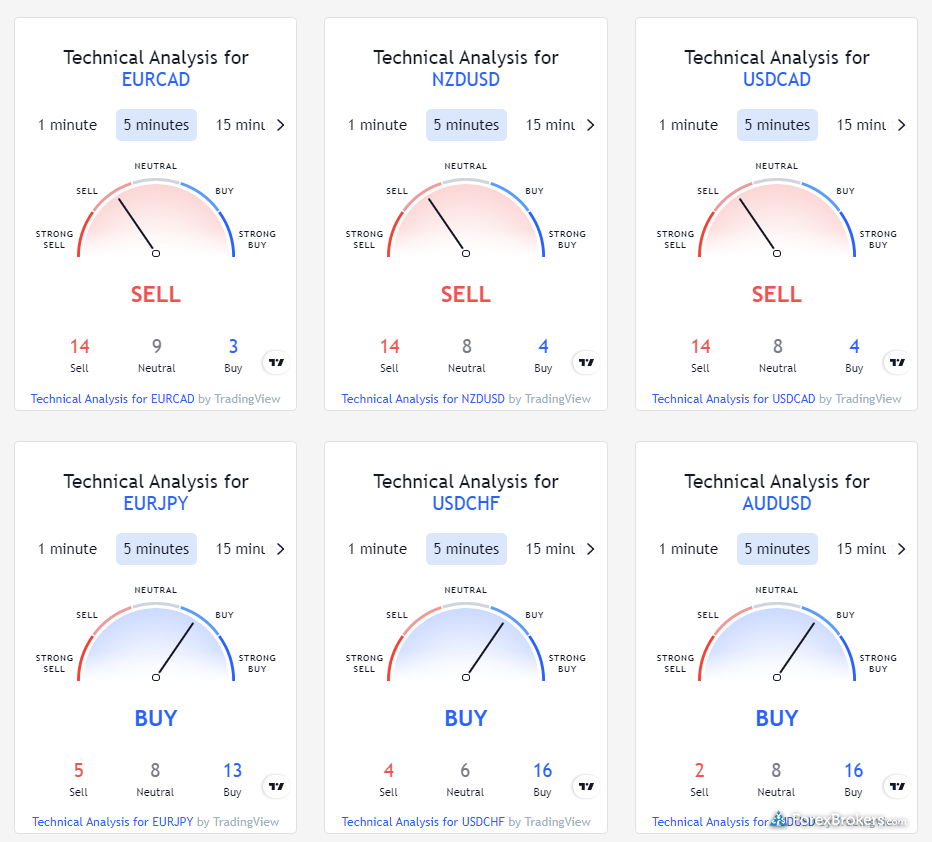

Trading tools: The Moneta Markets client portal features a growing selection of trading tools, such as Trading Central’s Market Buzz, Featured Ideas, and Economic Calendar, alongside custom indicators and links to various resources. However, as these features are not integrated within the trading platform, the need to switch back and forth to access these resources can be an incovenience.

Platform usability: The first thing I noticed on the Pro Trader platform is the smooth HTML5 that is now the industry standard for web-based trading apps and the iconic look and feel of the TradingView charts and platform layout. The platform is also incredibly easy to navigate. While beginner forex traders may find the Pro Trader platform suitable for their needs, more demanding traders may be left wanting more. For example, complex order types such as a trailing stop-loss are simply not available on Pro Trader.

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | Yes |

| Charting - Indicators / Studies (Total) | 105 |

| Charting - Drawing Tools (Total) | 78 |

| Charting - Trade From Chart | Yes |

| Watchlists - Total Fields | 4 |

Market research

Moneta Markets provides access to good third-party content from Trading Central, but does not otherwise provide much in the way of in-house research, and therefore trails the industry average in this category, far behind research leaders Saxo and IG.

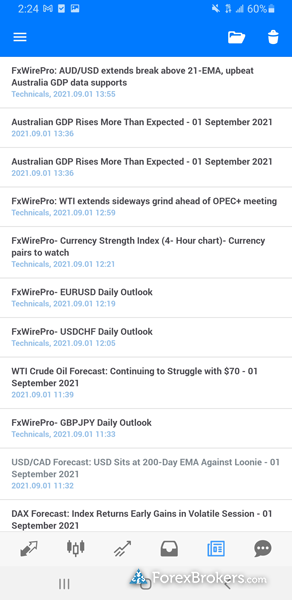

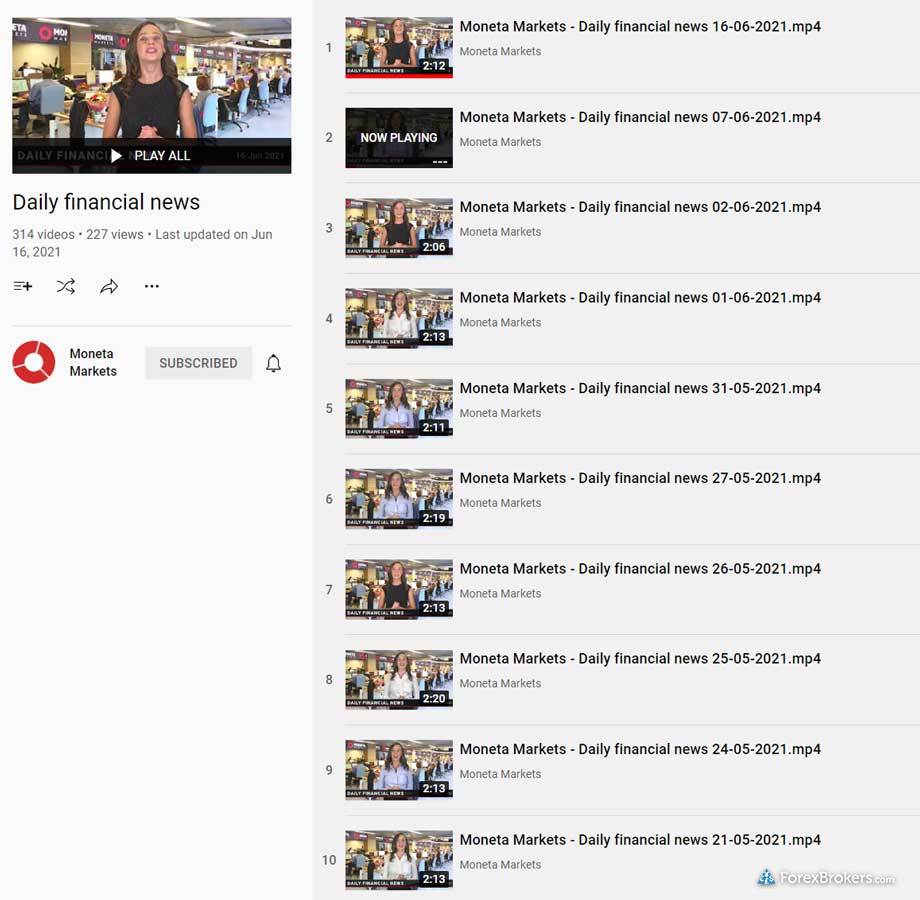

Research overview: Moneta Markets hosts videos from its Moneta TV series, but otherwise its research content is sourced almost entirely from third-party sources – such as the suite of research tools from Trading Central and streaming headlines from FxWirePro – with little-to-no in-house content.

Market news and analysis: Daily market briefings are available on the broker's YouTube channel under the Moneta TV series powered by Trading Central. Both video series follow a consistent daily template with a high-level overview of key market movements. Though a bit plain, the videos are quick snippets that I found to be useful and easy to digest. I would like to see these videos integrated into the platform (and not just the client portal and website), which would make them easier for traders to consume.

Trading Central: Moneta Markets provides access to several third-party research tools from Trading Central, such as Market Buzz, Featured Ideas, and the Economic Calendar. To access these tools, however, clients will need to maintain an account balance of at least $500. For comparison, some of the best forex brokers offer such content and premium tools for all live account holders. Furthermore, these tools are not directly integrated into the trading platform.

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment - Currency Pairs | Yes |

Education

Moneta Markets’ educational content doesn't offer much beyond the videos available in its Masters Course. The Masters Course covers multiple asset classes, and deftly explores a variety of topics and categories with brief video clips for beginners, and longer videos for more advanced concepts.

Learning center: The Moneta Markets Masters Course features a total of 114 videos that range from just a few minutes to about ten minutes long, many of which I found to be useful.

Room for improvement: I’d like to see Moneta Markets add more content (such as webinars) to its YouTube channel. It would also benefit from an expansion of its published written content, which would help to fill the gap in its educational offering.

| Feature |

Moneta Markets Moneta Markets

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | No |

Final thoughts

Testing Moneta Markets left me with a clear takeaway; to compete with the best forex brokers, it needs to enhance its offering in multiple categories. Moneta Markets currently trails the industry average in its research and educational content, and lags behind the best forex brokers in key categories such as trading costs and the availability of mobile trading apps and platforms.

About Moneta Markets

Moneta Markets was founded in 2019, and currently holds regulatory status in Australia with the Australian Securities and Exchange Commission (ASIC) as an Authorised Representative of a regulated broker, and in South Africa with the Financial Services Conduct Authority (FSCA), as well as with the Financial Services Authority (FSA) in the Seychelles. The Moneta Markets brand serves over 70,000 clients and handles over $100 billion in monthly trading volume.

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Zero Spread Forex Brokers of 2024

- Best Forex Brokers of 2024

- Best MetaTrader 4 Brokers of 2024

- Best Copy Trading Platforms of 2024

- Compare Forex Brokers

- Best Brokers for TradingView of 2024

- International Forex Brokers Search

- Best Forex Brokers for Beginners of 2024

- Best Forex Trading Apps of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare Moneta Markets Competitors

Select one or more of these brokers to compare against Moneta Markets.

Show all