Compare cTrader Brokers

| Company |

Minimum Deposit |

cTrader |

Tradeable Symbols (Total) |

Trust Score |

Visit Site |

IC Markets IC Markets

|

$200 |

Yes |

3583 |

84 |

|

Pepperstone Pepperstone

|

$0 |

Yes |

1726 |

95 |

|

FP Markets FP Markets

|

$100 AUD |

Yes |

10000 |

87 |

|

FxPro FxPro

|

$100 |

Yes |

2249 |

90 |

|

BlackBull Markets BlackBull Markets

|

$0 |

Yes |

26000 |

78 |

|

FXPrimus FXPrimus

|

$100 |

Yes |

140 |

71 |

|

TopFX TopFX

|

Depends on payment method |

Yes |

655 |

67 |

|

cTrader Pros & Cons

Below, I’ve summarized some of the pros and cons that come with using the cTrader platform suite.

Pros

- Powerful charts and charting capabilities.

- Support for copy trading with the cTrader Copy web platform.

- Algo trading is possible using the cTrader Automate module.

- The ability to set commissions and spread costs during backtesting makes for more realistic simulations.

- Traders can connect via API by copying the FIX API credentials from within the platform or using the cTrader Open API.

- Brokers offering cTrader must have at least one recognized liquidity provider (LP).

- Partial fills are supported, and orders are filled at a volume-weighted average price (VWAP).

Cons

- cTrader is only available from a small handful of brokers (compared to the widely available MetaTrader suite).

- cTrader’s reliance on the .NET framework may not be ideal for developers looking for more modern options.

- Though the platform’s backtesting simulations are powerful, they are less advanced than MetaTrader 5’s cloud-based resources.

Is cTrader free to use?

Yes, cTrader is free to use (though your forex broker will need to offer the cTrader platform suite to its clients). You can download the platform for free directly from Spotware Systems. Some brokers offering cTrader may provide a version of the cTrader platform that is branded with the broker’s name (also known as “white labeling”). In any case, platform features may vary depending on your broker and the version of cTrader being used. It’s worth noting that forex brokers offering cTrader will still charge you commissions, spreads, fees, or a combination of such trading costs (depending on the broker and its account offering).

savingsLooking for a low-cost broker?

Check out my guide to the Best Zero Spread Brokers to find forex brokers with the lowest spreads in the industry.

Do you need a broker to use cTrader?

Yes, you’ll need to open an account with a broker to use cTrader. Brokers offering cTrader will provide you with a compatible account type that can be configured for the platform. Once your account is set up, you will be able to log in to the cTrader platform suite (for desktop, web, and/or mobile) using the credentials provided by your broker. Using your live forex trading account, you’ll be able to obtain real-time market prices and execute trades.

Below, you'll see a gallery of screenshots taken of cTrader offerings from Pepperstone and IC Markets. You'll see desktop platforms, trade ticket windows, and Trading Central integration for forex traders who are interested in trading signals.

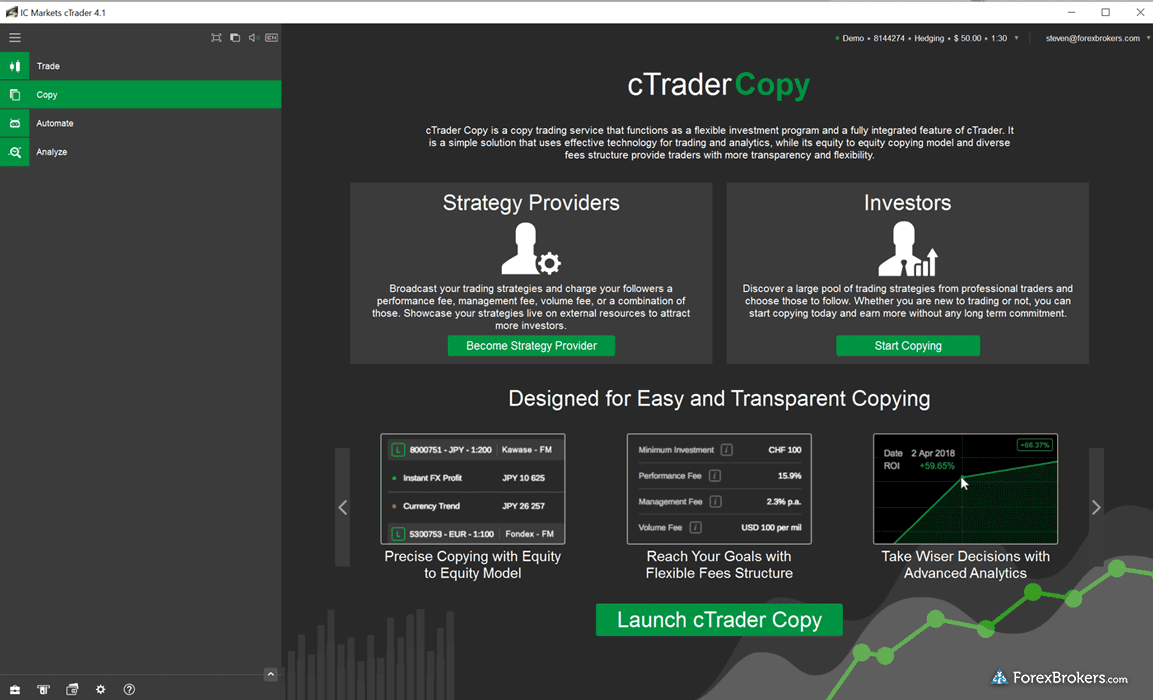

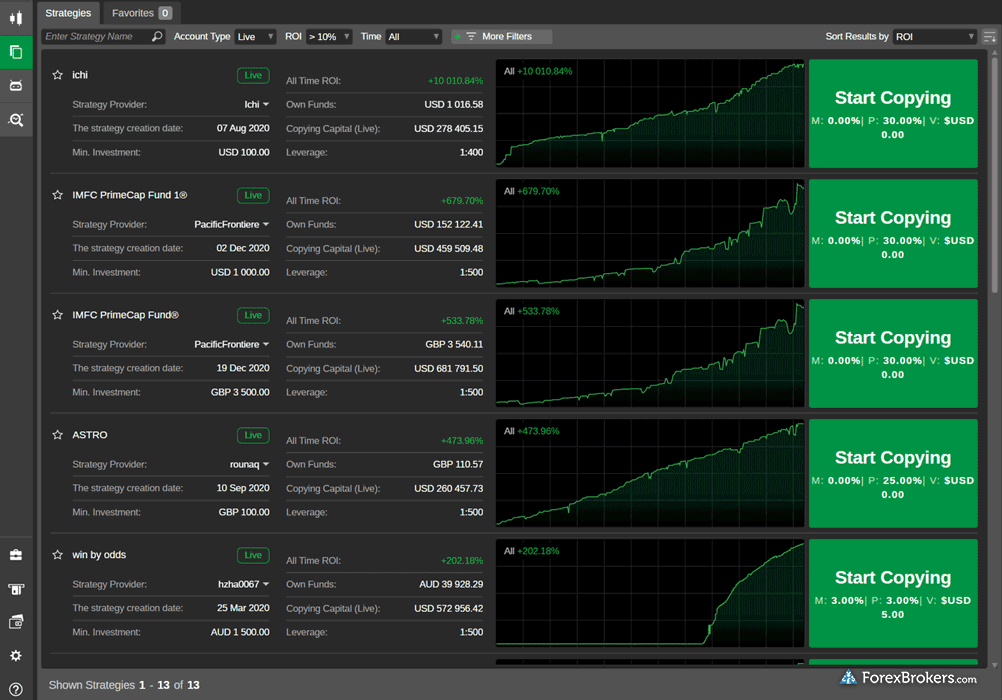

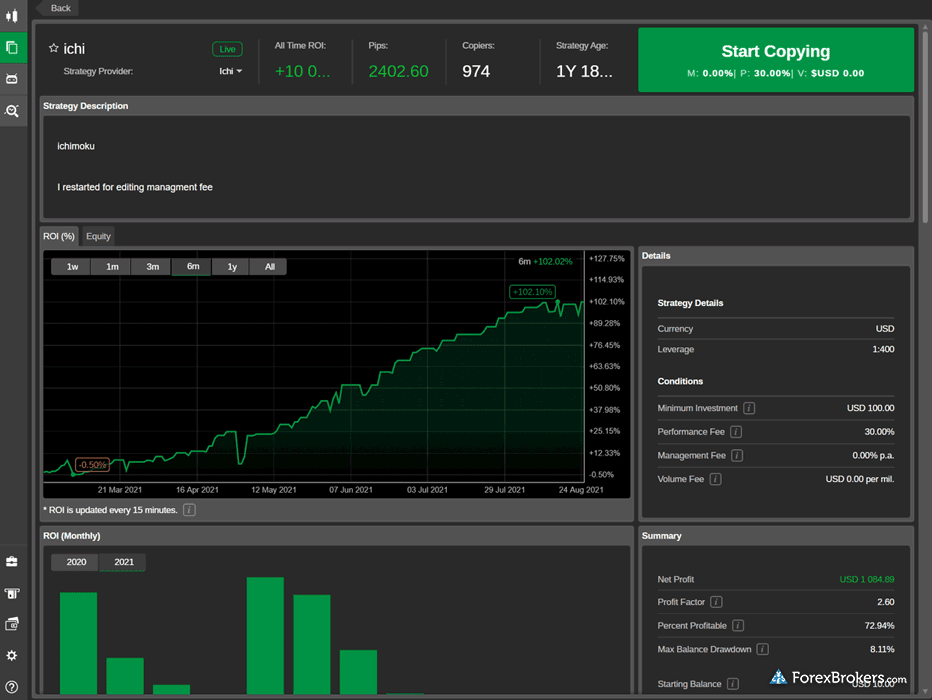

Does cTrader support copy trading?

Yes, cTrader offers a fully integrated copy trading platform called cTrader Copy. If supported by your forex broker, the cTrader Copy web application can be used for copy trading. Copy traders simply need to log in to the cTrader platform and navigate to the Copy application to begin comparing available strategy providers, analyzing historical performance statistics, and configuring settings to begin copying trades. Read my Copy Trading Guide to learn more about social copy trading.

Here are some screenshots of the cTrader Copy platform taken during our product testing.

How do you set up a broker on cTrader?

If you are a retail forex trader looking to use cTrader, I recommend visiting your forex broker’s website. If your broker supports cTrader, it will provide you with download links and setup instructions.

Here’s a quick primer on how to set up your brokerage account on cTrader:

- Verify availability. Confirm that your broker offers cTrader (see my list at the top of this guide to find a highly rated cTrader broker).

- Create an account. Open a forex demo account and/or a live trading account with your forex broker and select the cTrader platform.

- Install the platform(s). Installation links can typically be found in your broker’s client portal. They may also be sent to you via email after setting up your account.

- Log in to cTrader on your preferred device(s). Choose the version of the platform you wish to access (desktop, web, or mobile) and log in with the provided cTrader account credentials.

cTrader vs MetaTrader: Which is best for you?

cTrader is an excellent platform for serious traders who appreciate advanced charting and a sophisticated order management interface. cTrader is also a good choice for traders who are interested in obtaining (or developing) algorithmic trading programs. cTrader competes well with MetaTrader when it comes to its charting module, offering a larger number of time frames (26) than MT4 (9) or MT5 (21). The platform’s order entry and one-click trading features and configuration settings make cTrader a viable MetaTrader alternative.

That said, a much wider range of forex brokers support the extremely popular MetaTrader platform suite. Additionally, if you’ve found a particular algorithmic trading strategy that is only compatible with MetaTrader, it may be difficult to convert the strategy’s source code to be compatible with cTrader. Ultimately, your platform suite choice will largely come down to your personal preferences.

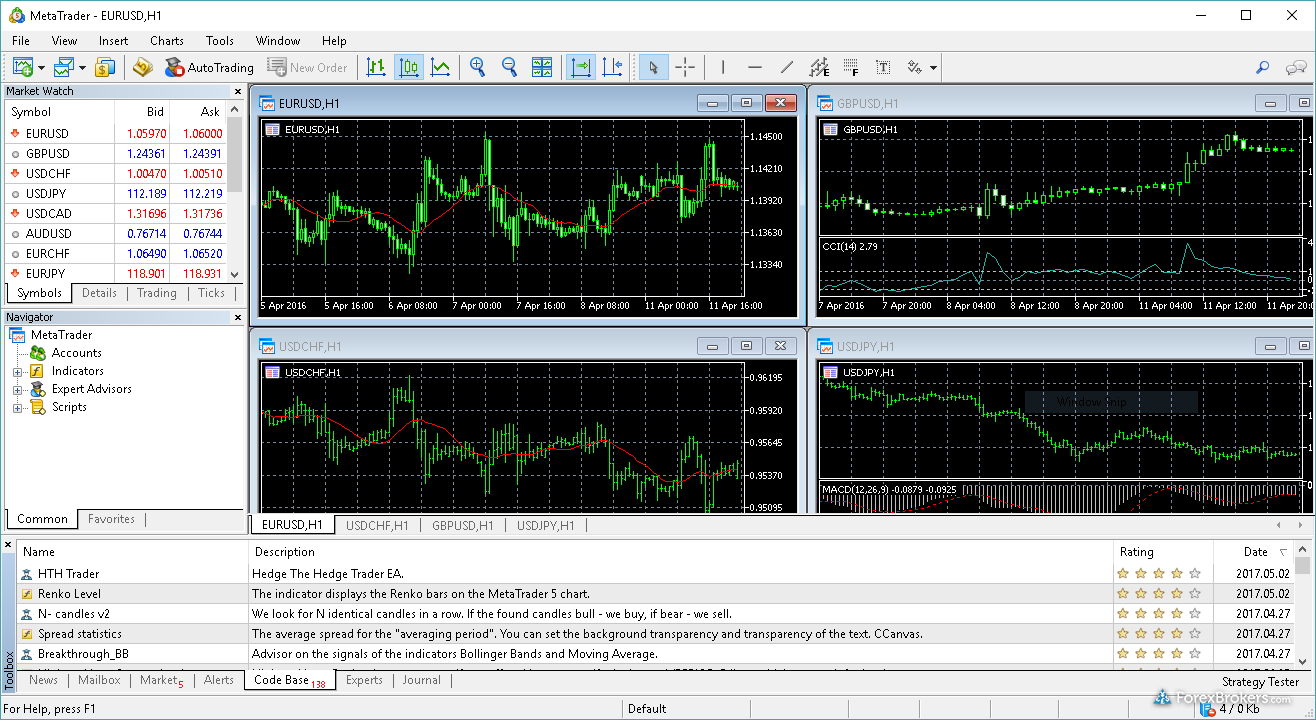

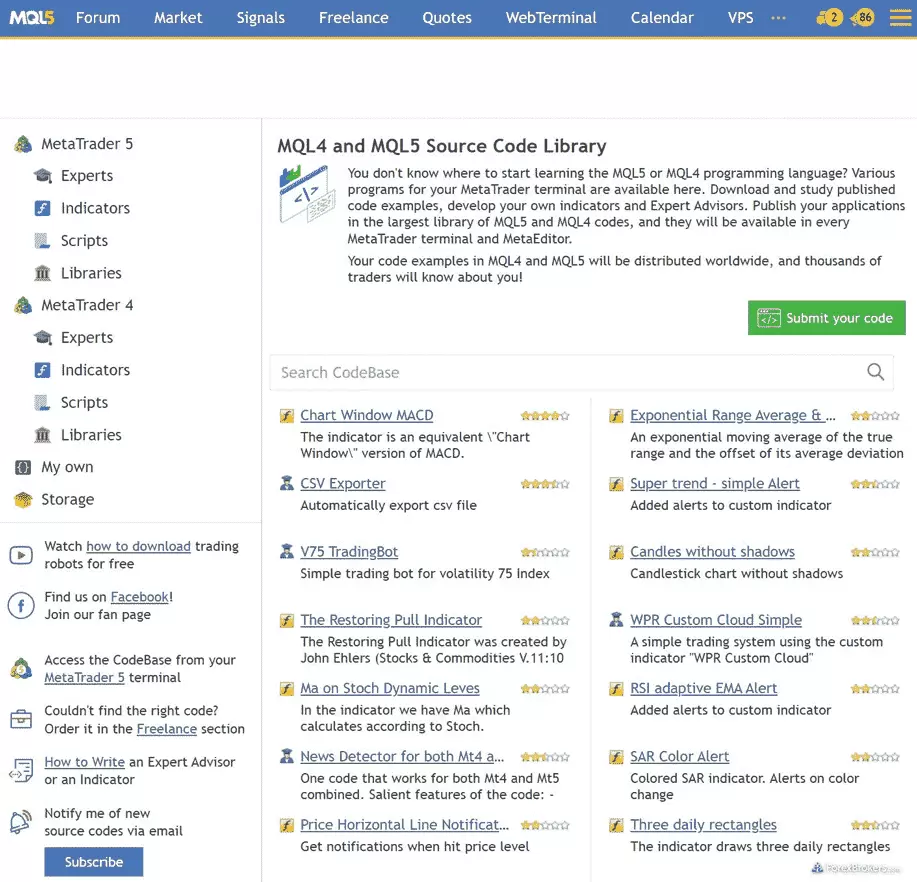

Check out some screenshots of MetaTrader (MT4 and MT5) taken during our testing.

computerMore about MetaTrader

Check out my guide to the MetaTrader suite, or learn more about the latest version of MetaTrader by reading my in-depth guide to MetaTrader 5. Can’t decide which version to use? My MT4 vs MT5 guide gives you all the info you need to make an informed decision.

What is the best cTrader broker?

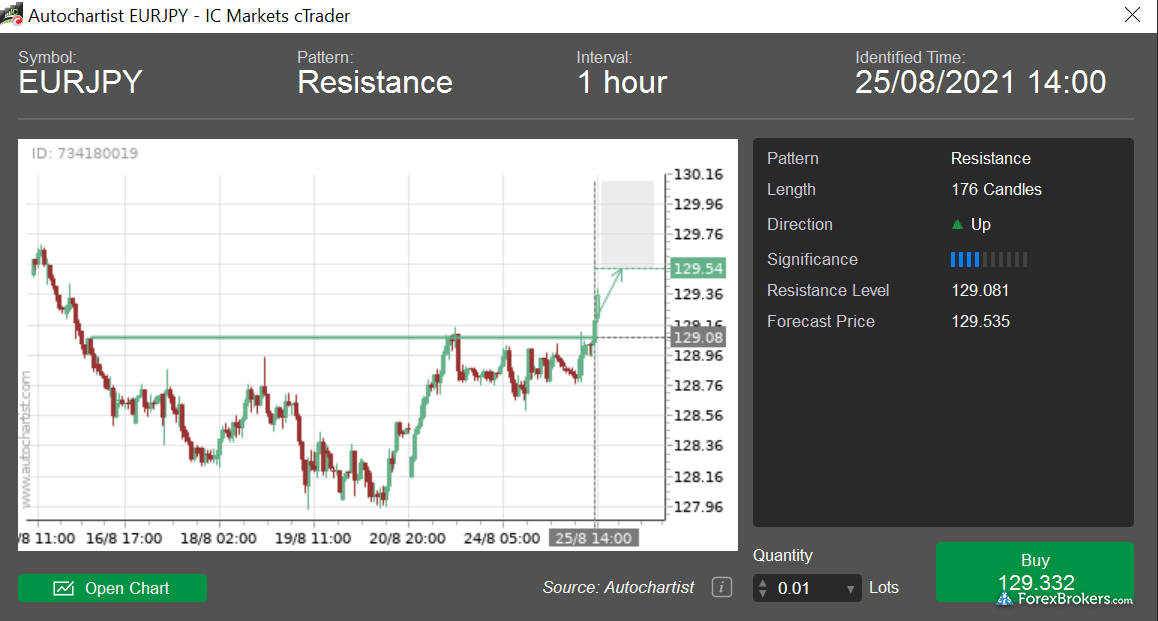

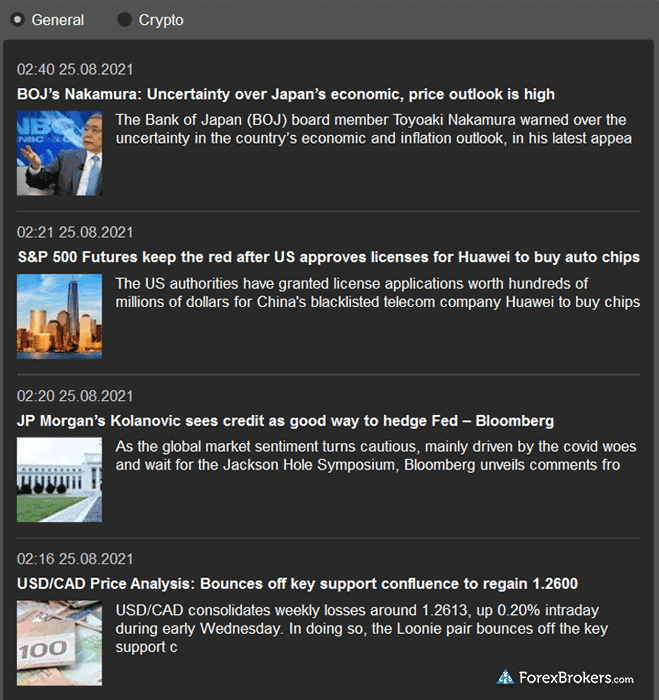

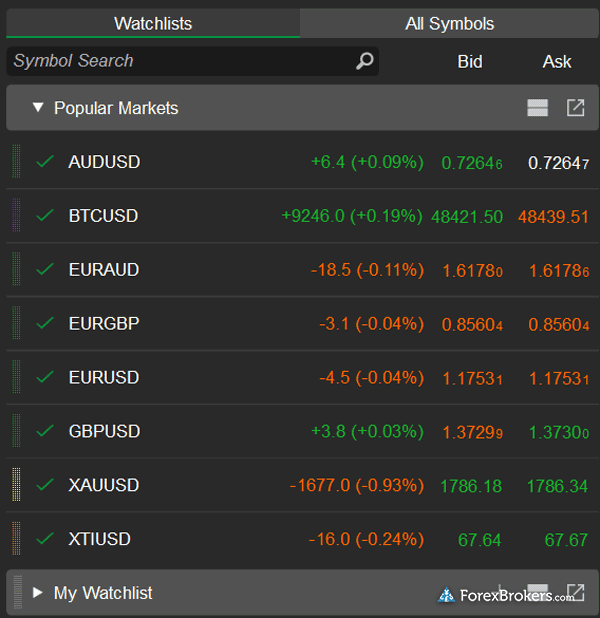

I’ve been using cTrader for over five years and I’ve tested dozens of forex brokers in that time; my choice for the best cTrader broker in 2024 is IC Markets. IC Markets has one of the most accommodating execution policies for algorithmic trading, helping to solidify its position among the best cTrader brokers in this category. IC Markets continues to expand its range of markets, features integrated news headlines from top-tier providers, and provides support for popular plugins from Autochartist and Trading Central.

Check out some screenshots of IC Markets' trading platforms, taken by our research team during our product testing.

cTrader for algorithmic trading

Investors looking to trade algorithmically on cTrader will need to either use the desktop version of cTrader or install the cAlgo desktop algo trading software for Windows. Algorithmic trading programs (known at cTrader as “cBots”) can be obtained from the cTrader Developer Network (cTDN) or third-party providers. Learn more about algo trading software.

Final Thoughts - From a Trader’s Perspective

As I mentioned above, cTrader is a fantastic platform choice for forex traders looking for advanced charting, sleek platform design, sophisticated order management, and a modern user interface.

cTrader has also made it possible for brokers to integrate additional value-added features such as Autochartist and Trading Central plugins. cTrader’s research is rounded out by news headlines from top-tier sources and an integrated economic calendar.

I have been a fan of cTrader’s charting technology for many years. cTrader also features a crisp overall platform design and an advanced order entry experience. That said, the cTrader platform suite has a niche market and does not enjoy the immense popularity of trading platform titans like TradingView and MetaTrader.

ForexBrokers.com 2024 Overall Rankings

Now that you've seen our picks for the top seven MetaTrader 5 brokers, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

Popular guides to forex trading tools and platforms

Popular Forex Guides

More Forex Guides

Popular Forex Broker Reviews

Methodology

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

In order to assess the best brokers for traders looking to use the cTrader platform, we research and test each individual broker’s cTrader offering.

We examine a wide range of features and evaluate forex brokers based on our own data-driven variables. We determine whether the broker offers the cTrader software offered by Spotware Systems, and we look for a number of supplementary features that can distinguish cTrader broker offerings.

Browser-based cTrader platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we test cTrader on mobile devices; for Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 12.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

About the Editorial Team

Steven Hatzakis

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

John Bringans

John Bringans is the Senior Editor of ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Joey Shadeck

Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

IC Markets

IC Markets

Pepperstone

Pepperstone

FP Markets

FP Markets

FxPro

FxPro

BlackBull Markets

BlackBull Markets

FXPrimus

FXPrimus

TopFX

TopFX

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

CMC Markets

CMC Markets

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

City Index

City Index

XTB

XTB

eToro

eToro

Capital.com

Capital.com

Swissquote

Swissquote

AvaTrade

AvaTrade

Plus500

Plus500

FXCM

FXCM

OANDA

OANDA

XM Group

XM Group

Admirals

Admirals

Tickmill

Tickmill

Markets.com

Markets.com

FinecoBank

FinecoBank

Vantage

Vantage

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX