Trade Nation Review

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trade Nation’s well-designed, easy-to-use trading app for web and mobile is an innovative platform suite that’s great for beginner forex and CFD traders. However, if you’re a seasoned trader, you may find that Trade Nation lacks some of the advanced features you’d find with the best trading platforms.

-

Minimum Deposit:

$0 -

Trust Score:

85 -

Tradeable Symbols (Total):

1000

Can I open an account with this broker?

Yes, based on your detected country of HK, you can open an account with this broker.

Trade Nation pros & cons

Pros

- Regulated in Australia, the U.K., South Africa, the Bahamas, and Seychelles.

- Trade nation's web and mobile platforms are thoughtfully designed and easy to use, helping the broker win Best in Class honors in our Ease of Use category in our 2024 Annual Awards.

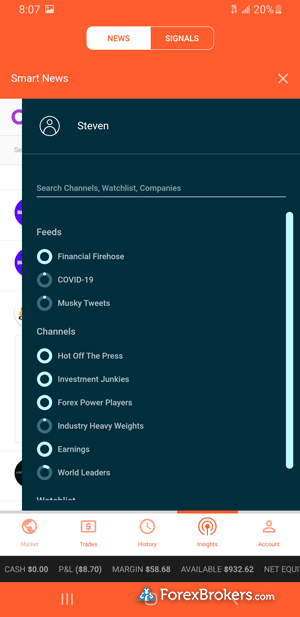

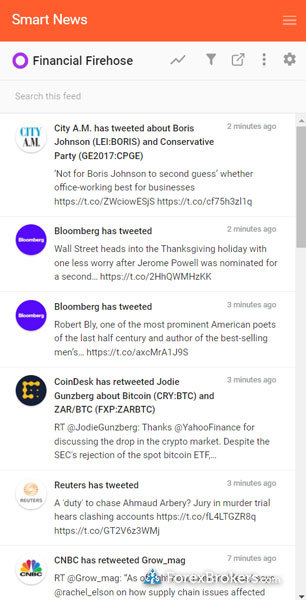

- The Smart News feature available in Trade Nation’s mobile app and web platform helpfully curates Tweets and news headlines.

- Offers a dollar-per-point default staking size, where rather than select a trade size in units, you can select how much you want to risk per price point or per pip (comparable to eToro or Plus500).

- Charts are powered by ChartIQ on TradeNation for web and mobile.

- Fixed spreads for forex and CFD trading are competitive – except during rollover time.

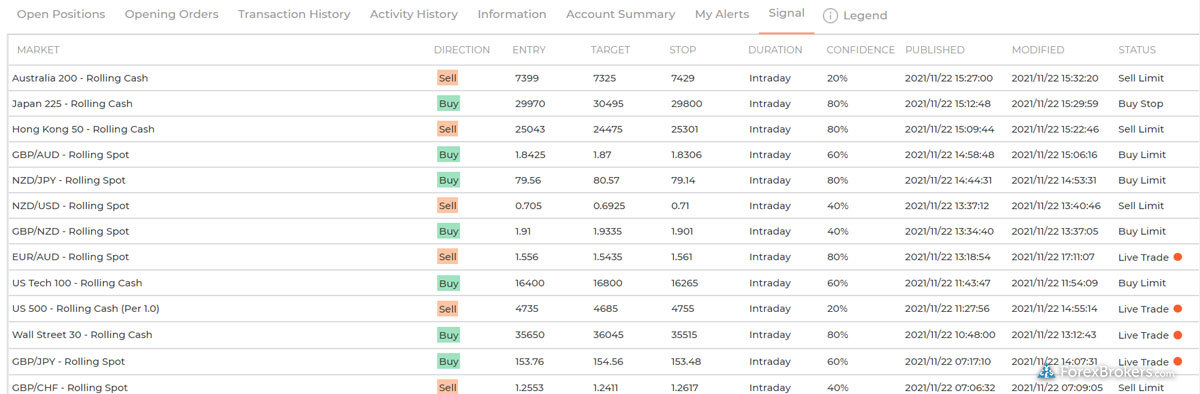

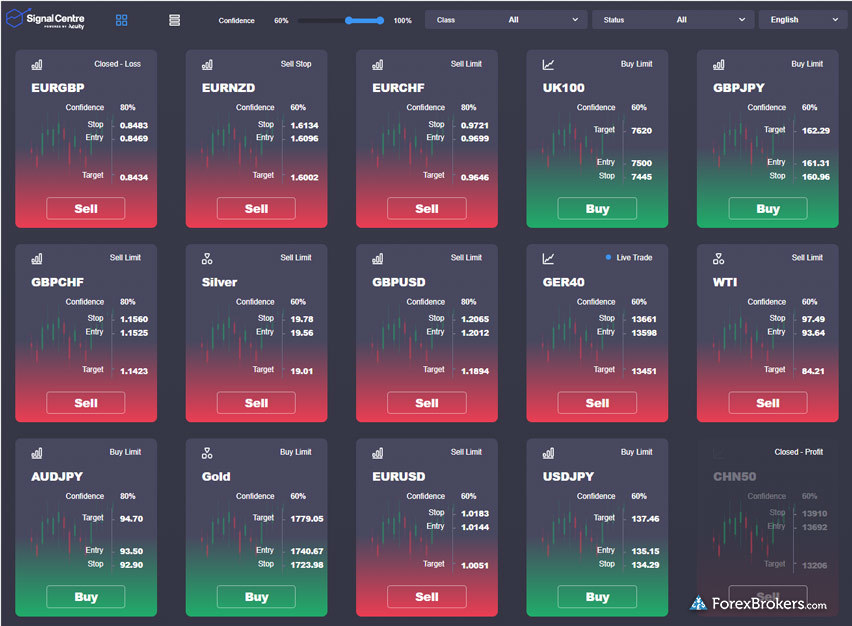

- Trading signals powered by Acuity are available within platform and as standalone web module as part of Trade Nation’s Signal Centre.

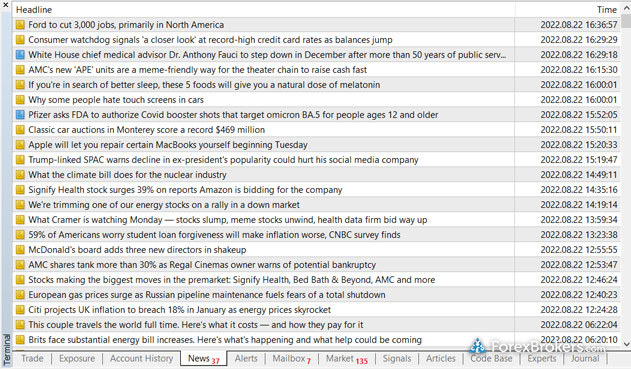

- TN Trader web platform features curated news headlines by Dow Jones Newswire.

Cons

- Market research updates on blog are sporadic, and mixed with educational articles.

- The educational offering is limited and lacks variety in its articles, videos, and blogs.

- The range of markets on MetaTrader 4 is limited compared to what's available on Trade Nation's proprietary web-trading platform.

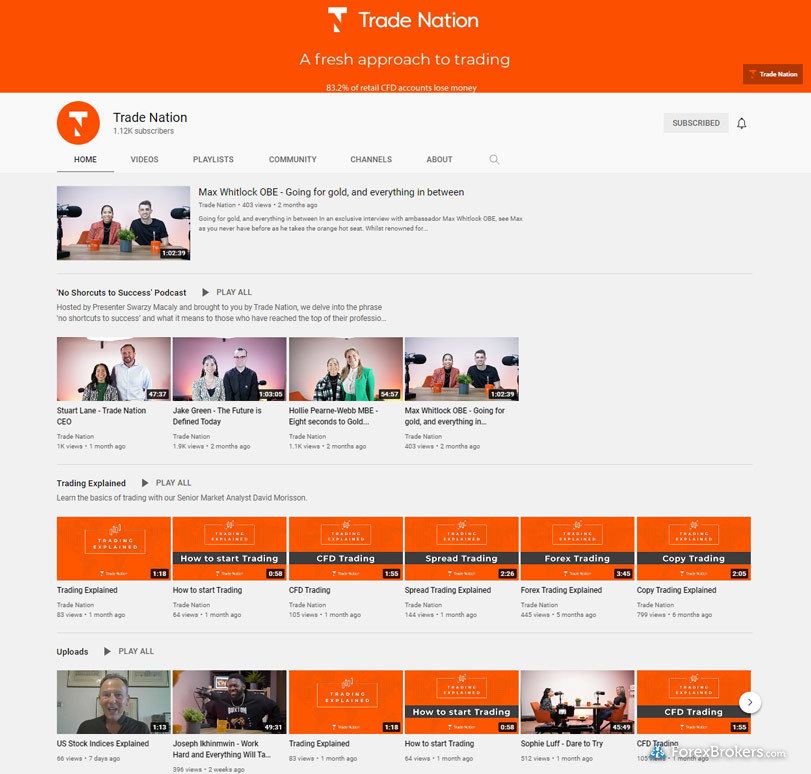

- Though Trade Nation’s new podcast series are well-made and often entertaining, they’re not always strictly focused on financial markets.

Overall summary

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Overall Rating |

|

| Trust Score | 85 |

| Offering of Investments |

|

| Commissions & Fees |

|

| Platform & Tools |

|

| Research |

|

| Mobile Trading |

|

| Education |

|

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Is Trade Nation safe?

Trade Nation is considered Trusted, with an overall Trust Score of 85 out of 99. Trade Nation is not publicly traded and does not operate a bank. Trade Nation is authorized by two Tier-1 regulators (Highly Trusted), one Tier-2 regulator (Trusted), zero Tier-3 regulators (Average Risk), and one Tier-4 regulators (High Risk). Trade Nation is authorised by the following Tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Year Founded | 2014 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 2 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 2 |

Offering of investments

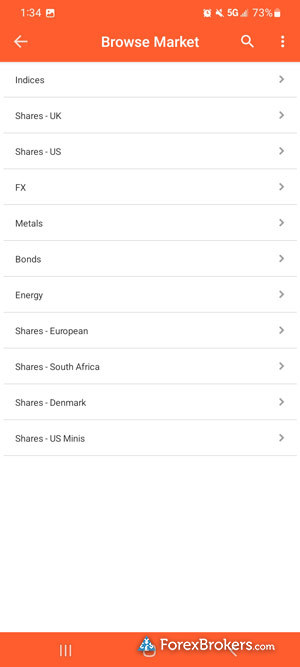

Trade Nation offers a total of just over 1000 tradeable symbols. These consist of 46 forex pairs and share CFDs across US, UK, and European exchanges, including South African shares, along with popular commodities, metals, bonds, cryptocurrencies, and indices.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). Cryptocurrency trading is available on Trade Nation’s Web Platform to clients who have signed up under Trade Nation’s Bahamas entity.

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 1000 |

| Forex Pairs (Total) | 46 |

| U.S. Stock Trading (Non CFD) | No |

| Int'l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

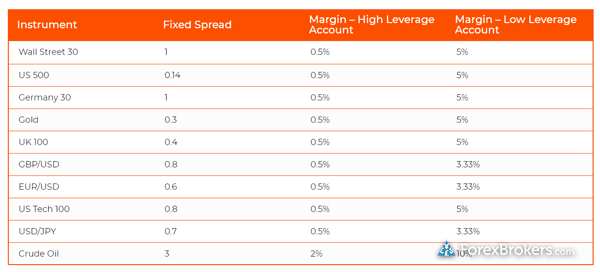

Trade Nation offers competitive fixed-spread pricing across its tradeable symbols in addition to variable-spread pricing on its MetaTrader platform. While most brokers offer variable pricing, Trade Nation keeps the spread distance fixed as prices update. This means its pricing can be considered an average price as-is, with no further calculation needed – except during the rollover period each day when prices widen for about one hour.

Fixed spreads: Trade Nation lists a fixed spread of 0.6 pips for the EUR/USD pair. It’s worth mentioning again that Trade Nation does widen its spreads briefly during its rollover period each day to as much as 1.4 pips, bringing the true average closer to 1 pip when factoring all price tick data (though it can be lower, depending on whether the average is weighted by time or trade volume).

Account types: Trade Nation offers three primary account types: two are MetaTrader-based, which includes a commission-based Raw Spread account that charges a $3.50 commission per side ($7 per round-trip) per standard lot and a commission-free account, and one is for its TN Trader account for use with its proprietary TN Trader web platform. The highest spreads are on its commission-free account for MetaTrader, whereas its TN Trader account appears to offer the lowest spreads compared to the other two account types when factoring in the all-in costs. Overall, considering that spreads are fixed, Trade Nation fares well in this category.

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Standard | 0.6 |

| All-in Cost EUR/USD - Active | 0.6 |

| Active Trader or VIP Discounts | No |

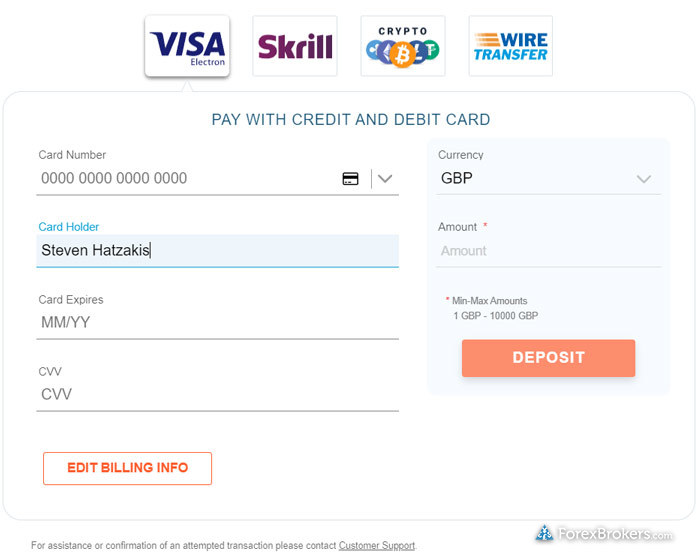

| ACH or SEPA Transfers | No |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | Yes |

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

Mobile trading apps

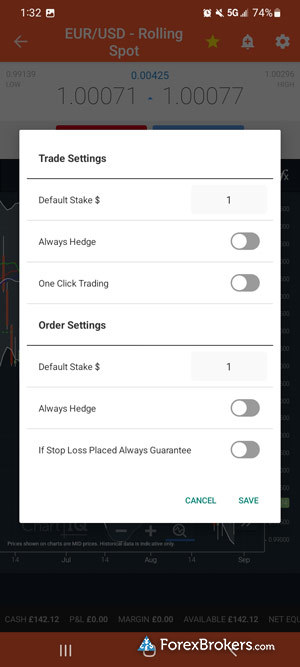

Overall, the Trade Nation app scores highly for ease-of-use but lacks some of the advanced features that are typically found in the best trading apps.

Apps overview: The Trade Nation mobile app is available directly from the Google Play and Apple App Store for Android and iOS devices, respectively, and MetaTrader 4 (MT4) is also available to Trade Nation clients.

Ease of use: The Trade Nation mobile app is just as easy to use as its web counterpart, and features the same functionality and unique features – such as its Smart News section with headlines and curated tweets — that helped Trade Nation earn a Best in Class rating for Ease of Use for 2024.

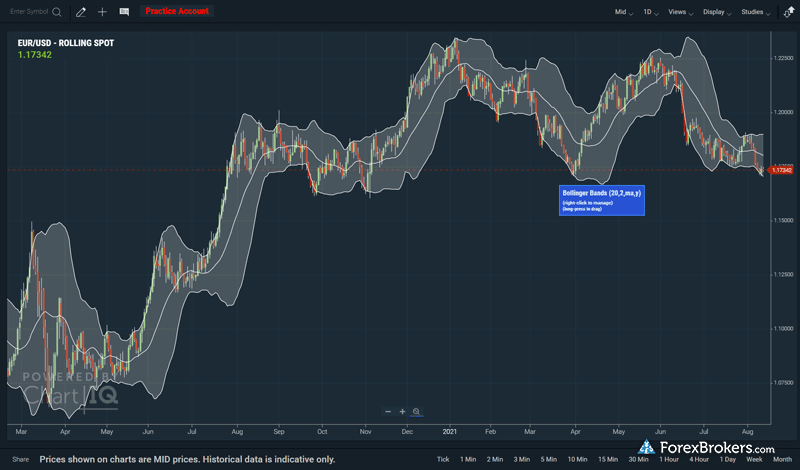

Charting: Charting in the Trade Nation mobile app is powered by ChartIQ, and features over 90 indicators and dozens of drawing tools.

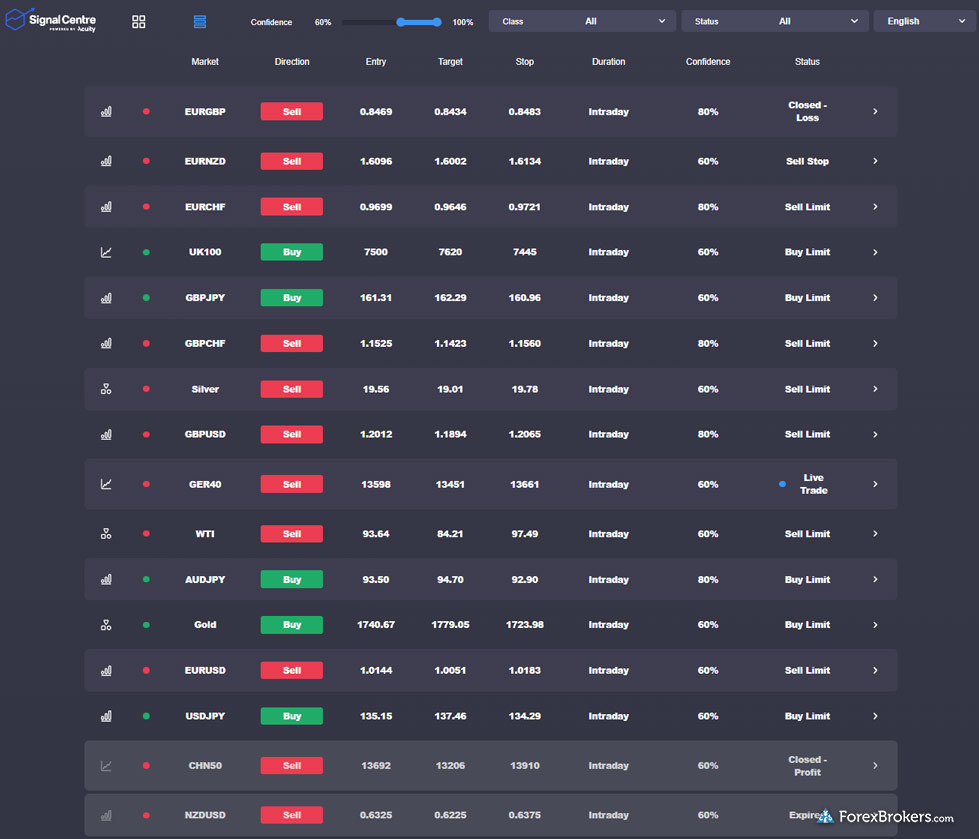

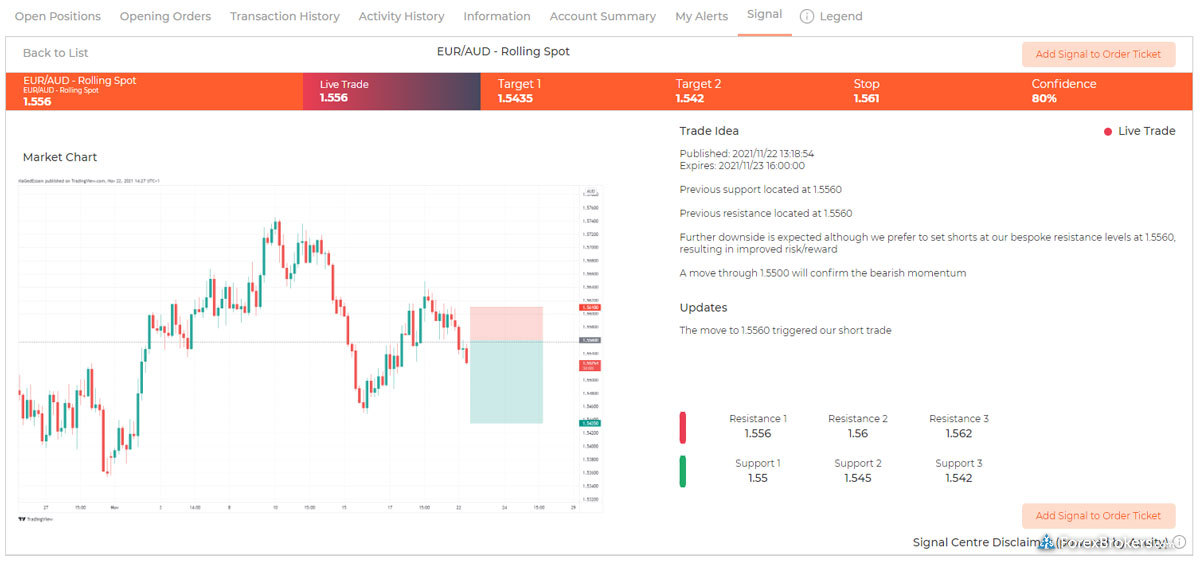

Trading tools: There has been progress year over year with the addition of more research, such as the Daily Report alongside headlines from Dow Jones within the mobile app, but there remains still more space that can be used to enhance the user experience. There’s simply a lot of real estate left on the platform where more trading tools and features can be added. That being said, I was pleased to find trading signals powered by Acuity Trading, which can be easily copied and are nicely integrated under the signals tab for live account holders.

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Watchlists - Total Fields | 14 |

| Watchlist Syncing | Yes |

| Charting - Indicators / Studies (Total) | 99 |

| Charting - Drawing Tools (Total) | 39 |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Charting - Multiple Time Frames | Yes |

| Mobile Economic Calendar | No |

Other trading platforms

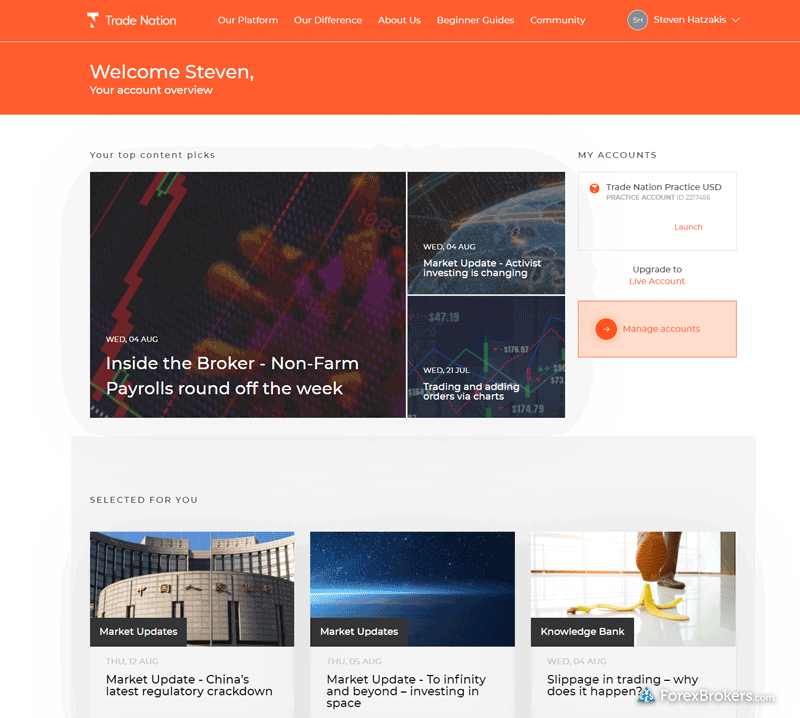

Trade Nation's TN Trader web platform is overly simplified – so much so, that it often feels as though there are significant gaps in its offering, despite standing out for its ease of use and minimalistic design. The addition of news headlines from Dow Jones has helped elevate Trade Nation’s web platform, though it still trails behind industry leaders such as Saxo, IG, and CMC Markets in this category.

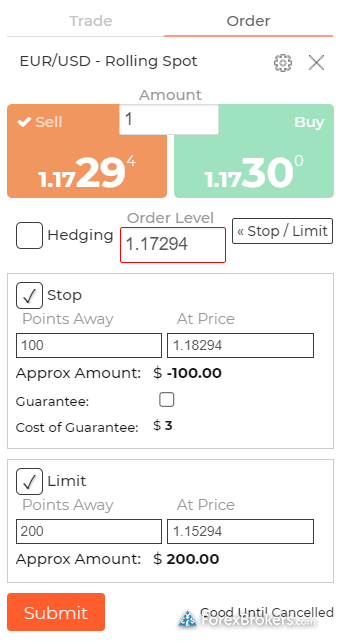

Platforms overview: The TN Trader web platform is supported by the latest modern browsers, along with the popular MetaTrader 4 (MT4) platform offered by Trade Nation. I found that the TN Trader platform has simple steps for carrying out core actions like setting an alert, adding a symbol to your favorites, opening a chart, or placing an order.

The features I liked most in Trade Nation’s web platform were the pre-defined watchlists found in the market explorer, and the ability to create multiple custom watchlists.

Charting: Charting in the TN Trader web platform is powered by ChartIQ, a popular provider of charting software within the online brokerage industry. With 35 drawing tools and 95 indicators, Trade Nation’s web charts have rich technical analysis capabilities – similar to TradingView charts. The biggest drawback is you cannot trade from the charts on TN Trader, a small but important distinction for active traders and those who like to see their order levels and drag-to-modify them on the chart.

Trading tools: Research and news headlines are absent in terms of in-house content or third-party articles beyond the curated news headlines from Dow Jones Newswire. And while there is a lot of real estate left on the platform where I was expecting to find more trading tools, I was pleased to find trading signals powered by Acuity Trading, which can be easily copied and are nicely integrated under the signals tab for live account holders.

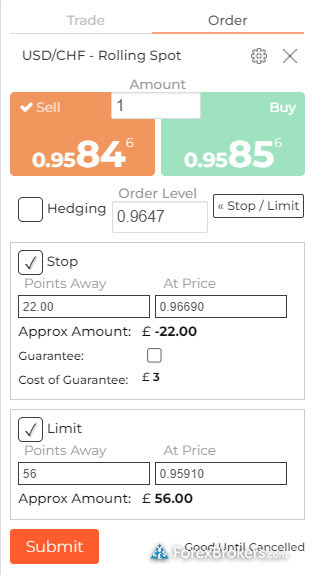

Guaranteed stop-loss: Trade Nation offers several order types, including a guaranteed stop-loss. At 3 pips, the price to add a guaranteed stop-loss order is expensive, compared to CMC Markets or IG. That said, pricing is competitive on Trade Nation’s fixed spread offering.

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | No |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting - Indicators / Studies (Total) | 99 |

| Charting - Drawing Tools (Total) | 39 |

| Charting - Trade From Chart | No |

| Watchlists - Total Fields | 14 |

Market research

Trade Nation trails slightly behind the industry average in the research category. Its mobile app does publish articles throughout the week, and offers curated Tweets and headlines. On the web platform, however, besides the Smart News module and news headlines, research is limited. That said, I was pleased to find Trade Nation’s newly added Signal Centre available to clients from within the web platform, featuring trading signals from an FCA-regulated provider.

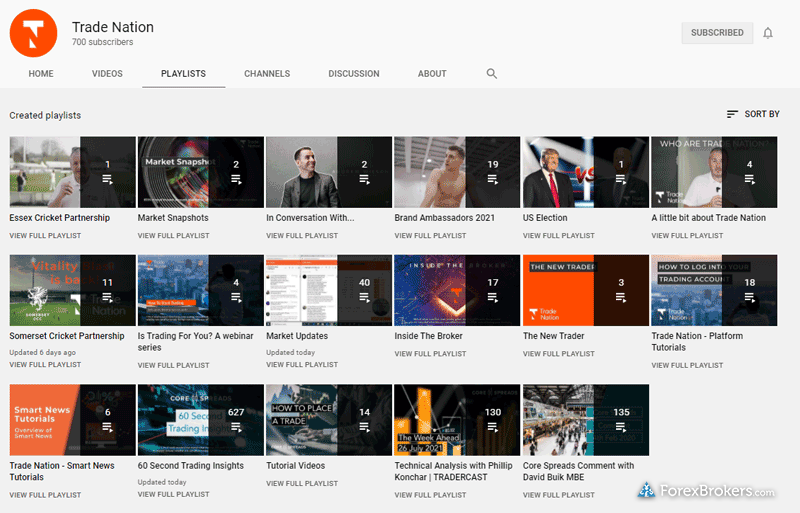

Research overview: Trade Nation’s research is mostly found in three places: the news and analysis section of its website, its official YouTube channel, and the news module in its mobile app and web platform. The recent addition of integrated news headlines from Dow Jones was a great step, along with its Top Trades and Daily Report updates. However, I would love to see them add an economic calendar to further flesh out its research offering.

Market news and analysis: On Trade Nation’s YouTube channel you’ll find a growing variety of content, like archived analysis videos such as the Trading Insights and TRADERCAST series that contain over 130 recordings. Overall, Trade Nation’s videos are good-quality, and focus on technical and fundamental analysis, yet content that focuses on research, daily market news, and analysis is still limited. The number of newly uploaded videos that are primarily research-focused has been reduced, and the best brokers in this category feature a wider variety of research content and produce videos more frequently each day.

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Daily Market Commentary | No |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment - Currency Pairs | Yes |

Education

Trade Nation’s educational content is mainly for beginners – even the premium and advanced content is basic. I found it difficult to navigate by topic or experience level because the educational materials are mixed together with market news in the same section. That said, some content does exist and it appears Trade Nation is slowly expanding this category. One such example is the broker’s addition of its Experts Explain series, where professionals write articles that are designed to answer common research questions.

Learning center: Educational content at Trade Nation consists primarily of its Beginner Guides series, a few archived webinars, and an assortment of articles in its news and analysis section. Also worth noting is Trade Nation’s No Shortcuts to Success podcast, which I found to be lively and contained good discussions.

Room for improvement: It does appear that Trade Nation is slowly expanding in this category but the progress is slow. Organizing the educational content so that it is clearly set apart from the research and market news articles, and adding interactive courses with progress tracking, would help elevate Trade Nation’s ranking in this category.

| Feature |

Trade Nation Trade Nation

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | No |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | No |

Final thoughts

Trade Nation has established itself across its network of global entities with a variety of regulatory licenses, and offers a decent range of markets through its easy-to-use trading platform suite for web and mobile. Adding additional licenses has helped lift its Trust Score and overall value proposition.

While Trade Nation could be a good stepping-stone for beginners and less active traders, the absence of advanced trading tools and additional research and educational content may leave more demanding investors looking for more. That said, the broker is preparing to launch TradingView, and evolving features such as its SignalDP and TradeCopier service are helping to bridge the gap to cater to more sophisticated traders.

About Trade Nation

Founded in 2014, Trade Nation is a brand and trading name of multiple entities that hold regulatory licenses across the globe, including in the U.K. by the Financial Conduct Authority (FCA) under Trade Nation Financial UK Ltd, in Australia by the Australian Securities and Investment Commission (ASIC) under Trade Nation Australia Pty Ltd, in South Africa by the Financial Sector Conduct Authority (FSCA) under Trade Nation Financial Pty Ltd, in the Bahamas by the Securities Commission of the Bahamas (SCB) under Trade Nation Ltd, and in Seychelles by the Financial Services Authority (FSA) of Seychelles under Trade Nation Financial Markets Ltd.

ForexBrokers.com 2024 Annual Awards

For the ForexBrokers.com 2024 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

Best in Class honors were awarded to the Top 7 forex brokers in each of the following areas: Beginners, Social Copy Trading, Ease of Use, MetaTrader, Algo Trading, Crypto Trading, and Professional Trading.

For more information, see how we test.

Category awards

Trade Nation Trade Nation

|

Ease of Use |

| Rank #1 | |

| Streak #1 | |

| Best in Class | |

| Best in Class Streak | 3 |

Does Trade Nation use MT4?

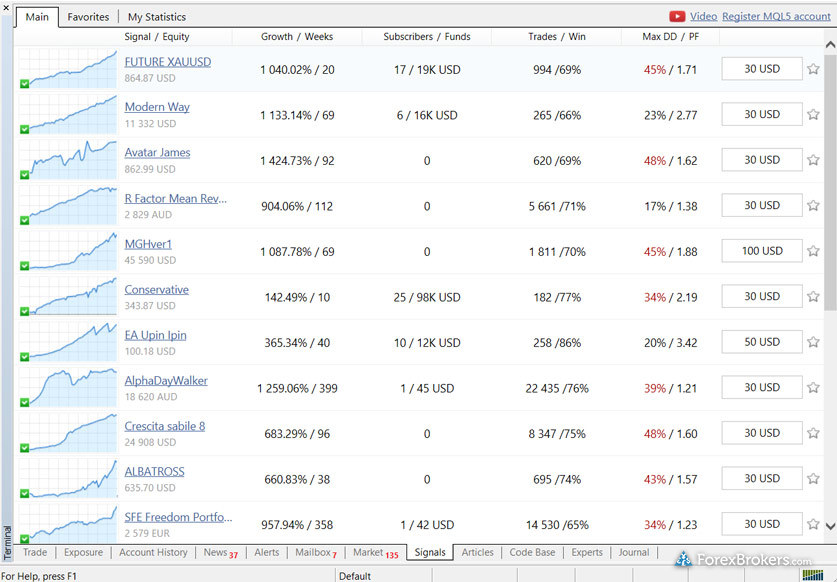

Yes, MetaTrader 4 (MT4) is available at Trade Nation for trading forex and CFDs, alongside the broker’s proprietary web trading platform and mobile app. If you are trying to decide between using MetaTrader and Trade Nation’s proprietary platform, it’s important to note that Trade Nation’s proprietary platform - TN Trader - delivers a wider range of markets along with competitive fixed-spread pricing. For example, on MT4 there are only a few hundred assets, depending on the Trade Nation entity your account is held with, compared to over 1000 available on the TN Trader web platform.

Is Trade Nation regulated in South Africa?

Yes, Trade Nation is regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa (under Trade Nation Financial Pty. Ltd.) Trade nation also holds regulatory status in the U.K., Australia, and the Bahamas. Click here to learn more about Trust Score and forex regulatory agencies.

Does Trade Nation have a ZAR account?

Yes, Trade Nation offers ZAR accounts. Trade Nation accounts can be denominated in any of its eight base currencies, including Great British Pounds (GBP), United States Dollars (USD), Euros (EUR), Australian Dollars (AUD), South African Rand (ZAR), as well as the Danish Kroner (DKK), Norwegian Kroner (NOK), and Swedish Kronor (SEK).

Trade Nation holds its customer funds at Barclays Bank in London, and its Trade Nation Australia client funds are held at Westpac Bank in Australia.

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Popular Forex Guides

- Best Forex Brokers for Beginners of 2024

- International Forex Brokers Search

- Best Forex Brokers of 2024

- Compare Forex Brokers

- Best Copy Trading Platforms of 2024

- Best Forex Trading Apps of 2024

- Best Zero Spread Forex Brokers of 2024

- Best MetaTrader 4 Brokers of 2024

- Best Brokers for TradingView of 2024

More Forex Guides

Popular Forex Broker Reviews

Compare Trade Nation Competitors

Select one or more of these brokers to compare against Trade Nation.

Show all