Best Forex Brokers in Thailand for 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Thailand is the 20th most populated country in the world, and its growing economy and robust monetary policy have granted its residents greater access to local capital markets and investment products such as the trading of forex and CFDs with domestic and international brokers.

The Central Bank of Thailand (BOT) along with Thailand’s major regulatory body, the Securities and Exchange Commission (SEC) of Thailand, are the primary regulators of local financial markets.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers Thailand

To create this list of the best forex brokers in Thailand in 2024, we compiled a list of firms that accept clients from Thailand and ranked them using our own independently researched ratings and rankings (learn more about how we test brokers).

-

IG

- Best overall broker, most trusted

-

Interactive Brokers

- Great overall, best for professionals

- Saxo - Best web-based trading platform

- FOREX.com - Excellent all-round offering

- XTB - Great research and education

-

Capital.com

- Great for beginners, easy to use

-

AvaTrade

- Great for beginners and copy trading

Best Forex Brokers in Thailand Comparison

Compare authorized forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts TH Residents | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

IG IG

|

0.98 | £250.00 |

|

||

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

||

Saxo Saxo

|

1.1 | $0 |

|

||

FOREX.com FOREX.com

|

1.4 | $100 |

|

||

XTB XTB

|

1.00 | $0 |

|

||

Capital.com Capital.com

|

0.67 | $20 |

|

||

AvaTrade AvaTrade

|

0.92 | $100 |

|

||

OANDA OANDA

|

1.57 | $0 |

|

||

Pepperstone Pepperstone

|

1.10 | $0 |

|

||

XM Group XM Group

|

1.6 | $5 |

|

||

Admirals Admirals

|

0.8 | $100 |

|

||

FP Markets FP Markets

|

1.1 | $100 AUD |

|

||

Tickmill Tickmill

|

0.51 | $100 |

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

||

BlackBull Markets BlackBull Markets

|

0.76 | $0 |

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

1.2 | $20 |

|

||

HFM HFM

|

1.2 | $0 |

|

||

ActivTrades ActivTrades

|

0.98 | 0 |

|

||

Trade Nation Trade Nation

|

0.6 | $0 |

|

||

Eightcap Eightcap

|

1.0 | $100 |

|

||

Moneta Markets Moneta Markets

|

1.38 | $50 |

|

||

Spreadex Spreadex

|

0.81 | $0 |

|

||

Exness Exness

|

N/A | $10 |

|

||

ACY Securities ACY Securities

|

1.2 | $50 |

|

||

easyMarkets easyMarkets

|

0.8 | $50 |

|

||

Libertex (Forex Club) Libertex (Forex Club)

|

N/A | $10 |

|

About the Bank of Thailand and SEC

The Central Bank of Thailand (BOT) oversees Thailand’s monetary policy and national currency, the Thai Bhat. The BOT also regulates local financial markets alongside Thailand’s major regulatory body, the Securities and Exchange Commission (SEC) of Thailand. The BOT’s forex regulations include the licensing of payment companies that carry out forex-related transactions in accordance with the Exchange Control Act.

The BOT’s Exchange Control Regulations pertain to cross-border payments and the rules that govern investing outside of Thailand. For example, Regulation 2.2.3 (Portfolio Investment Abroad) permits retail investors to invest in foreign securities outside of Thailand, albeit with certain limits on amounts and the use of onshore agents.

The SEC of Thailand is the capital markets regulator that oversees the Stock Exchange of Thailand (SET) along with investment products such as derivatives, digital assets (like cryptocurrencies, for example), and other securities. The SEC regularly releases regulatory updates (including investor alerts pertaining to unlicensed companies or unapproved practices) and has published a detailed handbook with best practices for participants in Thailand’s capital markets. The SEC’s authority is based in part on laws stemming from the Securities Exchange Act and Derivatives Exchange Act.

How to verify SEC of Thailand Authorisation

The Securities and Exchange Commission (SEC) of Thailand has an easy-to-use tool that allows you to verify SEC-authorised companies. To find out if a company is authorised by the SEC Thailand, you can use the tool to search for the company by name.

Important note:

Not all brokers that accept clients from Thailand are regulated by the SEC of Thailand. You should still verify that your broker is well-regulated in multiple jurisdictions to reduce your risk of falling victim to forex scams. Learn more about how we track each broker’s regulatory status by checking out our Trust Score page.

The importance of trading with regulated forex brokers

Regulated brokers are subject to stringent compliance obligations, capital requirements, and stricter laws; if regulated brokers fail to meet certain standards, those brokers can be subject to enforcement actions – and can even be shut down altogether. Unregulated brokers, on the other hand, are not required to report to a governing body. This lack of oversight can lead to questionable practices, and traders that deal with unregulated brokers often have no recourse for recovering funds if they fall victim to a forex scam (check out our guide on how to avoid forex scams to learn more).

Why regulation is important

Choosing a reputable, well-regulated forex broker is a crucial step towards avoiding forex scams. My educational series dedicated to forex scams shows you how to identify common forex scams and provides helpful information about what to do if you've been scammed. I also explain how crypto enthusiasts and bitcoin traders can spot common crypto scams.

Is forex trading allowed in Thailand?

Yes, forex trading is allowed in Thailand; residents of Thailand are unrestricted when it comes to forex trading, and can deposit up to $15,000 USD per day into their brokerage accounts (with no bank wire/transfer limits). Traders in Thailand are able to invest in both local and international financial markets, including in derivatives such as CFDs (learn more in our guide to CFD trading). Non-residents in Thailand enjoy similar trading abilities, though the banking products and services available to them will be slightly different than what is available to Thai residents.

How to get started trading forex in Thailand

The first step to trading forex in Thailand is to open an account with a highly-regulated forex broker that accepts Thai residents. Once you’ve chosen a reputable, well-licensed broker, you can follow these next steps to get started as a forex trader in Thailand:

- Complete your forex broker’s live account application process. Make sure to read through your brokers’ provided terms and conditions.

- Fund your new brokerage account using your preferred deposit method. PayPal has become a popular payment method among brokers and traders, check out our guide to the best forex brokers that accept PayPal.

- Study educational resources about forex trading. Many forex brokers deliver great educational content.

- Try out a demo (or, virtual trading) account. This will let you familiarize yourself with your broker’s trading platform and product offerings without risking any real money.

- Put together a trading plan. Even the best traders can lose money; sticking to a trading plan that keeps your average losses low (relative to average profits) is important for long-term success in the forex market. Make sure you are starting with an amount you can afford to risk.

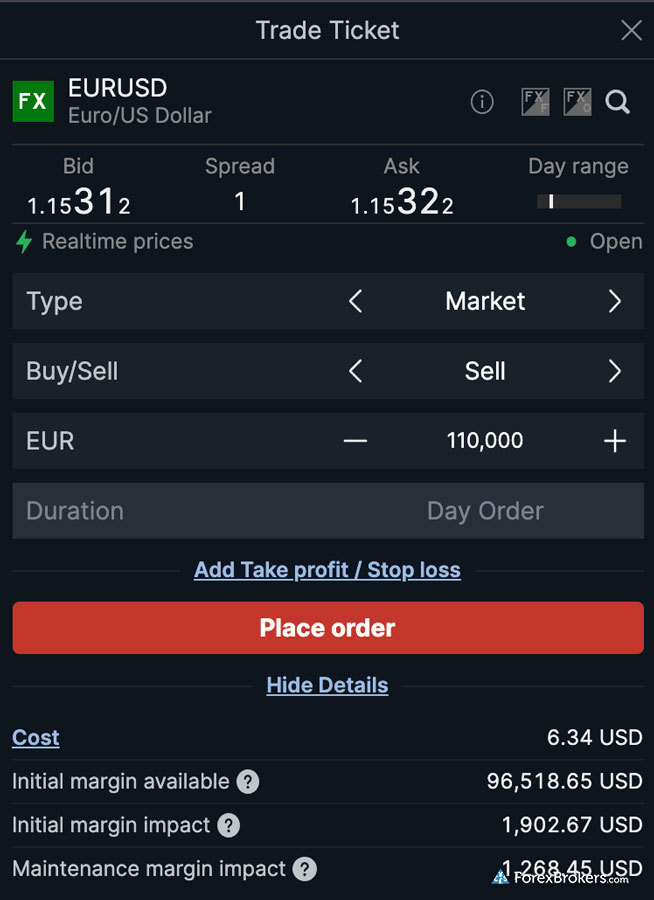

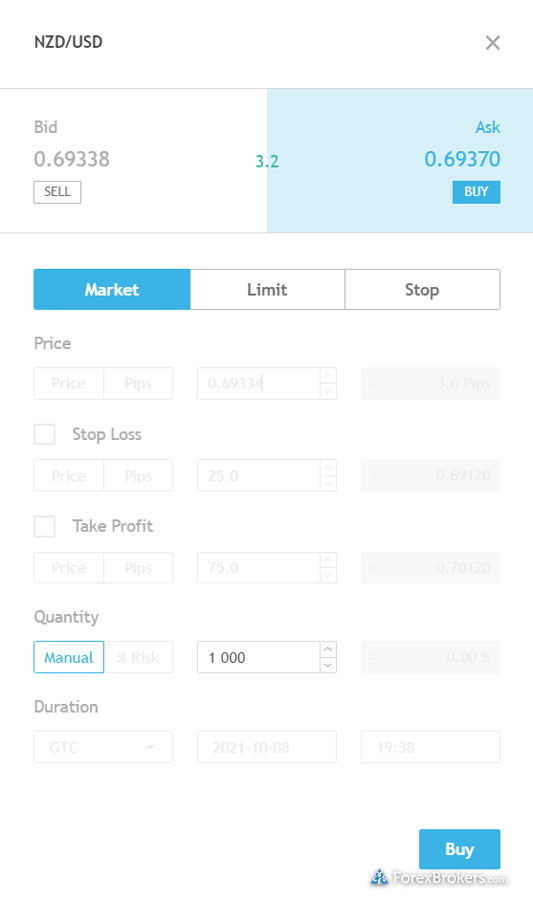

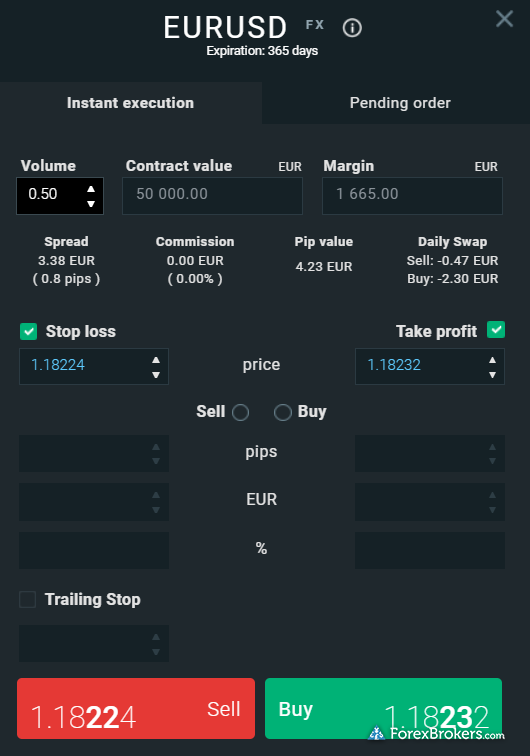

- Now, you can enter the forex market. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell.

Which forex broker is the best in Thailand?

IG is our pick for the best forex broker in Thailand for 2024. A highly trusted broker, IG has been in business for decades and holds a number of regulatory licenses in jurisdictions all over the world. IG also regularly ranks at the top of nearly all of ForexBrokers.com’s scoring categories, and was our #1 pick for the Best Overall Broker in our 2024 Annual Awards. IG consistently receives high scores from our research team for delivering powerful trading tools and platforms, well-designed mobile apps, and comprehensive educational resources for traders. If you’d like to learn more about why IG continues to rank highly across nearly all of our categories, check out our full-length review of IG.

Who are the most trusted forex brokers in Thailand?

The following brokers accept clients locally in Thailand, and – based on our research into the regulatory status of over 60 forex brokers – we’ve created this list of the Top 5 most trusted forex brokers in Thailand in 2024 (learn more by visiting our Trust Score page).

1. IG

99 Trust Score - Most trusted broker in 2024, Best Overall Broker in 2024

IG is publicly traded, well-capitalized, and holds dozens of regulatory licenses from major regulatory agencies around the globe. In fact, IG won the coveted top ranking in our Trust Score category for the ForexBrokers.com 2024 Annual Awards. Check out our in-depth review of IG to learn more about why IG was our top-ranked forex broker in 2024.

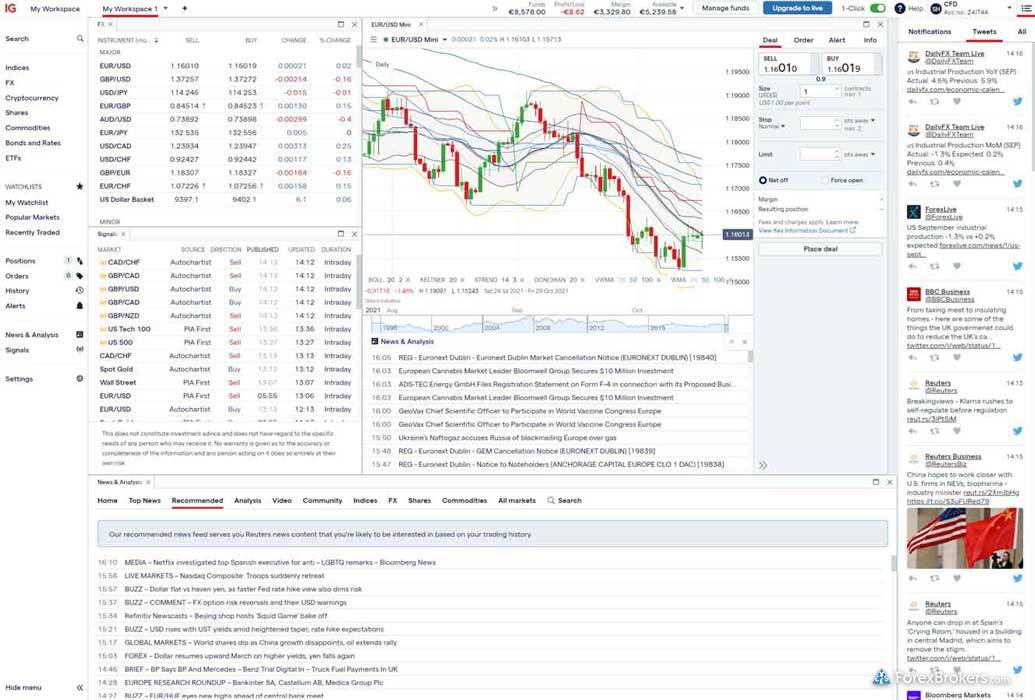

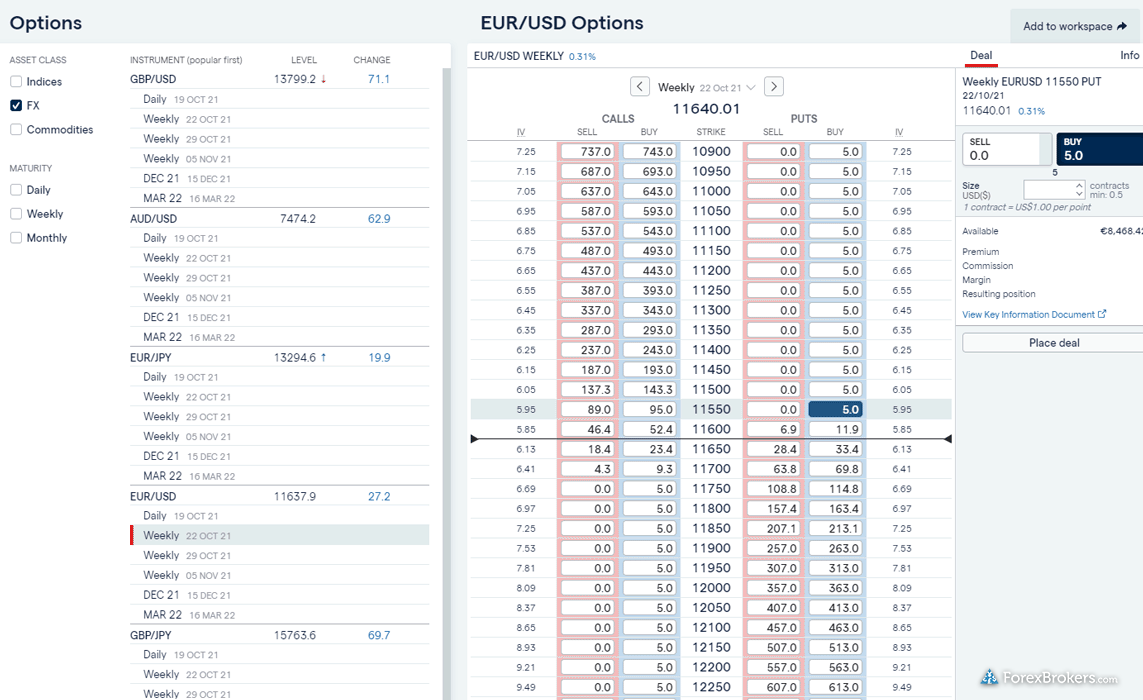

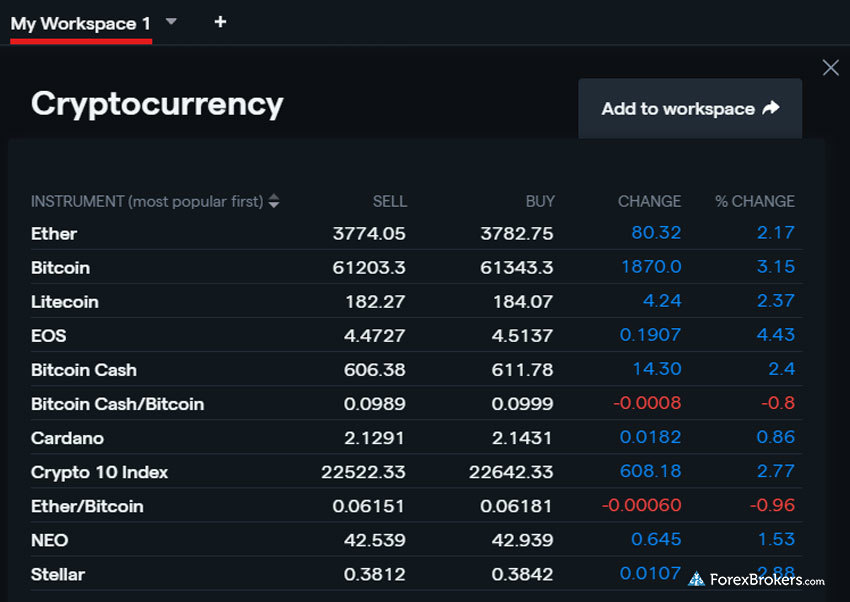

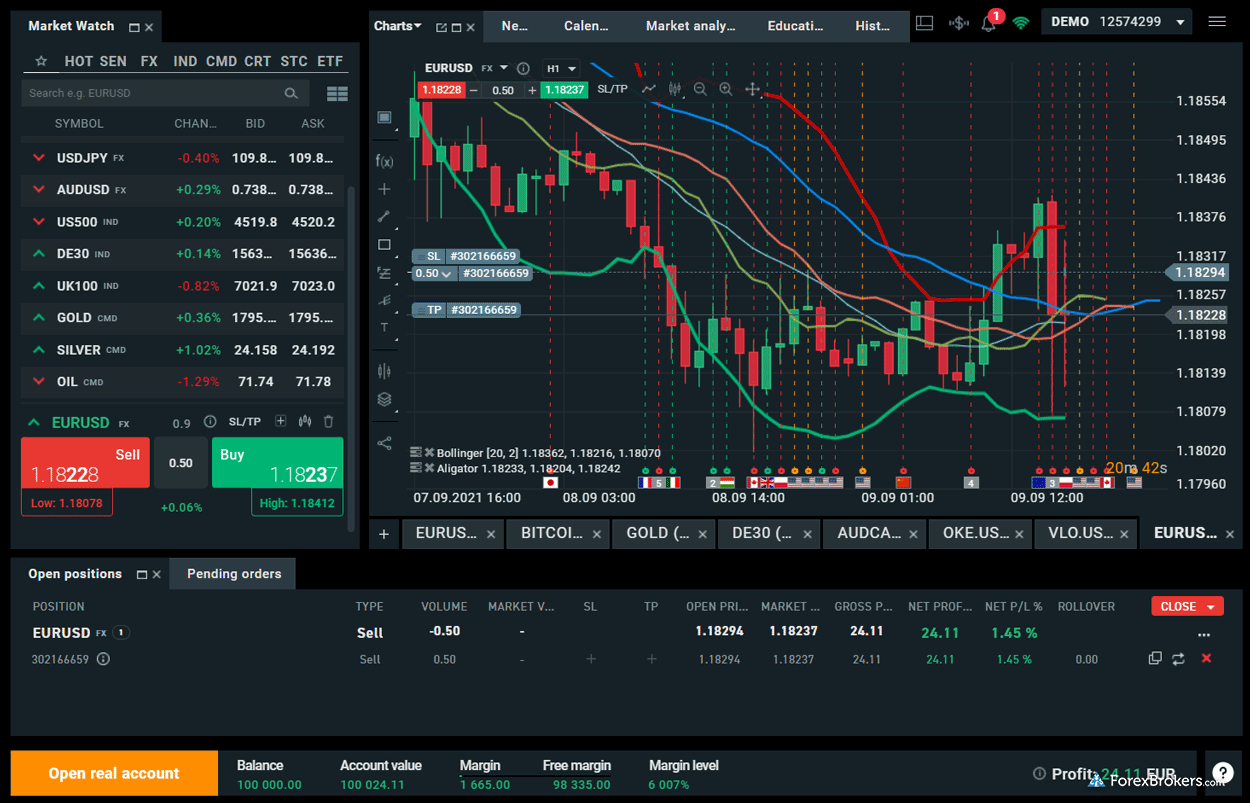

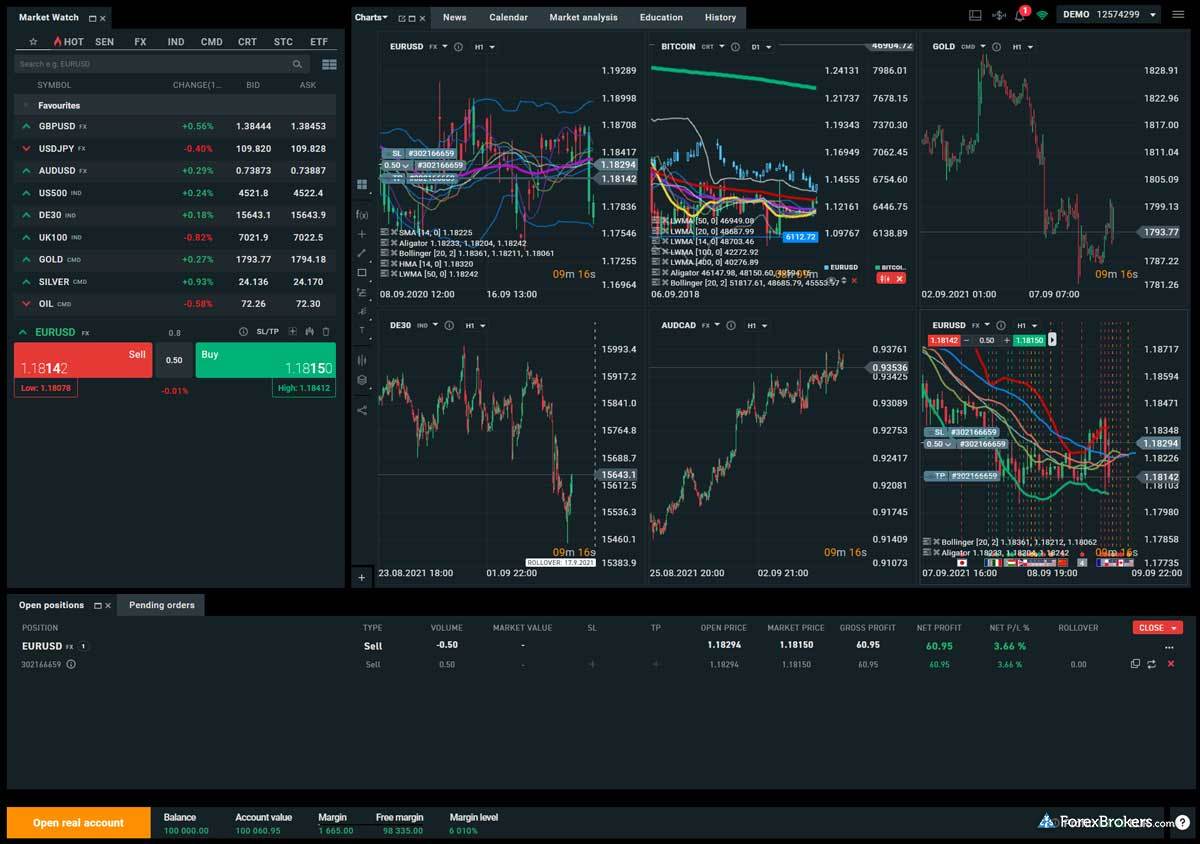

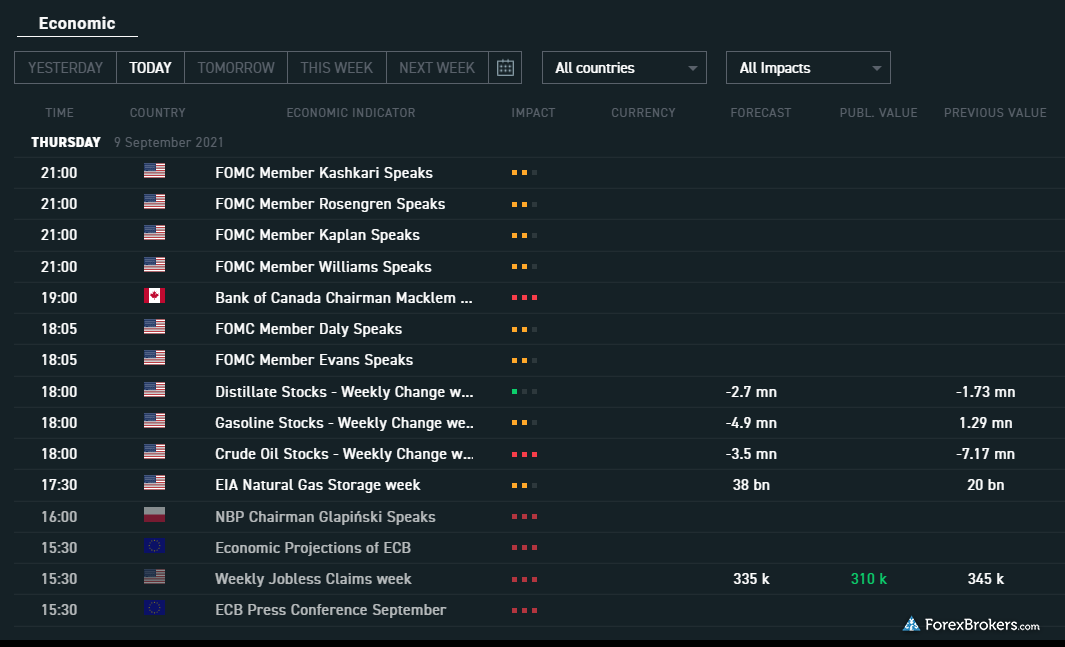

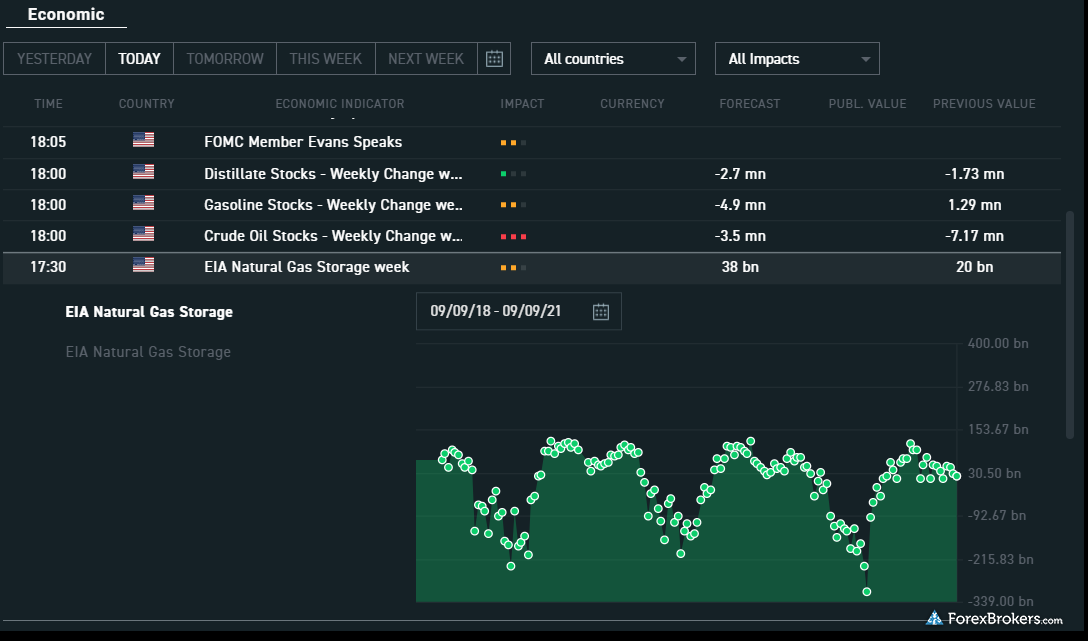

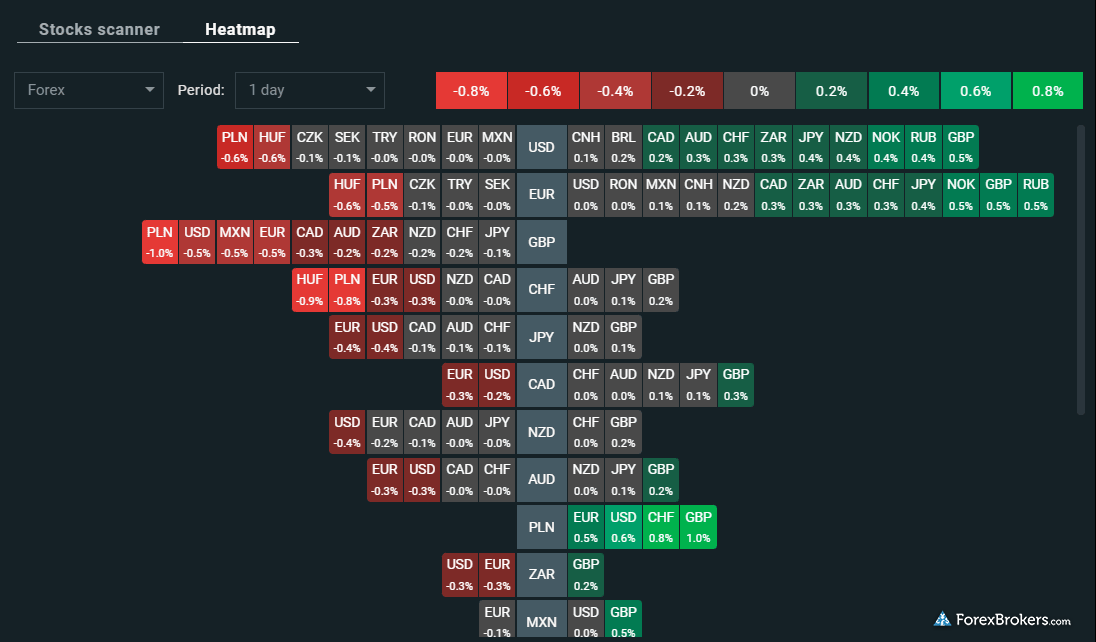

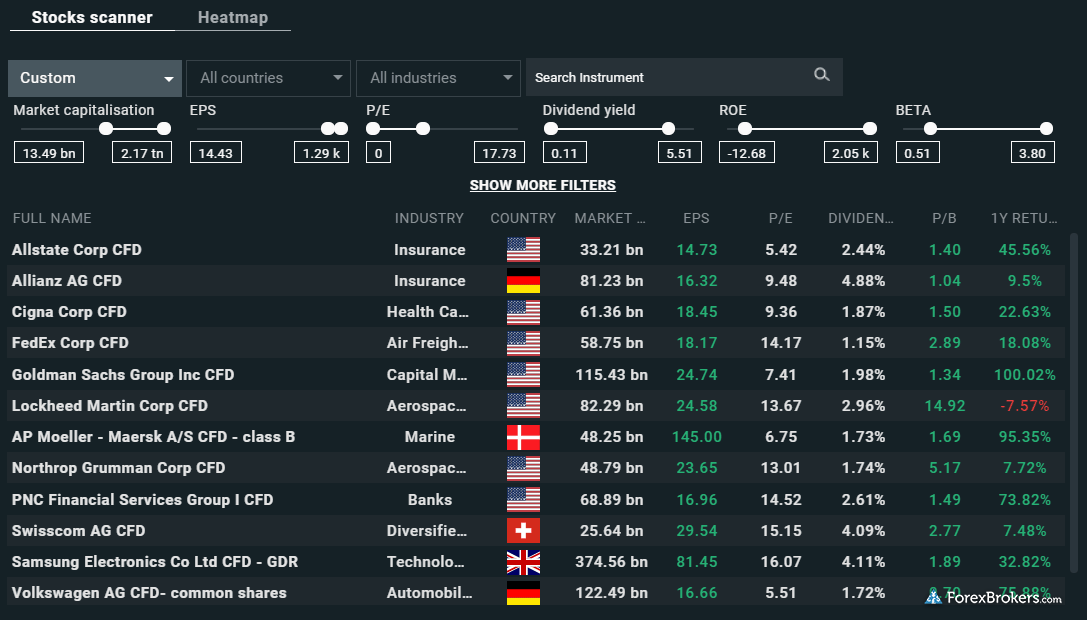

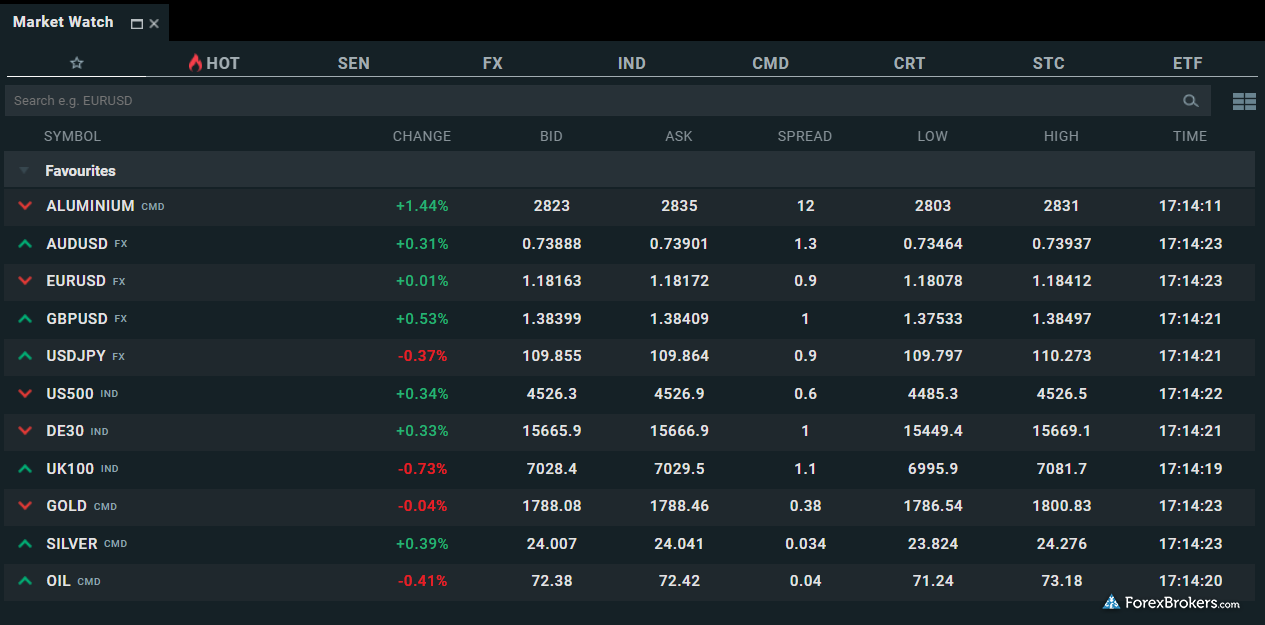

Check out a gallery of screenshots from IG's trading platforms, taken by our research team during our product testing.

2. Saxo Bank

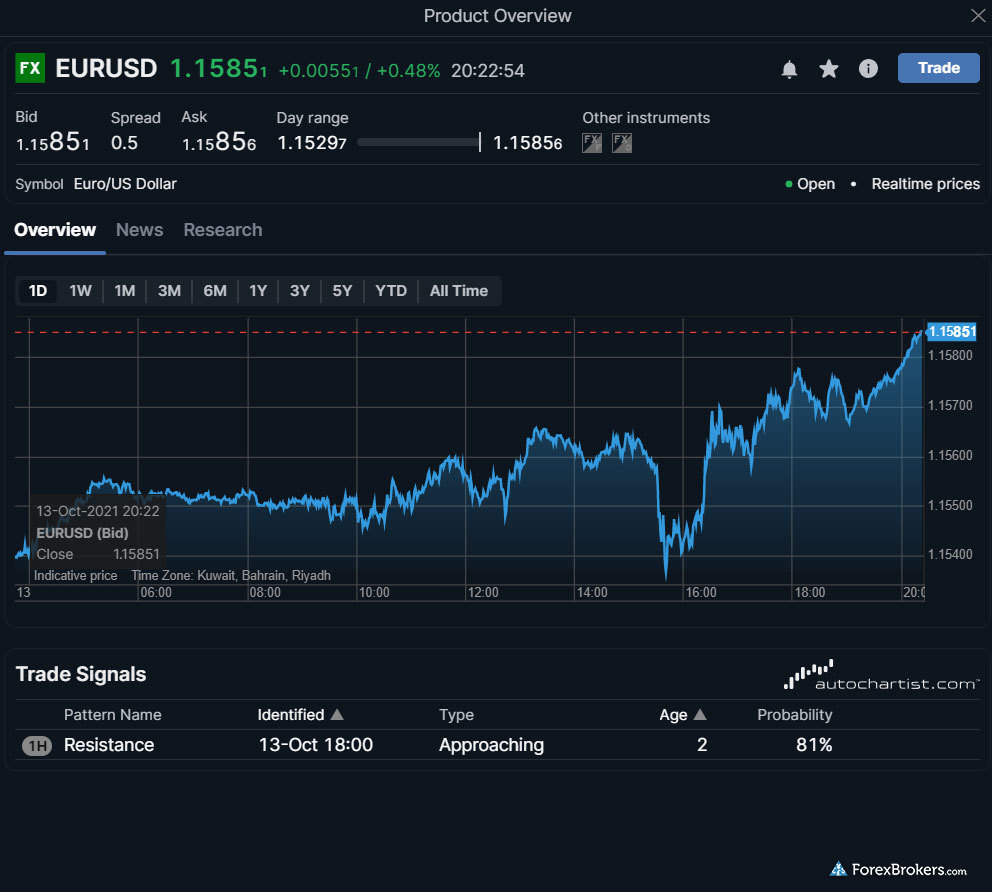

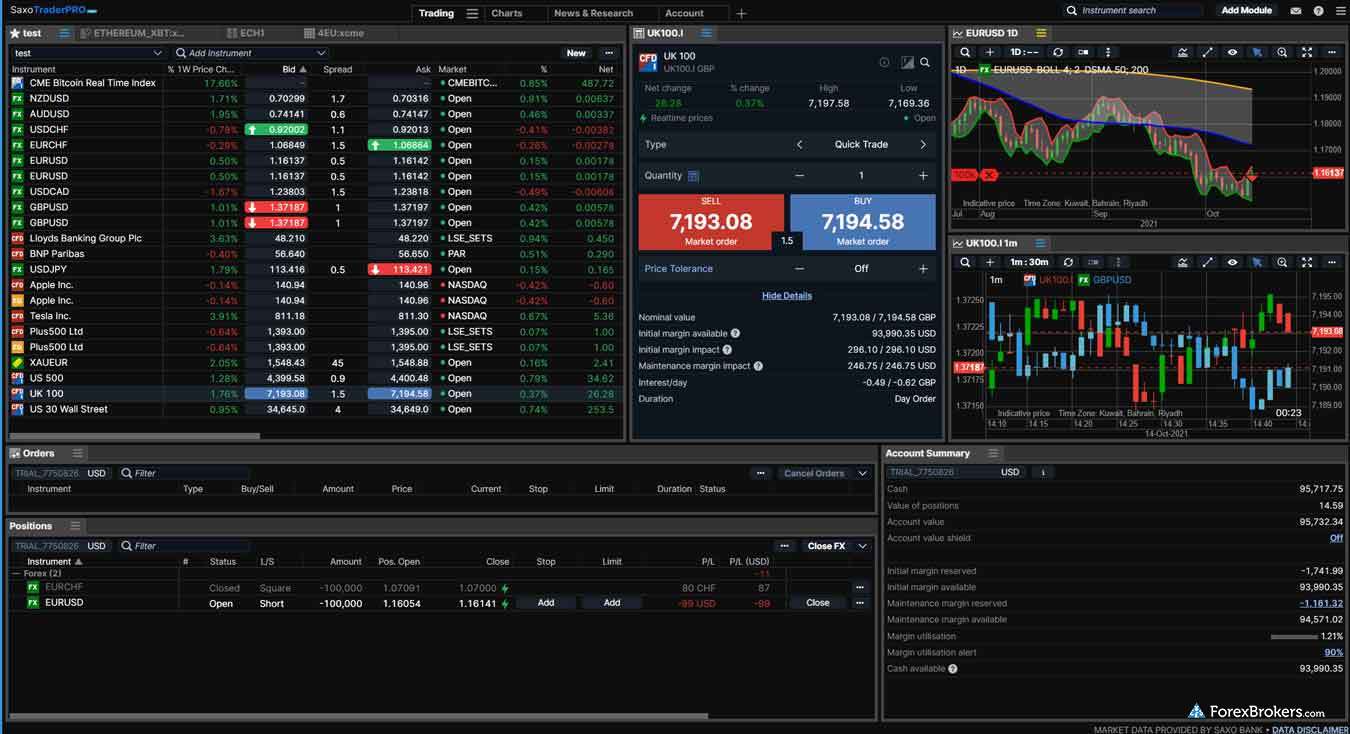

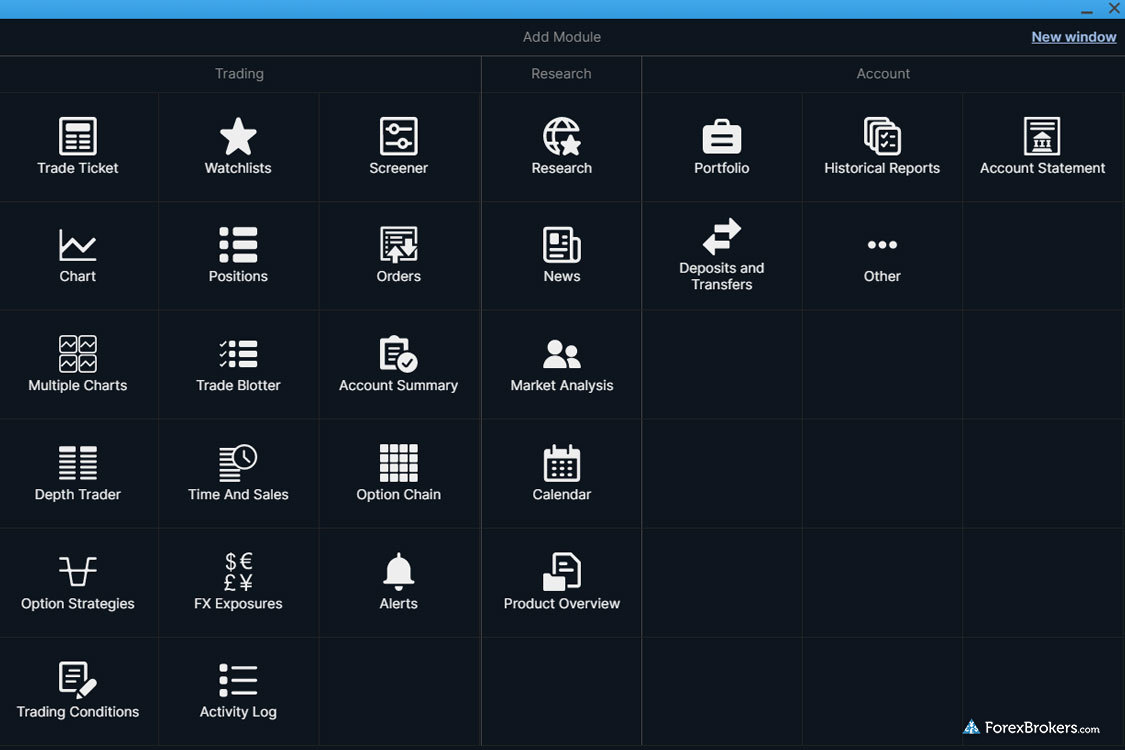

99 Trust Score - Operates three banks, earned our top 2024 Annual Award for Platforms & Tools

Saxo Bank operates three fully regulated banks and is licensed in seven Tier-1 jurisdictions across more than a dozen international jurisdictions. Saxo Bank holds over €85 billion in client assets and has operated for over thirty years. Check out our full-length review of Saxo Bank to learn more.

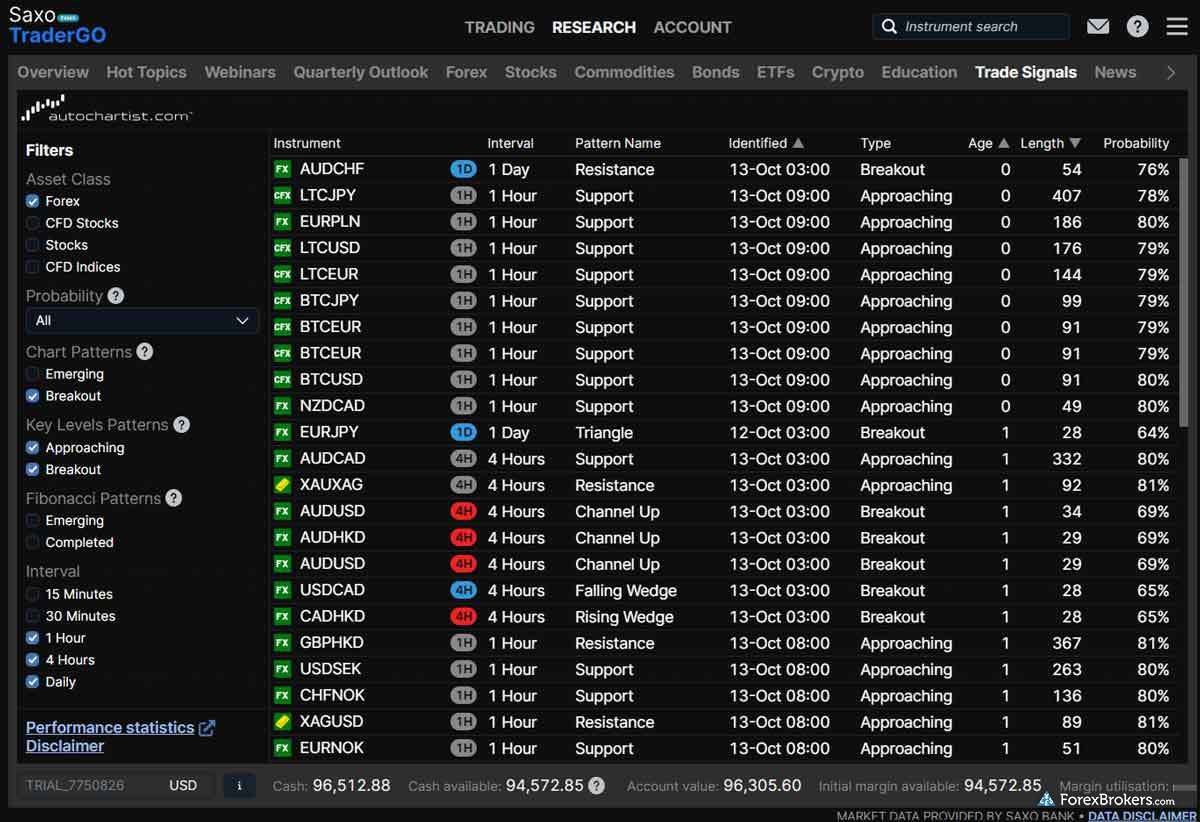

Browse a gallery of screenshots from Saxo Bank's trading platforms, taken by our research team during our product testing.

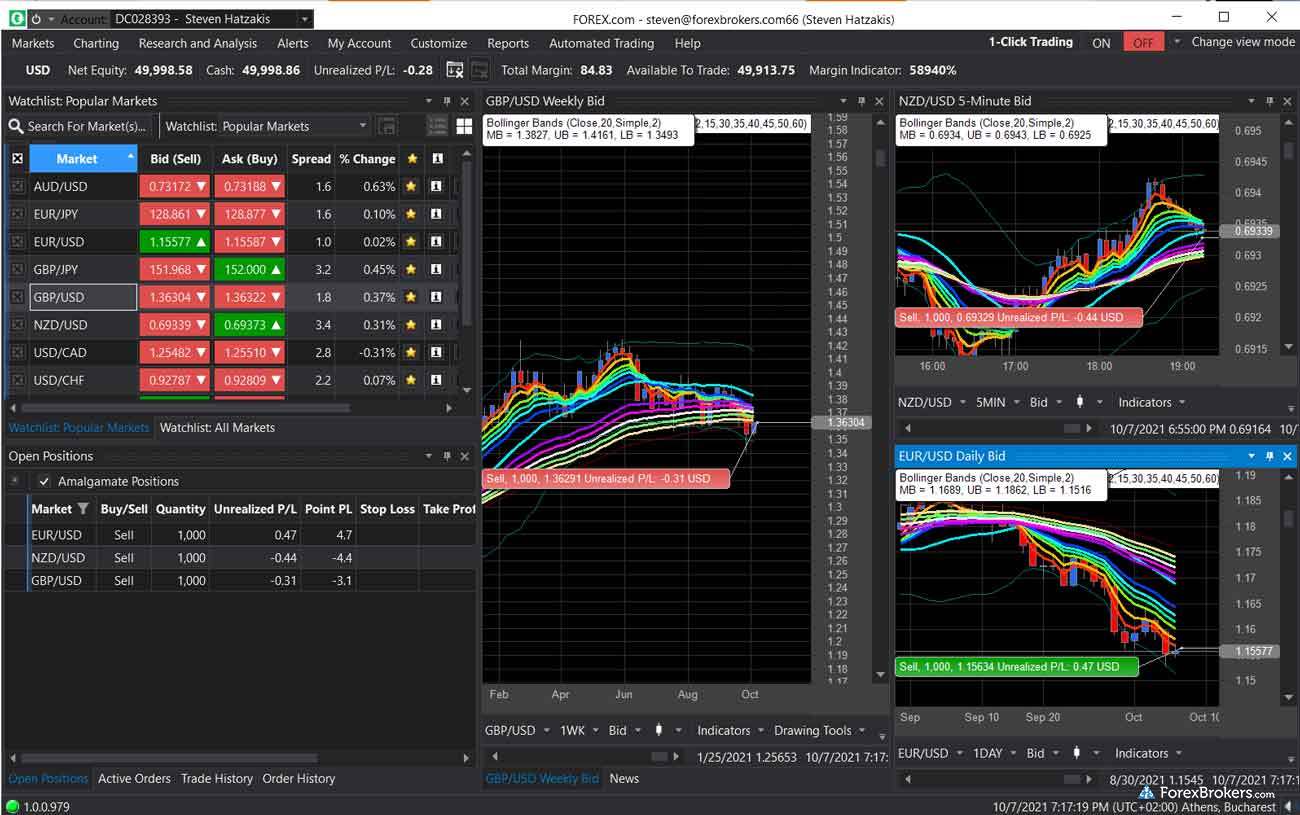

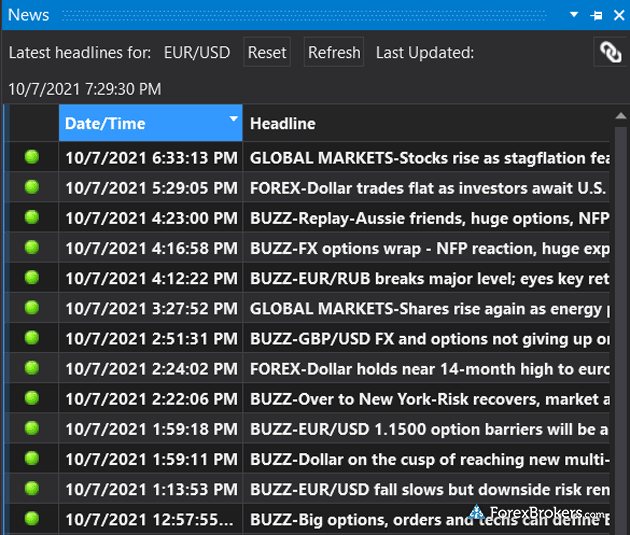

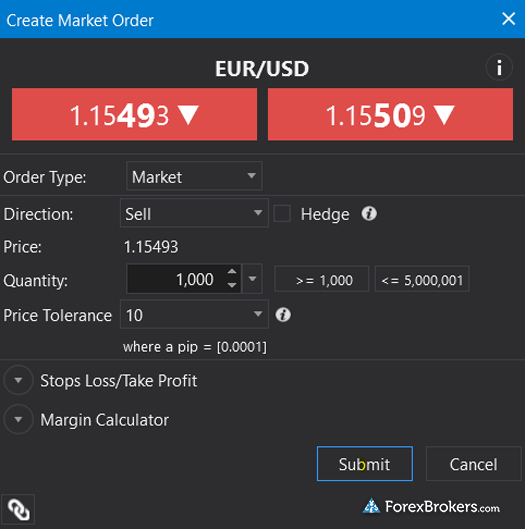

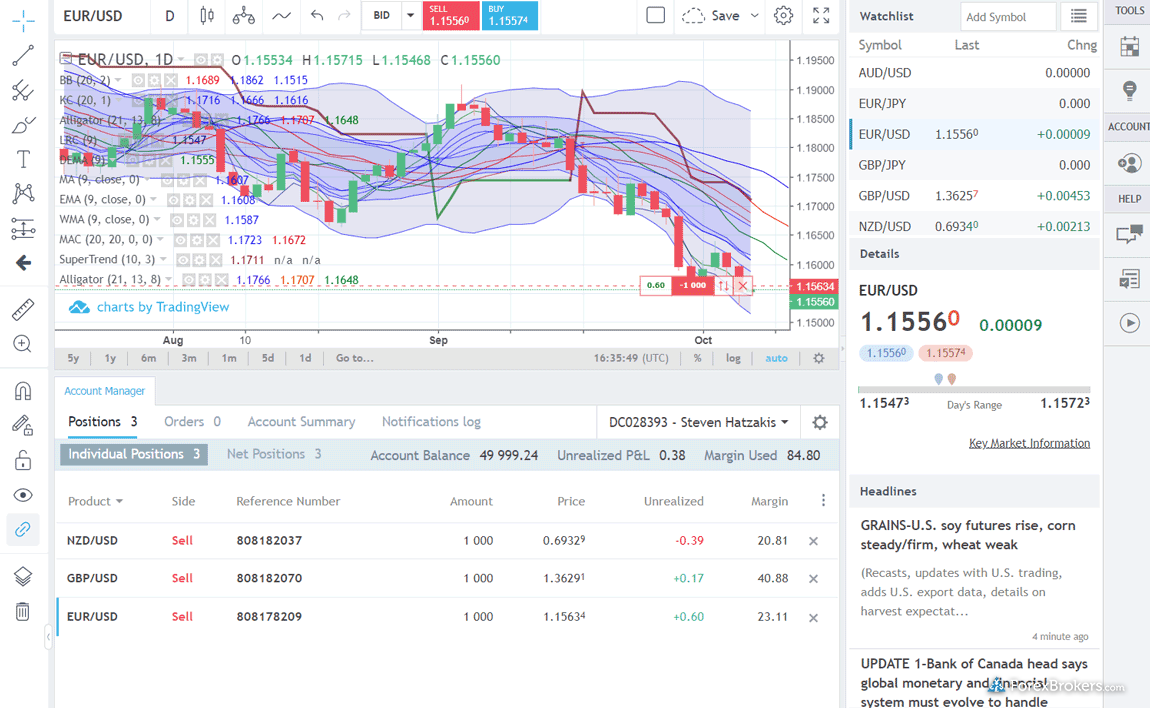

3. FOREX.com

99 Trust Score - Earned the Industry Award for #1 Interactive Educational Experience in our 2024 Annual Awards

Founded in 1999, FOREX.com is a GAIN Capital brand under the parent company of StoneX Group (NASDAQ: SNEX), a Fortune 500 company and a member of the National Futures Association (NFA) in the U.S. FOREX.com is licensed by seven Tier-1 regulatory agencies in jurisdictions across the globe. Learn more by reading our in-depth review of FOREX.com.

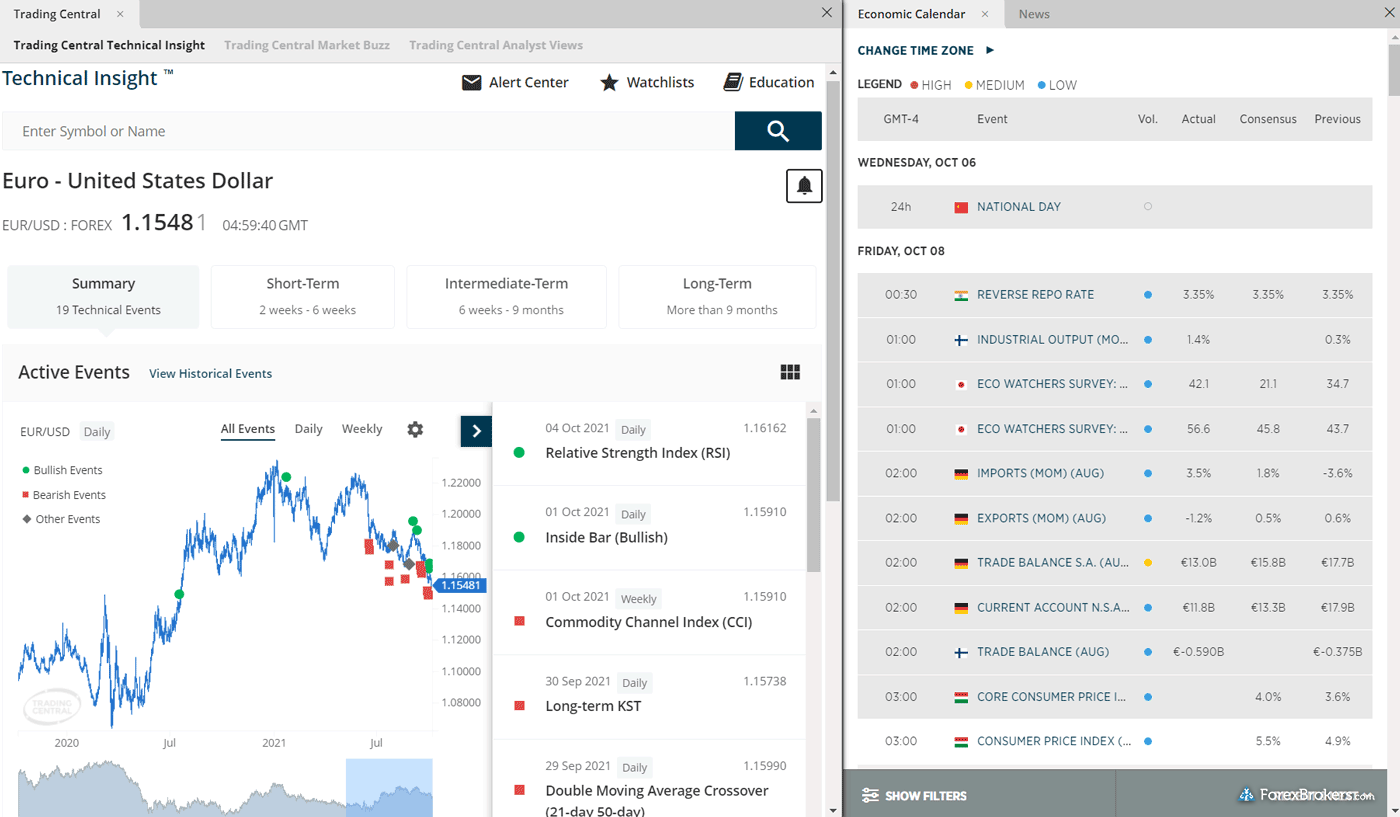

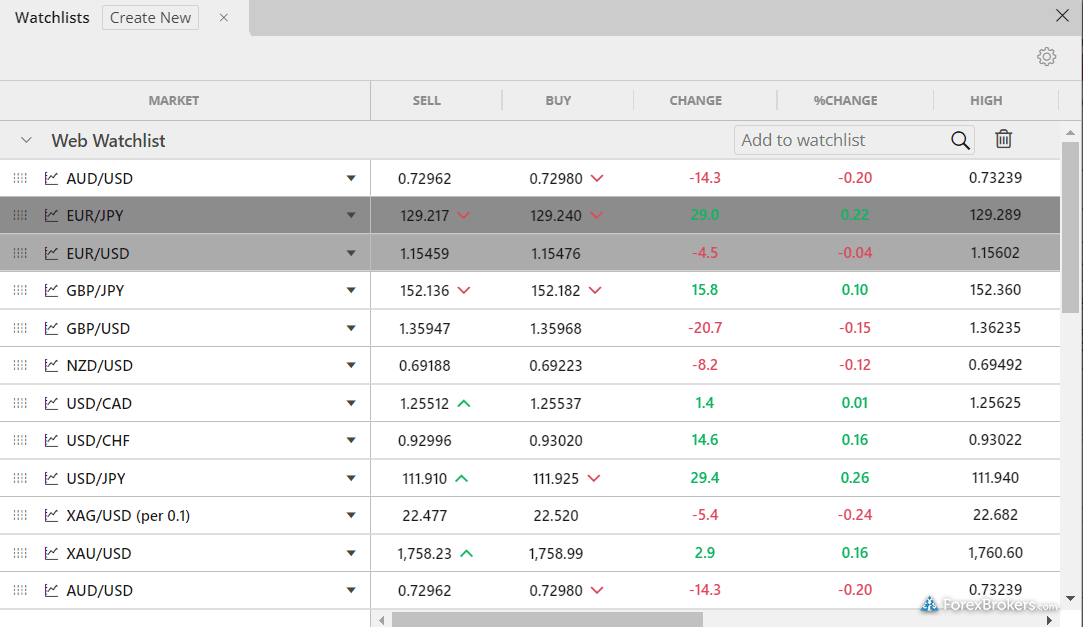

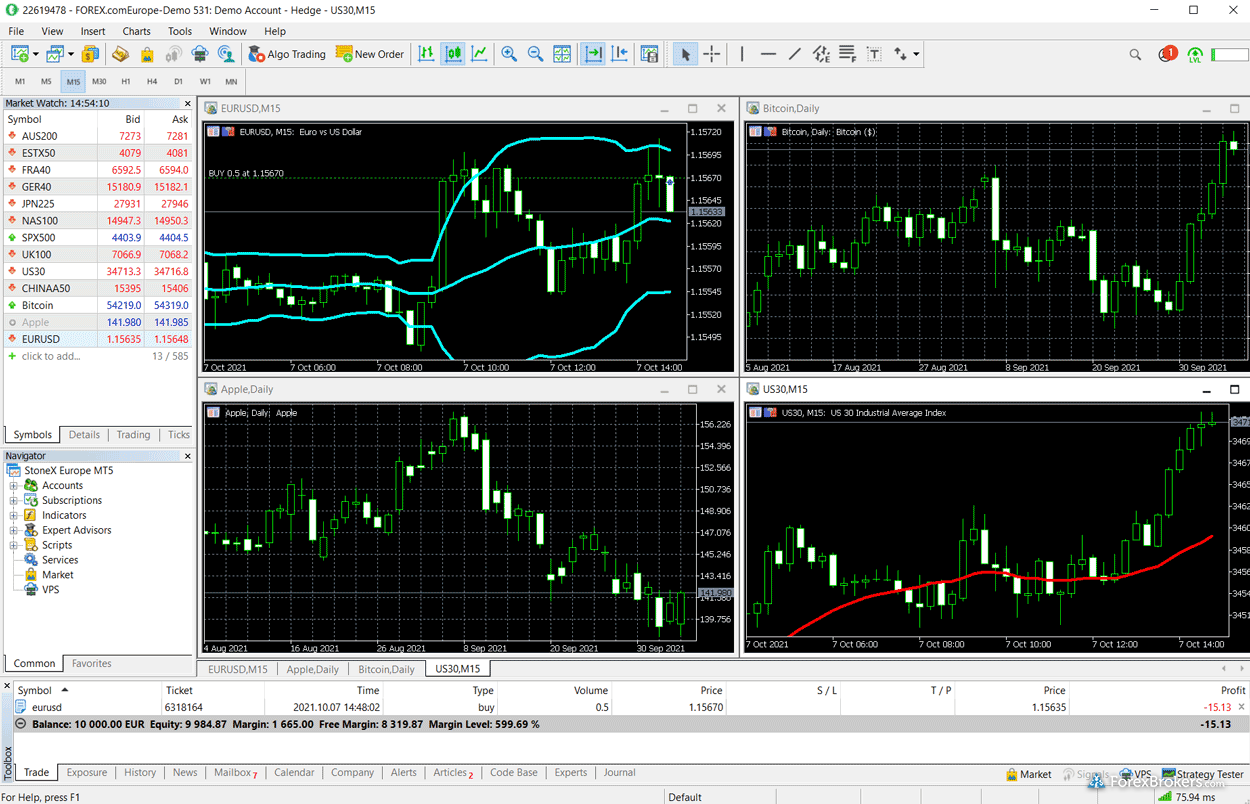

Browse a gallery of screenshots from FOREX.com’s trading platforms, taken by our research team during our product testing.

4. XTB

96 Trust Score - Publicly traded

Founded in Poland in 2004, XTB holds regulatory licenses in five regulatory jurisdictions, including the Financial Conduct Authority (FCA). Read our full-length review of XTB to learn more.

Check out some screenshots from XTB's trading platforms, taken by our research team during our product testing.

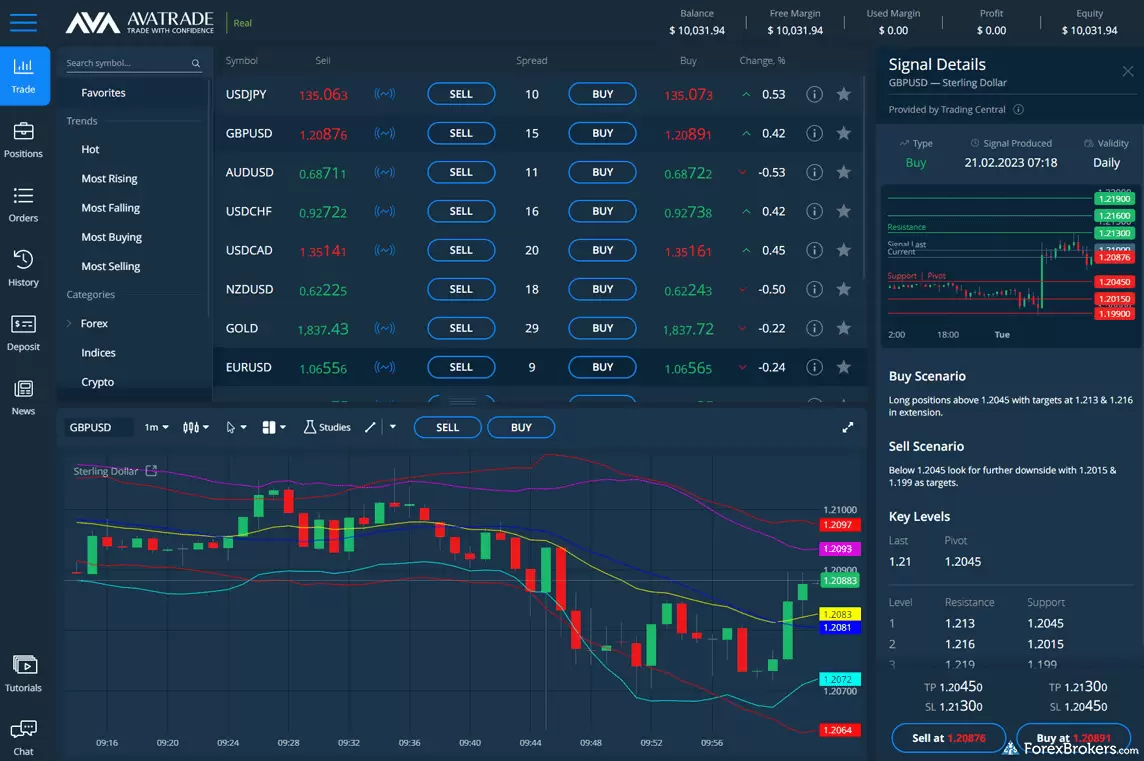

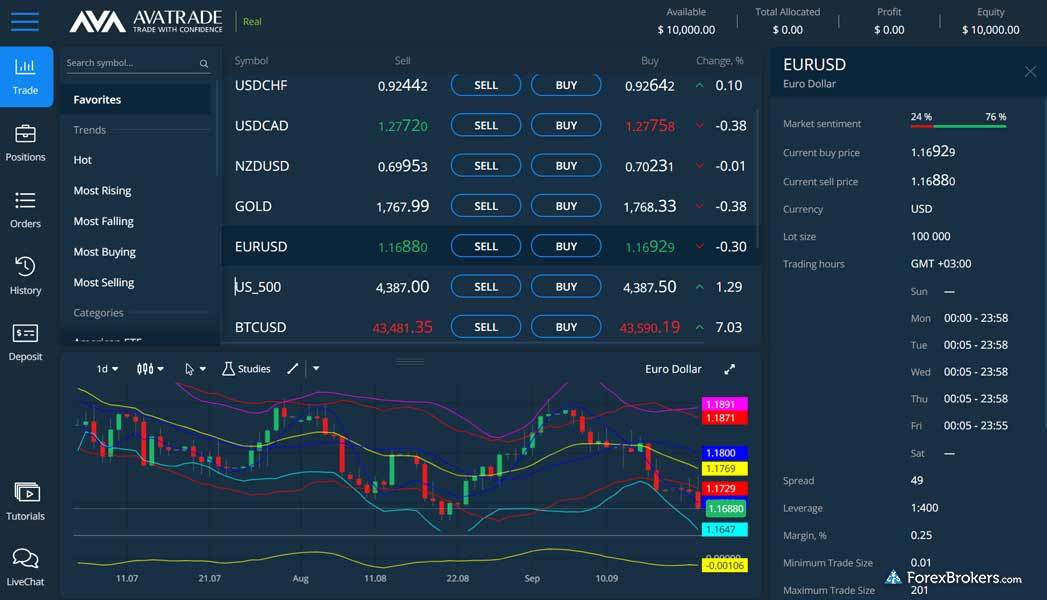

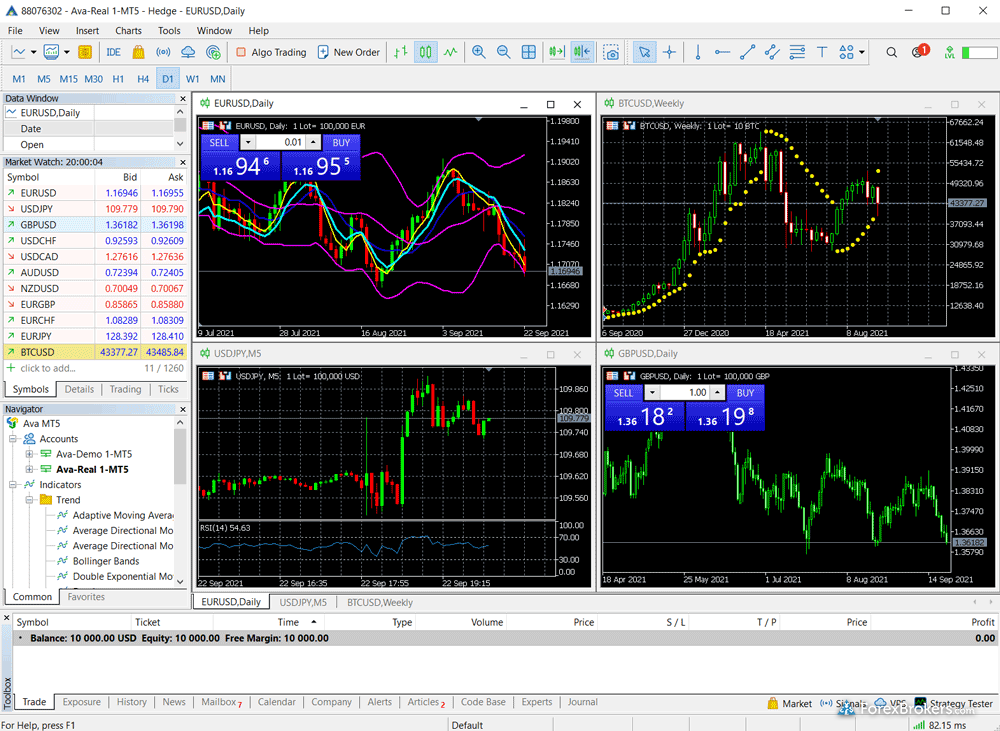

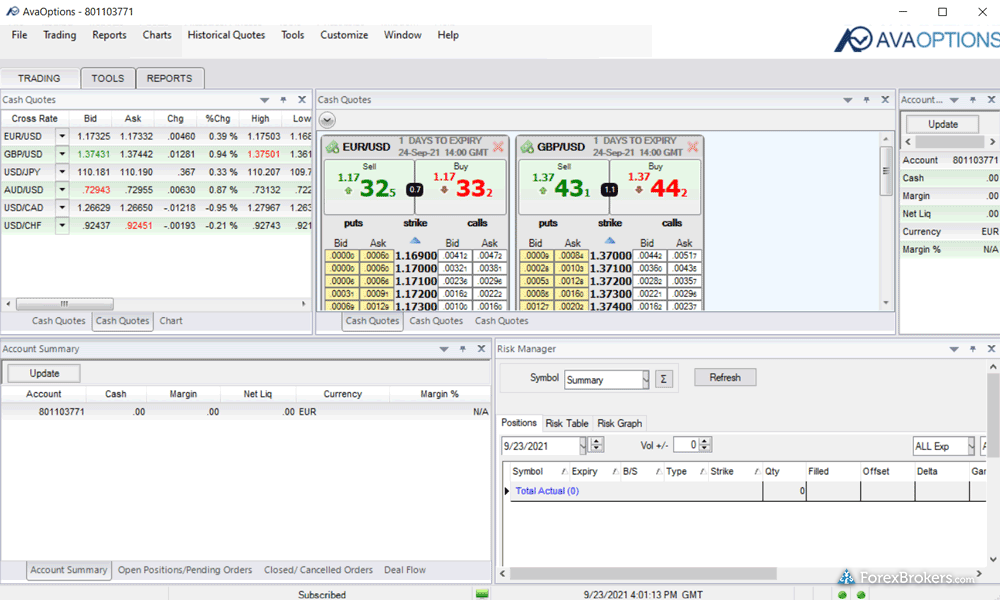

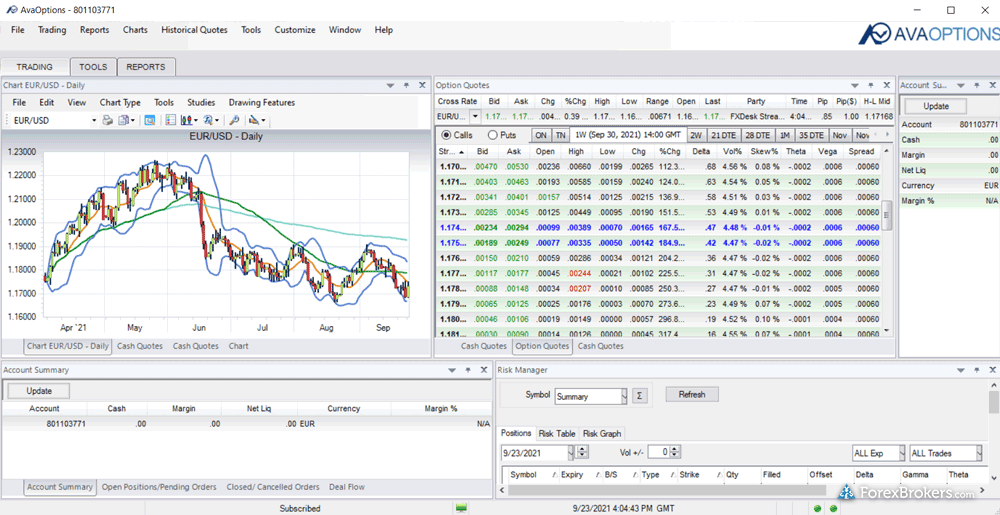

5. AvaTrade

94 Trust Score

AvaTrade holds nine regulatory licenses from agencies located in financial hubs across the globe. AvaTrade is headquartered in Ireland, where it is regulated by the Central Bank of Ireland and is a member of the Investor Compensation Company DAC (ICCL), which provides eligible clients up to EUR 20,000 of maximum reimbursement in the extraordinary event of their broker's insolvency. Learn more by checking out our full review of AvaTrade.

Check out some screenshots from AvaTrade's trading platforms, taken by our research team during our product testing.

Compare Thailand Brokers

Popular Forex Guides

- Best MetaTrader 4 Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- International Forex Brokers Search

- Compare Forex Brokers

- Best Forex Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best Forex Brokers for Beginners of 2024

- Best Brokers for TradingView of 2024

- Best Forex Trading Apps of 2024

More Forex Guides

Find the best forex brokers in the Asia-Pacific region

Asia

- Best Forex Brokers in India for 2024

- Best Forex Brokers in Indonesia for 2024

- Best Forex Brokers in Malaysia for 2024

- Best Forex Brokers and Trading Apps in Pakistan for 2024

- Best Forex Brokers in Philippines for 2024

- Best Forex Brokers in Russia for 2024

- Best Forex Brokers in Singapore for 2024

- Best Forex Brokers in Thailand for 2024

- Best Forex Brokers in Turkey for 2024

Oceania

2024 Review Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.