Best Forex Brokers in Nigeria for 2024

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. Here's how we test.

Nigeria is the seventh most populated country on the planet, and is currently the largest economy in all of Africa. It is also home to one of the largest stock exchanges in Africa – the Nigerian Stock Exchange (NGX).

Nigeria’s twin-peak regulatory system regulates its local financial markets, with the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC) of Nigeria operating as the country’s primary regulatory watchdogs.

Though forex-specific regulations have not yet been established in Nigeria by the SEC, there is strong demand for forex trading, and Nigerian residents are permitted to open brokerage accounts with forex brokers that are regulated outside of Nigeria.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers in Nigeria

To create this list of the best forex brokers in Nigeria in 2024, we compiled a list of firms that accept clients from Nigeria and ranked them using our own independently researched ratings and rankings (learn more about how we test brokers).

-

Interactive Brokers

- Great overall, best for professionals

- XTB - Great research and education

-

Capital.com

- Great for beginners, easy to use

-

AvaTrade

- Great for beginners and copy trading

- FXCM - Excellent trading platforms and tools

-

Pepperstone

- Great for MetaTrader and copy trading

-

XM Group

- Good for algo trading

Best Forex Brokers in Nigeria Comparison

Compare authorised forex and CFDs brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by my overall rankings of the top forex brokers.

| Company | Accepts NG Residents | Average Spread EUR/USD - Standard | Minimum Deposit | Overall Rating | Visit Site |

Interactive Brokers Interactive Brokers

|

0.63 | $0 |

|

||

XTB XTB

|

1.00 | $0 |

|

||

Capital.com Capital.com

|

0.67 | $20 |

|

||

AvaTrade AvaTrade

|

0.92 | $100 |

|

||

FXCM FXCM

|

0.78 | Starts from $50 |

|

||

Pepperstone Pepperstone

|

1.10 | $0 |

|

||

XM Group XM Group

|

1.6 | $5 |

|

||

Admirals Admirals

|

0.8 | $100 |

|

||

FP Markets FP Markets

|

1.1 | $100 AUD |

|

||

Tickmill Tickmill

|

0.51 | $100 |

|

||

IC Markets IC Markets

|

0.62 | $200 |

|

||

HYCM (Henyep Capital Markets) HYCM (Henyep Capital Markets)

|

1.2 | $20 |

|

||

HFM HFM

|

1.2 | $0 |

|

||

ActivTrades ActivTrades

|

0.98 | 0 |

|

||

Trade Nation Trade Nation

|

0.6 | $0 |

|

||

Eightcap Eightcap

|

1.0 | $100 |

|

||

Moneta Markets Moneta Markets

|

1.38 | $50 |

|

||

Exness Exness

|

N/A | $10 |

|

||

ACY Securities ACY Securities

|

1.2 | $50 |

|

||

easyMarkets easyMarkets

|

0.8 | $50 |

|

||

Octa Octa

|

0.9 | $25 |

|

||

Libertex (Forex Club) Libertex (Forex Club)

|

N/A | $10 |

|

What is the best forex broker in Nigeria?

1. Saxo Bank

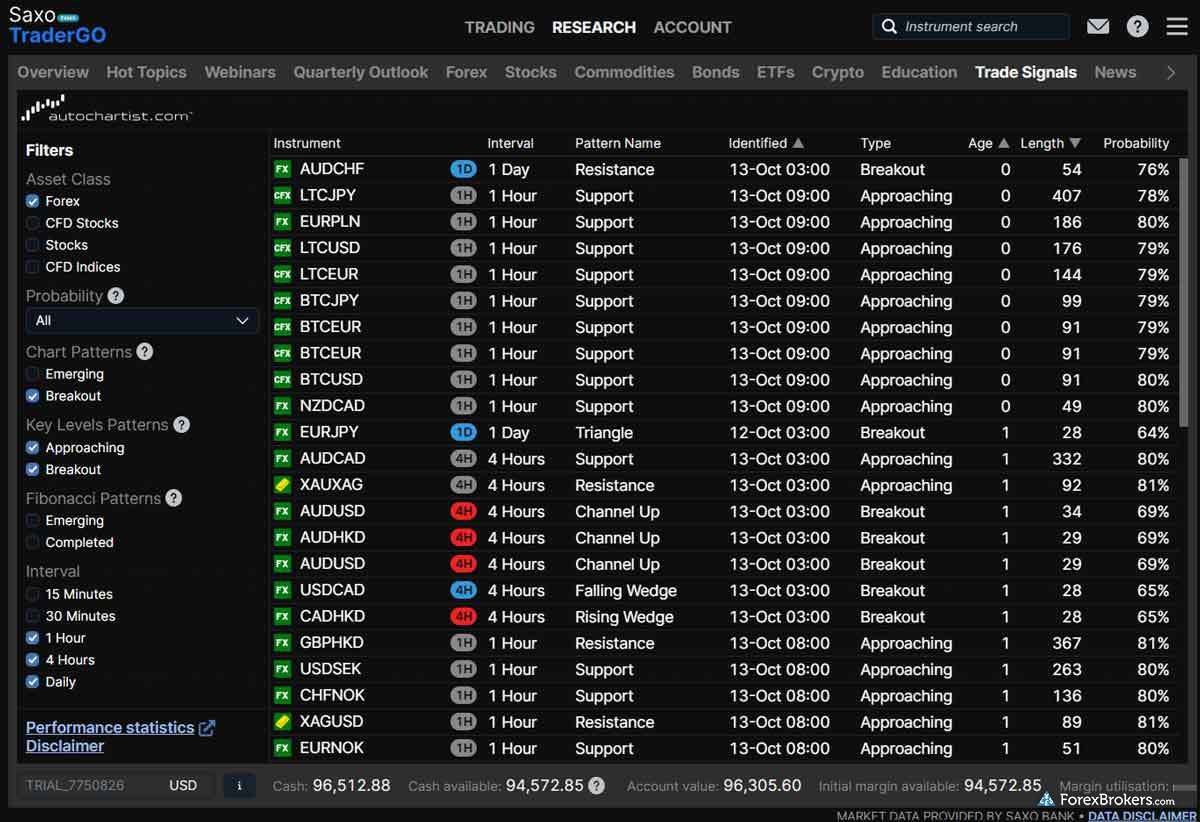

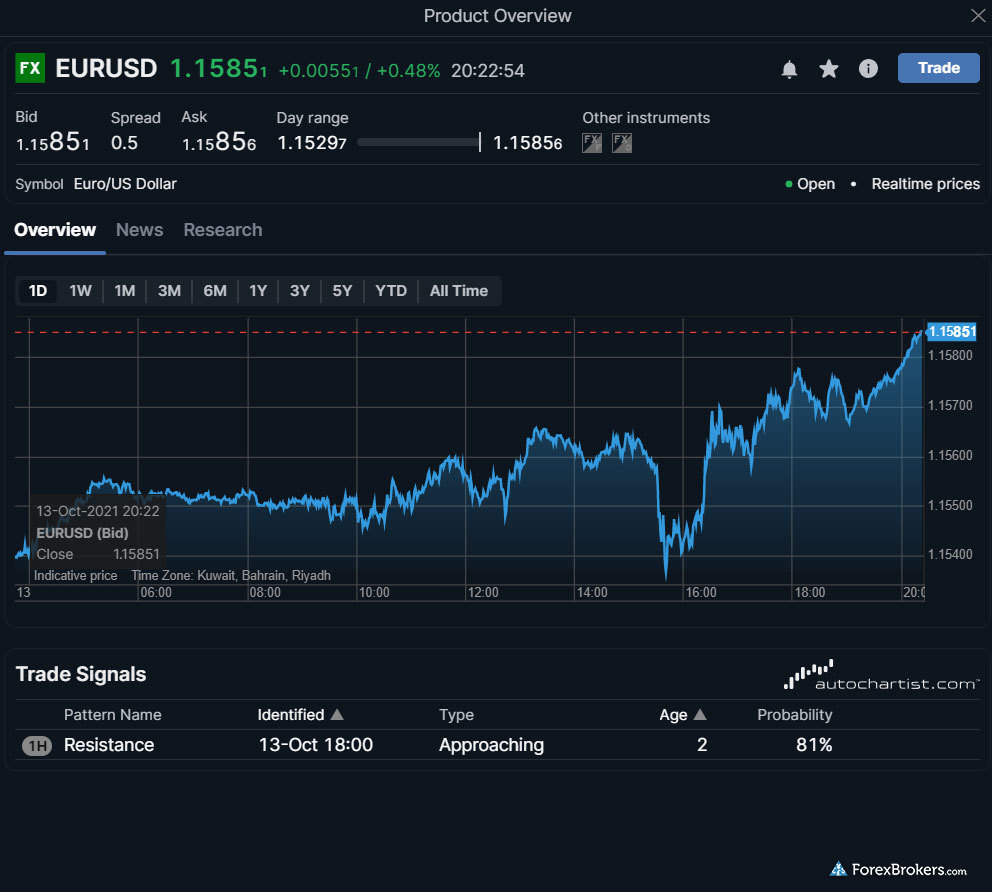

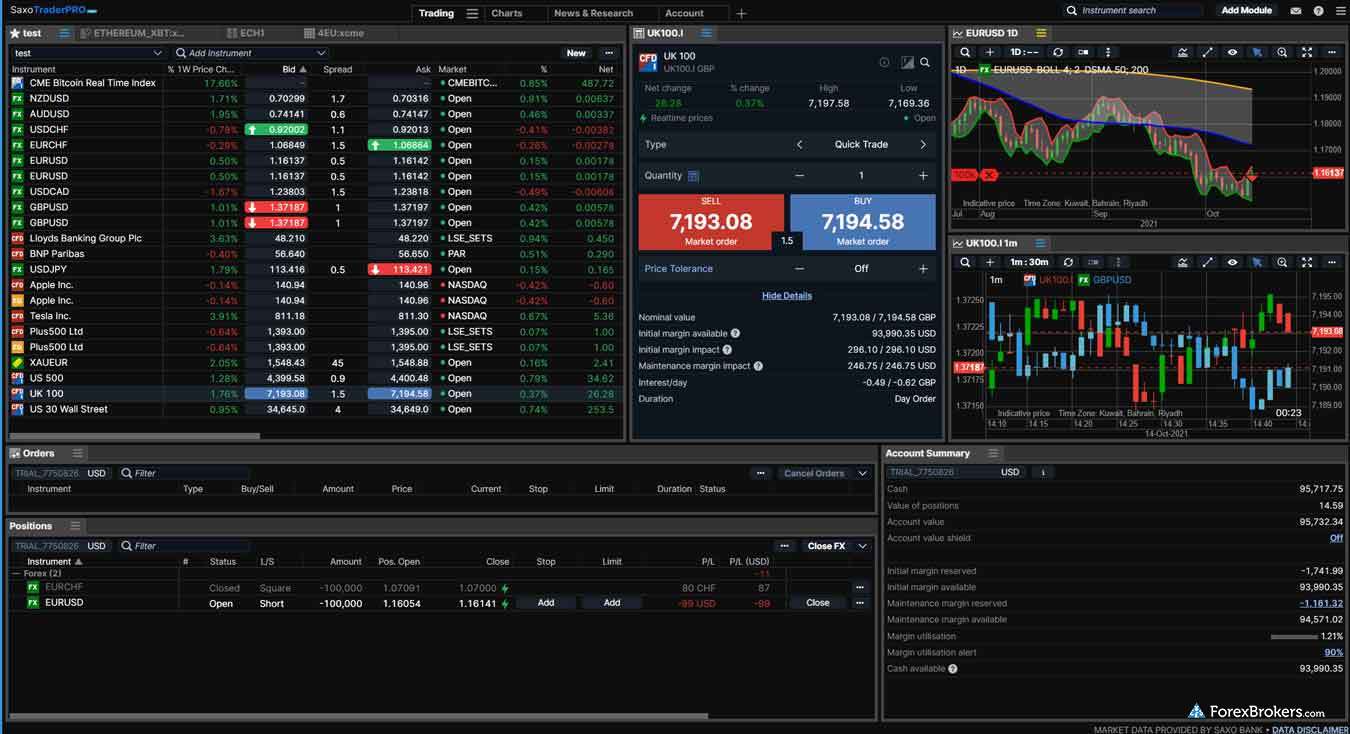

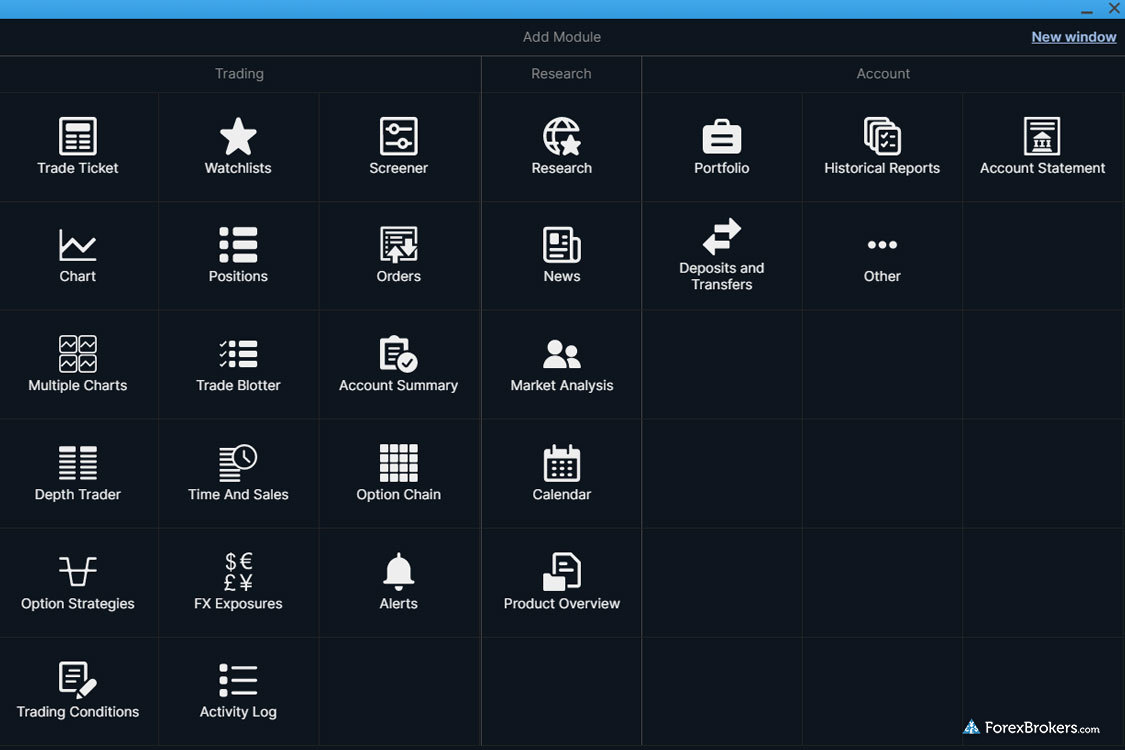

Saxo Bank took first place in our 2024 Annual Awards for the Platforms & Tools category

Saxo Bank is our pick for the best broker for Nigerian residents in 2024. The broker’s SaxoTraderGO and SaxoTraderPRO platform suites include everything traders might need to navigate the market, and deliver access to over 60,000 tradeable instruments. Saxo Bank also operates three fully regulated banks and is licensed in seven Tier-1 jurisdictions across more than a dozen international jurisdictions. Check out our full-length review of Saxo Bank to learn more.

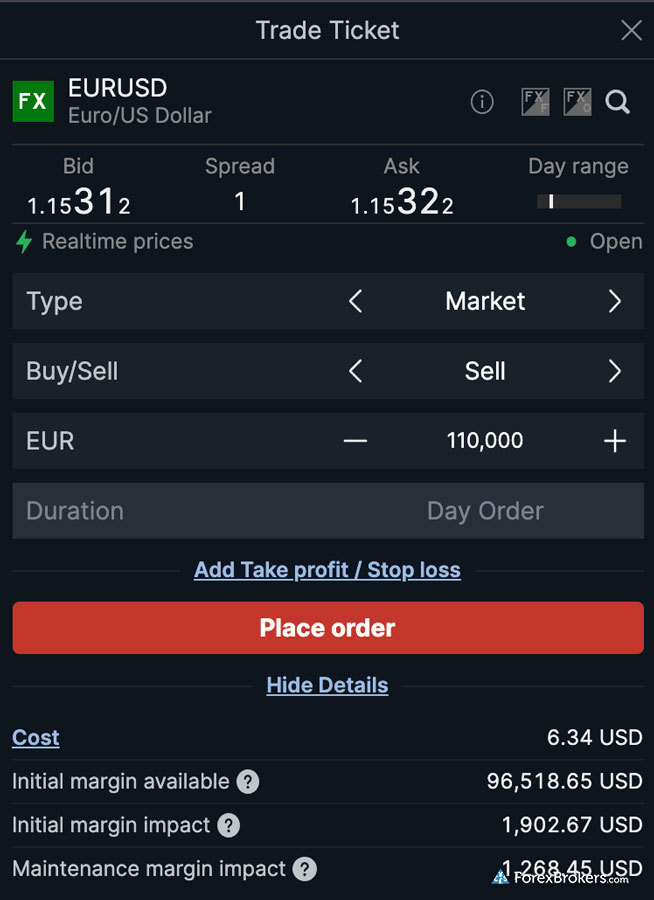

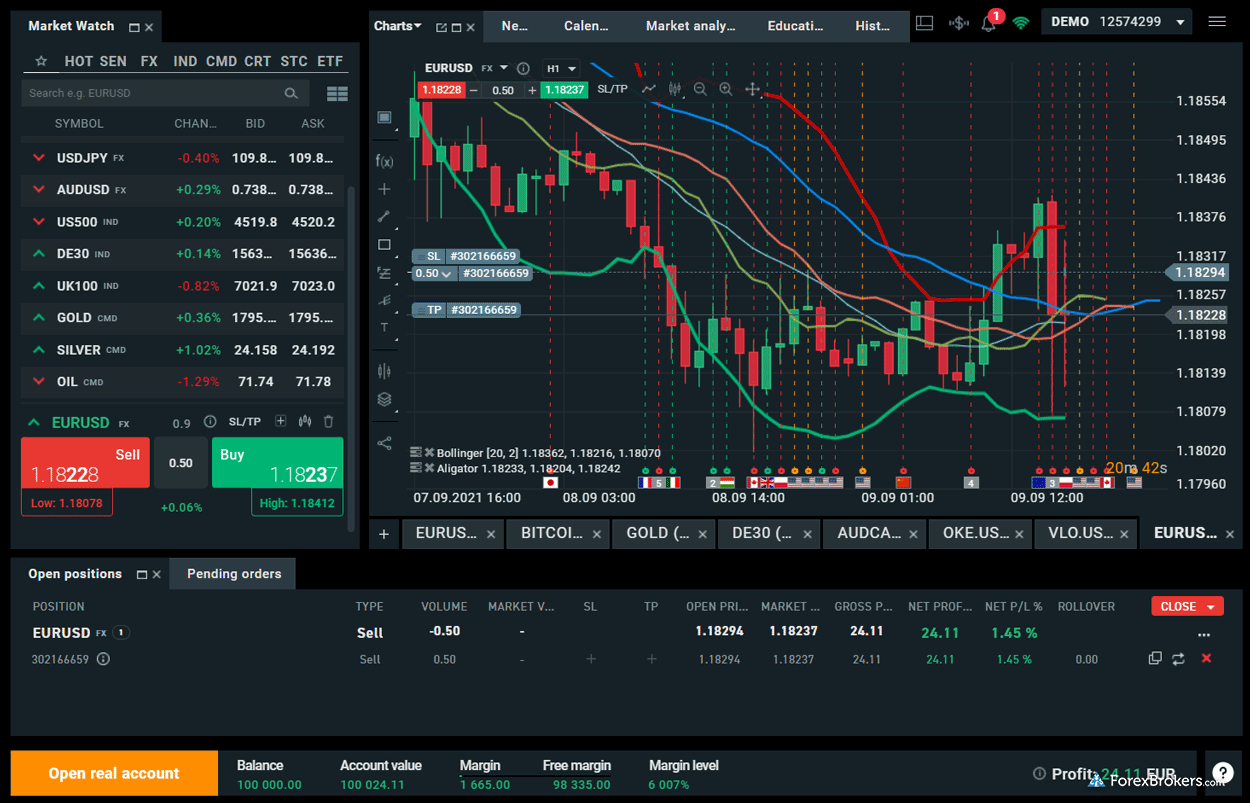

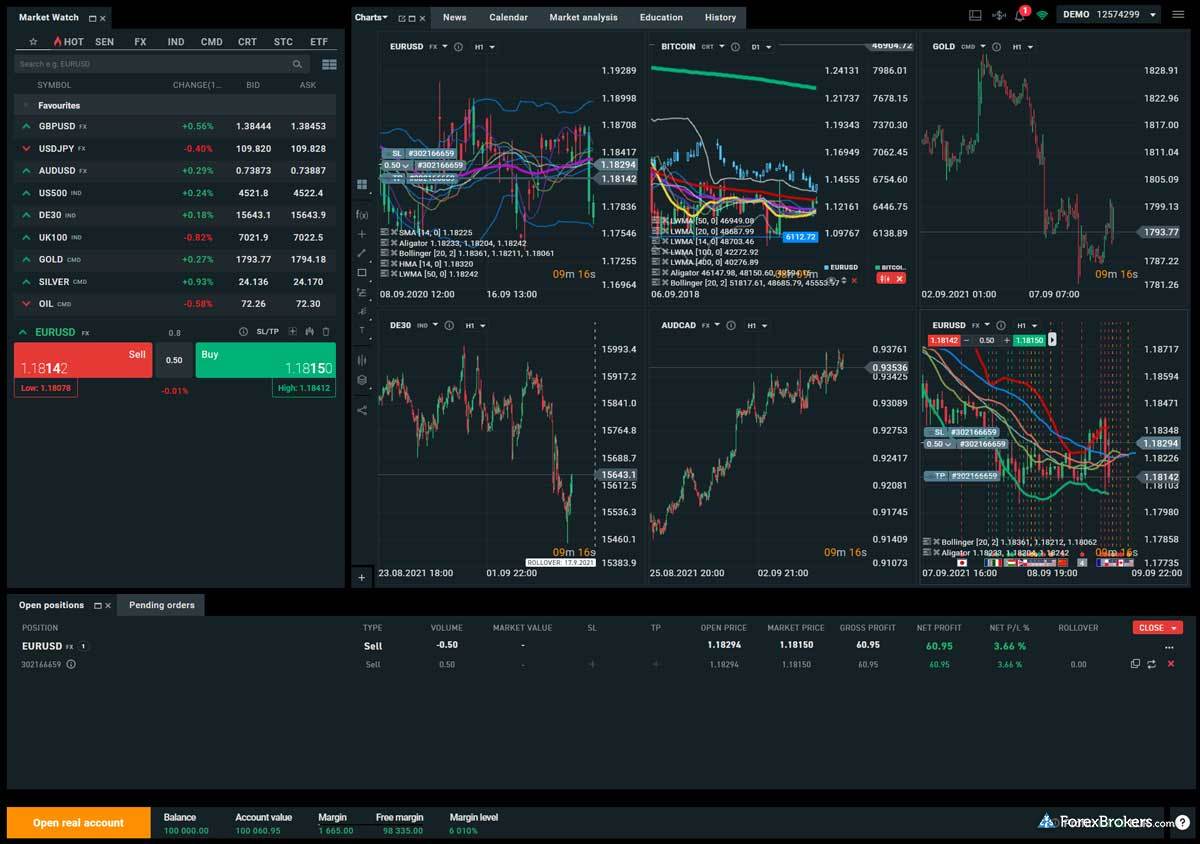

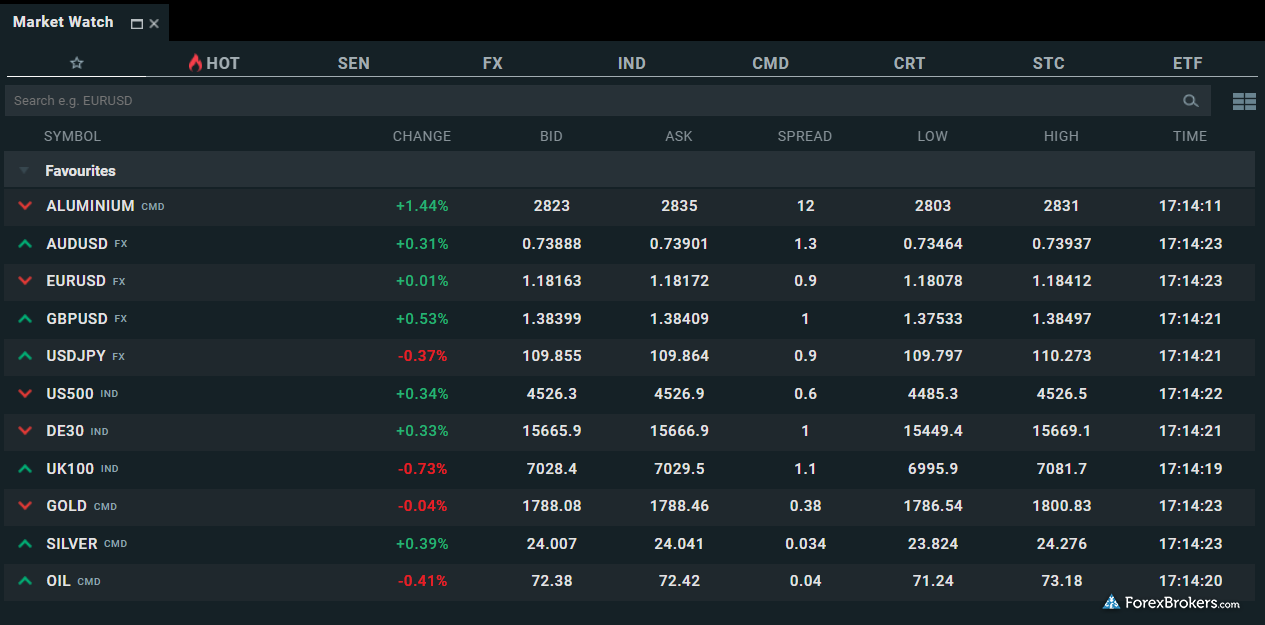

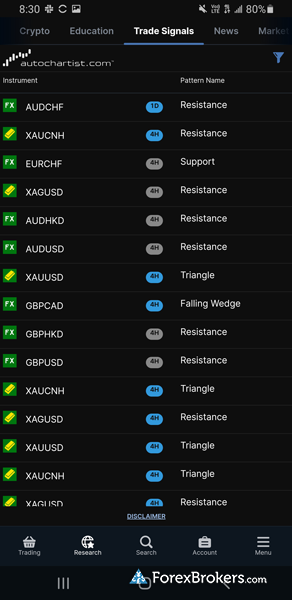

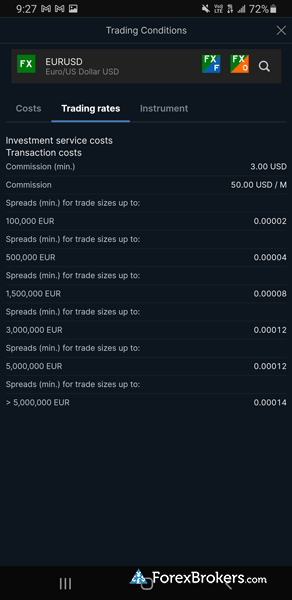

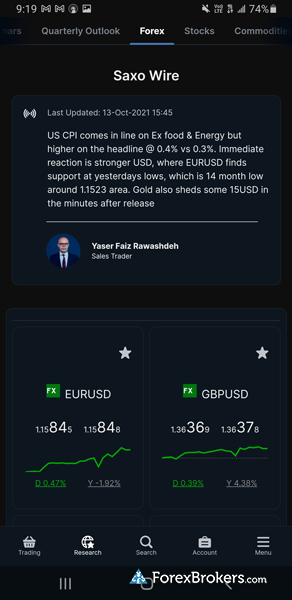

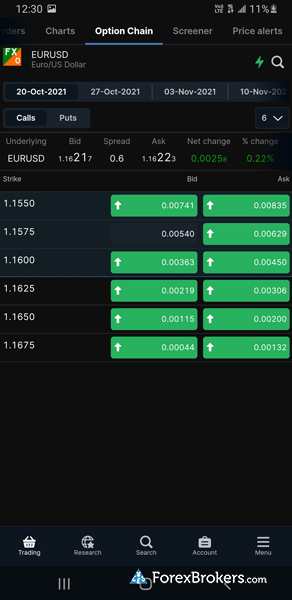

Check out this gallery of screenshots of Saxo Bank's award-winning platform suite, taken by our research team during our product testing.

2. XTB

XTB is a trusted multi-asset brand that offers a wide variety of forex and CFDs and an excellent overall trading experience. The broker’s proprietary xStation 5 trading platform is easy to use, cleanly designed, and loaded with powerful features. XTB also delivers educational resources for beginners and useful market research tools. XTB holds licenses in five regulatory jurisdictions, earning it the distinction of “Highly Trusted” within our Trust Score rating system. Read our full-length review of XTB to learn more.

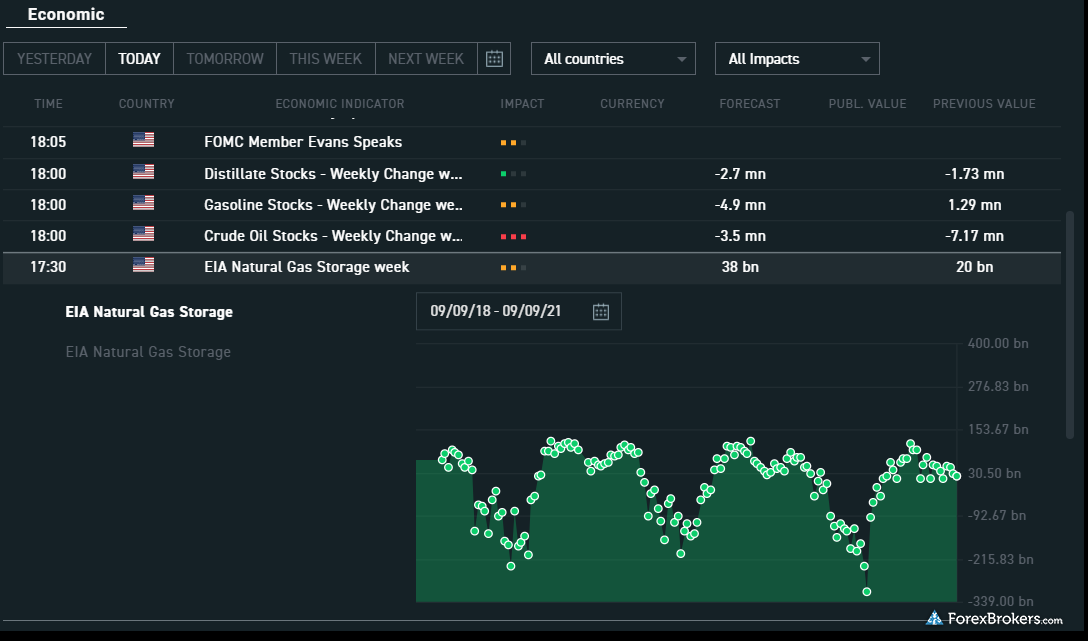

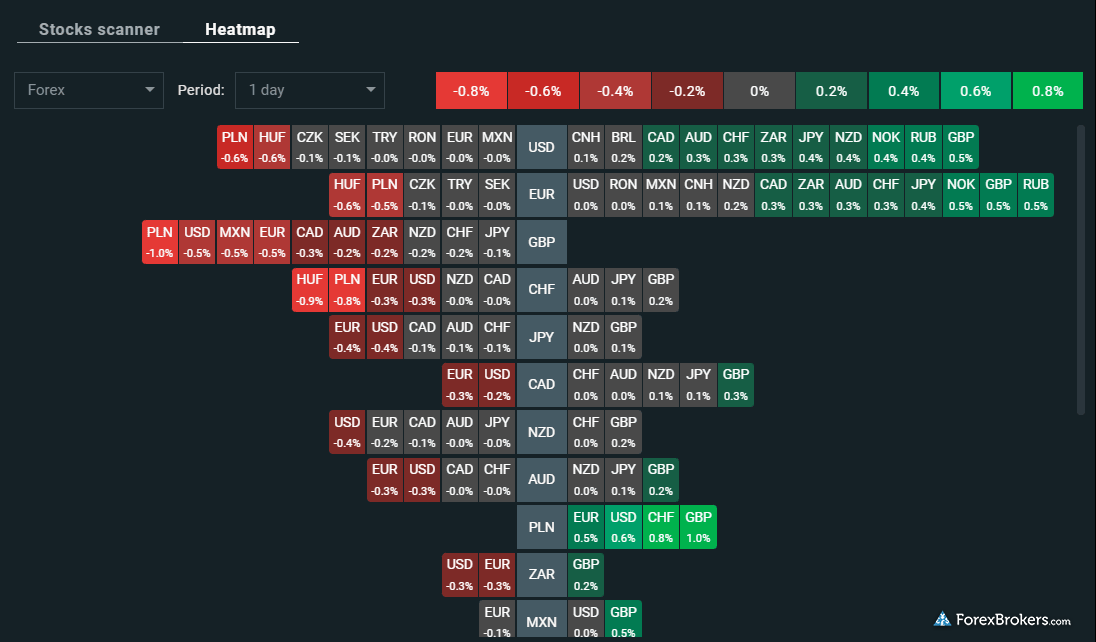

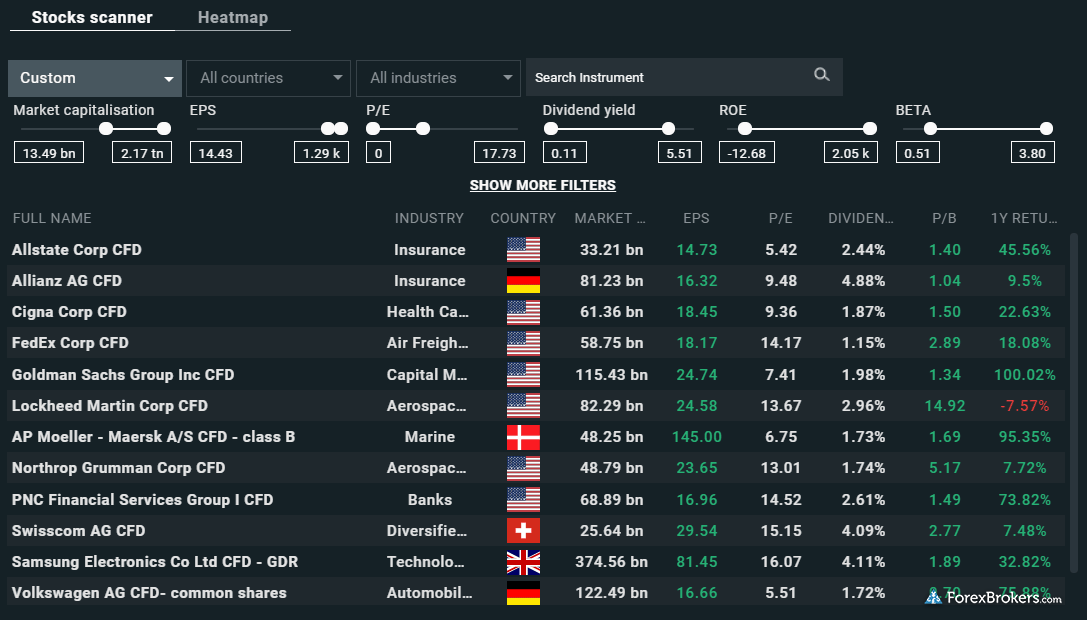

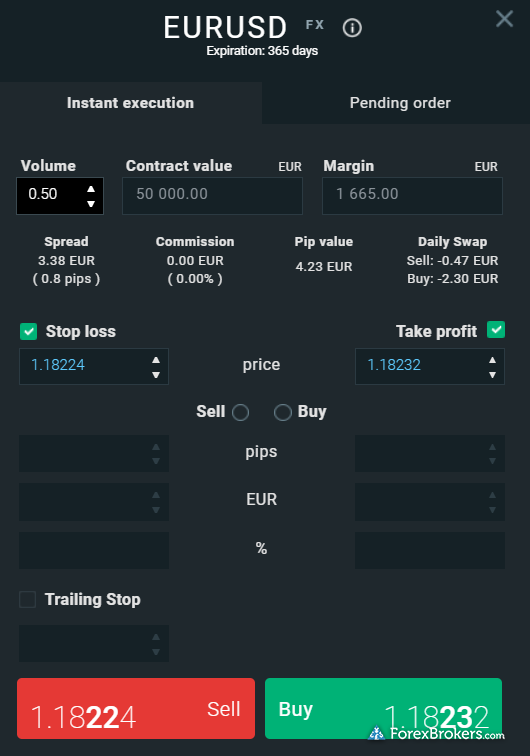

Take a look at this gallery of screenshots from XTB's cleanly designed xStation 5 platform, taken by our research team during our product testing.

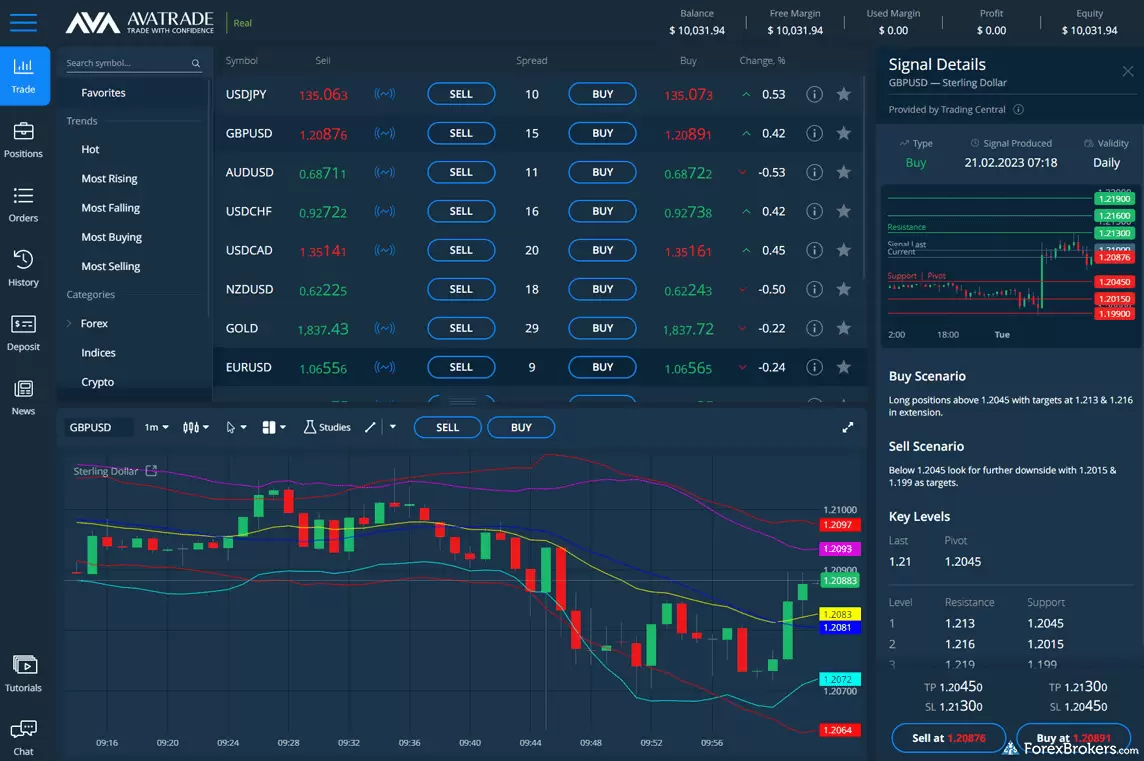

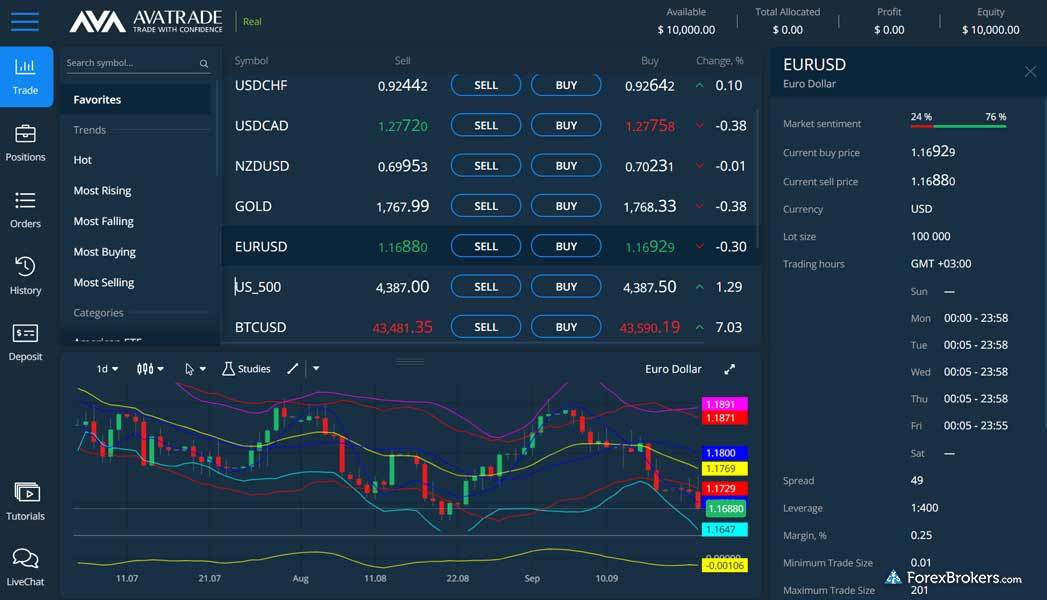

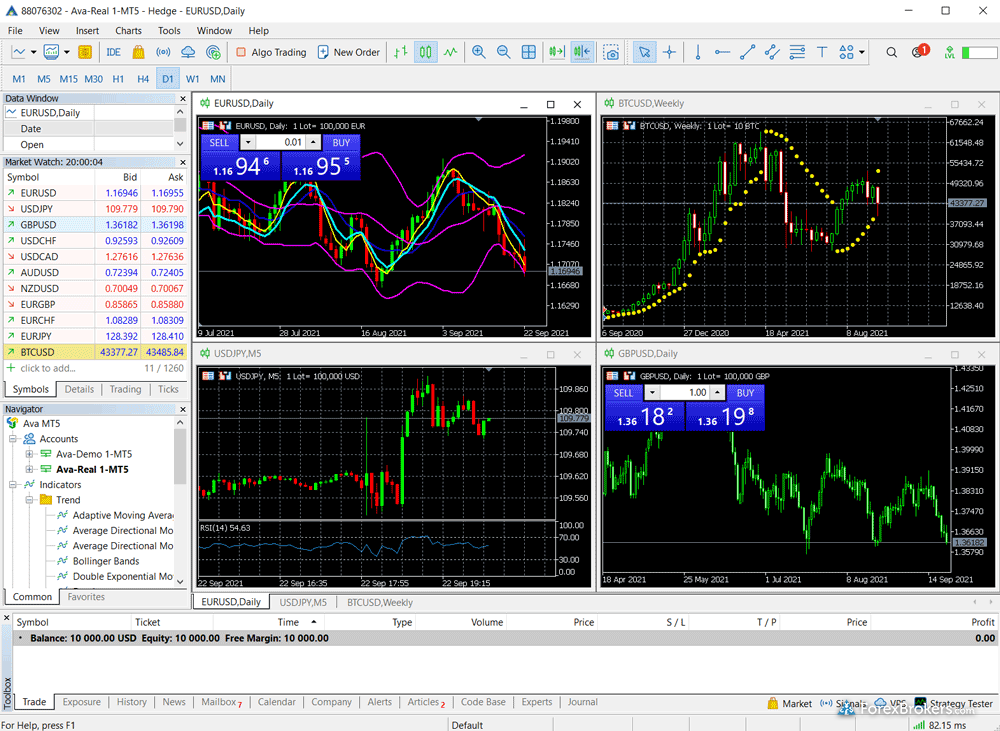

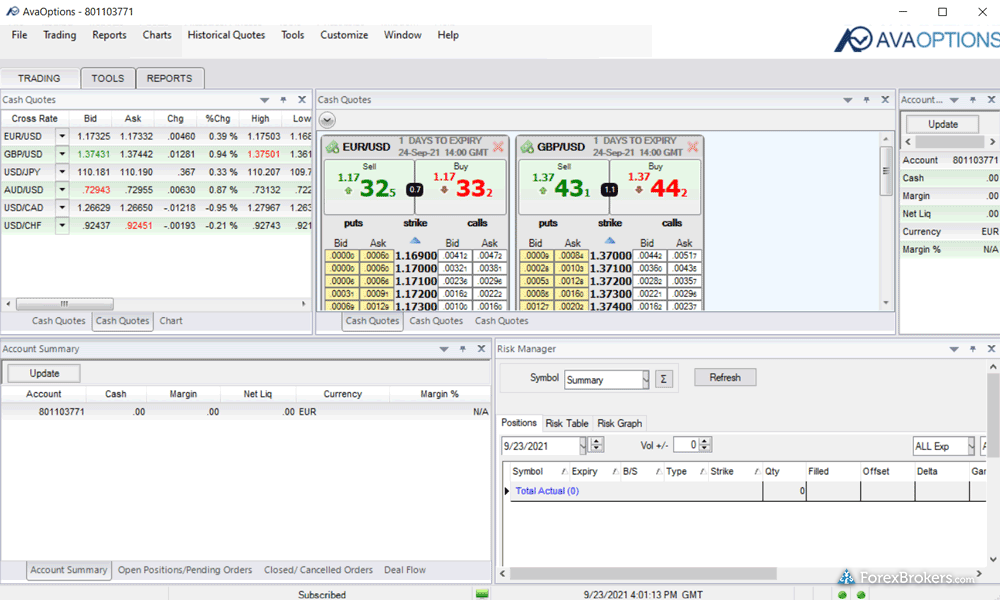

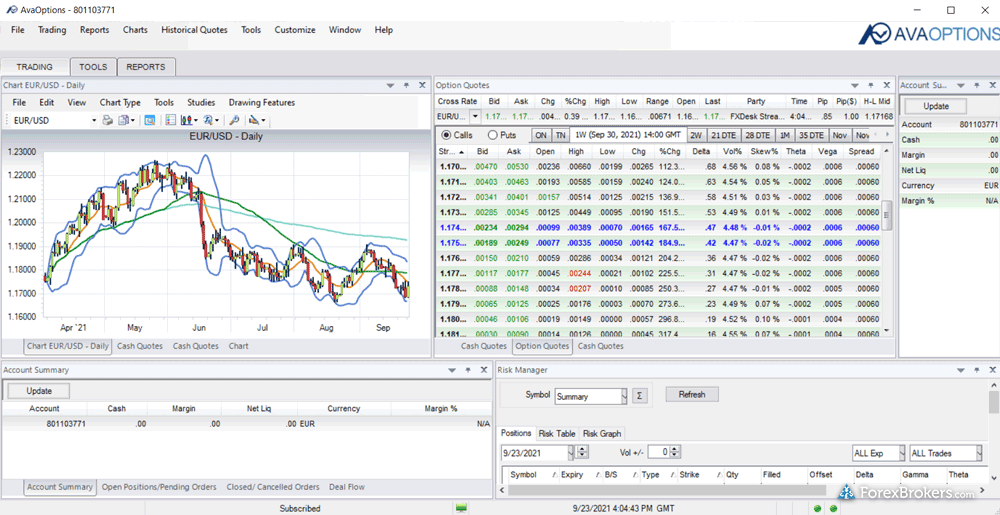

3. AvaTrade

AvaTrade is a well-rounded forex broker that offers an extensive selection of trading platforms. AvaTrade offers the full MetaTrader suite (check out our guides to MetaTrader and MetaTrader 5), and provides access to its own proprietary platforms, AvaTrade WebTrader and AvaTradeGO. Traders who are looking to engage in social copy trading have multiple platform options to choose from, including ZuluTrade, DupliTrade, and the MetaTrader signals market. AvaTrade is licensed across eight different regulatory jurisdictions (including four Tier-1 regulatory agencies). Read our full-length review of AvaTrade to learn more.

Check out a gallery of screenshots from AvaTrade's extensive selection of trading platforms, taken by our research team during our product testing.

Forex regulation in Nigeria

Nigeria’s forex regulations pertain to the physical exchange of currencies, rather than speculation on forex prices. This was made clear by the Nigerian Government’s announcement on new policy actions in foreign exchange markets. Brokers catering to Nigerian residents that offer over-the-counter (OTC) forex products (such as futures) must be properly authorised to do so (according to a 2016 guideline established by Nigeria’s Central Bank). Residents of Nigeria must report any income in Nigeria that they obtained from trading forex (even if that income was earned with a broker based outside of Nigeria) to remain in compliance with local laws.

Nigeria’s financial markets

Nigeria’s national currency is the naira (NGN), issued and managed by the Central Bank of Nigeria (CBN).

The primary stock market in Nigeria is the Nigerian Stock Exchange (NGX), located in Lagos. The NGX offers an assortment of asset classes that include securities, bonds, exchange-traded funds (ETFs), and derivatives.

To buy securities in NGX’s primary or secondary markets, an investor must first appoint a stockbroker or dealer registered as a Dealing Member or Trading License Holder of the NSE to facilitate trading. The responsibility of clearing and settling NGX transactions then falls on the Central Securities Clearing System Plc. (CSCS), which is the licensed depository for the Nigerian capital market.

About the Central Bank of Nigeria

The Central Bank of Nigeria (CBN) regulates Nigerian monetary policy and the local currency – the Nigerian Naira (NGN). In recent years, Nigeria has experienced rampant inflation. As of Q4 2023, inflation levels are above 28%, resulting in a relatively weak local currency (as of January 2024, 1.00 USD = 896.50 NGN).

About the SEC Nigeria

The Securities and Exchange Commission (SEC) of Nigeria regulates Nigerian capital markets, including companies that offer securities and derivatives such as forex and CFDs. The Investments and Securities Act (ISA) of 2007 laid the foundation for the current regulatory structure in Nigeria, added investor protections, and helped to modernize its economy. Forex regulations have not yet been clearly defined for retail CFD trading, but Part X and Part XI of the ISA outline the requirements (and obligations to investors) that apply to brokers that are dealing as a principal.

How to verify CBN Authorisation

Unless you are dealing with a local bank or broker in Nigeria, it’s unlikely that your forex broker is regulated by the CBN or SEC of Nigeria. That said, Nigeria’s Capital Markets Operator Search (CMOS) is a tool provided by the SEC that allows traders to search for brokers that are licensed in Nigeria.

The importance of trading with regulated forex brokers

Regulated forex brokers are subject to greater levels of oversight and more stringent compliance requirements. Unregulated or unlicensed brokers don’t face the same obligations to deliver fair trade execution, for example, and may employ other questionable practices. Unregulated brokers are also not required to report to a governing body. Traders that deal with unregulated brokers often have no recourse for recovering funds if they fall victim to a forex scam. That being said, not all regulatory licenses carry the same weight. Learn more about the different tiers of regulatory licenses on our Trust Score page.

Why regulation is important

Choosing a well-regulated forex broker is important for avoiding forex scams. Check out my popular educational series that teaches you how to identify common forex scams and provides helpful information about what to do if you've been scammed. For crypto traders, I explain how you can spot common crypto scams.

Is forex trading legal in Nigeria?

Yes, forex trading in Nigeria is legal, though Nigerian brokers offering over-the-counter (OTC) forex products must be authorised to do so, according to the Nigerian Central Bank. That being said, there are no rules in place that prevent local residents from opening accounts with forex brokers that are regulated outside of Nigeria. Of course, any income that Nigerian residents earn from trading with foreign brokers must be reported in Nigeria.

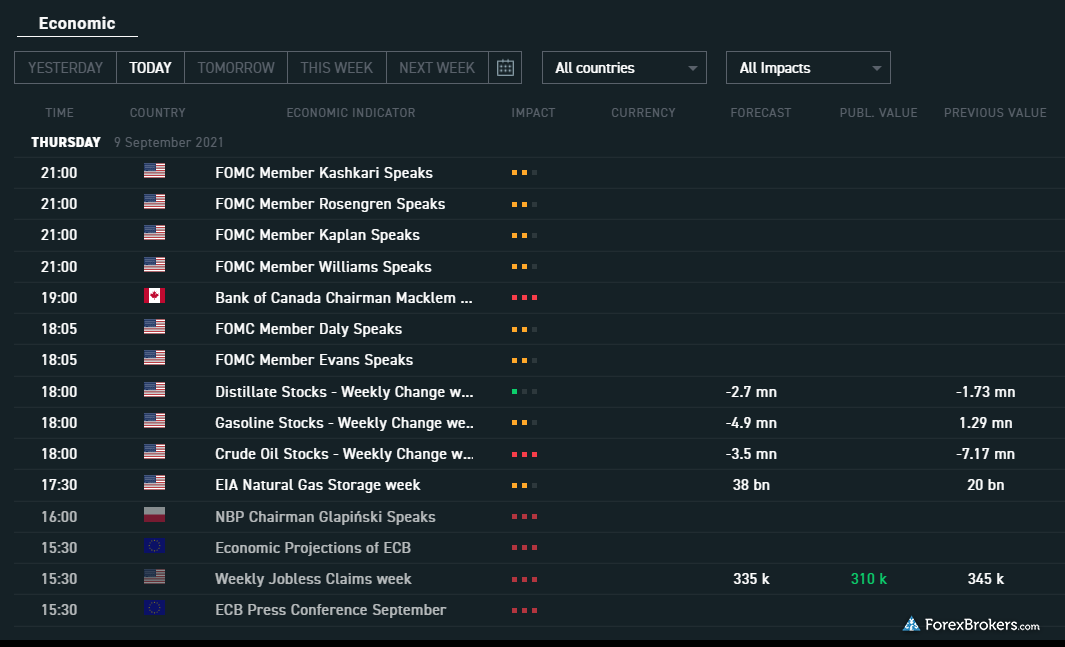

What is the best time to trade forex in Nigeria?

While there may not be a “best” time for forex trading (this would depend on a wide range of factors and preferences), there are times – statistically speaking – that can indicate an active market for major currency pairs. In this context, the best forex trading session in Nigeria time (GMT+1) typically begins right after the New York session has started (around 2:00pm West Africa Time) and ends at 5:00pm West Africa Time.

The major forex trading sessions are in Sydney, Tokyo, London and New York. At 2:00pm West Africa Time, the London session is just past the halfway point. At this time, the overlap that exists with the New York session can result in higher trading volumes, more decisive price movements, and greater liquidity within the markets. Forex currency pairs involving the USD, GBP and EUR (in addition to other major and cross-currency pairs) can be more active during these times.

If you are trading Asia-Pacific related currency pairs (involving currencies such as the AUD, NZD, SGD, HKD, JPY, and RMB), greater price action can occur just after midnight in Nigeria when the Sydney session overlaps with the Tokyo session.

How can I trade forex in Nigeria?

Before you start trading forex in Nigeria, it’s important to choose a forex broker that is well-regulated and properly licensed. Once you’ve chosen a trustworthy forex broker, these next steps can get you started as a forex trader in Nigeria:

- Complete your forex broker’s live account application process and read through the provided terms and conditions.

- Next, you’ll need to fund your new brokerage account using your preferred deposit method. Tip: Make sure you are starting with an amount you can afford to risk.

- Try out a demo (or, virtual trading) account to familiarize yourself with your broker’s trading platform and product offerings. This is also a good time to consume educational content about forex trading (most brokers offer educational resources).

- Put together a trading plan. Even the best traders can lose money; sticking to a trading plan that keeps your average losses low (relative to average profits) is important for long-term success in the forex market.

- Now, you can enter the forex market. Choose your desired trade size, and open a long position by clicking buy on a given currency, or open a short position by clicking sell.

Getting started with forex trading?

There’s lots to learn when getting your start with forex trading – no matter where you live. Check out our beginner’s guide to forex trading to gain more helpful insights and to see our picks for the best forex brokers for beginners.

Which forex broker is best for beginners?

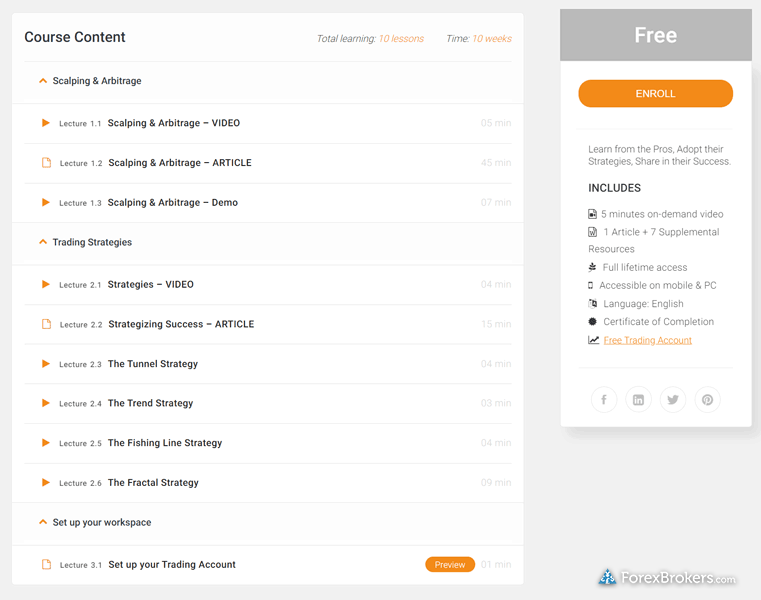

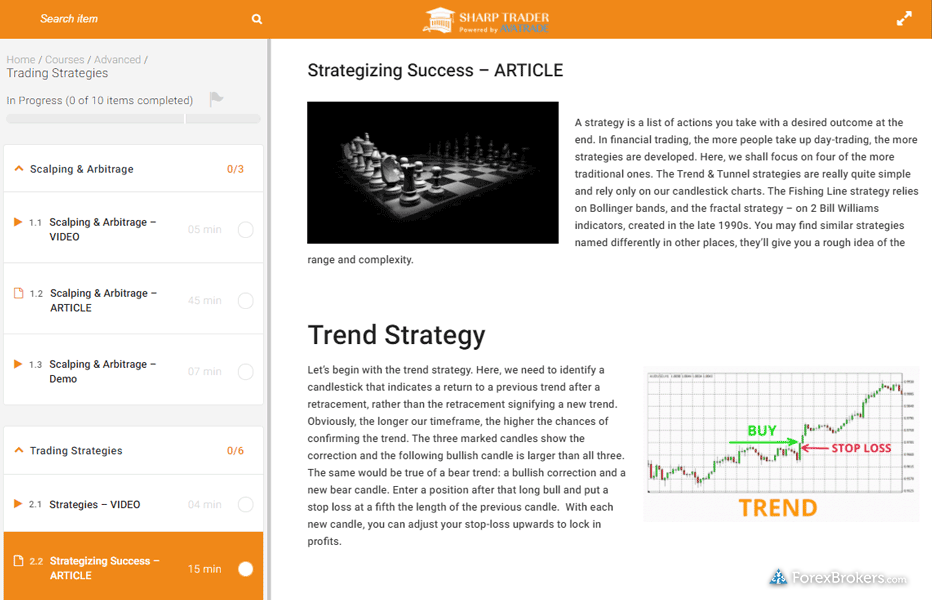

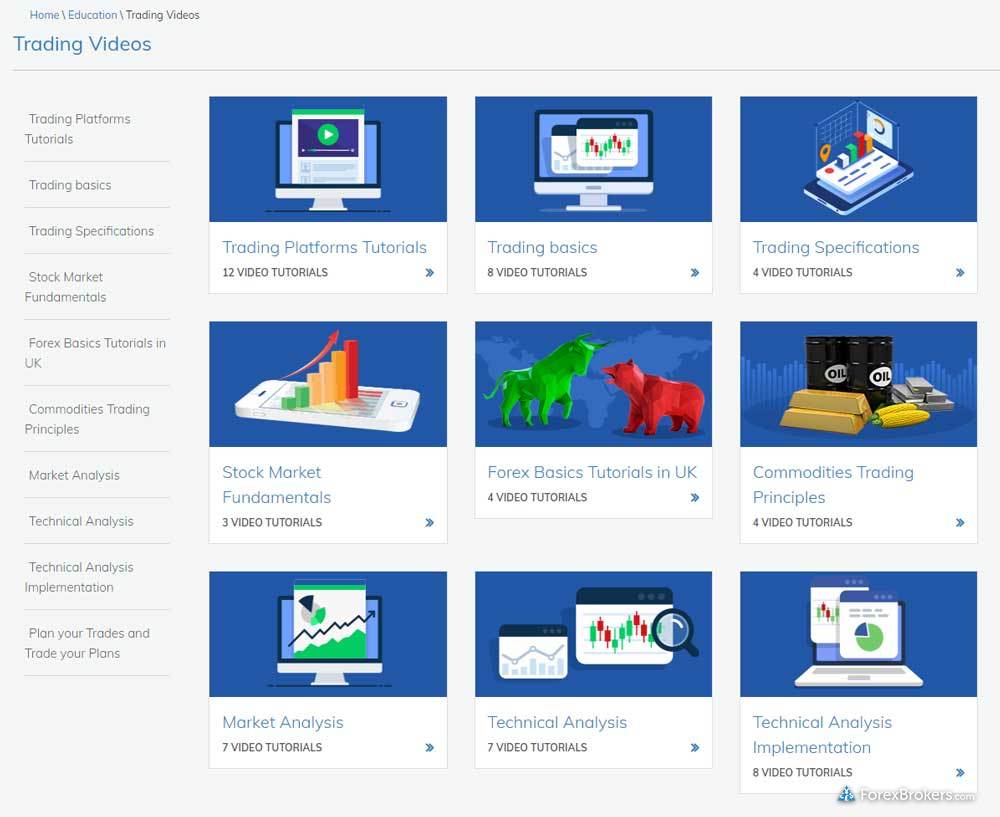

AvaTrade is the best forex broker in Nigeria for beginner forex traders in 2024. AvaTrade delivers an in-depth library of educational content for new traders, some of which is sourced from leading third-party providers such as Trading Central, while some is developed directly by AvaTrade’s in-house staff. AvaTrade’s SharpTrader offering provides access to educational courses that are organized by experience level, and include videos, written content, and integrated quizzes. These rich educational features for beginner forex traders helped AvaTrade earn Best in Class honors for Education in our 2024 Annual Awards. To learn more, check out our review of AvaTrade.

Check out a gallery of screenshots from AvaTrade's educational offering, taken by our research team during our product testing.

Which trading app is best in Nigeria?

From among brokers that accept Nigerian residents, Saxo Bank offers the best mobile trading app for Nigerian forex traders in 2024. The broker’s SaxoTraderGo mobile app delivers an excellent user experience that deftly mirrors the features of Saxo Bank’s web-based trading app. The seamless SaxoTraderGO experience includes syncing watchlists and trendlines, rich charting capabilities, and powerful trading tools. To learn more about Saxo Banks excellent platform suite, check out our full-length review of Saxo Bank.

Scroll through a gallery of screenshots from Saxo Bank's mobile app, taken by our research team during our product testing.

Forex trading on the go?

Mobile forex trading is more popular than ever, and many of the best international forex brokers offer multiple mobile apps and well-designed mobile trading platforms. Check out my guide to mobile forex trading to see my picks for the best mobile apps.

Article Resources

Nigerian Stock Exchange Website, Central Bank of Nigeria Website Securities and Exchange Commission (SEC) of Nigeria Website

Compare Nigeria Brokers

Popular Forex Guides

- Best Copy Trading Platforms of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Forex Brokers for Beginners of 2024

- Best Forex Brokers of 2024

- Compare Forex Brokers

- Best Forex Trading Apps of 2024

- Best Brokers for TradingView of 2024

- Best MetaTrader 4 Brokers of 2024

- International Forex Brokers Search

More Forex Guides

Find the best forex brokers in the Middle East and Africa

Middle East

- Best Forex Brokers in Saudi Arabia for 2024

- Best Forex Brokers in Israel for 2024

- Best Forex Brokers in United Arab Emirates for 2024

Africa

- Best Forex Brokers in Kenya for 2024

- Best Forex Brokers in Nigeria for 2024

- Best Forex Brokers in South Africa for 2024

Methodology

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team, led by Steven Hatazkis, conducts thorough testing on a wide range of features, products, and services. We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables. Our research team collects and validates thousands of data points each year.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s regulatory status and number of held regulatory licenses.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go.

We also test on mobile devices; for Apple, we test using the iPhone XS running iOS 16, and for Android we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 13.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Read our full explanation and accounting of our research and testing process to learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.