Best overall for TipRanks - IG

A highly trusted multi-asset broker that offers a comprehensive trading package, IG is my top pick for TipRanks brokers in 2024.

IG integrates TipRanks directly into the broker's award-winning trading platform and is available for both demo account and live account holders.

TipRanks’ features at IG include Analysts' Consensus by sector, as well as their most recommended stocks for cash equities and CFD traders. You also get access to price targets and ratings that range from strong to moderate buy, sell, or hold recommendations across six sectors. Check out my full review of IG to learn more about its offerings.

Best platform integration - eToro

eToro was one of the first forex brokers to integrate TipRanks, years before it achieved more popularity. Available to live customers with a funded account, eToro offers TipRanks within the analysis tab on the platform.

TipRanks also creates well-performing Smart Portfolios available at eToro for social copy trading, like the one that tracks the holdings of Greenhaven Associates (a hedge fund run by well-known investor Edgar Wachenheim) and is copied by 578 investors. Due to its long tenure at eToro, this copy trading portfolio has over 7 years of actual performance (not including backtested results) to examine.

Overall, eToro has the most advanced integration of TipRanks features, with the only drawback being that demo account holders cannot preview it without funding a live account. Check out my full review of eToro to learn more.

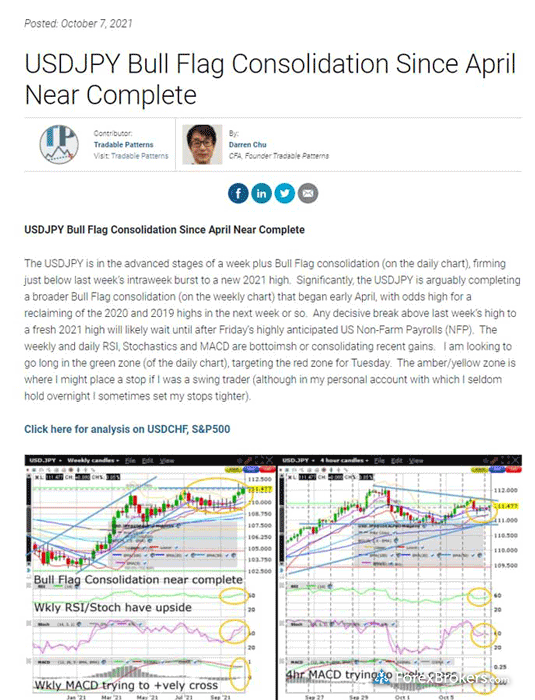

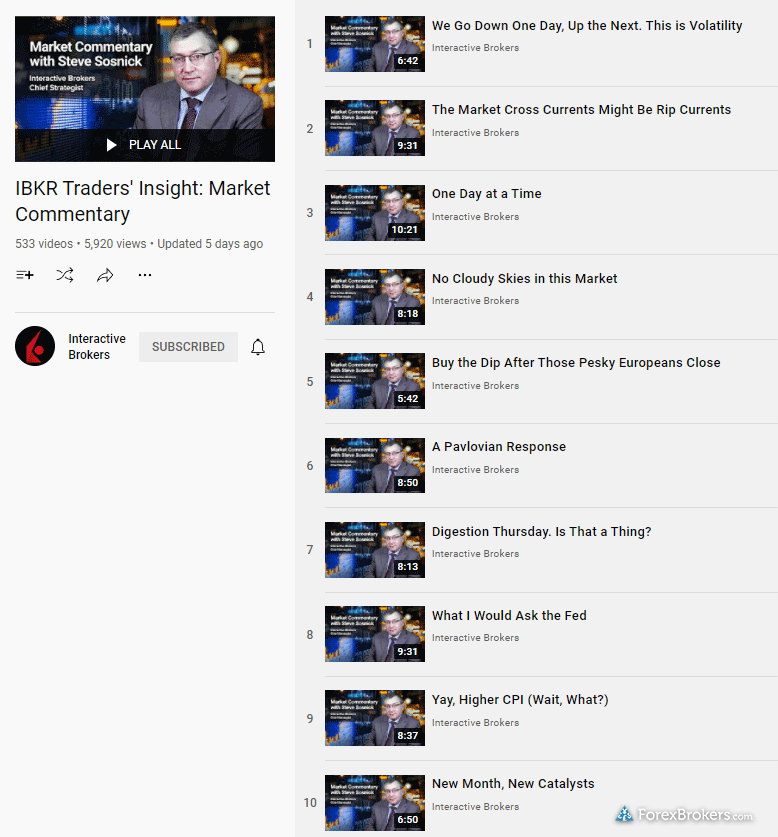

Integrated TipRanks TV - Interactive Brokers

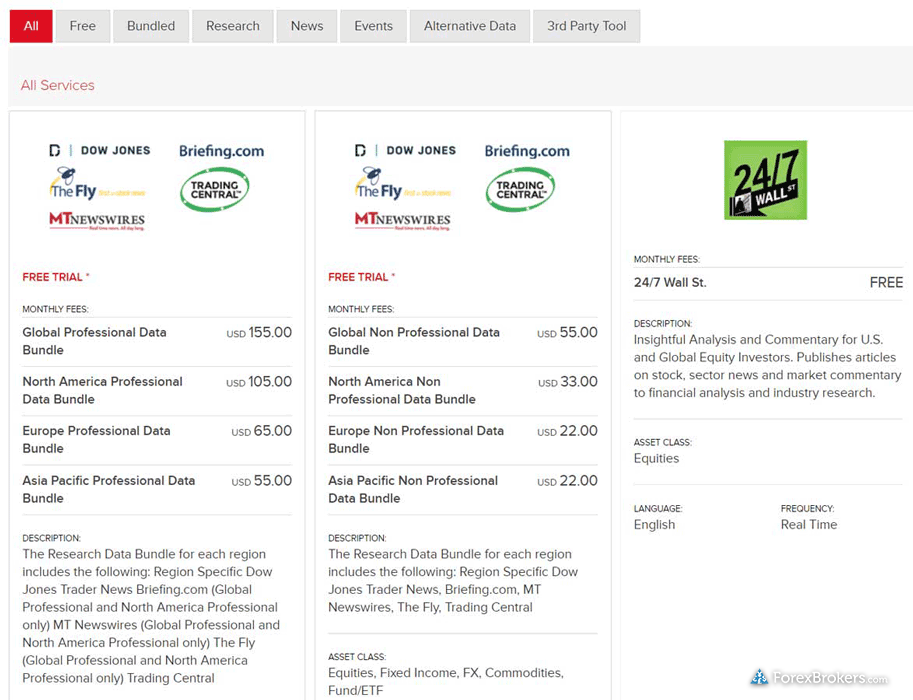

Interactive Brokers, a highly trusted multi-asset broker, offers the widest array of third-party research in 2024, so it’s no surprise they also offer a robust and unique TipRanks integration.

Interactive Brokers has taken a video-dominant approach to its integration of TipRanks in the Trader Workstation (TWS) desktop platform and IBKR mobile app. TipRanks news headlines link to relevant video content in a way that is interactive and easy to consume.

This approach is a bit different from what you will usually find with TipRanks, but will certainly complement the dozens of third-party providers that IBKR also offers within its platforms to help with your market analysis. Read by full review of Interactive Brokers for a more in-depth exploration of its platforms.

Comparison of Forex Brokers that integrate with TipRanks

As with any tools from third-party developers, there are different approaches that brokers may take when integrating tools such as TipRanks, like selecting different widgets to provide from the list of available ones that TipRanks offers. Probably the most important decision for a broker is whether to provide it as a standalone platform, a custom integration (the most demanding), or offer a simple plugin for MetaTrader (the easiest).

Among brokers I’ve tested that offer the service, I’ve found that eToro and IG have the best integration of TipRanks in terms of aesthetics and functionality.

| Company |

TipRanks |

Social Trading / Copy Trading |

MetaTrader 4 (MT4) |

MetaTrader 5 (MT5) |

Tradeable Symbols (Total) |

Visit Site |

IG IG

|

Yes |

No |

Yes |

No |

19537 |

|

eToro eToro

|

Yes |

Yes |

No |

No |

3479 |

|

Interactive Brokers Interactive Brokers

|

Yes |

No |

No |

No |

8500 |

|

FXCM FXCM

|

Yes |

Yes |

Yes |

No |

440 |

|

Admirals Admirals

|

Yes |

Yes |

Yes |

Yes |

8702 |

|

Advantages of using TipRanks for forex market research

TipRanks has grown significantly in recent years by expanding its software suite of tools with additional features and widgets designed to help traders analyze markets and find trading opportunities.

While TipRanks doesn’t yet cover forex as an asset class, many forex brokers offer multiple non-forex asset classes that TipRanks does cover where it can make sense to use TipRanks to complement your research process.

If you only trade forex then TipRanks won’t be as useful for you, but if you are also trading stocks or crypto from a forex broker that offers TipRanks, then it could be an advantageous tool in your arsenal due to its market screeners, advanced sentiment analysis, and plugin for MetaTrader.

FAQs

Is TipRanks worth it?

Yes, TipRanks can be worth your time if used correctly and in a balanced manner alongside your trading strategy. Tools like TipRanks can add rationale to your trading decisions and help you develop a better understanding of market expectations. Traders can benefit from TipRanks features, such as their Analysts' Consensus, economic calendars, Daily Insights, Smart Portfolios, and their Expert Center. These features can be a great addition to your trading toolkit, but it’s important to remember not to overly rely on any single trading tool. You should always use trading tools to complement your existing analysis as part of a well-rounded approach.

Note: When using TipRanks through a forex broker, you won't have to pay for the service directly. That said, the range of features that TipRanks offers may not always be available at supporting brokers that offer TipRanks, as it will depend on their specific integration. For instance, the following calendars and calculators from TipRanks are usually not included at brokers that offer TipRanks, and are available only on the TipRanks website:

- Dividend Calendar

- Earnings Calendar

- Economic Calendar

- IPO Calendar

Additional features may only be available to premium or ultimate subscribers, like the following:

- Content Package (News & Analysis, and member-only events)

- Daily Insights (Analyst Ratings and Insider Trading)

- Data Export (PDF, etc.)

- Email Alerts

- Expert Center

- Investment Ideas (Trending Stocks and other curated lists)

- Research Tools (Screeners and Calendars)

- Smart Portfolio

- Stock Analysis Tool (Smart Score, Ratings, Price Targets, Risk Factors, Opinions, Sentiment, etc.)

How accurate is TipRanks?

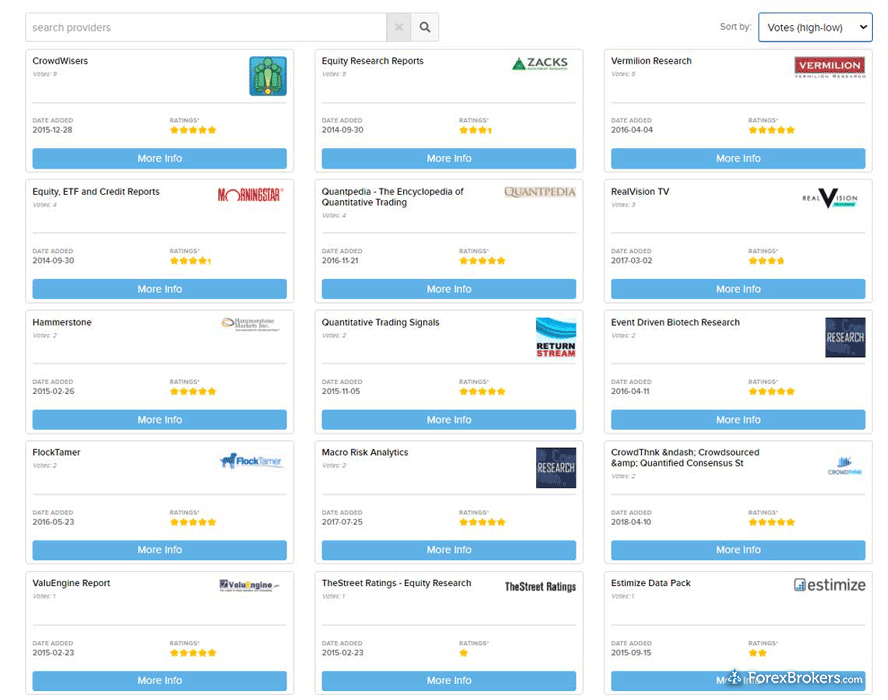

Many of the data points that TipRanks uses are unique to its database, including from analysts who help contribute to the crowdsourced data that TipRanks provides. This analysis can include over 130 financial news providers among other sources which TipRanks deems to be reliable.

Considering the hundreds of thousands of data points generated each day by providers like TipRanks, even the best media sites can occasionally produce inaccurate data, but this usually represents a very small percentage of their overall output.

I am not aware whether TipRanks publishes such statistics, and like any news source - including for trading ideas and signals - the accuracy of any sentiment or price forecast will depend on the timing of when you view the data, how it is consumed, and any resulting performance. I don’t believe that reliability should be a concern, but traders must be prudent in not overly relying on any one piece of data, whether it be a sentiment score, technical analysis, or trade signal recommendation, regardless of the provider.

timerTimeliness Matters:

A sentiment value can be relevant when it is created but could become stale if not subsequently updated on more recent data points, and thus many forms of news can quickly become less actionable as the market has already factored in this information.

What countries are TipRanks available in?

Are tips from market research sites useful?

The usefulness of any market research you consume will depend on several factors, including the quality of the data and analysis, any provided forecast, and how the underlying asset performs. There are so many factors at play that a useful investing tip in one context could be useless in another. It all depends on if it is immediately relevant to your trading situation. When I am using a service like TipRanks, it will be to find opportunities or to gain insights into an opportunity that I am already considering.

For example, I might be considering entering the market for a trade on a given asset class and use analysis and research information from a service like TipRanks for additional confirmation on whether to make the trade or not, depending on the strength of the signal.

The best brokers for market research provide high-quality content and actionable information in a timely manner so that you have a better chance to act on it for potential benefit. That said, tools like TipRanks, in conjunction with research and trading tools available at your broker should be used as part of a well-rounded trading methodology that includes proper position sizing and risk management.

What does TipRanks offer forex brokers?

While TipRanks doesn’t yet cover forex it already caters to multiple forex brokers and a variety of asset classes that those brokers offer via its widgets and API suite. Its API suite includes market data & research, idea-generating tools, news, calendars, MetaTrader, portfolio tools, and content related to ETFs and crypto.

How brokers approach integrating these features can vary but I expect to see TipRanks roll out more tools for brokers to use as there is much more available on the TipRanks website than what most TipRanks-enabled brokers offer in terms of widgets and functionality.

Now that you've seen our picks for the best forex brokers for TipRanks, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

IG

IG

eToro

eToro

Interactive Brokers

Interactive Brokers

FXCM

FXCM

Admirals

Admirals

Saxo

Saxo

CMC Markets

CMC Markets

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

City Index

City Index

XTB

XTB

Capital.com

Capital.com

Swissquote

Swissquote

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

Pepperstone

Pepperstone

XM Group

XM Group

FP Markets

FP Markets

Tickmill

Tickmill

IC Markets

IC Markets

FxPro

FxPro

Markets.com

Markets.com

FinecoBank

FinecoBank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

FXPrimus

FXPrimus

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX