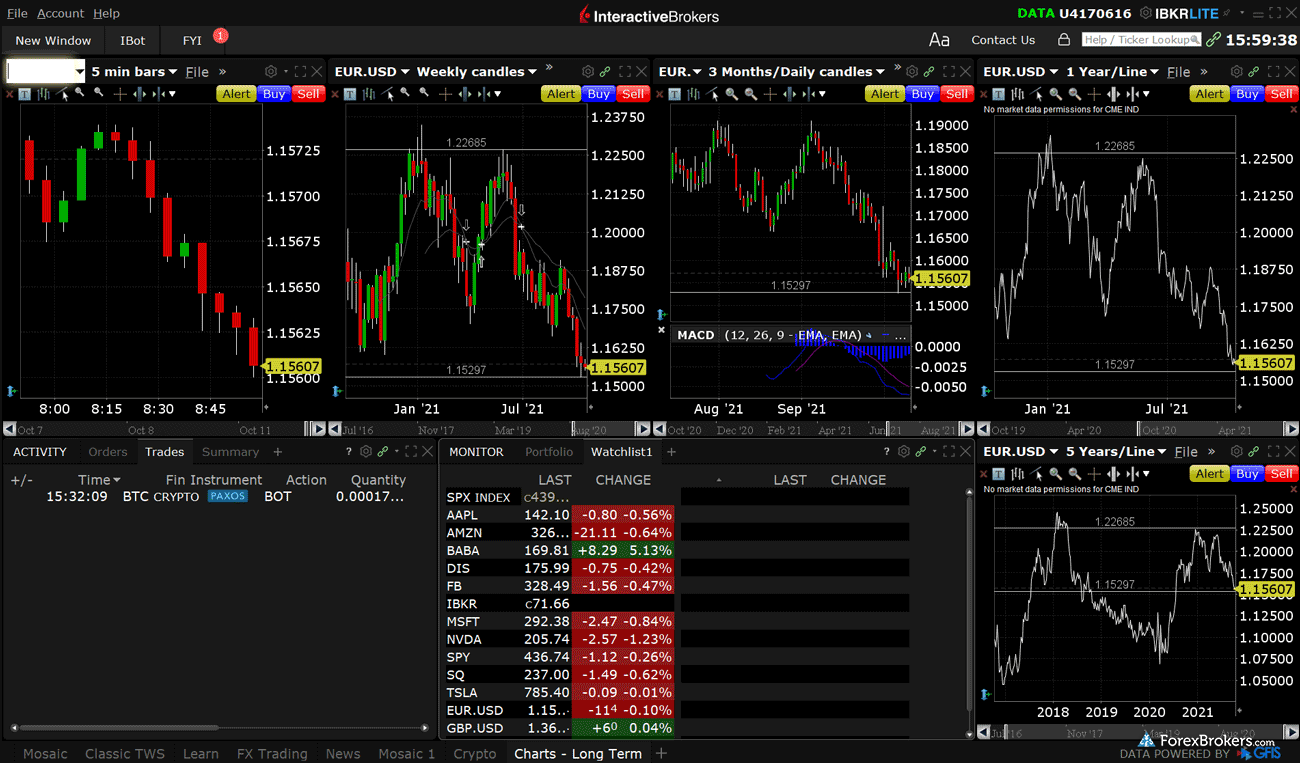

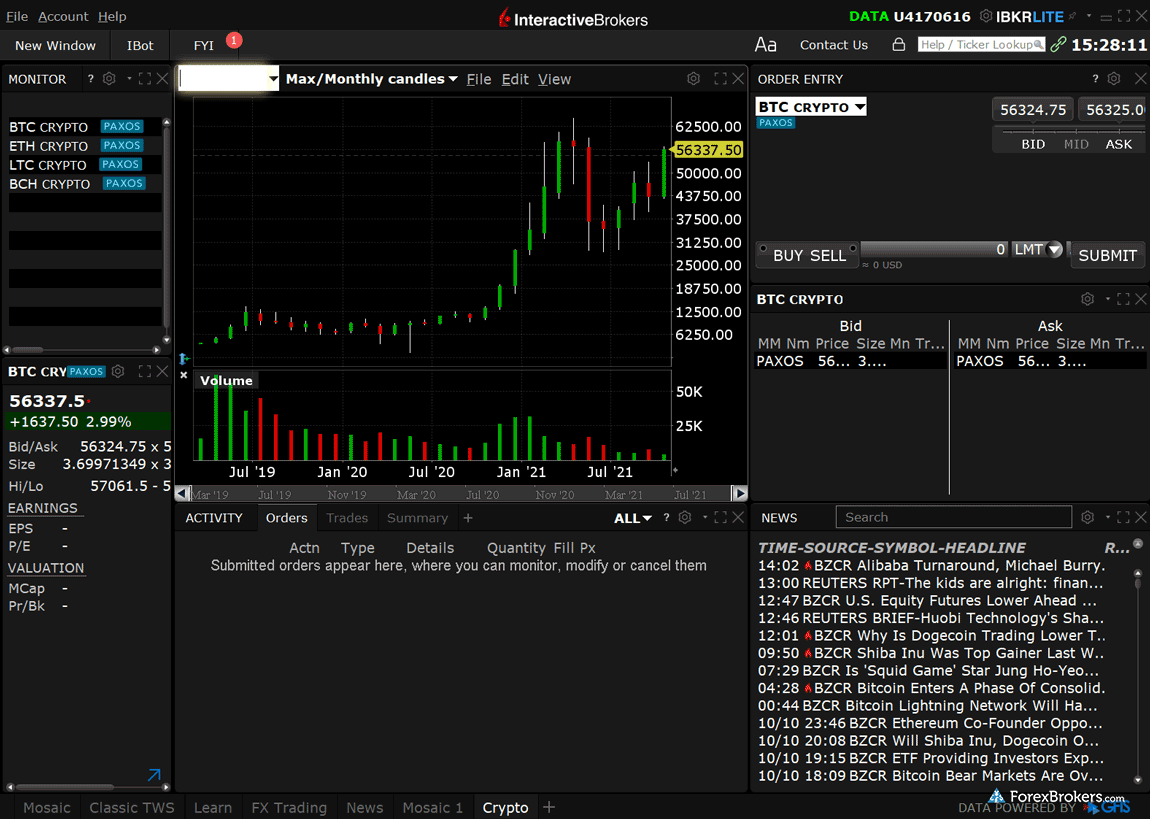

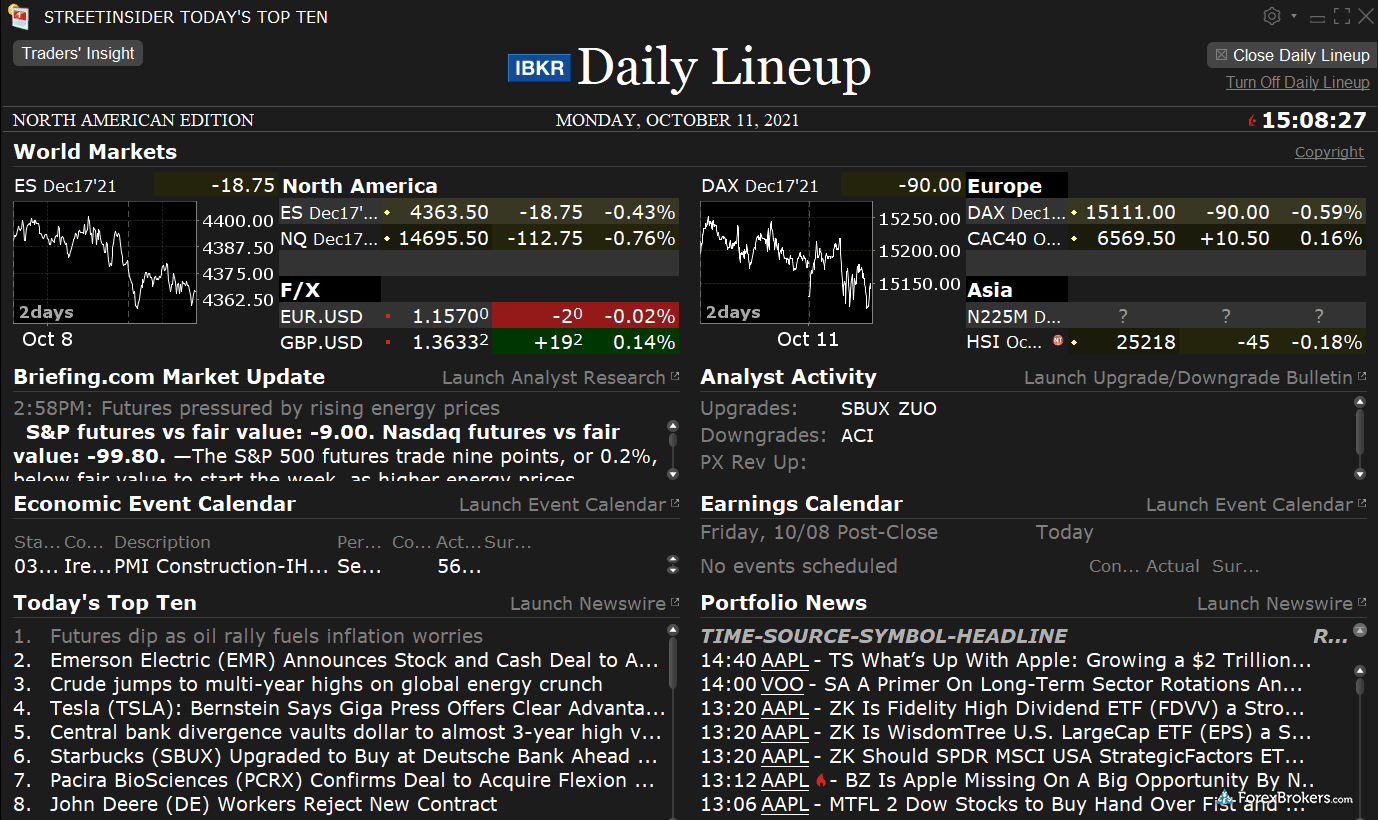

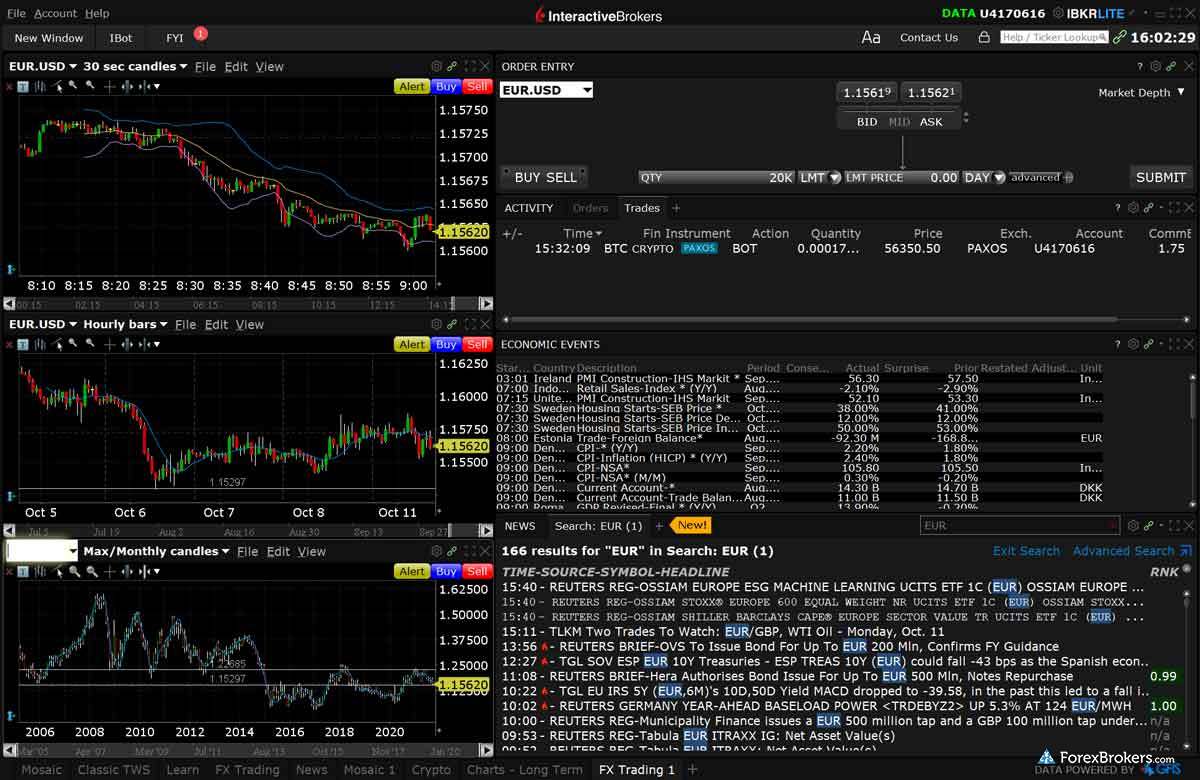

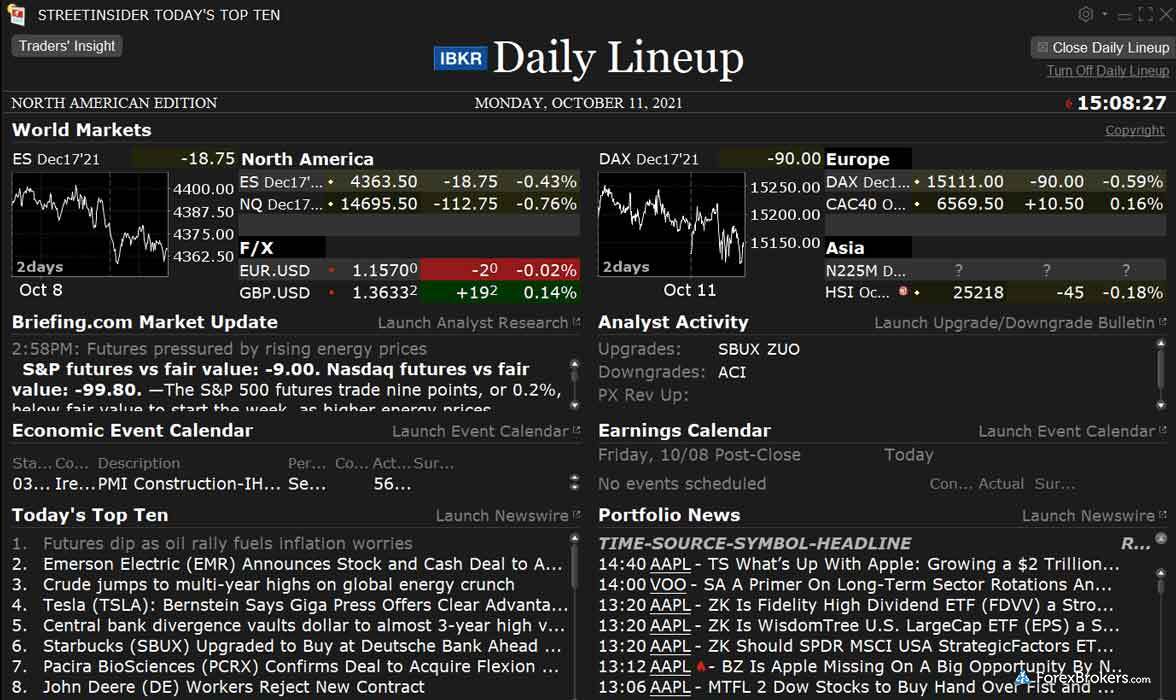

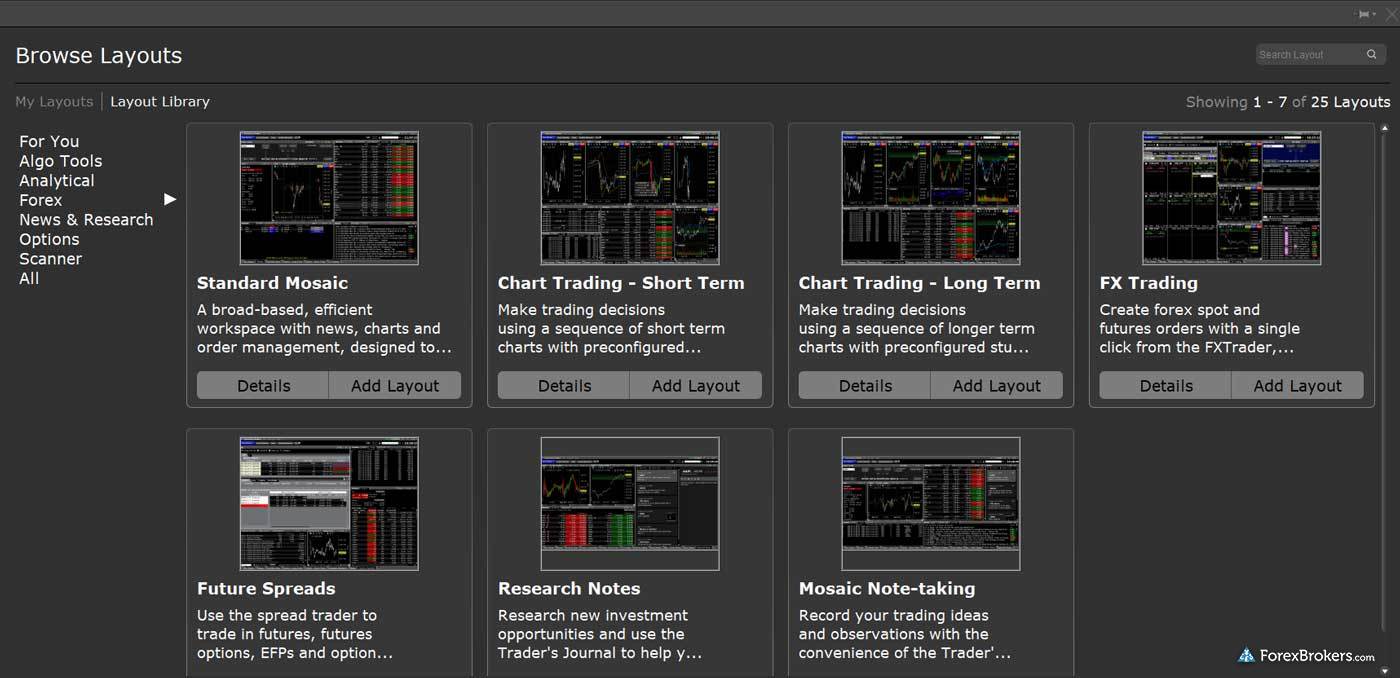

Extensive selection of trading tools and markets - Interactive Brokers

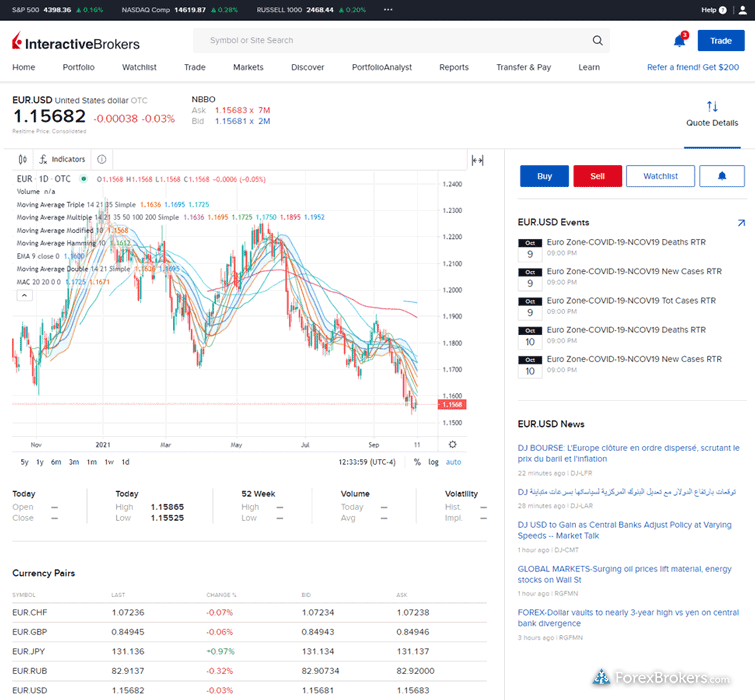

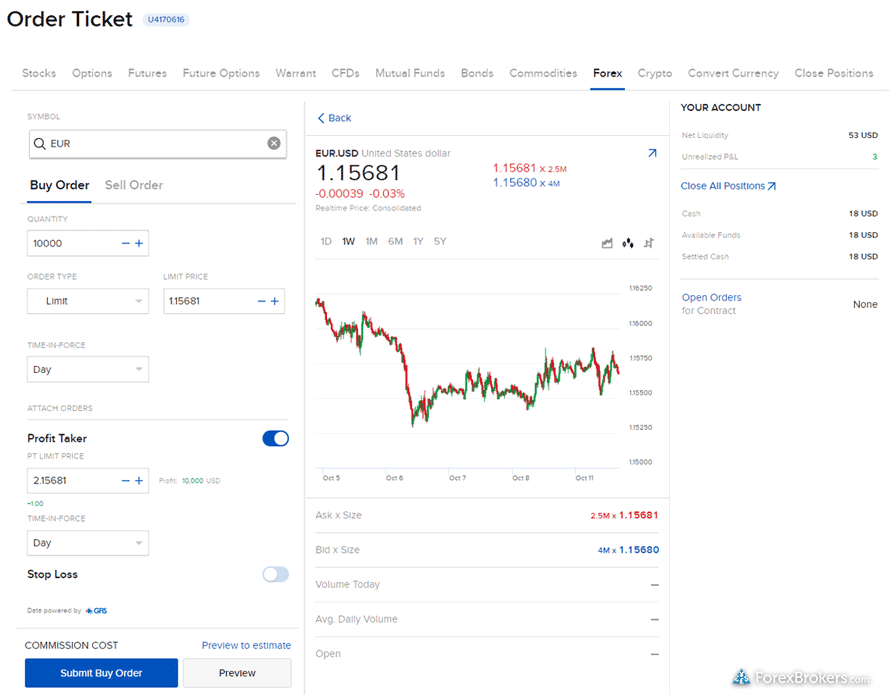

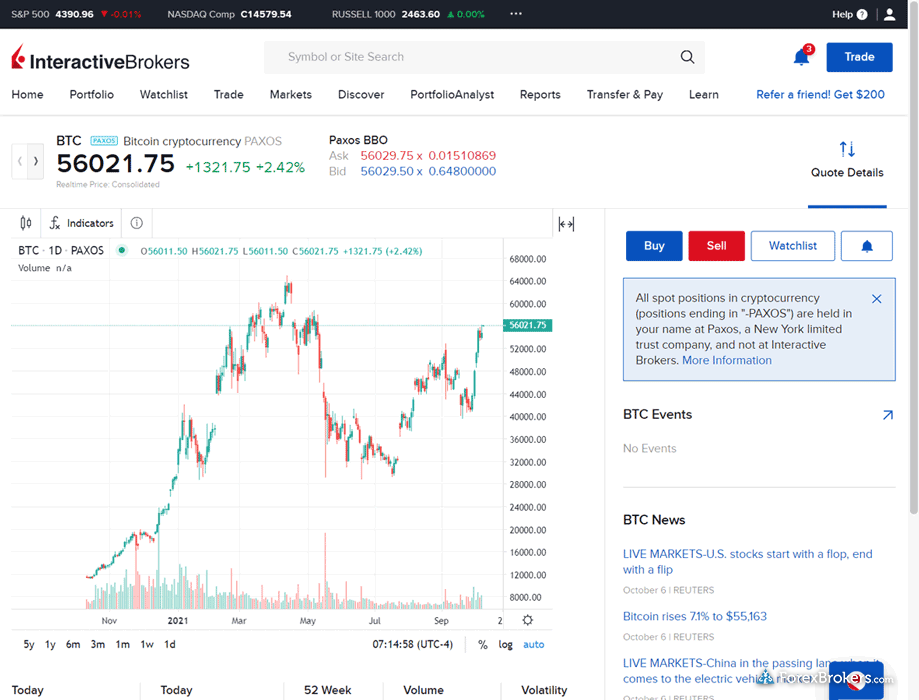

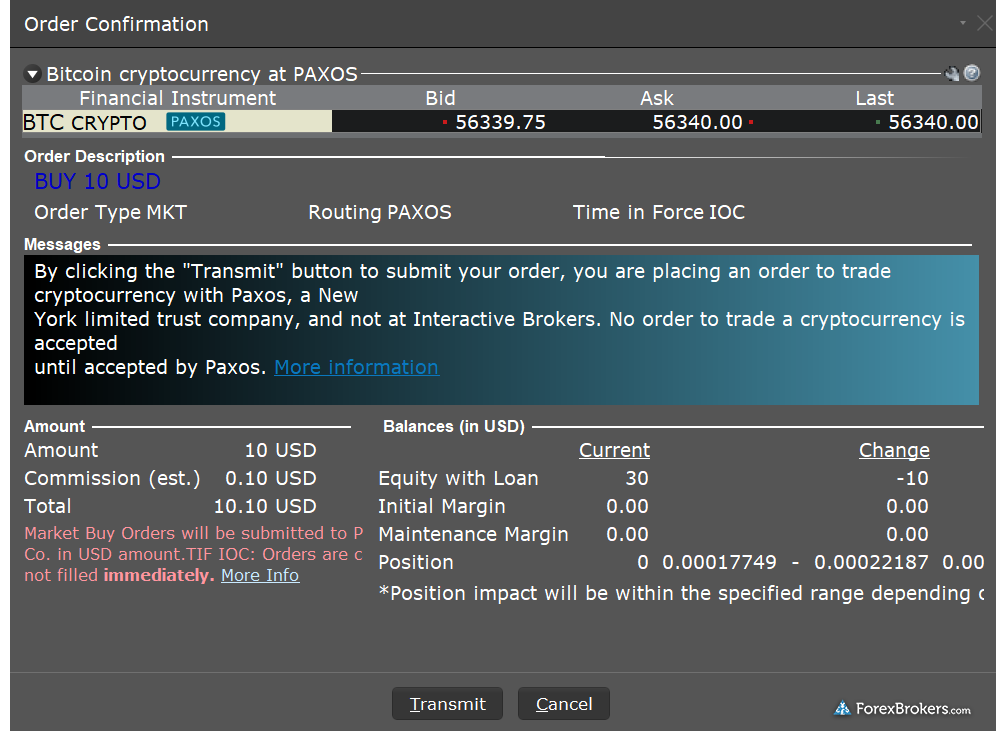

Interactive Brokers (IBKR) has long been a preferred choice for professionals and institutions - including day traders who trade for a living.

IBKR offers a vast selection of markets, tools, and customizations, including advanced order types, that are available within its platform across any device.

With its competitive commission rates and low average spreads, IBKR is a formidable broker in the forex market, or any other global market from within the same account, making it my number one choice in 2024 for day trading. For more information, take a look at my full Interactive Brokers review.

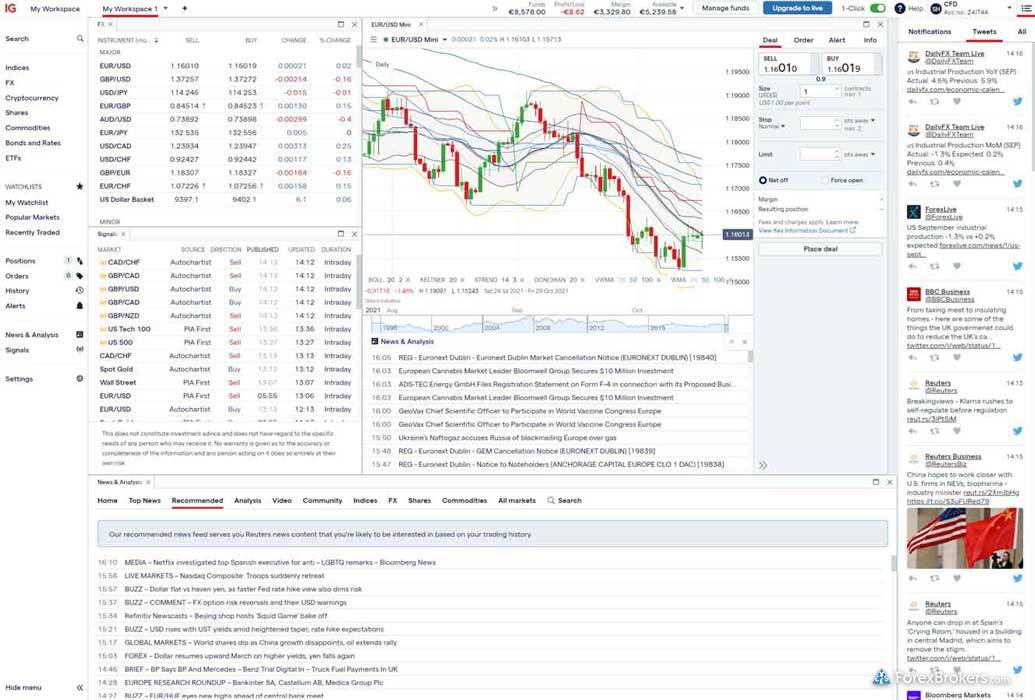

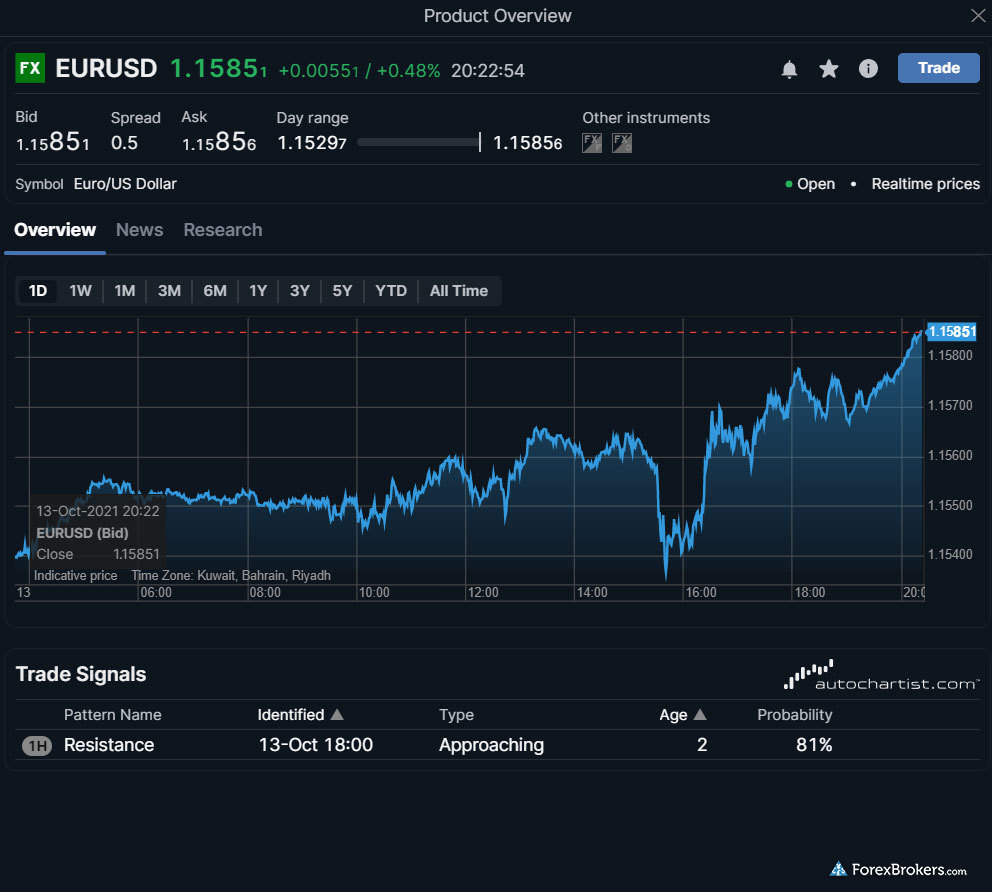

Integrated signals and trading from charts - IG

IG is an excellent choice for forex day trading, not only because it is our highest ranking broker in 2024 across numerous categories, but because day traders in particular will benefit from the innovative tools available when they are trading from the chart.

The IG platform allows you to quickly modify orders (speed is crucial when day trading). Your orders display as a line directly within a chart, which can be easily clicked, dragged, and moved to change an order. While this feature is offered by most of the brokers in this guide, IG's implementation of this functionality is excellent. Additionally, IG's integrated trading signals work in tandem with trading from within the chart.

Whether you need to force open trades for hedging or use advanced orders, IG’s web-based platform, mobile app, and L2 Dealer platform for Forex Direct account holders are superb choices. The MetaTrader platform is also available, alongside an extensive selection of forex pairs, CFDs, and other instruments including options, derivatives, and even cryptocurrency CFDs. For a deeper dive into their offerings, check out my full IG review.

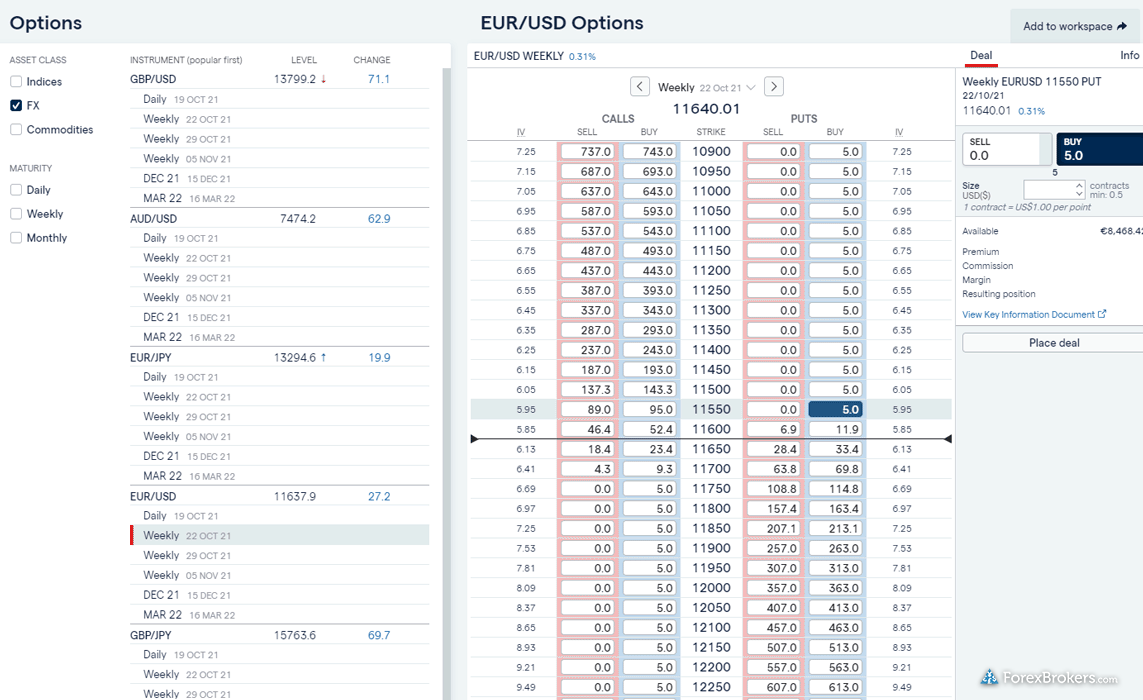

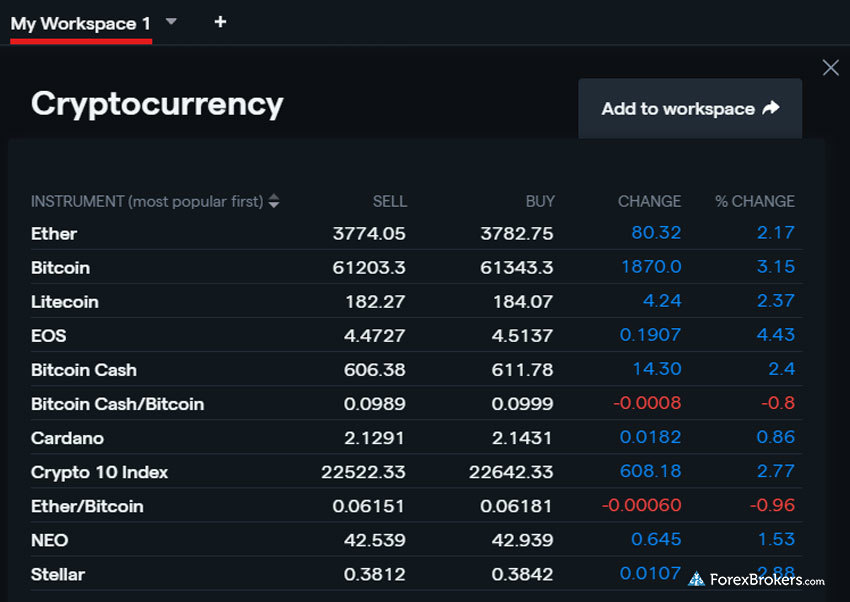

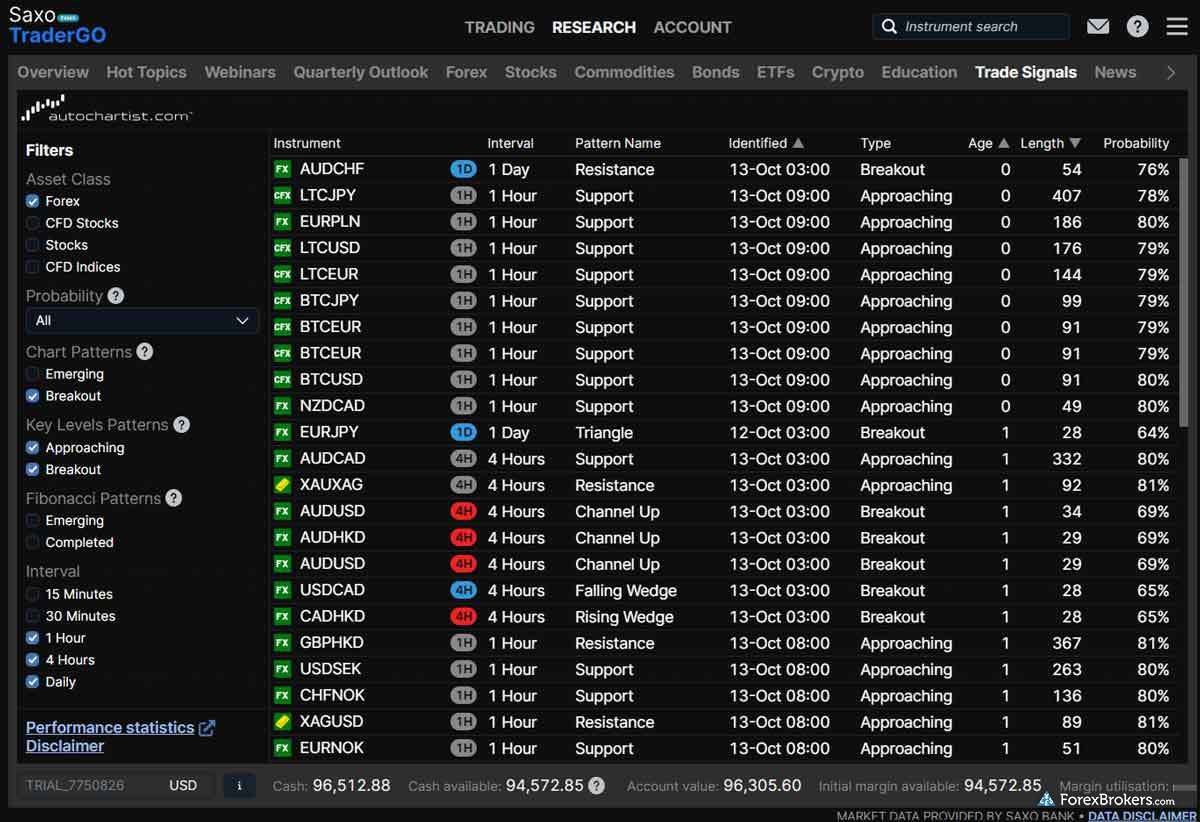

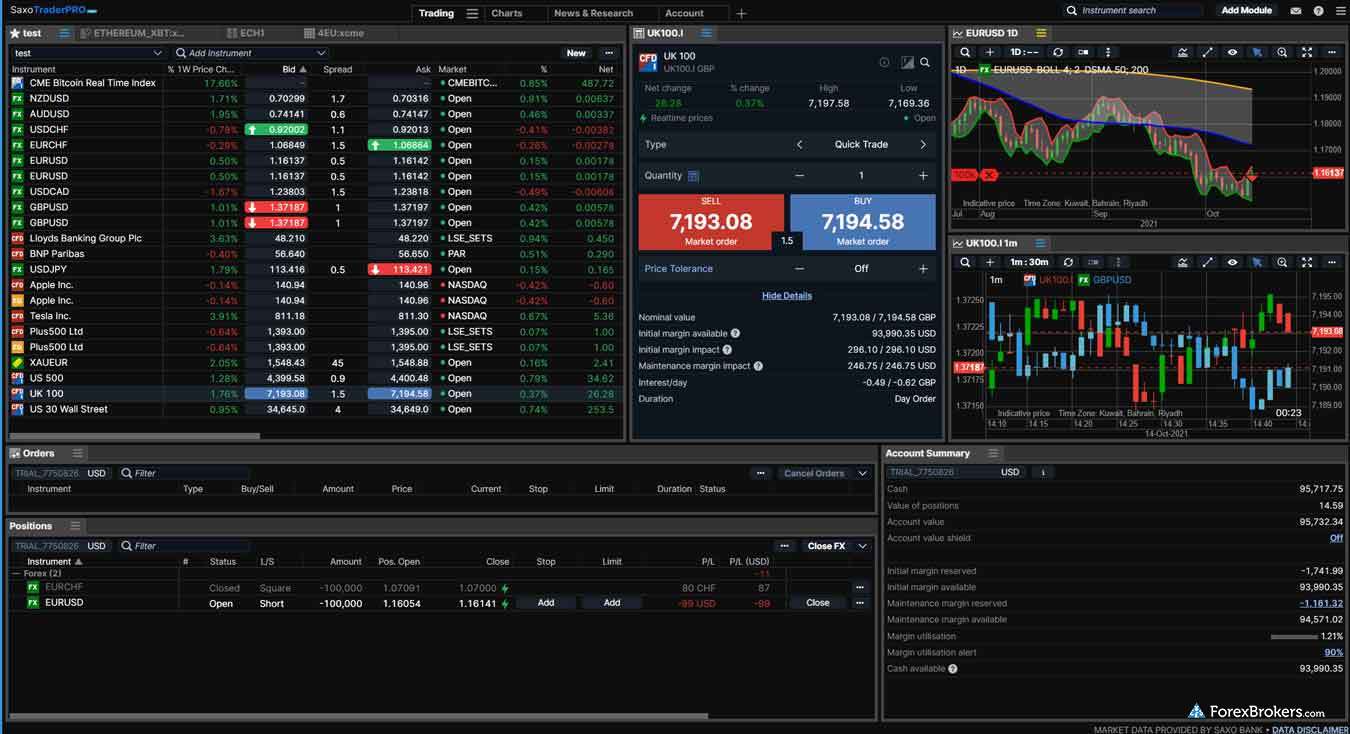

Powerful platform suite - Saxo

Part of the Saxo Bank Group, Saxo is a highly trusted and established market leader for financial services and a well-rounded multi-asset broker for day trading forex across a huge selection of currency pairs.

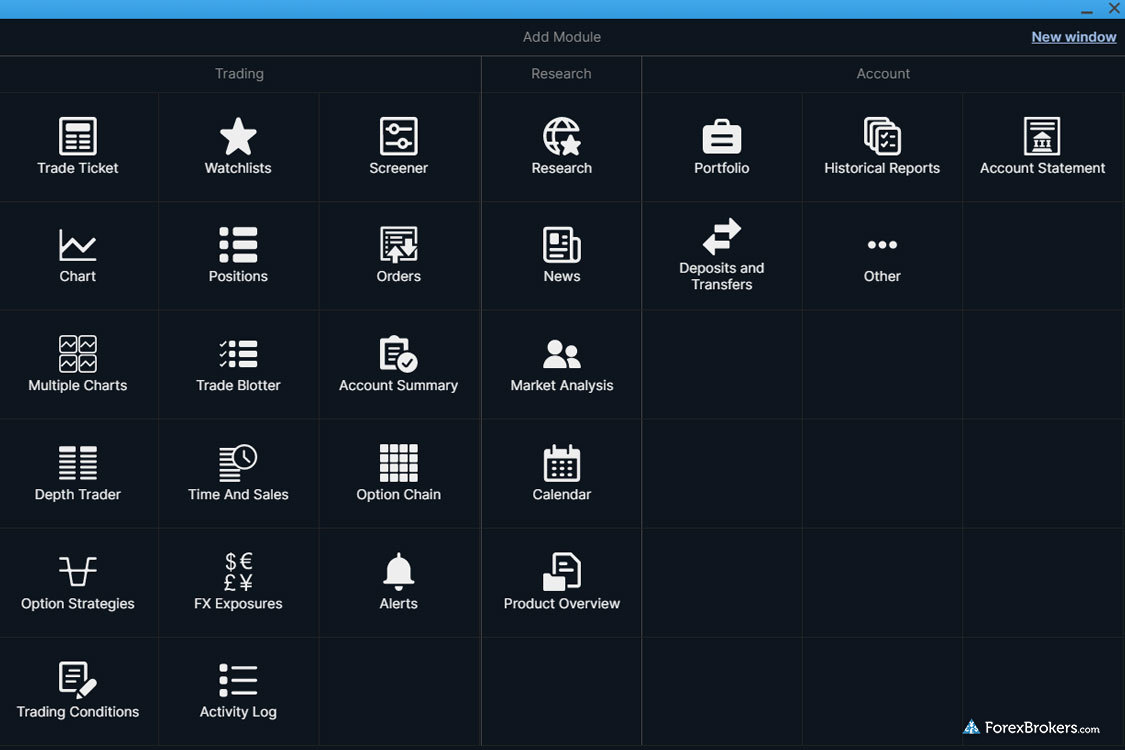

The SaxoTraderPRO (desktop) and SaxoTraderGO (web and mobile) platforms are among my favorites, especially for day trading, as you have practically everything you need to focus on order management and market analysis.

Saxo also reduced its minimum deposit, making it easier to get started if you are on a tighter trading budget. Saxo ranks highly across many categories, including its platforms and high-quality market research, making it a great choice for day trading in 2024. Take a look at my full Saxo review for more details.

Comparison of the best brokers for forex day trading

Check out a side-by-side comparison between brokers of the categories most relevant to day trading based on our independent testing:

| Company |

Average Spread EUR/USD - Standard |

All-in Cost EUR/USD - Active |

Active Trader or VIP Discounts |

Execution: Agency Broker |

Execution: Market Maker |

Visit Site |

Interactive Brokers Interactive Brokers

|

0.63 info |

0.63 info |

Yes |

Yes |

No |

|

IG IG

|

0.98 info |

0.82 info |

Yes |

Yes |

Yes |

|

Saxo Saxo

|

1.1 info |

0.9 info |

Yes |

Yes |

Yes |

|

CMC Markets CMC Markets

|

0.61 info |

0.51 info |

Yes |

No |

Yes |

|

FOREX.com FOREX.com

|

1.4 info |

0.83 info |

Yes |

No |

Yes |

|

FXCM FXCM

|

0.78 info |

0.78 info |

Yes |

Yes |

Yes |

|

Charles Schwab Charles Schwab

|

1.25 info |

1.25 info |

No |

Yes |

No |

|

Note: Brokers listed in the above table rank best in class for Commissions & Fees.

How to choose the best forex broker for day trading

Choosing the right forex broker for day trading is one of the most important decisions you'll make for successful trading. It is a choice that will directly impact the ability to carry out your strategy and affect your trading conditions, including the account type, platforms, and available tools available to you.

First, the broker should be properly regulated and highly trusted to reduce your chances of dealing with a scam broker or one that could fail due to improper financial adequacy (i.e., they should be well capitalized). On each of our broker reviews, we provide a Trust Score to ensure you are well-informed about the broker’s regulatory status and financial background.

Second, a broker should offer the currency pairs you want to trade and provide fair trading conditions across their available account types. For example, a day trader should have full understanding of the type of order execution they will receive from their broker, such as knowing if they are a market maker or agency broker, and if its the best fit for their needs. Additionally, knowing whether a broker allows high-frequency trading, algo trading, or hedging can be essential for a day trader wishing to pursue a diverse range of strategies.

Finally, its trading platform suite should be conducive to your trading needs, including the available trading apps, tools and advanced order types that will best accommodate your strategy as a day trader. Many brokers offer sophisticated third-party trading platforms like MetaTrader, cTrader, or TradingView which can all be used for day trading depending on your preferences. Brokers who offer platforms that provide the detailed technical analysis necessary for these strategies, and allow you to execute them easily, take the lead for those seeking to day trade.

FAQs

What are the best forex day trading strategies?

The only limit to a possible day trading strategy is that it must, of course, be short-term and fast-paced, with trades closing the same day. Some of the best forex trading strategies for day trading include automated indicator-based strategies, where a trading signal is generated to buy or sell based entirely on the state of one (or many) market indicators. Other more subjective strategies may use technical analysis involving trendlines and drawing tools or measuring market patterns using formulas like Pivot Points, Fibonacci Retracements, and Elliot Waves.

While the technical studies, analysis drawings, or measurements may help in determining when to enter and exit the market, proper position sizing is more dependent on your own goals and should be adjusted to your specific profit targets and appetite or tolerance for risk. In all cases, your strategy must factor in the trade size which will determine the pip value and is relevant for your stop-loss or limit order levels, if entered, and the general risk/reward ratio.

For an in-depth exploration of how to develop your own day trading strategy for forex, take a look at my full guide on how to start forex day trading.

When is the best time to day trade forex?

The best time to day trade forex depends on several factors that may be unique to you and the state of the market around the time of your analysis, including the currency pairs you want to trade, the time zone you are located in, and the current market conditions for the underlying currencies.

For example, if you are planning to trade the EUR/USD within the next ten minutes but there is a major upcoming economic news event from the U.S. Federal Reserve, that could be the worst time to trade given the potential for market volatility and price gaps, including widening spreads (depending on the broker).

On the other hand, focusing on specific forex market hours can be helpful if you want to focus on pairs that are active during a particular trading session, such as during the overlap of the London and New York trading sessions. Check out my forex market hours guide for a deeper dive into this topic.

What is the best forex day trading platform for beginners?

IG is my top choice in 2024 for beginners to day trading thanks to its wealth of educational materials and streamlined web platform and mobile app. IG’s web trading platform in particular is handy for newer day traders due to its excellent balance of advanced features that are easily accessible, such as trading from the chart and managing orders with the drag-to-modify feature.

IG also offers a commission-based account, Forex Direct, tailored especially for active traders routinely executing large orders. This account type delivers even more competitive pricing that could be beneficial as your trading volumes grow and you progress into a more advanced day trader.

Are there any fees for day trading forex?

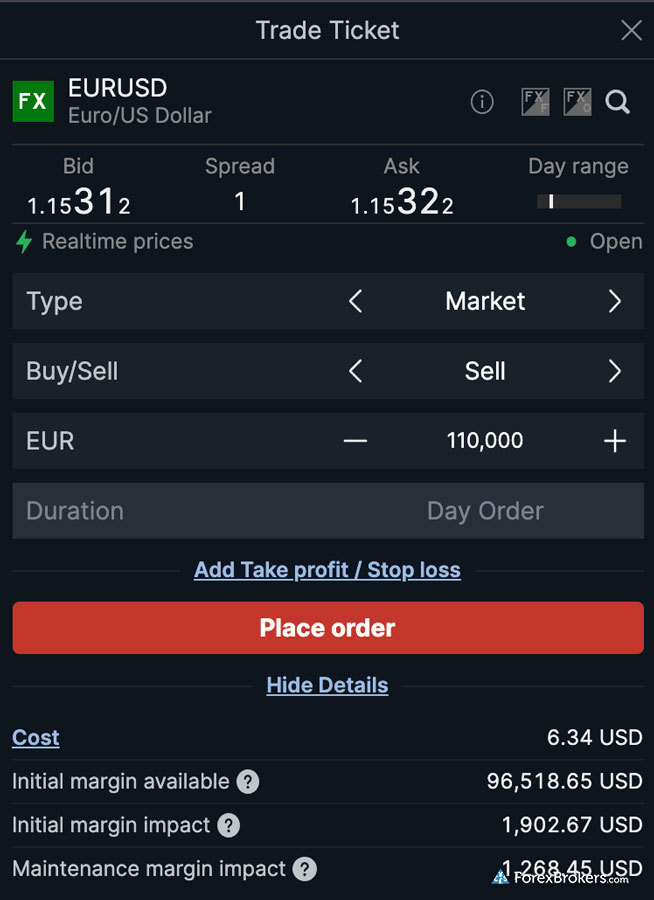

Yes, there are always costs related to forex trading. Even if you are in and out of the market quickly while day trading and exit your trades before the rollover at the end of each trading day, you will still cross the spread or bid/ask prices on each trade, in addition to any per-trade commissions.

For example, even if you have a commission-free account, when you place an order to buy currency, the asking price will always be higher than the bidding price if you were to sell again at that exact moment. In other words, once your order to buy is executed at the asking price, the trade is already at a loss for the amount of the spread, which must be overcome to either break even or turn a profit.

For these reasons, it’s crucial to factor your trading costs into your strategy, especially for more cost-sensitive trading strategies. This will be true over time even on a so-called zero spread account since on average, after many trades, costs will still add up despite paying close to zero spreads.

Now that you've seen our picks for the best forex brokers for day trading, check out the ForexBrokers.com Overall Rankings. We've evaluated over 60 forex brokers, using a testing methodology that's based on 100+ data-driven variables and thousands of data points. Check out our full-length, in-depth forex broker reviews.

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Generative AI tools are not a part of our content creation or product testing processes. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Read our Generative AI policy to learn more.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

Interactive Brokers

Interactive Brokers

IG

IG

Saxo

Saxo

CMC Markets

CMC Markets

FOREX.com

FOREX.com

FXCM

FXCM

Charles Schwab

Charles Schwab

City Index

City Index

XTB

XTB

eToro

eToro

Capital.com

Capital.com

Swissquote

Swissquote

AvaTrade

AvaTrade

Plus500

Plus500

OANDA

OANDA

Pepperstone

Pepperstone

XM Group

XM Group

Admirals

Admirals

FP Markets

FP Markets

Tickmill

Tickmill

IC Markets

IC Markets

FxPro

FxPro

Markets.com

Markets.com

FinecoBank

FinecoBank

BlackBull Markets

BlackBull Markets

Vantage

Vantage

ThinkMarkets

ThinkMarkets

FlowBank

FlowBank

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

DooPrime

DooPrime

ActivTrades

ActivTrades

Trading 212

Trading 212

BDSwiss

BDSwiss

Trade Nation

Trade Nation

TMGM

TMGM

Eightcap

Eightcap

Moneta Markets

Moneta Markets

Spreadex

Spreadex

MultiBank

MultiBank

Exness

Exness

ACY Securities

ACY Securities

easyMarkets

easyMarkets

RoboForex (RoboMarkets)

RoboForex (RoboMarkets)

VT Markets

VT Markets

Octa

Octa

IronFX

IronFX

IFC Markets

IFC Markets

Trade360

Trade360

Axi

Axi

TeleTrade

TeleTrade

iFOREX

iFOREX

FXOpen

FXOpen

FXPrimus

FXPrimus

Xtrade

Xtrade

Forex4you

Forex4you

GBE brokers

GBE brokers

Alpari

Alpari

TopFX

TopFX

Libertex (Forex Club)

Libertex (Forex Club)

LegacyFX

LegacyFX

FXGT.com

FXGT.com

ATFX

ATFX